The ABS released their Residential Property Price Index series yesterday.

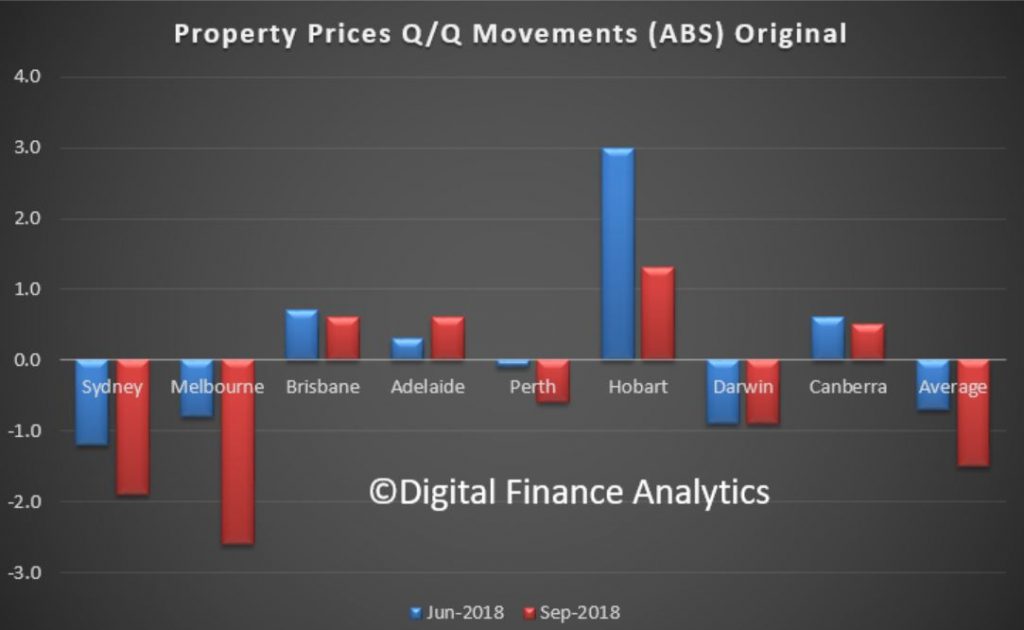

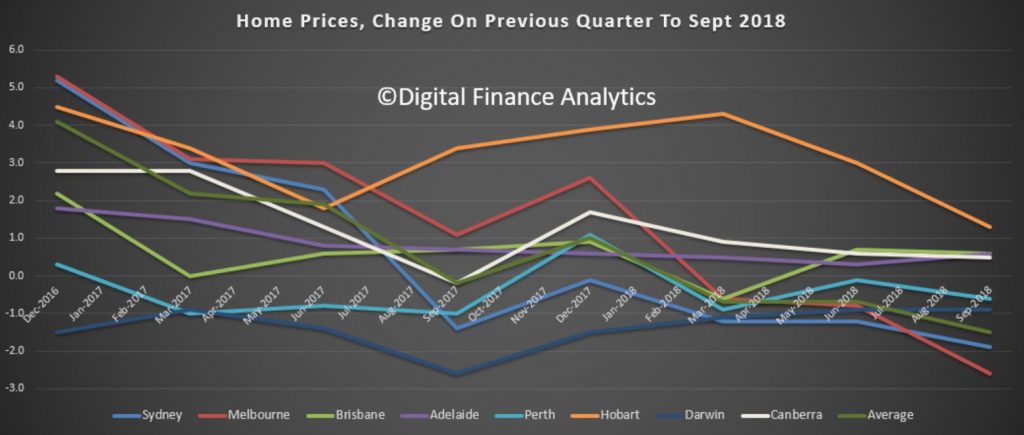

They said that the price index for residential properties for the weighted average of the eight capital cities fell 1.5% in the September quarter 2018. The index fell 1.9% through the year to the September quarter 2018.

The capital city residential property price indexes fell in Melbourne (-2.6%), Sydney (-1.9%), Perth (-0.6%) and Darwin (-0.9%), and rose in Brisbane (+0.6%), Adelaide (+0.6%), Hobart (+1.3%) and Canberra (+0.5%).

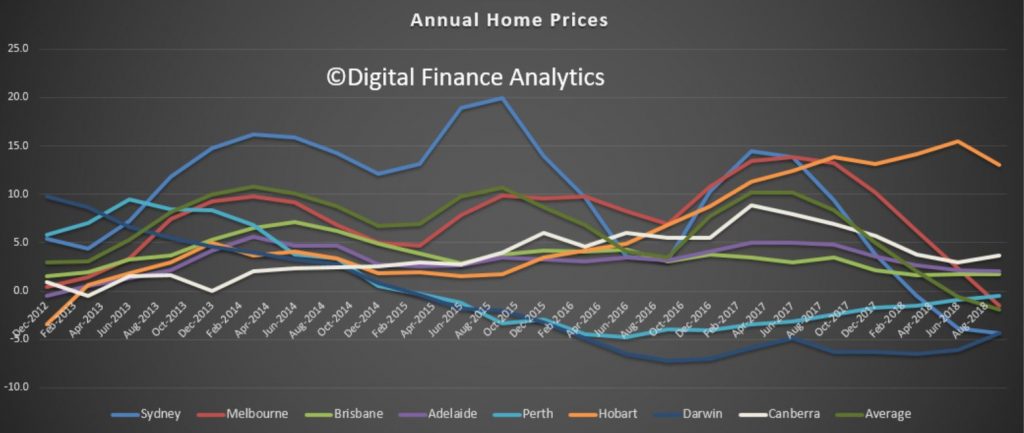

Annually, residential property prices fell in Sydney (-4.4%), Darwin (-4.4%), Melbourne (-1.5%), Perth (-0.5%) and rose in Hobart (+13.0%), Canberra (+3.7%), Adelaide (+2.0%) and Brisbane (+1.7%).

The total value of residential dwellings in Australia was $6,847,057.2m at the end of the September quarter 2018, falling $70,148.6m over the quarter.

The mean price of residential dwellings fell $9,700 to $675,000 and the number of residential dwellings rose by 40,900 to 10,143,700 in the September quarter 2018.

Of course these averages do not tell the true picture, because the movements are not uniform across a state. In some post codes now we are seeing falls of more than 20% from the previous peak, elsewhere prices are holding more steadily. However, given credit availability drives home prices, and credit is harder to come by, we should expect more falls ahead. Then the question becomes, is a soft landing feasible? I have to say that all the cycles I have examined never ended softly, so it would be a first, if it did happen.

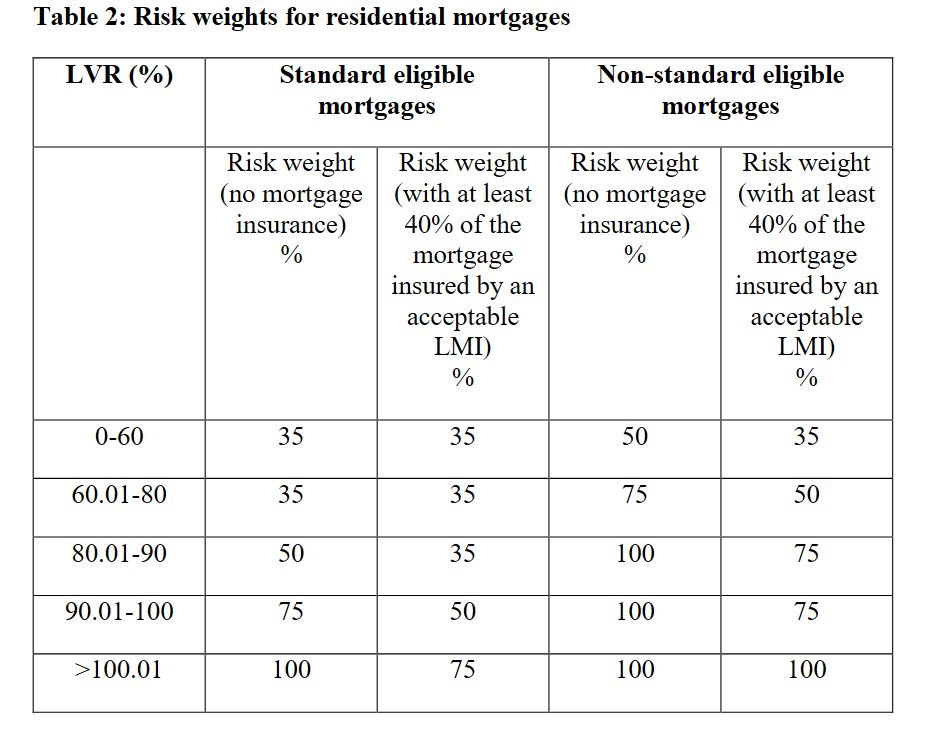

But there is another point to consider. Major banks use internal risk models to calculate the amount of capital they hold against mortgage loans. Other banks use more standard approaches.

The calculation is driven by a range of factors, but LVR is one element. Here is the APRA risk weights table. The point is a loan with an LVR at 80% has a risk weight of 50%, but the same loan at 90% LVR requires 75%, and 100% LVR 100% weighting. In other words, the capital doubles between 80 and 100% LVR!

At some point quite soon now banks will need to re-baseline their mortgage books. When property prices were rising, they would do this quite regularly to reduce the capital requirement. The reverse is also true.

The governing APRA document says “The ADI must also revalue any property offered as security for such loans when it becomes aware of a material change in the market value of property in an area or region”. Have banks started to revalue their portfolios and up their risk weights in the light of these falls? This is also, by the way, why economists attached to the major banks have an interest in playing down potential home price falls.

APRA says “the valuation may be based on the valuation at origination or, where relevant, on a subsequent formal revaluation by an independent accredited valuer. The determination of the appropriate risk weight is also dependent upon mortgage insurance provided by an acceptable lenders mortgage insurer (LMI)”. Of course many lenders now have access to Automated Valuation Models from players such as CoreLogic.

So now the question becomes, how much more capital will the banks have to put aside to take account of falling prices, who will bear the cost, and will APRA back down on its capital requirements which insist the banks hold more capital ahead? I expect more weakness in bank share prices as the impact of this hits home. As home prices fall further the impact will be magnified.