Last week we ran our latest live event, and discussed a range of potential scenarios relating to the virus. If the virus is localised and of short duration, there was still a path to higher prices, but as its severity and reach grows, prices would turn negative. This is a simple (actually complex) set of relationships between economics, human behavior and property.

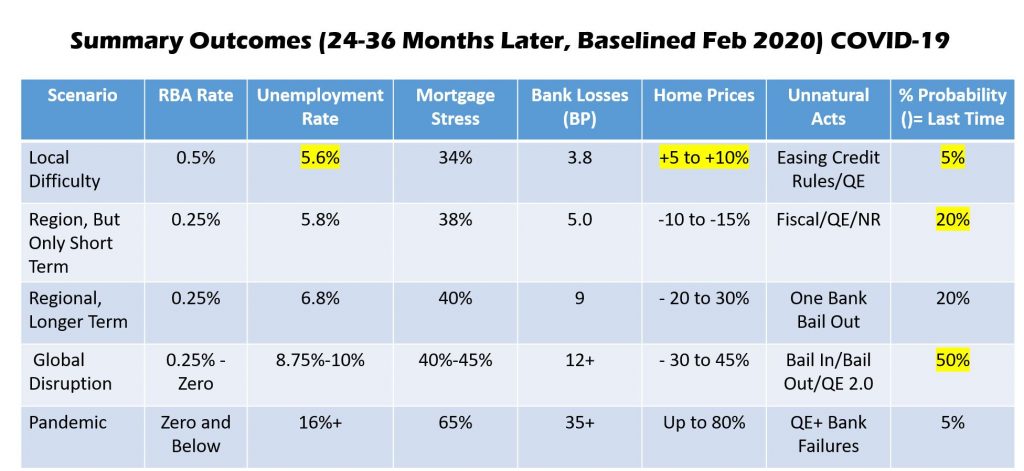

Here is a summary of the various scenarios from our modelling. We weighted the greatest probability at 30-45% fall in the months ahead, assuming global disruption, financials market falls and reinfection. All of which is coming true.

Begs the question, how soon will prices turn south unequivocally?

You can watch our live event here: