Corelogic published their hedonic index for April 2018. Capital city dwelling values record their first annual decline since November 2012 while regional dwelling values continue to edge higher.

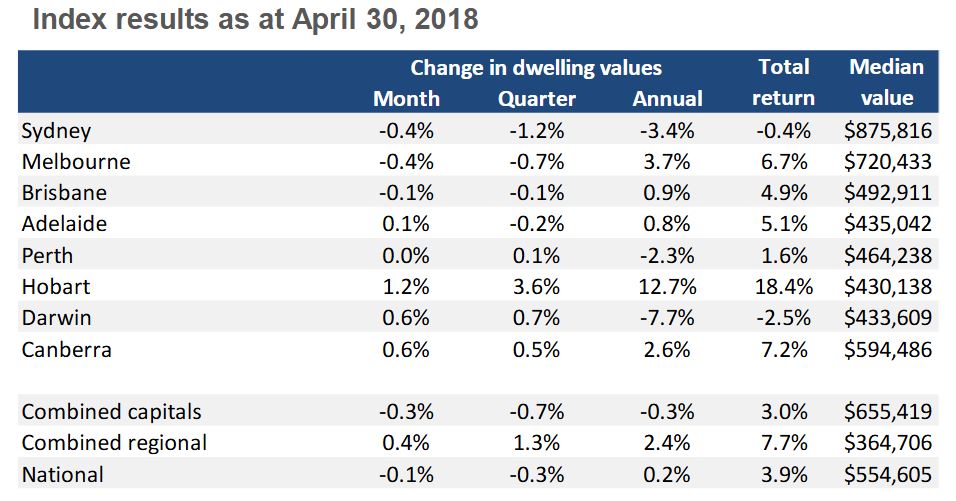

National dwelling values nudged 0.1% lower in April, the seventh consecutive month-on-month fall since values started retreating in October last year.

The declines were concentrated within the largest capitals, while regional dwelling values edged 0.4% higher.

Capital city dwelling values were 0.3% lower over the month, driven by larger falls of -0.4% in Sydney and Melbourne and a smaller decline in Brisbane values (-0.1%). The falls were offset by flat conditions in Perth and subtle rises in Adelaide (+0.1%), Darwin and Canberra (both +0.6%). Hobart was the only city where dwelling values rose by more than 1% in April.

On an annual basis, the combined capitals recorded the first decline in dwelling values since late 2012, with values slipping 0.3% lower, driven by falls in Sydney (-3.4%), Perth (-2.3%) and Darwin (-7.7%). The only capital city to see an improvement in annual growth conditions relative to a year ago is Perth, where the rate of decline has slowed from -3.0% last year to -2.3% over the past twelve months.

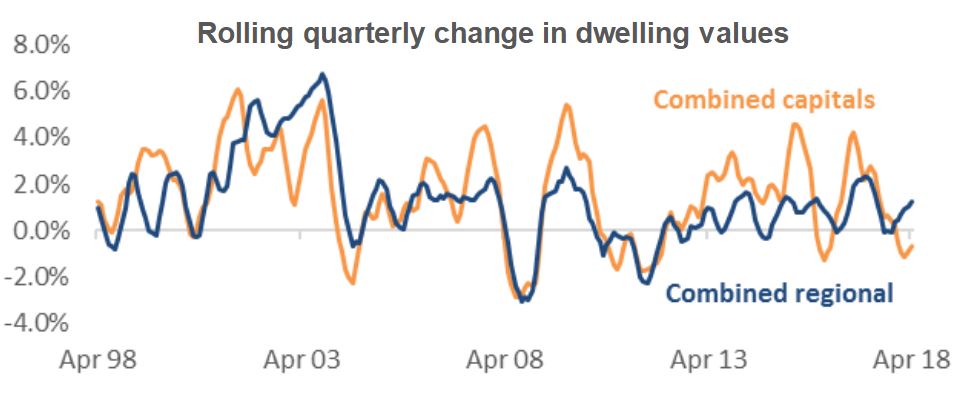

Regional areas now outpacing the capital cities The past five years has seen combined capital city dwelling values appreciate at the annual rate of 6.8% which is almost double the annual rate across the combined regional markets at 3.5%. The past twelve months has seen capital city dwelling values fall by 0.3% while regional values are 2.4% higher.

Unit values outperform house values Similarly, capital city detached house values have recorded an average annual growth rate of 7.3% over the past five years, while unit values were up 5.5% per annum over the same period. Mr Lawless said, “Despite the surge in unit construction over recent years, the past twelve months has seen unit values continue to trend higher, up 1.9%, compared with a 1.0% fall in house values.”

More affordable housing stock has been resilient to value falls Across the most expensive quarter of the market, dwelling values have increased at almost twice the pace of the most affordable quarter over the past five years, up 8.2% per annum compared with 4.4% per annum. As conditions have slowed down, it’s been the most affordable end of the housing market where values have remained resilient to falls, trending 1.9% higher over the past twelve months while the most expensive quarter of properties has seen values fall by -1.6%.