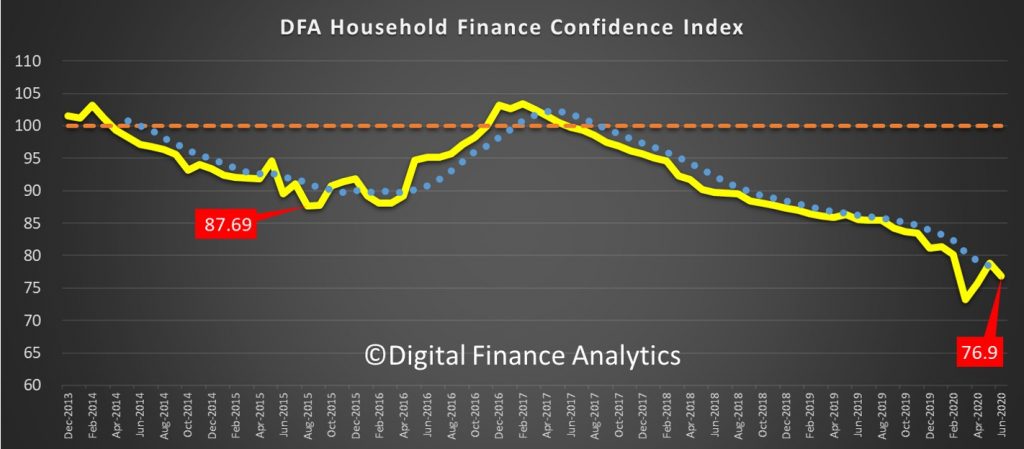

The latest results from our household surveys reveals that after a small recovery last month, confidence has deteriorated again. This is data to mid July, and includes the recent impact of renewed lock-downs in some areas. Indeed, significantly the Melbourne lock-down, and the broader concerns about COVID are responsible for the latest falls. No V-shaped recovery here.

We discussed this at length during our live stream yesterday.

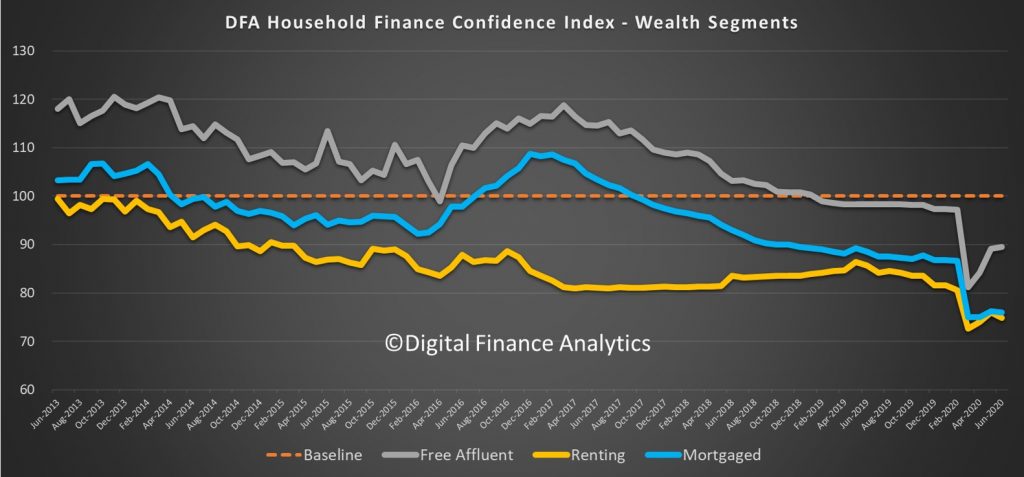

The DFA survey asks households to compare their financial status compared to a year ago across multiple dimensions, including income, costs, jobs, debt savings and net worth. We are also able to cut the data across multiple dimensions. For example, across our wealth segments, those with no mortgage, but holding mortgage free property and shares etc. are a little more confident, thanks to the financial market rebound. But those with mortgages, and those renting are both feeling the pressure.

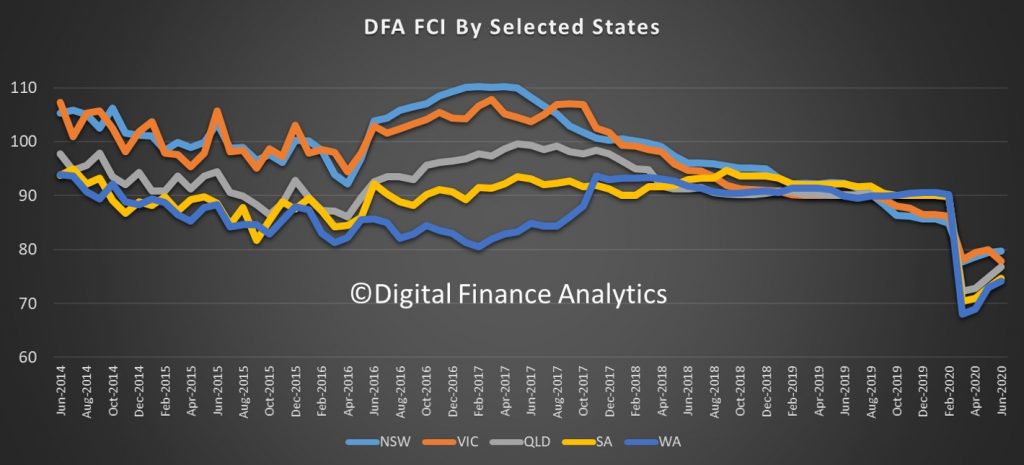

Across the states, the pain is more extreme in VIC, and NSW, while the smaller states are moving higher, though still remain well below the neutral 100 average.

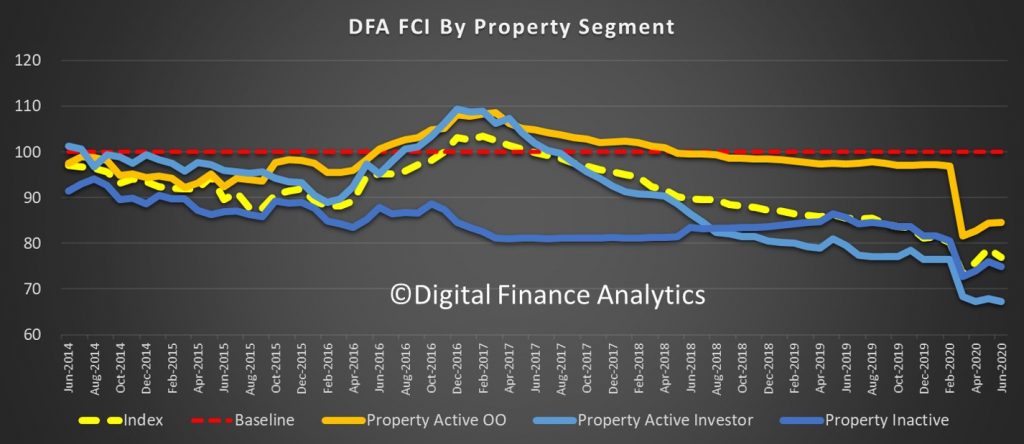

Across our property segments, property investors continue to slide, thanks to lower rental returns, higher vacancy rates, and little expect capital gain. No surprise then that more investors are seriously weighing up selling before further markets falls. Owner occupied property holders have benefited from lower interest rates as the surge of refinancing to lower mortgage rates continues. Renters are under pressure, because despite lower rentals for some, there are pressures relating to rental holidays (deferrals?).

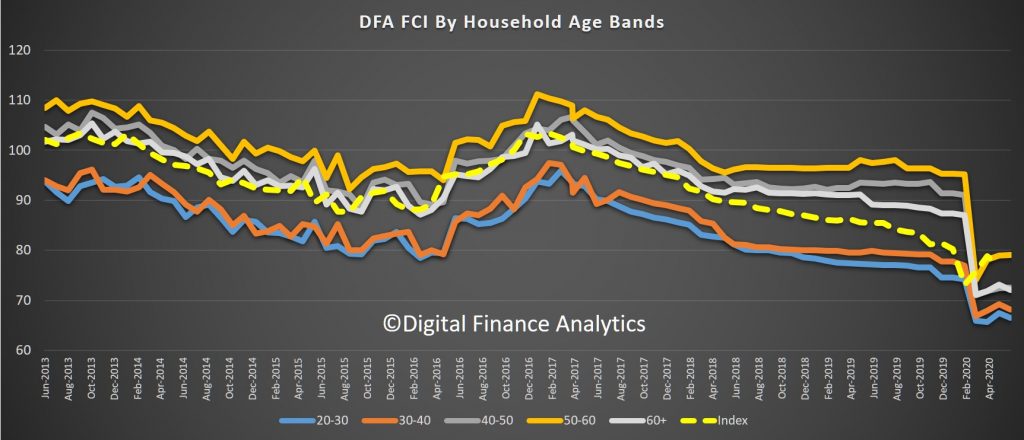

Across the age bands, those younger and older are seeing more pressure, whereas those in middle-aged bands improved slightly, because these cohorts have accumulated more assets and equity, and have relatively less debt. Older households are experiencing a real income drought thanks to lower returns on deposits, and lower expected dividends. More younger households are unemployed and job prospects are faltering.

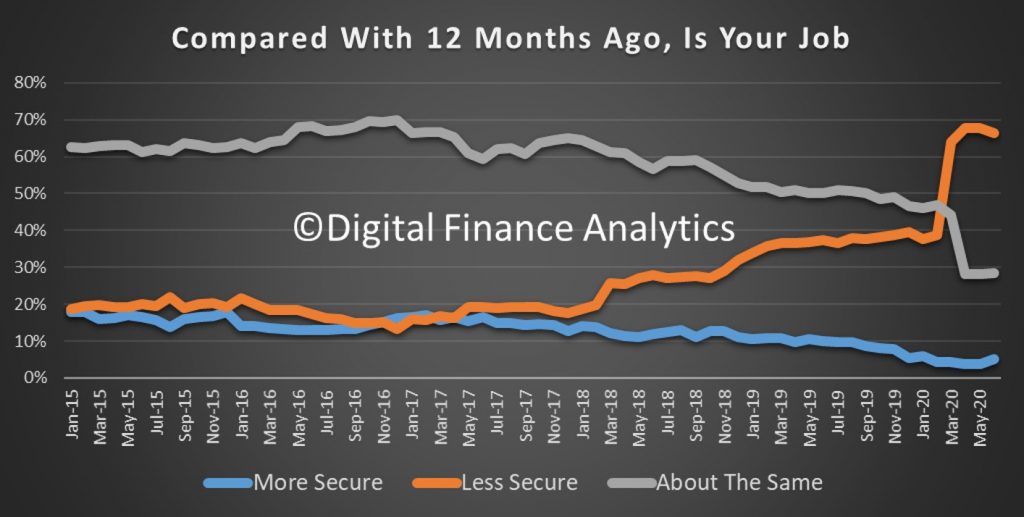

Across the elements which drives the survey, job security remains a major concern. There was a small drop in those feeling less secure, as some jobs came back, but over 68% of households remain concerned – which suggests they will be cautious ahead.

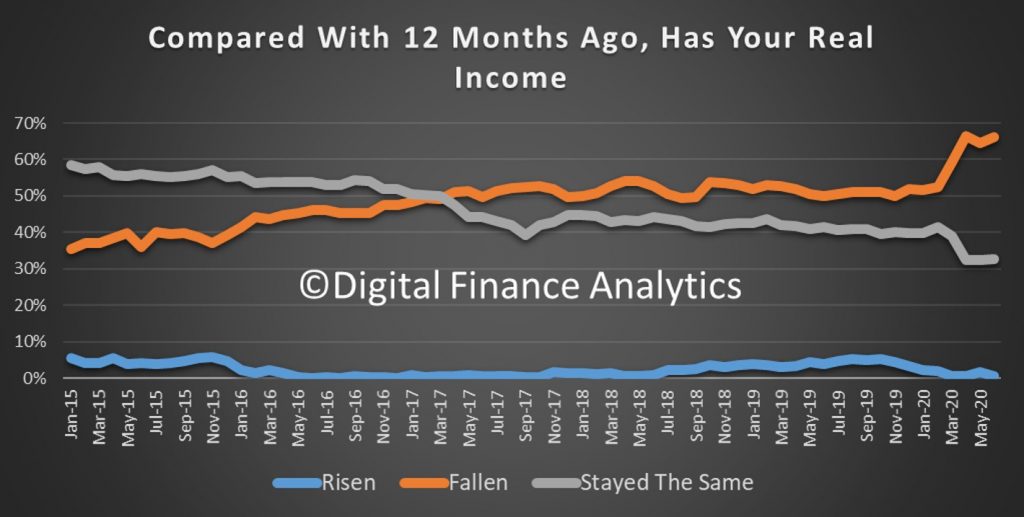

Income pressures have increased, with jobs evaporating, and less hours worked. This is the highest reading since we started running the survey.

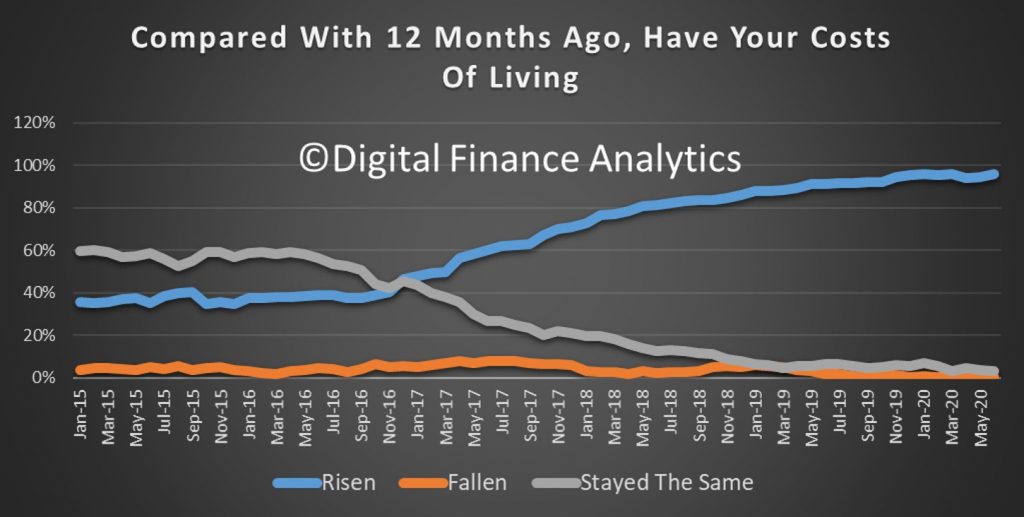

The question of costs continues, with many reporting increased costs of living way above the official cpi. This despite the increased working from home. Higher power costs from more home use was a stand out. The need to commence paying for childcare also hit home.

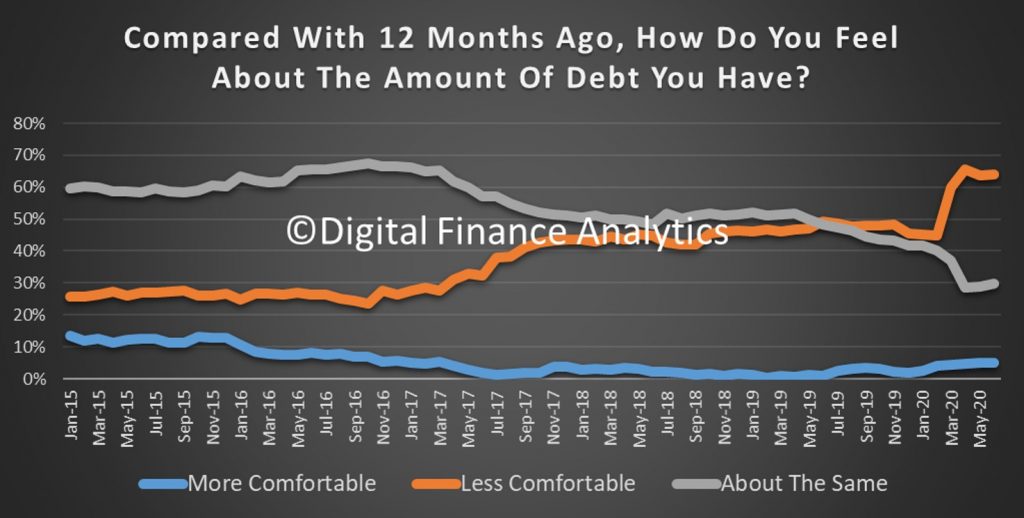

Debt remains a burden for those with mortgages and for households with other unsecured debts. More than 60% of borrowing households are worried abut their ability to service their loans. Many are seeking refinancing, or to use debt consolidation to try to reduce payments. And as we reported previously mortgage stress is as high as ever its been. We think defaults will follow, despite lenders’ repayment holidays.

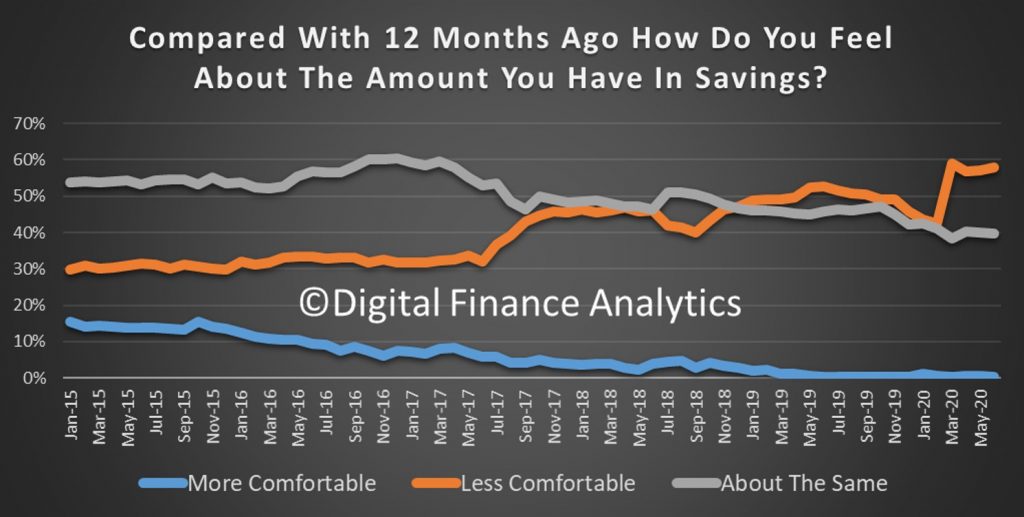

Savings remain under pressure (although some on JobKeeper received more income than normal and have saved some of the funds, and superannuation withdrawals are also being horded by many to accessed the scheme). The pressure comes from needing to tap into savings for living expenses, and lower returns from deposits. More than 3 million households do rely in income from deposit accounts, and rates are close to zero now.

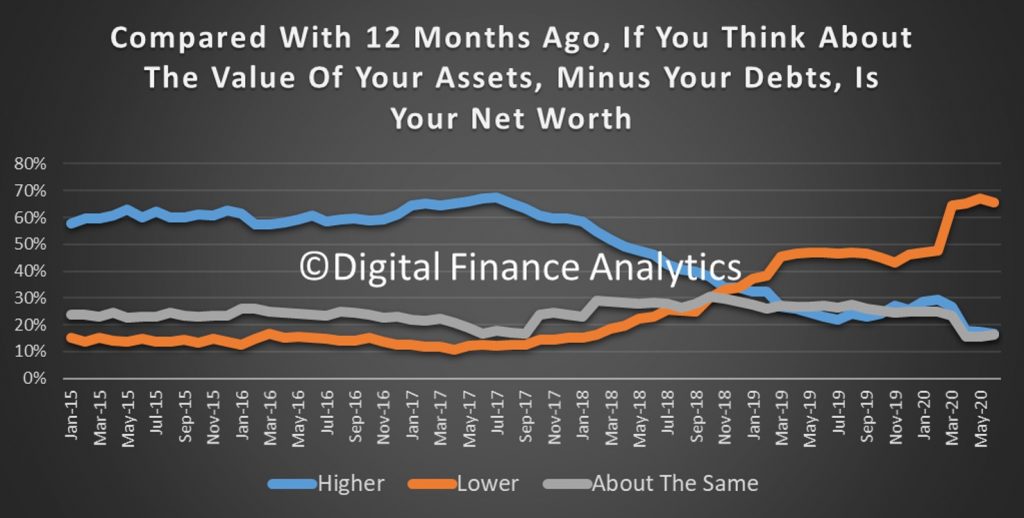

Finally, net worth has declined for more than 60% of households, thanks to lower property prices, though offset by higher stock prices. Forward expectations are also weaker, as more property price falls rises. Any market correction would also add more fuel to the fire.

So standing back, it is clear the household sector continues to be trapped in a web of concerns, and as a result their willingness to spend is likely to be crimped. Not good for future GDP. Until COVID is controlled, we have to expect confidence to continue to languish. This has some way to travel. Expect saw-tooth patterns of growth for the next couple of years.