The IMF just released a working paper* “Debt Is Not Free“. The evidence presented in this paper points to the risks, suggesting that public debt might not be free after all! In addition, low, or ultra low interest rates are not a get out of jail card!

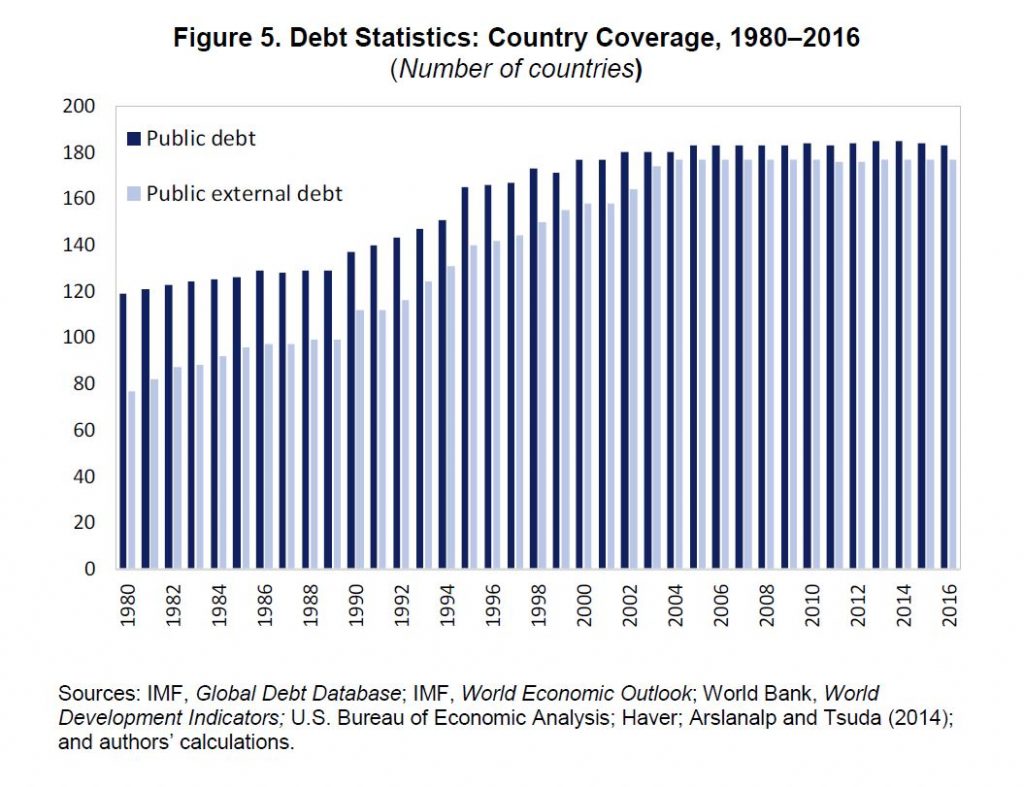

The case for more public debt is being reinforced by weak economic activity across the globe, large investment needs, and increasing concerns that monetary policy may be reaching its limits particularly in advanced economies. And yet, the risk of fiscal crises still casts a long shadow. Therefore, as many countries remain riddled with mounting debt, one of the most pressing questions facing policymakers is whether current high debt levels are a bellwether of future crises with large economic costs.

The argument that “public debt may have no fiscal cost”is also gaining traction as many countries face historically low interest rates and the global stock of negative-yielding debt is hovering around $12 trillion by the end of 2019. The underlying rationale is that if interest rates are lower than the economic growth rate—that is, the interest-growth differential is negative—there is no reason to maintain a primary surplus as it would be feasible to issue debt without later increasing taxes.

This working paper contributes to the debate on the costs of public debt by revisiting its importance in predicting fiscal crises. In a world of ultra-low interest rates, it is tempting to believe that there may be no costs. For those that subscribe to that theory, the natural conclusion is that now may be the time to rely more heavily on debt to attend to worthy causes such as fixing a crumbling infrastructure all while propping up a frail economy. The skeptics point to history, noting that those that ignore high debt do it at their peril as excessive debt may force disruptive fiscal adjustments or eventually lead to costly crises.

They use machine learning models to confront these dueling views with evidence. Our results show that public debt in its various forms is the most important predictor of fiscal crises and it does matter always and everywhere. But public debt is not the only game in town as its interactions with other predictors also make a difference. Surprisingly, however, the interest-growth differential does not have much signaling value: it does not really matter whether it is highly positive or negative; moreover, beyond certain debt levels, the likelihood of a crisis surges regardless.

It is important to acknowledge that the machine learning techniques used do not allow us to establish causality. This is an area where computational science is still trying to make inroads. What they can confidently say is that there is a high correlation between public debt and crises and that this association is very robust. Therefore, at the current juncture, complacency about high debt levels would be ill-advised even if interest-growth differentials were to remain low. The underlying reason is that the dynamics of crises are highly non-linear and by the time the interest-growth differential may start flashing red, a crisis may well be underway catching policymakers off guard.

These findings do not mean that bringing debt down is always the right policy prescription. There are clearly cases where the use of debt for countercyclical purposes, to increase public investment, or to address other structural needs is desirable. However, the evidence presented in this paper points to the risks, suggesting that public debt might not be free after all!

*IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Bullocks. Unelected IMF “paper” is just testing to see if the sheeple are ready for fleecing. Public debt? You mean govt debt? Depends- if foreign denominated, is a problem. Govt debt, done properly,is credit supply or investment, it doesn’t get “paid back”. Biggest problem is private debt- not flexible.

All foreign and private debt backed by collateral-property,stock, land,people, your children!-the collectors will call.