According to Moody’s, on 5 December, the Reserve Bank of New Zealand (RBNZ) announced the finalisation of its capital requirements for New Zealand banks. The RBNZ’s decision to raise capital requirements – although slightly watered down from its earlier proposal – is broadly credit positive, because it will make the banking system more resilient to shocks. At the same time, the higher capital requirements will weigh on the banks’ return on equity. We expect the new measures will prompt higher lending rates in efforts to boost profitability and constrain growth in more capital-intensive lending.

For domestic systemically important banks (D-SIBs), which are New Zealand’s four largest banks, ANZ Bank New Zealand Limited, ASB Bank Limited, Bank of New Zealand, and Westpac New Zealand Limited, the Common Equity Tier 1 (CET1), Tier 1 and Total Capital requirements have risen to 13.5%, 16% and 18% of risk weighted assets (RWA), respectively. While the new rules are a slight relaxation from the RBNZ’s initial proposal of 14.5%, 16% and 18% announced in December 2018, they represent a significant increase from the current requirements of 7%, 8.5% and 10.5%. For all other banks, the CET1, Tier 1 and total capital ratio requirements will be 11.5%, 14% and 16%, respectively.

The RBNZ also announced that existing Additional Tier 1 and Tier 2 securities will no longer count towards regulatory capital. Replacing them will be redeemable, perpetual, preference shares and subordinated debt, provided these securities do not have any contractual contingent features such as conversion or write-off at the point of non-viability.

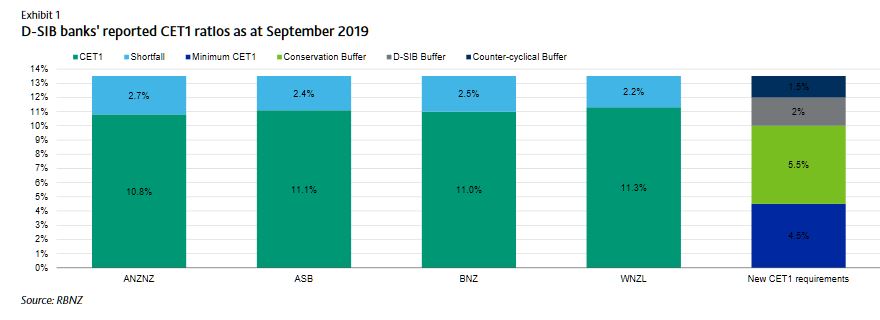

The higher requirements will be implemented by maintaining a regulatory minimum Tier 1 ratio of 7%, of which 4.5 percentage points must be CET1 capital, and introducing a number of prudential capital buffers, which total 9 percentage points (see Exhibit 1). Under the new framework, banks can temporarily operate below 13.5%, but above 4.5%, without triggering a breach of regulatory requirements. However, they will be subject to more intensive supervision and other consequences such as dividend restrictions.

On average, the D-SIB CET1 ratios are around 2.5 percentage points lower than the new requirement of 13.5% (Exhibit 1).

The RBNZ is also limiting the difference between the calculation of RWAs by D-SIBs, which use the internal ratings based approach (IRB), and other banks that use the Standardised approach. This will be done by recalibrating the calculation IRB banks’ RWAs to around 90% of the outcome under the Standardised approach. The combination of higher capital ratio targets and higher RWAs imposed on D-SIBs could spur more competition by reducing some of the capital advantage previously enjoyed by banks using the IRB approach.

The new capital regime will take effect from 1 July 2020 and the banks will have up to seven years to meet the new rules, an increase from the five years initially proposed. The RBNZ’s decision to extend the transition period will ensure banks are well placed to meet the new targets, especially given the Australian Prudential Regulation Authority’s (APRA) recent changes to Australian Prudential Standards (APS) 222 to further restrict how much equity support Australia’s largest banks can provide to their New Zealand subsidiaries, and proposed changes to APS 111, which will increase the capital requirements of providing such support.

The Australian parents of the New Zealand D-SIBs Australia and New Zealand Banking Group Limited, Commonwealth Bank of Australia, National Australia Bank Limited, and Westpac Banking Corporation have all disclosed the estimated impact of the new rules (Exhibit 2).