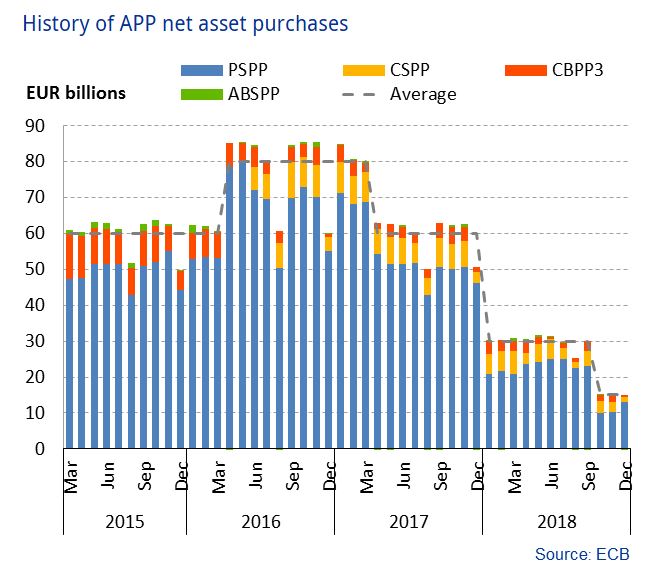

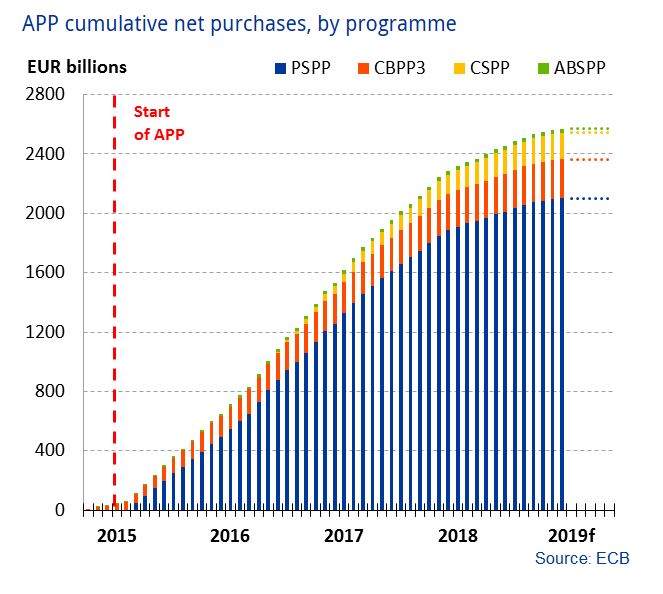

The European Central Bank has been running an aggressive asset purchase programme their expanded asset purchase programme (APP). The period of APP net asset purchases ended in December 2018. The question is now, what will the impact be, given the fact this programme has been supporting the euro economies for the past three years.

The APP includes all purchase programmes under which private sector securities and public sector securities are purchased to address the risks of a too prolonged period of low inflation over the medium term. The measures help to further strengthen the pass-through of the Eurosystem’s asset purchases to financing conditions of the real economy, and, in conjunction with the other non-standard monetary policy measures in place, provides further monetary policy accommodation.

On 13 December 2018, the Governing Council of the European Central Bank (ECB) decided to end the net purchases under the APP in December 2018 and announced that it “intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation”.

However, the Governing Council will aim to maintain the size of its cumulative net purchases under each constituent programme of the APP at their respective levels as at the end of December 2018. Limited temporary deviations in the overall size and composition of the APP may occur during the reinvestment phase due to operational reasons.

Within the programme there are currently four elements.

Corporate sector purchase programme (CSPP)

Between 8 June 2016 and 19 December 2018 the Eurosystem conducted net purchases of corporate sector bonds under the corporate sector purchase programme (CSPP). As of January 2019, the Eurosystem no longer conducts net purchases, but continues to reinvest the principal payments from maturing securities held in the CSPP portfolio.

Public sector purchase programme (PSPP)

Between 9 March 2015 and 19 December 2018 the Eurosystem conducted net purchases of public sector securities under the public sector purchase programme (PSPP). As of January 2019, the Eurosystem no longer conducts net purchases, but continues to reinvest the principal payments from maturing securities held in the PSPP portfolio.

The securities covered by the PSPP include nominal and inflation-linked central government bonds and bonds issued by recognised agencies, regional and local governments, international organisations and multilateral development banks located in the euro area

As of December 2018, government bonds and recognised agencies make up around 90% of the total Eurosystem portfolio, while securities issued by international organisations and multilateral development banks account for around 10%. These proportions will be maintained, on average, during the reinvestment phase.

Asset-backed securities purchase programme (ABSPP)

Between 21 November 2014 and 19 December 2018 the Eurosystem conducted net purchases of asset-backed securities under the asset-backed securities purchase programme (ABSPP). As of January 2019, the Eurosystem no longer conducts net purchases, but continues to reinvest redemptions from securities held in the ABSPP portfolio.

The reinvestment of ABSPP redemptions are distributed over time and in line with market issuance and secondary market liquidity. The ABSPP reinvestment purchases are conducted in a highly flexible manner in primary and secondary markets across jurisdictions.

The ongoing presence of the Eurosystem in the ABS market supports the diversification of funding sources and stimulates the issuance of new securities. The ABSPP therefore further enhances the transmission of monetary policy, facilitates the provision of credit to the euro area economy, eases borrowing conditions for households and firms and contributes to a sustained adjustment of inflation rates to levels that are below, but close to, 2% over the medium term.

Covered bond purchase programme 3 (CBPP3)

Between 20 October 2014 and 19 December 2018 the Eurosystem conducted net purchases of covered bonds under a third covered bond purchase programme (CBPP3). As of January 2019, the Eurosystem no longer conducts net purchases, but continues to reinvest the principal payments from maturing securities held in the CBPP3 portfolio.

The measure helps to enhance the functioning of the monetary policy transmission mechanism, supports financing conditions in the euro area, facilitates credit provision to the real economy and generates positive spillovers to other markets.