The Australian Financial Security Authority has released the quarterly statistics for insolvencies to March 2018, down to a location (SA3) level.

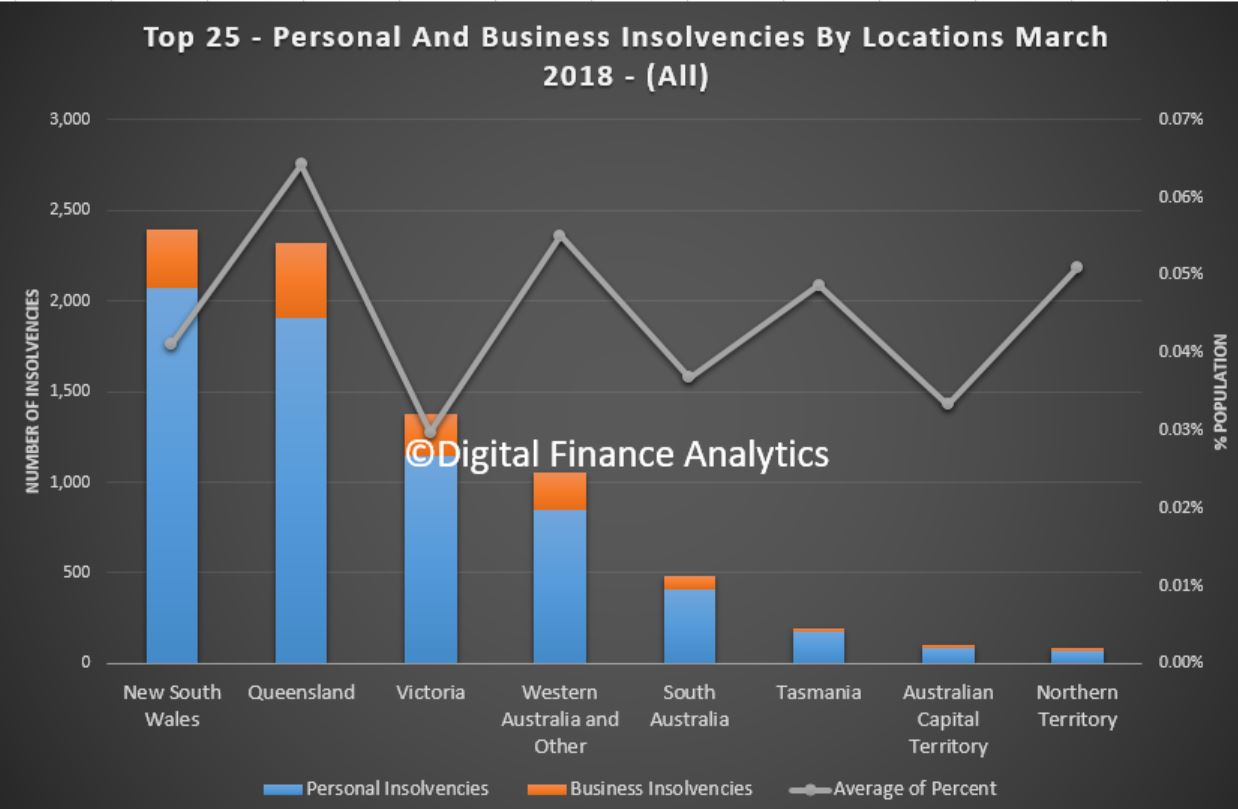

By state, NSW leads the way with 2,073 personal insolvencies and 322 business insolvencies. Queensland has 1,908 personal insolvencies and 410 business insolvencies and has the highest proportion of the population across the states in trouble.

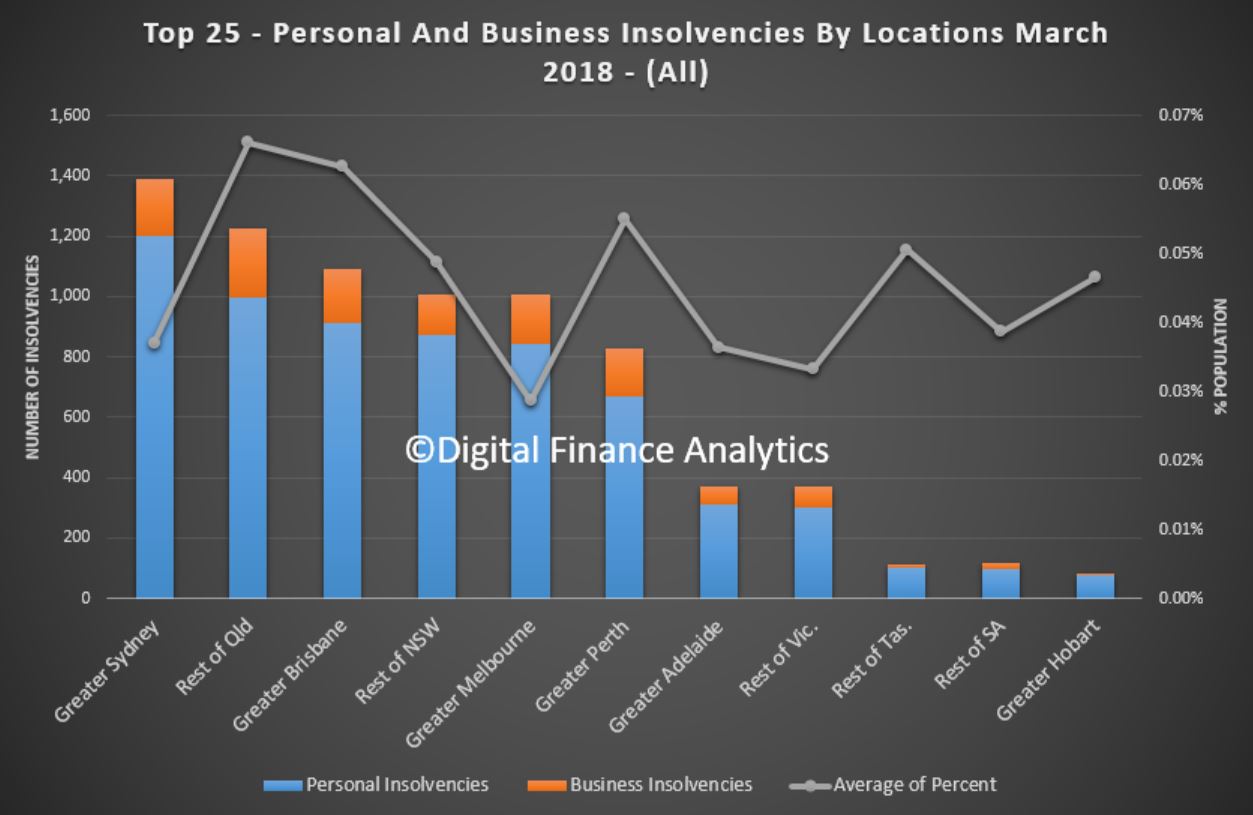

Drilling down, we see the Greater Sydney and the Rest of Queensland lead they way, followed by Brisbane.

Drilling down, we see the Greater Sydney and the Rest of Queensland lead they way, followed by Brisbane.

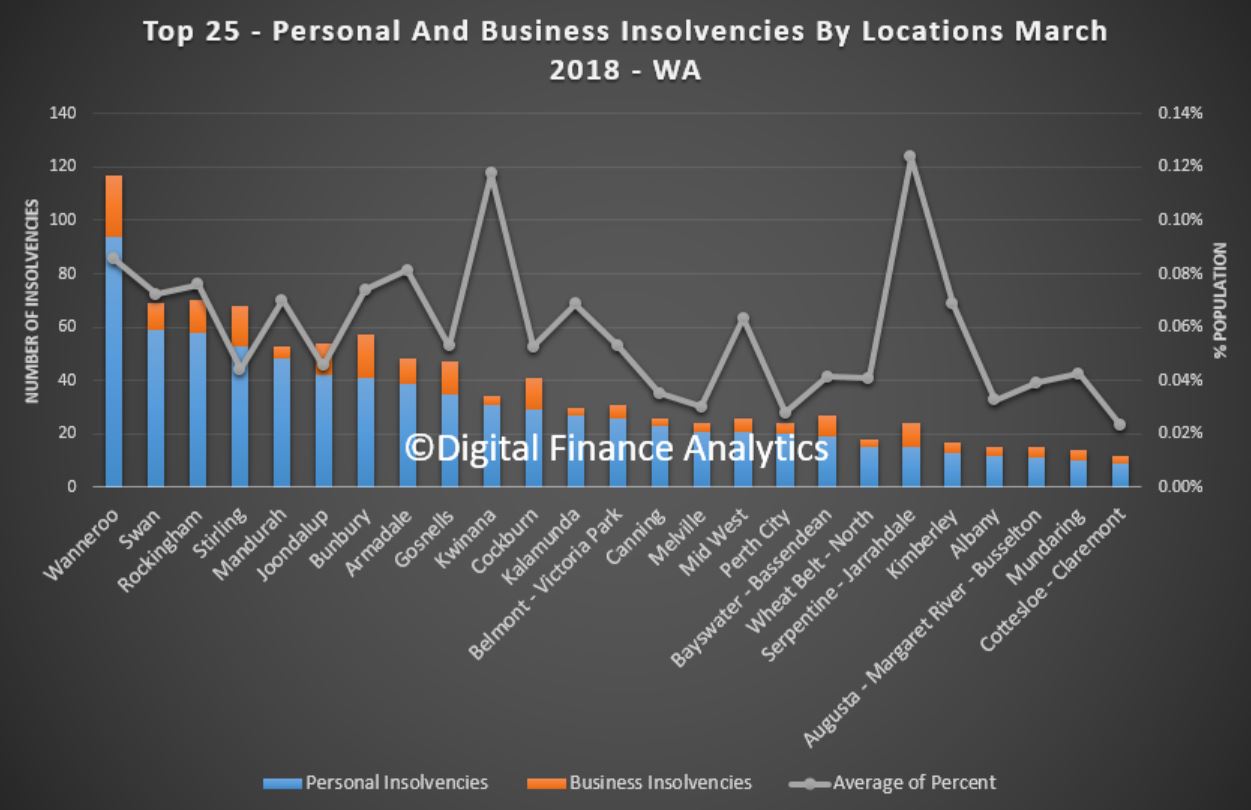

We can then look across the main states by location. WA’s worst location is Wanneroo, followed by Swan and Rockingham (aligns with our mortgage stress analysis by the way).

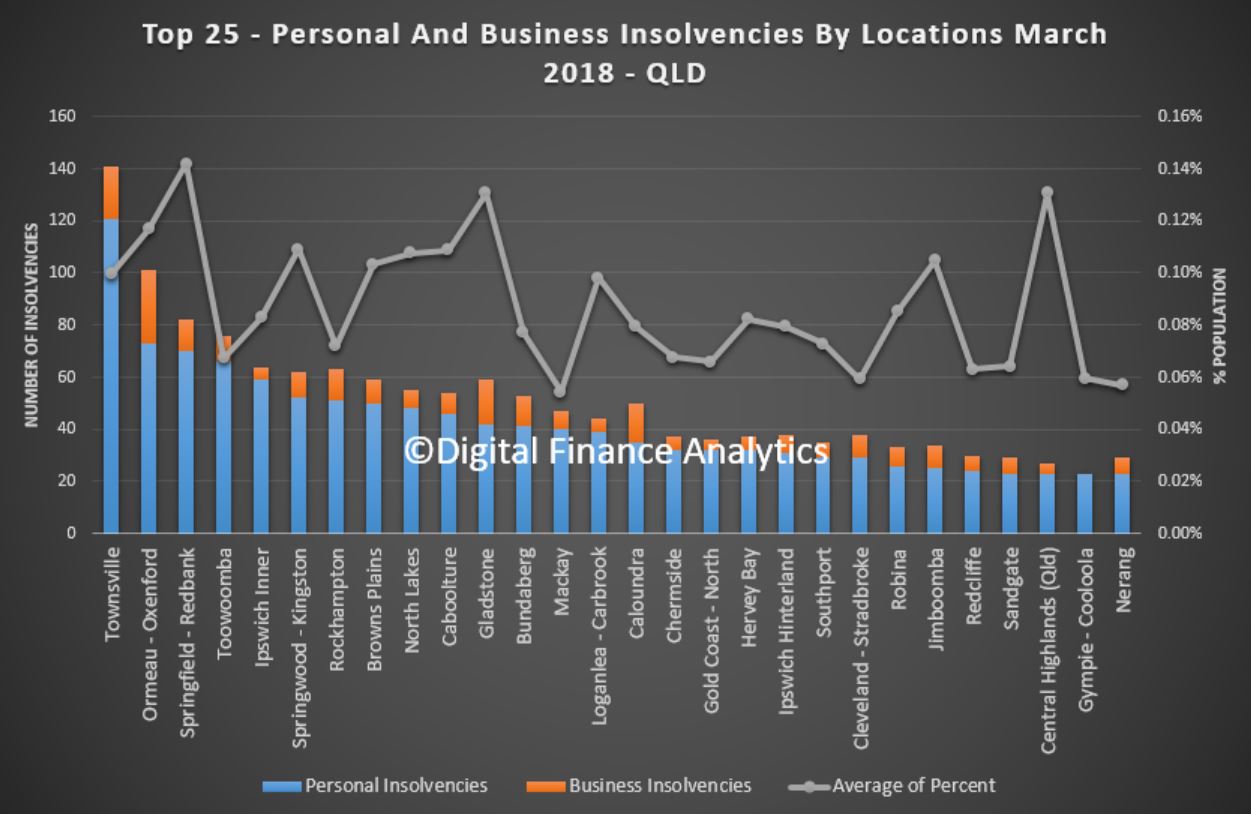

In Queensland, Townsville and Ormeau – Oxenford lead the way.

In Queensland, Townsville and Ormeau – Oxenford lead the way.

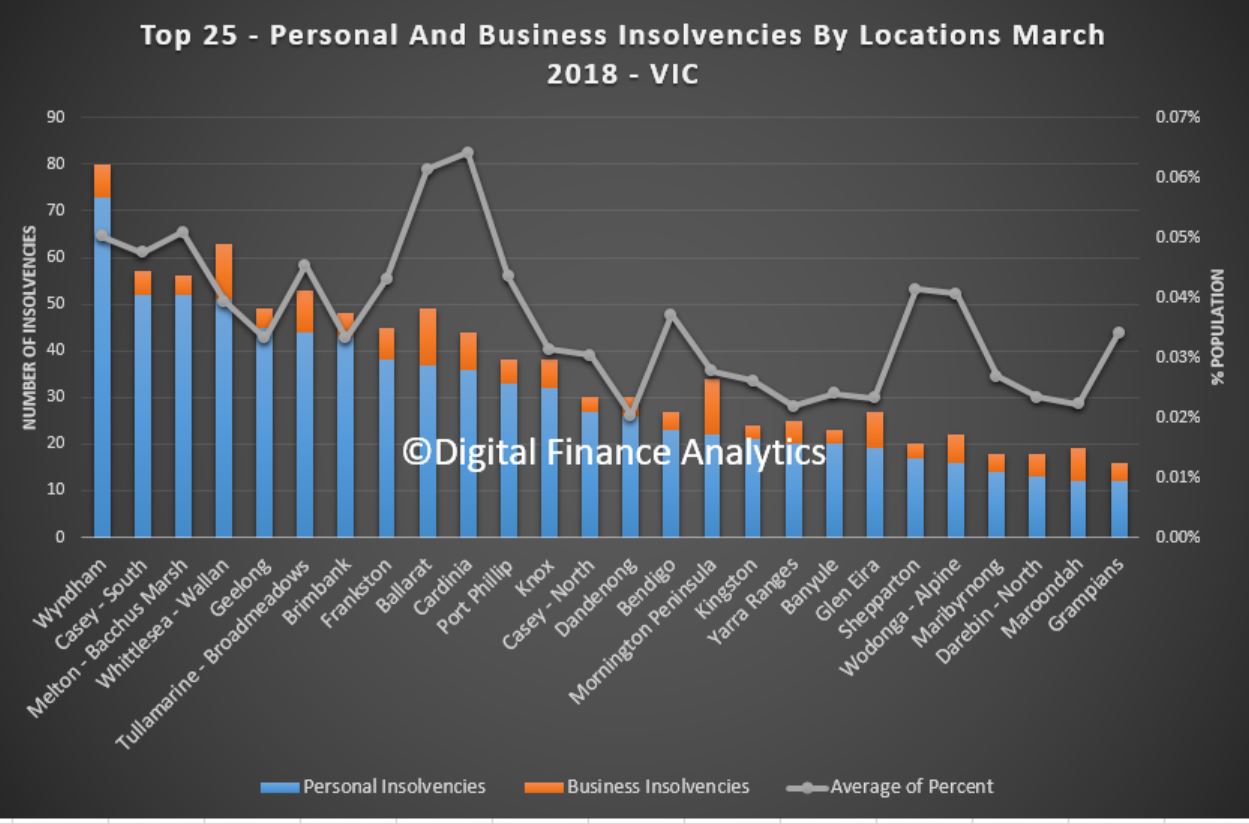

In Victoria Wyndham and Casey – South are the highest counts.

In Victoria Wyndham and Casey – South are the highest counts.

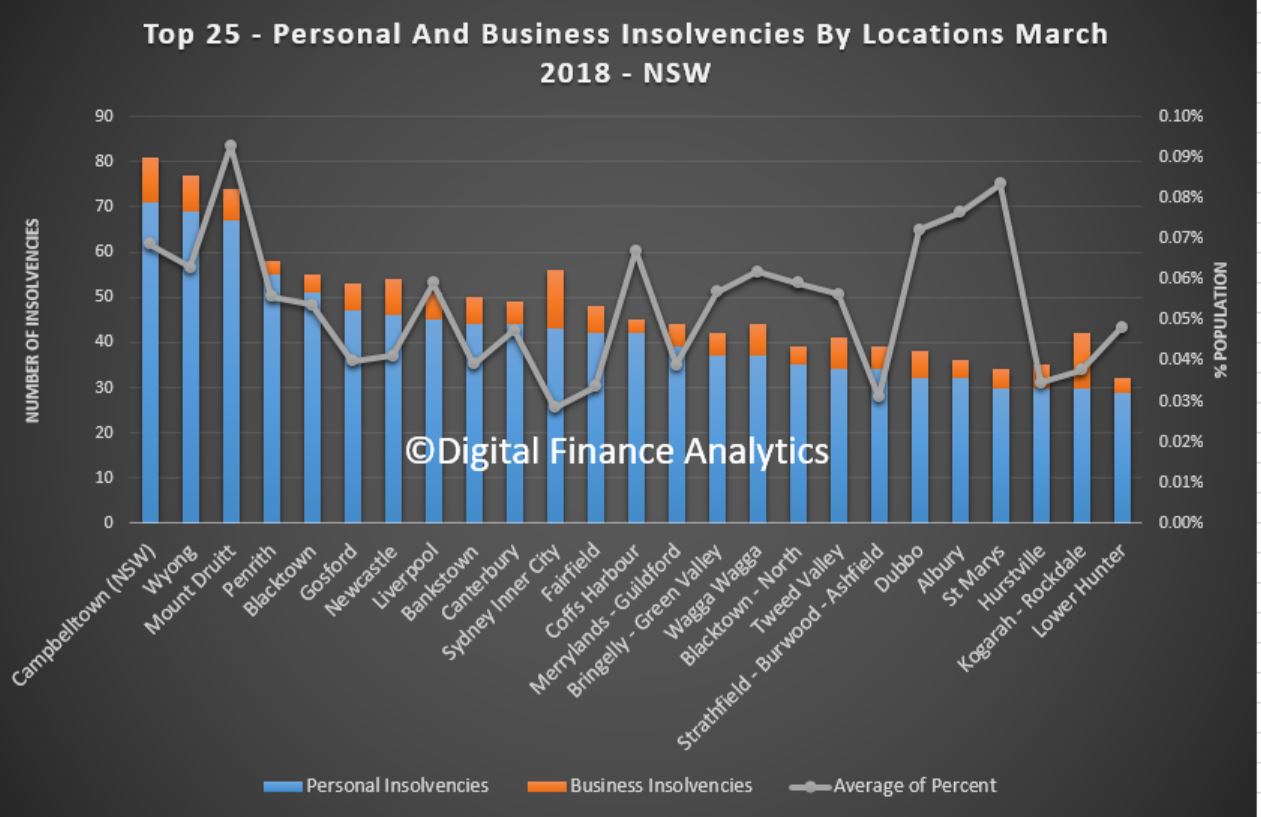

And in NSW, Campbelltown, Wyong, Mount Druitt and Penrith are the leaders – again close correlation with our mortgage stress analysis.

And in NSW, Campbelltown, Wyong, Mount Druitt and Penrith are the leaders – again close correlation with our mortgage stress analysis.

The point to make is insovencies do vary considerably by geography, as does the mix of business and personal insolvencies.

The point to make is insovencies do vary considerably by geography, as does the mix of business and personal insolvencies.