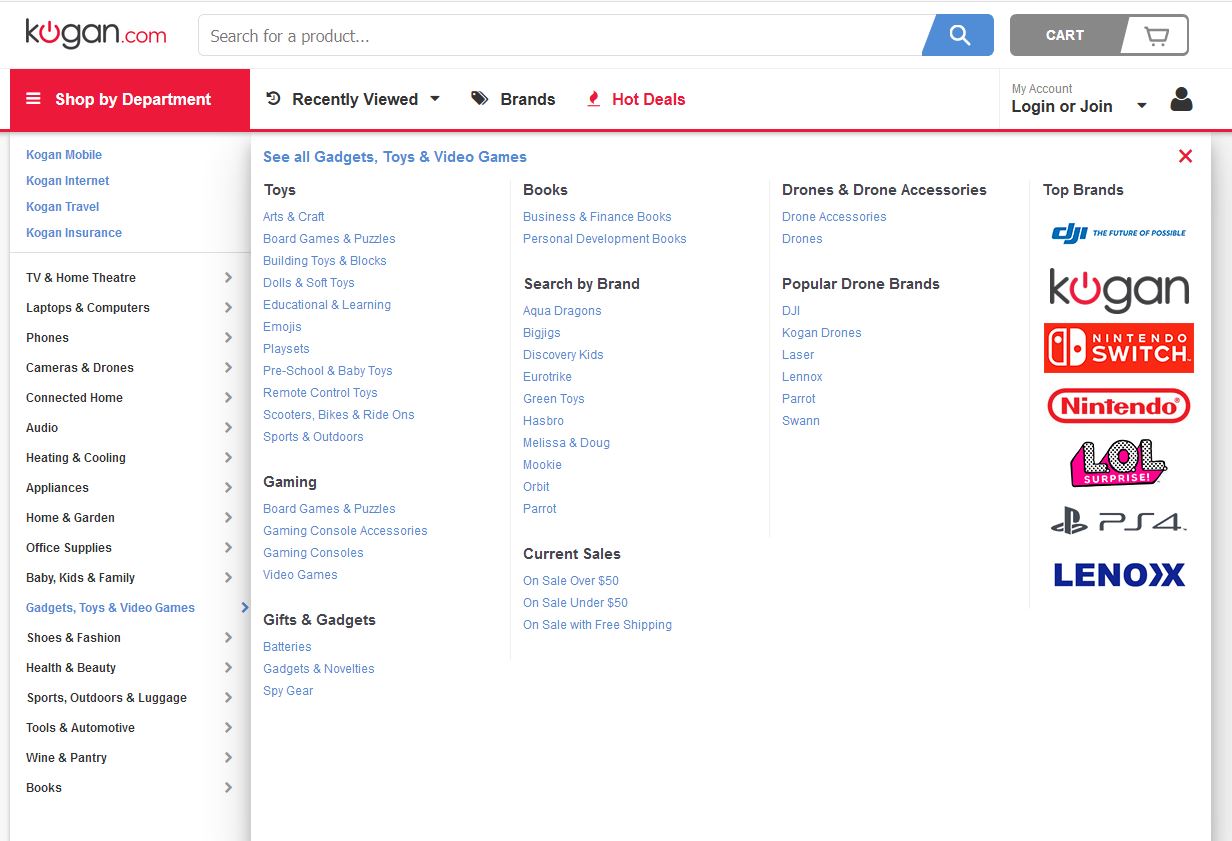

Online retailer Kogan is expanding into the finance sector, with home loan’s first off the rank in 2019 via Kogan Money offering products through agreements with Pepper Money and Adelaide Bank. Kogan Money Home Loans will be the first of a suite of products and services set to be rolled out under the new brand.

More evidence of the distribution of financial services enabled by digital.

The company’s active customer base is now 1,388,000, up by 433,000 or 45.3% and last month they posted a 277% rise in full year profit to $14.11 million, up more than $10 million from last year’s $3.74 million, driven by the pure play online retailer’s portfolio strategy. The result came as revenue jumped by $122.79 million or 42.4% to $412.31 million.

The company’s active customer base is now 1,388,000, up by 433,000 or 45.3% and last month they posted a 277% rise in full year profit to $14.11 million, up more than $10 million from last year’s $3.74 million, driven by the pure play online retailer’s portfolio strategy. The result came as revenue jumped by $122.79 million or 42.4% to $412.31 million.

According to their announcement:

Kogan Money will focus on simplifying credit and financial services for all Australians and making them more affordable through digital efficiency.

Under the agreement with the two lenders, Adelaide Bank will make available competitively priced conforming or prime home loans. Pepper will make available competitive near prime, non-conforming or specialist, home loan.

Details such as the level of interest rates have not yet been released, but are expected much closer to the launch date.

David Shafer, executive director of Kogan.com, said the partnerships will help Australian homeowners.

Kogan is excited to partner with Adelaide Bank and Pepper to enable us to offer Aussies a range of competitively priced home loans available online.

Adelaide Bank has a long history of partnering with innovative brands and business that bring greater choice and diversity to consumers.

Pepper is the leader in alternative lending in Australia and, since 2001, has been helping Aussies who may not tick all the traditional boxes for home loans to get financing.

With well over a million active customers, Kogan.com is proud to be able to form partnerships like these that form a genuine win-win-win for both Adelaide Bank and Pepper, for Kogan’s shareholders, and most importantly, for Kogan.com customers.

Adelaide Bank’s head of strategic partnerships, Damian Percy, said, Kogan.com is a leader in the online retail space and Adelaide Bank has a long tradition of partnering with like-minded businesses to bring greater choice and competition to the Australian home loan market.

Together we believe we can make a real difference to the emerging community of Australian online shoppers by delivering simple, great value housing solutions through Kogan Money.

Mario Rehayem, CEO Australia at Pepper Money, said, Pepper Money is delighted to be partnering with Kogan.com on the Kogan Money Home loans opportunity.

They are a company who clearly anticipates their customer needs and looks for innovative ways to solve them.

Through our experience and depth of product offerings, we look forward to helping more of their customers succeed in finding the home loan finance they need.