After plans were originally announced in September, online Australian retail group Kogan.com has launched its home loan offering today (28 November), via Australian Broker.

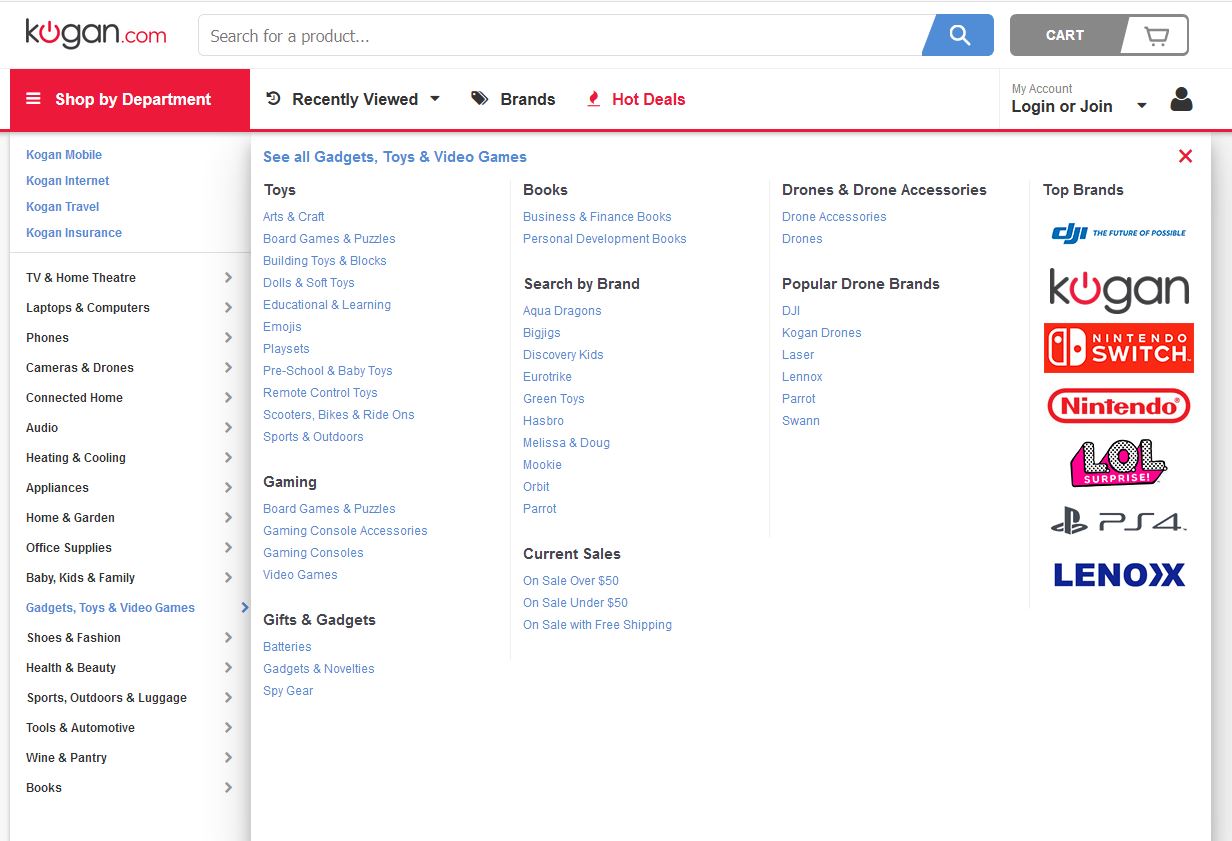

The website sells everything from technology and homewares to holidays and insurance, and will now begin offering Kogan Money Home Loans.

The products are for a range of borrowers, including first home buyers, refinancers and investors.

Rates for owner-occupiers start from 3.69% per annum, comparison rate 3.70% p.a. or 3.83% p.a. with 100% offset. Investor rates start from 3.89% p.a., comparison rate 3.90% p.a. or 4.03% p.a. with 100% offset.

Kogan lists other benefits as fixed and variable home loans with the option of 100% offset accounts, as well as catering for specialist loans for self-employed, debt consolidation and those with credit issues.

The retailer said it provides a loan calculator to help borrowers get a quicker understanding of how much they can borrow, as well as lending specialists who will call borrowers back “within a few business hours”.

The home loans are funded by Adelaide Bank and Pepper Group.

The Essential Home Loans range, funded by Adelaide Bank, boasts free online redraw, no monthly or ongoing fees on the home loan and $10 per month for the 100% offset account, unlimited extra repayments (up to $20,000 p.a on fixed), interest only options available, and weekly, fortnightly, or monthly repayments (for P&I loans).

The Options Home Loans range funded by Pepper helps those that have unique circumstances, such as having a non-standard income, having suffered previous financial setbacks or are self-employed.

David Shafer, executive director of Kogan.com, said, “Kogan.com delivers products and services that Australians need at some of the most affordable prices in the market, and we’re proud to extend our offerings to the financial services Australians use every day through the launch of Kogan Money Home Loans.

“Digital efficiency continues to be a key driver of our ability to achieve price leadership, and we’ve taken this approach with our Kogan Money Home Loans offering.

“Knowing where to start when getting a home loan can be difficult, especially in a crowded market. Kogan Money Home Loans is making this process easier and more efficient for the many Australians looking to secure a home loan either when purchasing a property or as part of a refinance.

“A large part of Kogan Money Home Loans’ mission is to provide solutions to help people lower the cost of owning homes and investment properties and to achieve property ownership.”