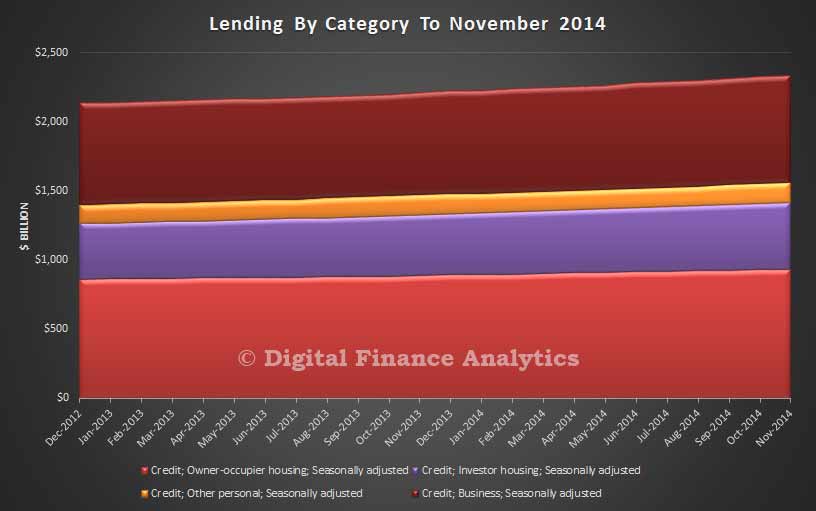

Last week saw the release of the November data from both the RBA and APRA. Looking at the overall summary data first, total credit grew by 5.9% in the year to November 2014. Housing lending grew at 7.1%, business lending at 4.6%, and personal credit by 1.1%.

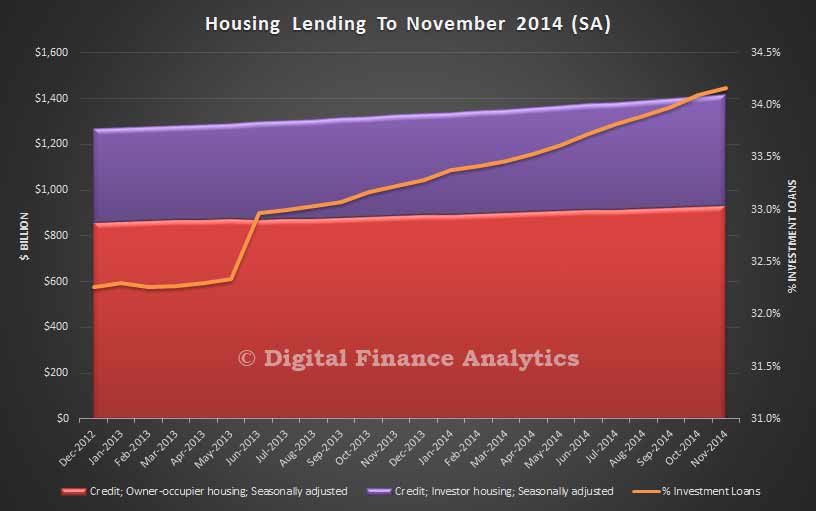

Looking at home lending, in seasonally adjusted terms, total loans on book rose to $1.42 trillion, with owner occupied loans at $932 billion, and investment loans at $483 billion, which equals 34.2%, a record.

Looking at home lending, in seasonally adjusted terms, total loans on book rose to $1.42 trillion, with owner occupied loans at $932 billion, and investment loans at $483 billion, which equals 34.2%, a record.

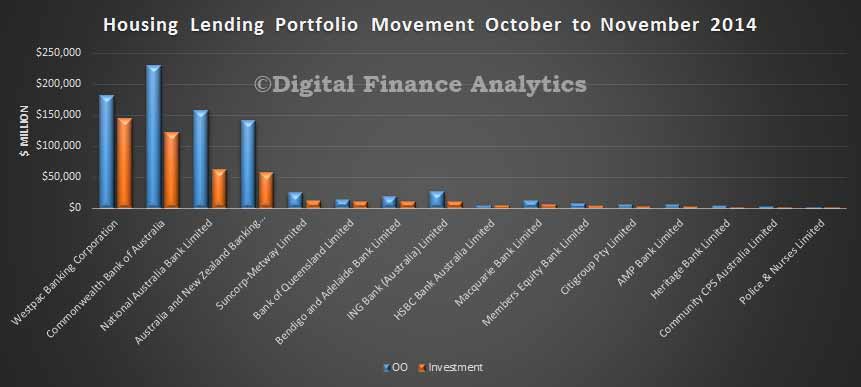

From the APRA data, loans by ADI’s were $1.31 trillion, with 34.82% investment loans, which grew at 0.84% in the month. Looking at relative shares, CBA continues to hold the largest owner occupied portfolio, whilst WBC holds the largest investment portfolio.

From the APRA data, loans by ADI’s were $1.31 trillion, with 34.82% investment loans, which grew at 0.84% in the month. Looking at relative shares, CBA continues to hold the largest owner occupied portfolio, whilst WBC holds the largest investment portfolio.

Looking at relative movement, WBC increased their investment portfolio the most in dollar terms. CBA lifted their owner occupied portfolio the most.

Looking at relative movement, WBC increased their investment portfolio the most in dollar terms. CBA lifted their owner occupied portfolio the most.

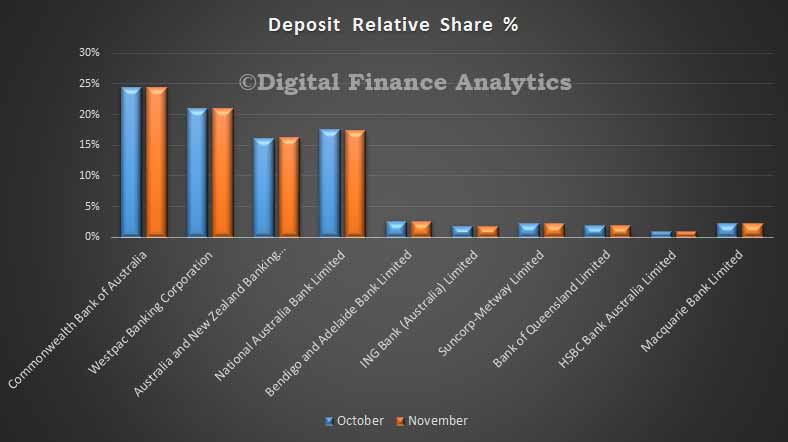

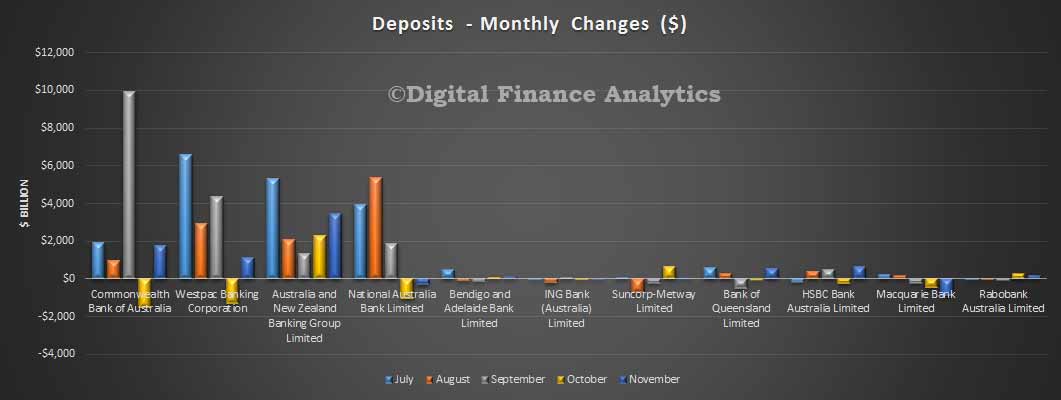

Turning to deposits, they rose 0.39% in the month, to 1.78 trillion.

Turning to deposits, they rose 0.39% in the month, to 1.78 trillion.

There was little change in relative market share, though we noted a small drop at nab, which relates to their cutting deposit rates from their previous market leading position.

There was little change in relative market share, though we noted a small drop at nab, which relates to their cutting deposit rates from their previous market leading position.

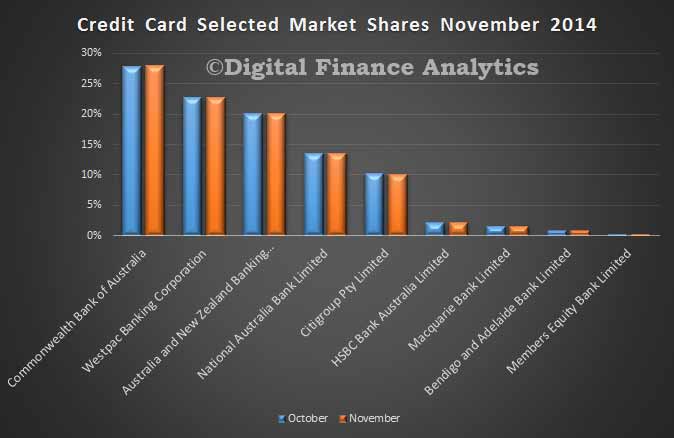

Finally, looking at the cards portfolios, the value of the market portfolio rose by $627 billion, to $41,052 billion. There were only minor portfolio movements between the main players.

Finally, looking at the cards portfolios, the value of the market portfolio rose by $627 billion, to $41,052 billion. There were only minor portfolio movements between the main players.