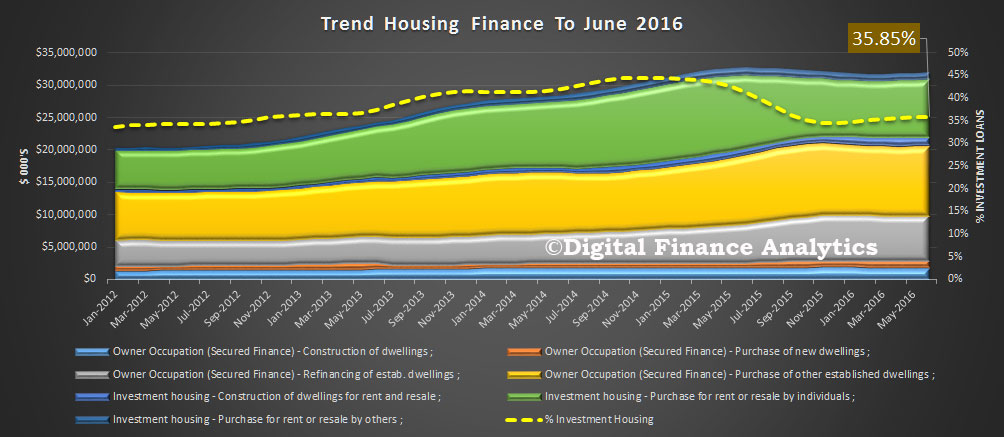

The latest finance data, for June was released by the ABS today. The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.4%. Investment housing commitments rose 0.8%, and owner occupied housing commitments rose 0.2%. Ignore the 3.2% seasonally adjusted investment loan number, it is too unreliable.

The proportion of loans for investment purposes rose in the month, and was 35.85% of all home loans.

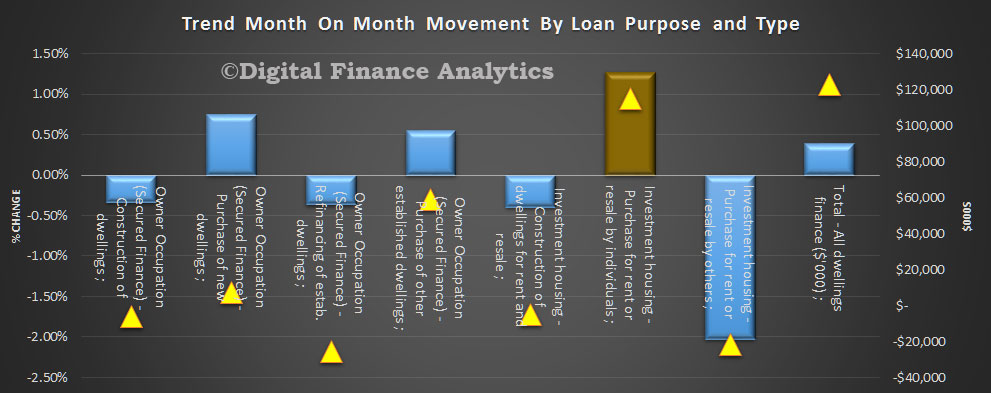

Looking at the composition of the changes, month on month, in percentage terms (left hand scale, bars), investment loans for individuals rose 1.27% (up $115m), whilst OO lending for new dwellings fell.

Looking at the composition of the changes, month on month, in percentage terms (left hand scale, bars), investment loans for individuals rose 1.27% (up $115m), whilst OO lending for new dwellings fell.

In trend terms, the number of commitments for owner occupied housing finance rose 0.2% in June 2016 whilst the number of commitments for the purchase of new dwellings rose 0.6%, the number of commitments for the purchase of established dwellings excluding refinancing rose 0.2%, while the number of commitments for the construction of dwellings fell 0.1%.

In trend terms, the number of commitments for owner occupied housing finance rose 0.2% in June 2016 whilst the number of commitments for the purchase of new dwellings rose 0.6%, the number of commitments for the purchase of established dwellings excluding refinancing rose 0.2%, while the number of commitments for the construction of dwellings fell 0.1%.

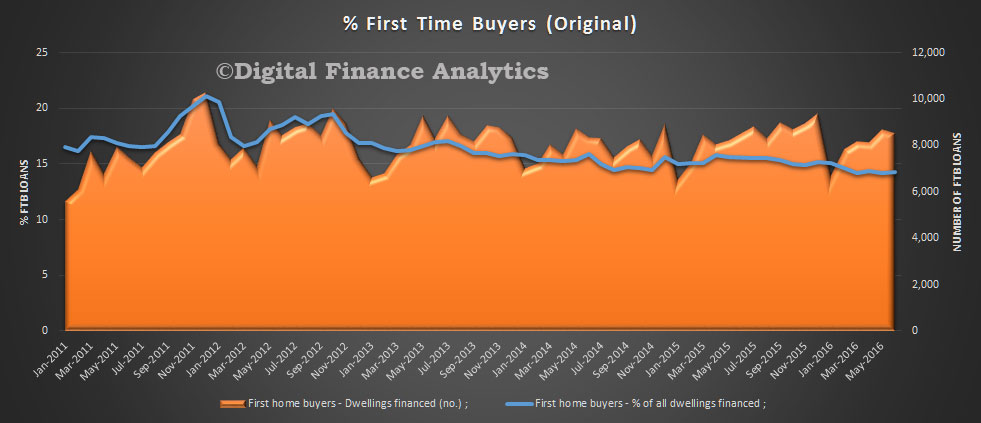

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 14.3% in June 2016 from 14.2% in May 2016. However the number of purchasers fell 2.2%.

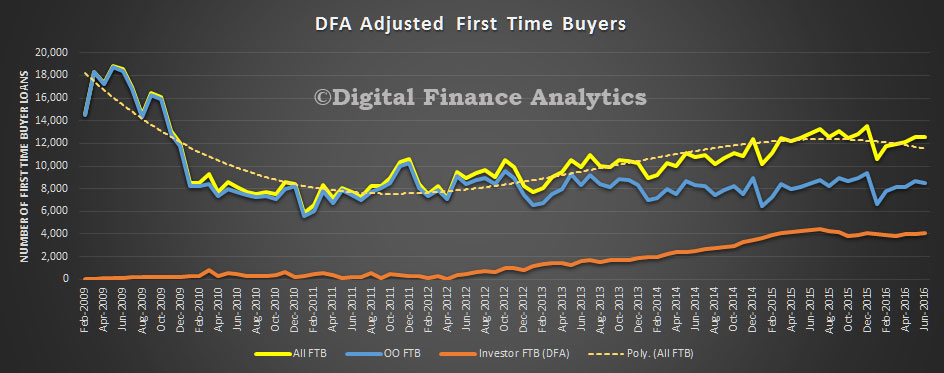

The DFA investment tracker, which measures first time buyers going direct to the investment sector rose 1.1%, with more than 4,000 purchasers in the month.

The DFA investment tracker, which measures first time buyers going direct to the investment sector rose 1.1%, with more than 4,000 purchasers in the month.

It is worth remembering the RBA identified $1bn of loans switched between investment and owner occupied in the month, so this may have distorted the figures. In addition the ABS warns:

It is worth remembering the RBA identified $1bn of loans switched between investment and owner occupied in the month, so this may have distorted the figures. In addition the ABS warns:

Monthly First Home Buyer statistics will be subject to revision as the modelled component is adjusted to reflect improved reporting by lenders. The ABS is currently investigating the effect of improved reporting on the model and, subject to all institutions providing improved data, expects to revise First Home Buyer statistics in coming months. The revisions will be preceded by an Information Paper explaining the changes. Information relating to changes to the method of estimating loans to first home buyers, introduced from the December 2014 issue. First home buyers are defined as persons entering the home ownership market as owner-occupiers for the first time. First time investors are excluded.

One thought on “Latest Home Finance Data Is All About Investment Loans”