Macquarie Group provided an update on business activity in the third quarter of the financial year ending 31 March 2018 (December 2017 quarter). It was pretty much in line with expectations.

They said the annuity-style businesses’ combined quarter net profit contribution was slightly up on the prior corresponding period, mainly due to strong performance fees in Macquarie Asset Management, timing of transactions in Corporate and Asset Finance Principal Finance and continued growth in Banking and Financial Services.

They said the annuity-style businesses’ combined quarter net profit contribution was slightly up on the prior corresponding period, mainly due to strong performance fees in Macquarie Asset Management, timing of transactions in Corporate and Asset Finance Principal Finance and continued growth in Banking and Financial Services.

Their capital markets facing businesses’ combined quarter net profit contribution was down on the prior corresponding period primarily due to timing of income recognition associated with transportation and storage agreements within the Commodities and Global Markets business.

Macquarie expects the FY18 result for the Group to be up approximately 10% on FY17.

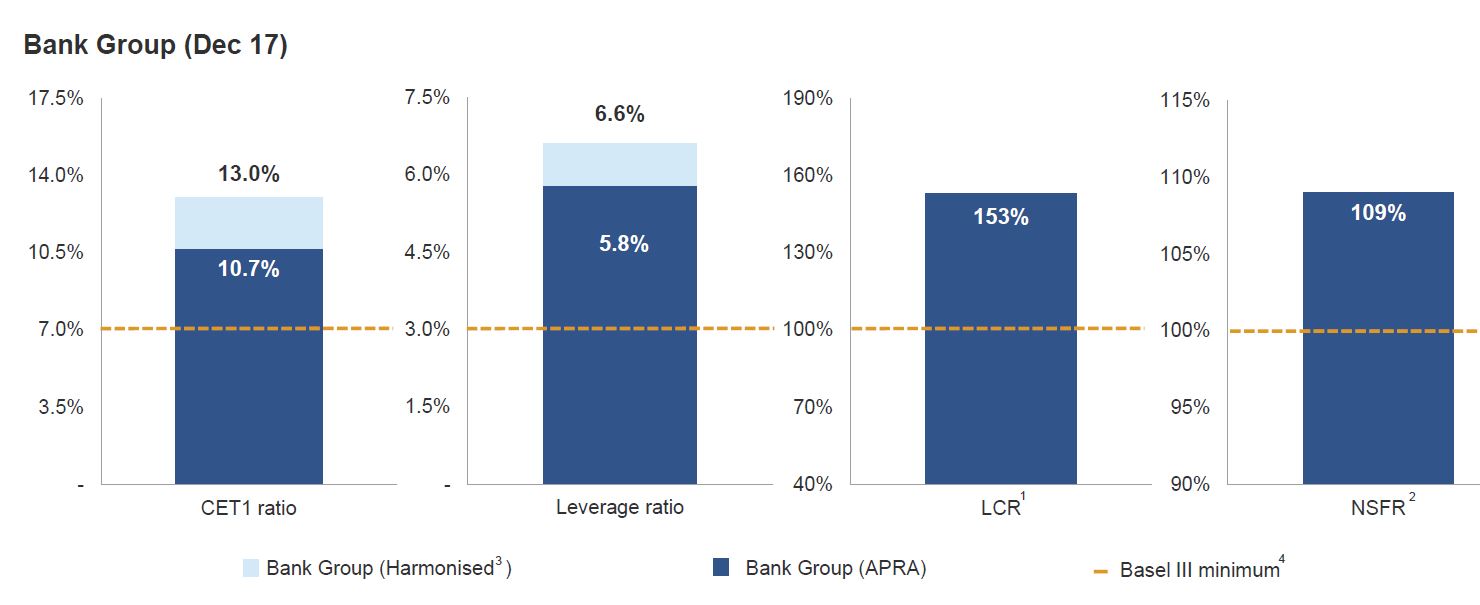

They maintain a strong financial position, with Bank CET1 ratio 10.7% (Harmonised: 13.0%); Leverage ratio 5.8% (Harmonised: 6.6%); LCR 153% NSFR 109%. They have a Group capital surplus of $A4.1 billion, above regulatory minimums. Although Macquarie’s share buyback program remains in place, no buying occurred during 3Q18.

Based on past performance, Macquarie estimates a reduction of approximately 3-4% in the Group’s historical effective tax rate from the US tax reform, but currently expects that there will be no material impact to FY18 NPAT.

Based on past performance, Macquarie estimates a reduction of approximately 3-4% in the Group’s historical effective tax rate from the US tax reform, but currently expects that there will be no material impact to FY18 NPAT.

Here are the business unit summaries.

- Macquarie Asset Management (MAM) had assets under management (AUM) of $A483.5 billion at 31 December 2017, up two per cent on 30 September 2017 predominately driven by positive market and foreign exchange movements. During the quarter, Macquarie Infrastructure and Real Assets (MIRA) raised over $A7.1 billion in new equity, including $A3.9 billion in Asia and $A2.0 billion in Europe; invested equity of $A4.1 billion including infrastructure in Europe, Asia, Australia and the United States as well as agriculture in Australia; divested $A3.9 billion of assets in Denmark, France, the United States and Korea; and had $A15.1 billion of equity to deploy at 31 December 2017. Macquarie Investment Management was awarded $A4.6 billion in new, funded institutional mandates and contributions across 35 strategies. Macquarie Infrastructure Debt Investment Solutions (MIDIS) total third party investor commitments increased to over $A8.2 billion and closed a number of investments, bringing total AUM to $A5.8 billion. MIRA reached agreement to acquire GLL Real Estate Partners, a ~$A10b German-based manager of real estate assets in Europe and the Americas.

- Corporate and Asset Finance’s (CAF) Asset Finance and Principal Finance portfolio of $A34.6 billion at 31 December 2017 was broadly in line with 30 September 2017. Asset Finance originations were in line with expectations. During the quarter, Principal Finance had portfolio additions of $A0.1 billion. Notable realisations included the sale of Principal Finance’s investments in a United Kingdom rooftop solar platform; a United Kingdom care homes and supported living business; and a United States power plant in North Dakota.

- Banking and Financial Services (BFS) had total BFS deposits of $A46.3 billion at 31 December 2017, broadly in line with 30 September 2017. The Australian mortgage portfolio of $A31.2 billion increased four per cent on 30 September 2017, while funds on platform of $A85.3 billion increased eight per cent on 30 September 2017. The business banking loan portfolio of $A7.2 billion increased one per cent on 30 September 2017.

- Commodities and Global Markets (CGM) experienced stronger results in North American Gas and Power, while lower volatility impacted client hedging activity and trading results in Global Oil and Metals. Despite volatility being subdued in foreign exchange and interest rates, client activity in derivatives remained solid, particularly in Japan and North America. Increased market turnover led to improved brokerage income in Asian equities.

- Macquarie Capital experienced strong levels of activity during the quarter, with 107 transactions valued at $A35 billion completed globally, up on pcp (by number), driven primarily by advisory activity in Infrastructure and Energy, and advisory and debt capital markets activity in the Americas and Europe. Notable transactions included: Joint Lead Manager and Underwriter on Transurban Group’s $A1.9 billion fully underwritten pro rata accelerated renounceable entitlement offer, the largest publically-distributed ANZ new equity issue of 2017; raised over $US1.7 billion in equity commitments for Macquarie Capital sponsored real estate logistics platforms globally to be invested in India, China, United Kingdom and Australia; Green Investment Group announced several low carbon infrastructure transactions during the quarter, including acting as financial advisor, 50 per cent equity investor and development partner in the 650MW Markbygden Wind Farm in Sweden, allowing development of the largest single-site wind farm in Europe (circa €800 million total capital raise); and financial advisor to Centerbridge Partners on its acquisition of Davis Vision and joint bookrunner and joint lead arranger on the $US985 million financing.