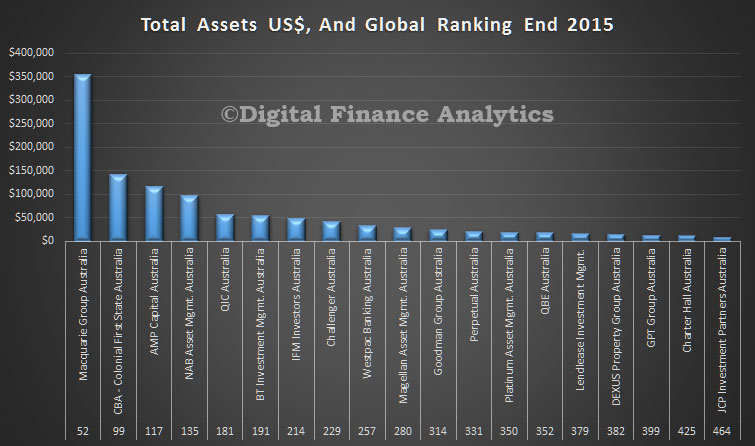

Assets managed by the world’s largest 500 asset managers fell in 2015 for the first time since 2011. In Australia, Macquarie is the largest asset manager and ranked 52 globally, with US$355 billion in assets under management. It was ranked 50 in 2015 and saw a decline of US$14.8 billion in assets, or 4%.

Australia’s second largest manager, the Commonwealth Bank of Australia, owners of Colonial First State experienced a 9% drop in funds under management from $US156.3 billion to US$142.3 billion. Their rank increased from 100 in 2014 to 99 in 2015.

Westpac, due to its decision to sell down its stake in BT Investment Management, saw the largest fall in assets during the year. Its assets under management fell 53% from $US72.6 billion to $US33.7 billion.

Charter Hall experienced the greatest increase in rank, moving from 468 in 2014 to 425 in 2015 and had the greatest percentage increase in funds among Australian managers, rising 23% from $US9.4 billion to $US11.6 billion.

In 2005 Australia accounted for 0.89% of global assets, now in 2015 it has risen to 1.47%. Assets grew 12% in the last 5 years in local currency, and 5% in US$ terms.

According to the Pensions & Investments / Willis Towers Watson World 500 research, total assets under management (AUM) were down 1.7% to US$ 76.7 trillion at the end of 2015, compared to US$ 78.1 trillion the year before.

North American firms’ AUM were US$ 44.0 trillion at the end of 2015, a decrease of 1.1% from the previous year, while assets managed by European managers, including the U.K., decreased by 3.3%, to US$ 25.1 trillion. UK-based firms’ assets decreased 2%, reducing their AUM to US$ 6.6 trillion.

The top 20 managers’ share of the total assets increased from 41.6% to 41.9%, even though their assets decreased from US$ 32.5 trillion to US$ 32.1 trillion. The bottom 250 managers’ share of total assets decreased from 6.0% to 5.8%, having assets of US$ 4.4 trillion.

The research, which was conducted in conjunction with Pensions & Investments, a leading US investment newspaper, reveals that actively managed assets, which continue to make up the majority of total assets (78.3%), also fell 2.8% in 2015, while passive assets declined at a faster rate, 5.5% during the year.