According to Moody’s, on 11 January, the Canadian government published a consultation paper on its previously announced open banking initiative to foster competition within its banking industry. The initiative will provide policy recommendations on how best to allow retail bank customers to share their financial transaction data with fintechs and other financial services providers such as small and mid-sized banks to facilitate application development so that retail clients can compare financial products and change bank accounts more easily.

The government initiative is credit negative for the largest Canadian banks’ retail operations because it has the potential to incrementally weaken the industry’s favorable industry structure of a few concentrated players, and therefore the banks’ retail franchise strength and associated high profitability.

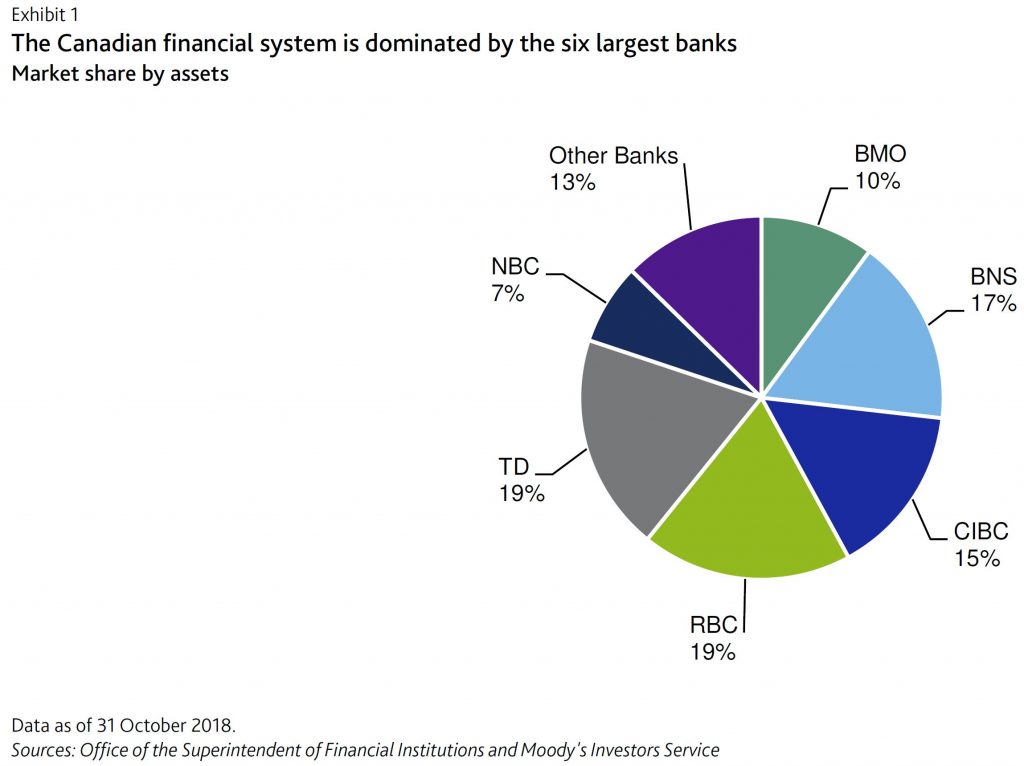

The largest Canadian banks are Bank of Montreal (BMO, Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), The Toronto-Dominion Bank (TD) and National Bank of Canada (NBC). As of 31 October 2018, these six banks held 87% of Canada’s banking assets.

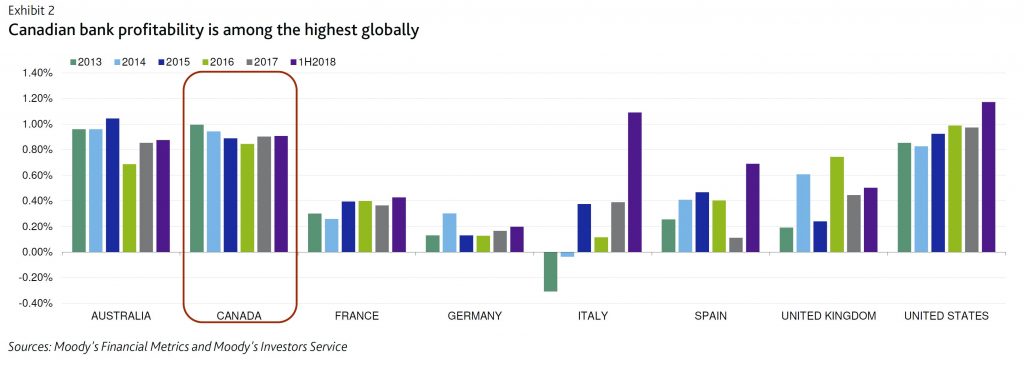

Canada’s banking system is highly concentrated and more profitable for the largest incumbents than in other banking jurisdictions.

Moody’s says “we believe the six largest banks have sufficient financial resources and fintech expertise to adapt to innovation in consumer banking. Nonetheless, technological disruption is likely to erode the incumbents’ profitability in certain retail lending products, such as credit

cards, and/or payments over the long term as smaller, more agile banks achieve competitive advantages”.