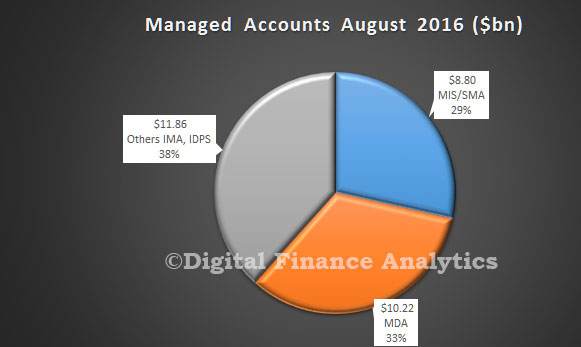

Further evidence of complexities in the investment sector in Australia are demonstrated by the latest estimates from The Institute of Managed Account Professionals (IMAP) which uses data from their 2016 survey. This shows that based on responses from 29 out of 37 organisations surveyed, total funds under management/administration (FUM) held in managed accounts now exceeds $30.874 billion.

The results show that managed accounts are a very significant part of the retail financial services market – already equivalent to approximately 5% of all the investment assets held on platforms.

In February 2015, IMAP had surveyed the main providers and estimated that the market size exceeded $13 billion in total FUM. Morgan Stanley recently predicted that Managed Accounts would exceed $60 billion by 2020. So there has been significant growth.

In February 2015, IMAP had surveyed the main providers and estimated that the market size exceeded $13 billion in total FUM. Morgan Stanley recently predicted that Managed Accounts would exceed $60 billion by 2020. So there has been significant growth.

Here is the list of entities who responded. There is an interesting mix of integrated financial services players, and several stand alone organisations and start-ups. Many have fingers in multiple pies!

The results show that managed accounts are a very significant part of the retail financial services market – already equivalent to approximately 5% of all the investment assets held on platforms.

The results show that managed accounts are a very significant part of the retail financial services market – already equivalent to approximately 5% of all the investment assets held on platforms.

IMAP says the inflow to managed accounts services has been strong through 2015-16 and is likely to continue to grow strongly. The growth since the 2015 survey has been largely in platform based services rather than in “client own name” services, showing the extent to which financial planners and advisers have now adopted managed accounts as a way of delivering their overall advice service.Over 85% of the FUM measured in this survey would also be counted in a survey of the retail IDPS and Superannuation platforms. Also, this 2016 result is not directly comparable to the total FUM amount measured in the 2015 survey because the survey process this year continues to add new participants. The results also show significant growth for those who have participated in both surveys. Managed Accounts are provided in a variety in legal structures and several organisations can be involved in a single service. This means that there is a risk of overlap between the returns from several organisations, so the numbers are at best indicative.

ASIC says MDA services involve a range of financial products and financial services, such as offering and trading in financial products, operating a custodial and depository service, and giving personal advice. Because of the individualised nature of the range of financial services involved, they will regulate persons contracting with retail clients to provide MDA services as providers of financial services rather than issuers of a financial product. Managed accounts are increasingly considered a mainstream investment management solution and many managed account solutions are made available using a MDA approach.

However, advisers operating a managed discretionary account (MDA) service are expecting new tighter regulations soon.

A large number of industry participants provide MDA services to retail clients using a no action letter issued back in 2004. The no action letter came about because the industry argued that unlike “full service” MDAs, many advisers primarily used discretion to rebalance managed fund portfolios via a regulated platform which took care of administration, custody and reporting. It successfully argued that it wasn’t clear whether they needed to be licensed or not. If the no action letter is removed, Limited MDA arrangements, particularly those with portfolios across a range of instruments, will probably need to gain specific MDA authorisation on their licence to continue their current approach.

ASIC has also flagged plans to increase the capital requirements for MDA

operators so that net tangible assets (NTA) of 0.5 per cent of funds under administration (FUA) up to $5 million will need to be maintained (assuming custody is outsourced).