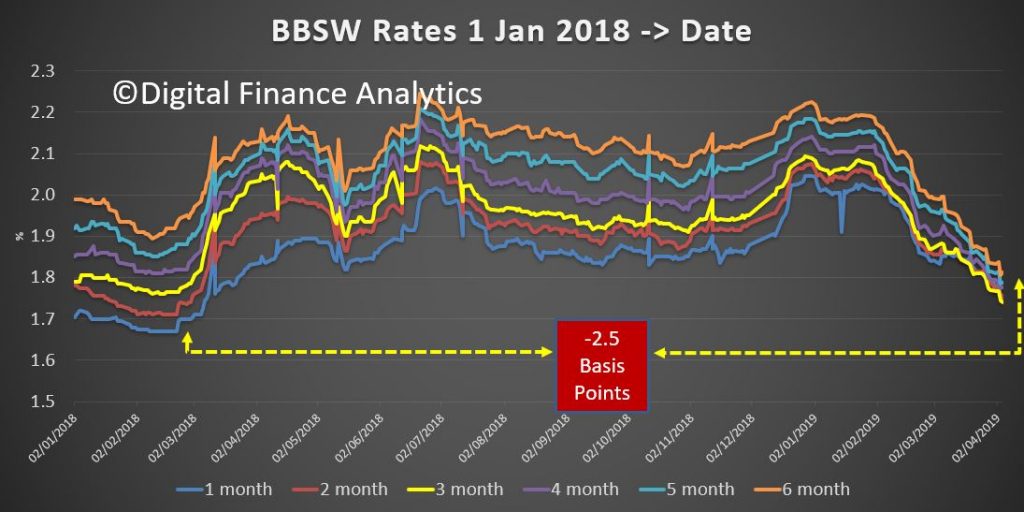

The recent fall in the BBSW has offered a window of opportunity for CBA and Westpac, the two mortgage behemoths to cut fixed rates.

This will put more pressure on smaller players (see BOQ yesterday) and likely trim some deposit rates as pressure on margins accelerates.

This from Australian Broker.

Just days after CBA announced it was cutting its rates and stepping away from its competitors, another big four has matched the changes across the board – and likely triggered a continued decrease in fixed rates at lenders of all sizes.

The newly announced decreases go into effect at Westpac tomorrow for fixed rate loans paying P&I and are open to both new and existing customers switching into a fixed rate.

“As expected, it hasn’t taken Westpac long to match the fixed rate cuts this week from Commonwealth Bank,” said Steve Mickenbecker, Canstar group executive of financial services.

“These decreases are a further sign that the big banks are wanting to fight back to regain the market share losses to the local arms of foreign banks and other domestic lenders over the past 12-months.”

At Westpac, the three- and five-year fixed rates for owner occupiers paying P&I are to decrease by 0.10% while the four-year rate will drop by 0.20%.

Fixed rates will also decrease for investors paying P&I, by 0.06% for two-year, 0.20% for three-year, and 0.10% for five-year, demonstrating “the bank’s desire to increase investment lending in the face of declining demand,” according to Mickenbecker.

Other lenders have already been making moves of their own to stay competitive.

Suncorp has announced a discount for its three-year fixed package rates for eligible new home lending, meaning the non-major currently has the lowest three-year fixed rate in the market at 3.49% for owner occupied and 3.69% for investment.

“We are now eagerly awaiting the response from the other two major banks and the rest of the market, in light of these competitive fixed rates from the country’s two biggest lenders,” concluded Mickenbecker.