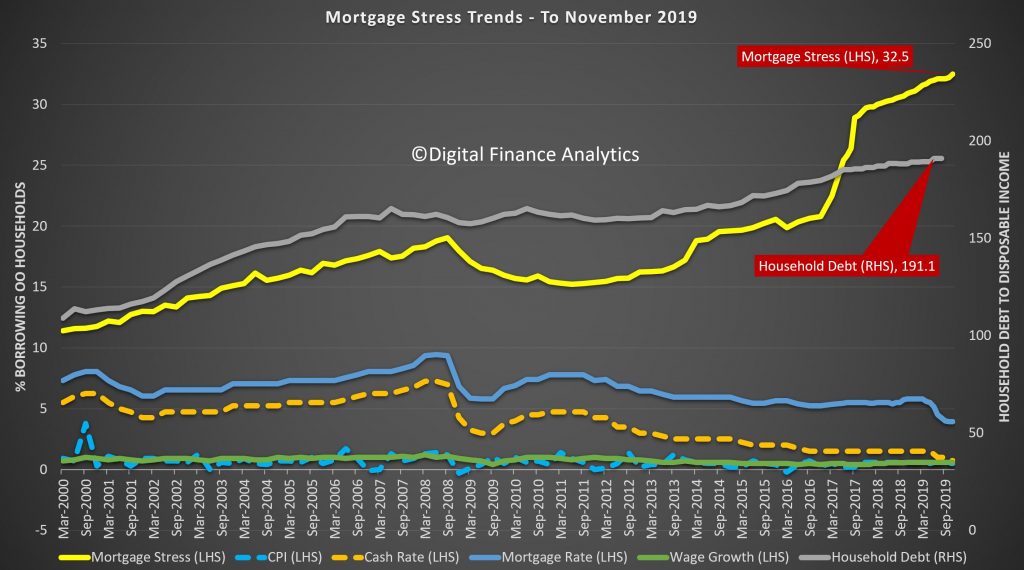

DFA has released our mortgage stress survey results to the end of November. And after a couple of months going sideways, thanks to some rate cuts and tax refunds, the trajectory has gone sharply higher again this month.

One factor which is now biting is the switch from interest only loan to principle and interest loan repayments, which has lifted average monthly repayments by more than 20% for some. In addition the underemployment and unemployment factors are playing in, as is the drought. In fact, the drought now appears to be right up there in terms of directly hitting regional unemployment as well as lifting food prices more generally. This all suggests that even more stress is baked in ahead.

The proportion of households now in mortgage stress, based on an assessment of their cash flow (money in, compared with money out, including mortgage repayments where appropriate), has now lifted to 32.5% of households.

This equates to 1,082,000 households, the highest ever measured in our surveys. Worse, more are slipping into risk of mortgage default, according to our forward modelling*. More are also in severe stress, reaching over 80,000 for the first time. These households are more likely to default ahead.

Household debt to income remains at an all-time high. In addition, more continue to raid deposits to make ends meet.

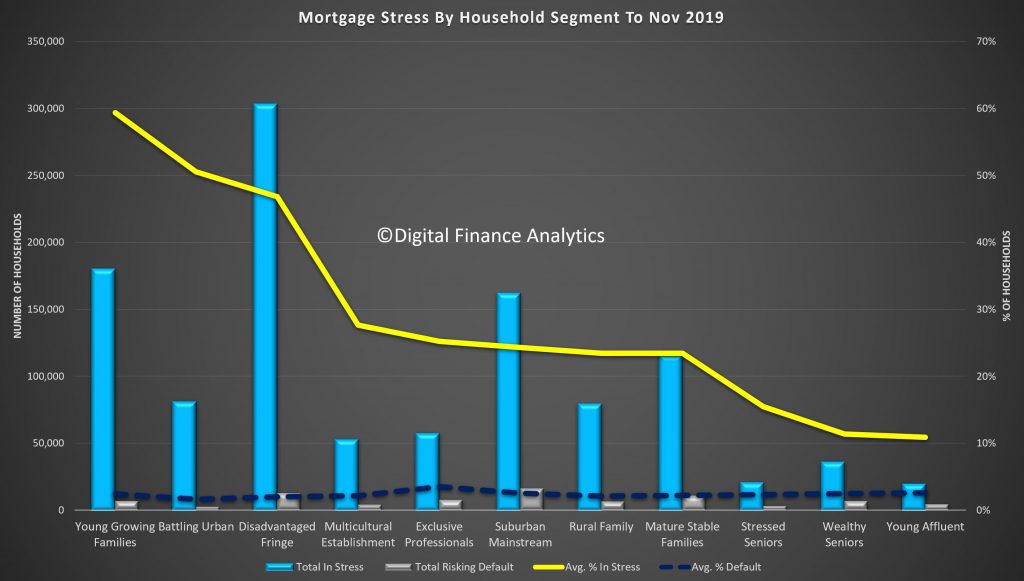

Across the DFA household segments we continue to see some variations between cohorts. Young Growing families have the highest stress, and many first time buyers are represented in this group. The largest counts are located on the urban fringe, and many of these households are living on newly build high density estates. However, stress continues to spill over into more affluent groups, and here the impact of the IO loan switch is quite strong. Some of these are living in the high rise sector, where construction issues are also biting.

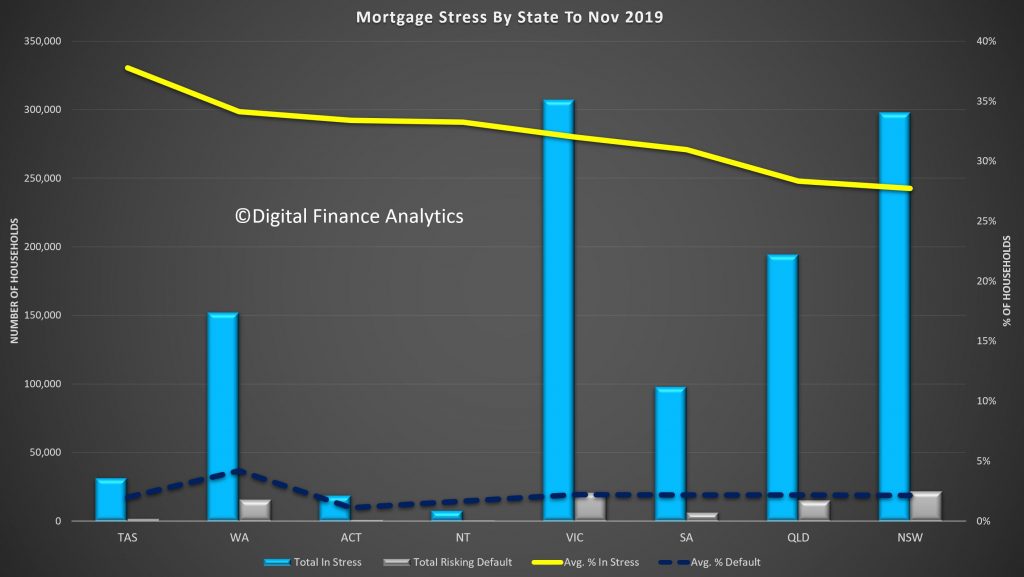

Across the states Tasmania has the highest proportion in stress, thanks to low wages, and recent price hikes, but the largest number of households in any one state is in Victoria. However, the default rates look to be rising faster in Sydney, where values are more extended relative to incomes.

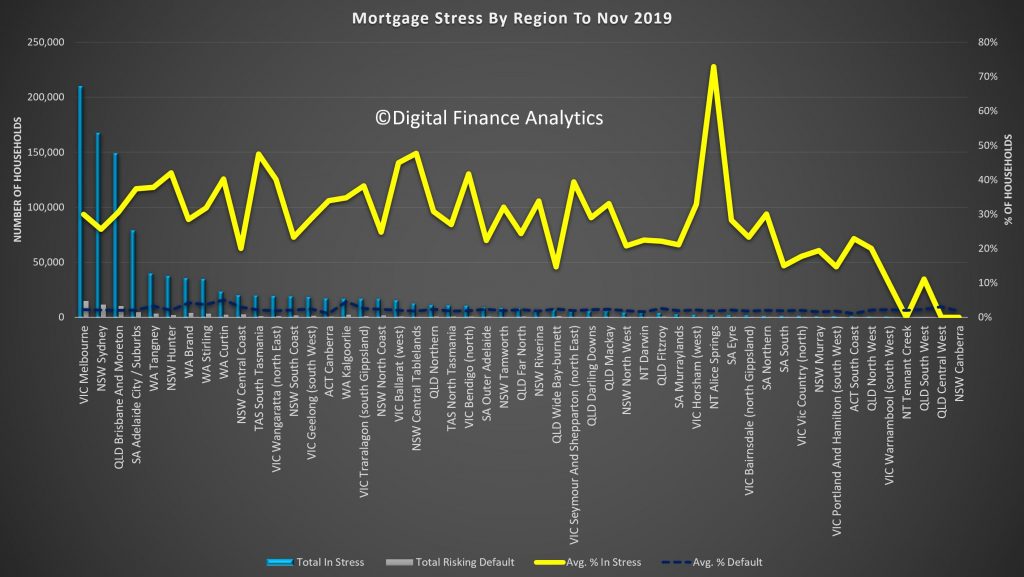

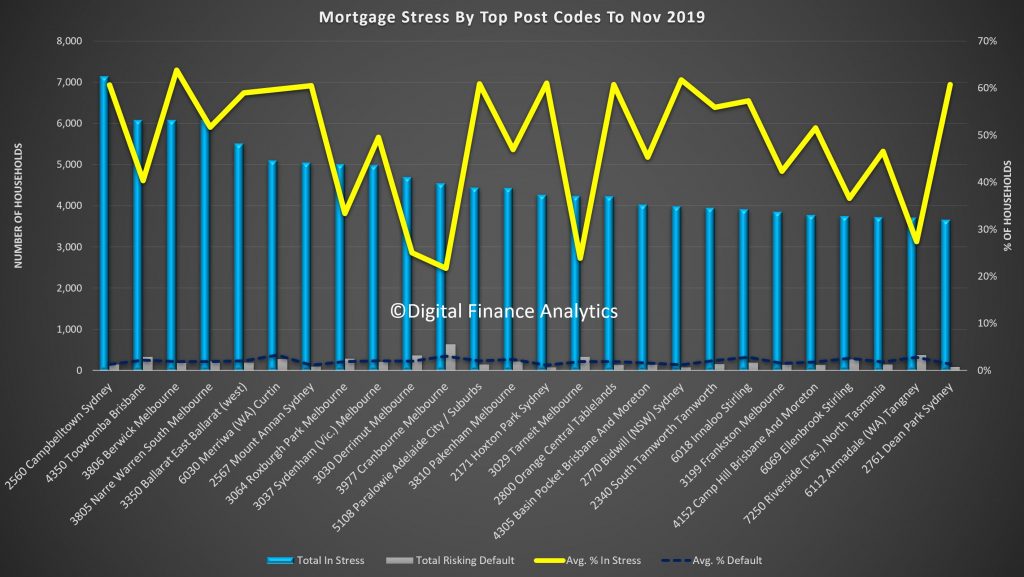

At a regional level, the largest counts are in the main urban centres of Melbourne and Sydney as expected, although stress is spilling out more widely into regional centres.

And our top post codes continues to centre in on the urban fringe, with Campbelltown, Toowoomba and areas around Melbourne including Berwick and Narre Warren all showing the largest counts of stressed households. Cranbourne 3977 has the highest count of potential defaults this month. Postcodes in WA are still under pressure as the economic grind continues.

*Note: last month we briefing misreported the household stress figure at 1.77 million not 1.07 million. This was corrected within a few moments of posting. You can see the previous post here.

Our surveys are based on a rolling 52.000 household sample, which equates to around 0.5% of households.