In our final update of the year, we incorporate the latest from our surveys as we assess the impact higher interest rates are having on households across the country, based on our rolling 52,000 omnibus survey.

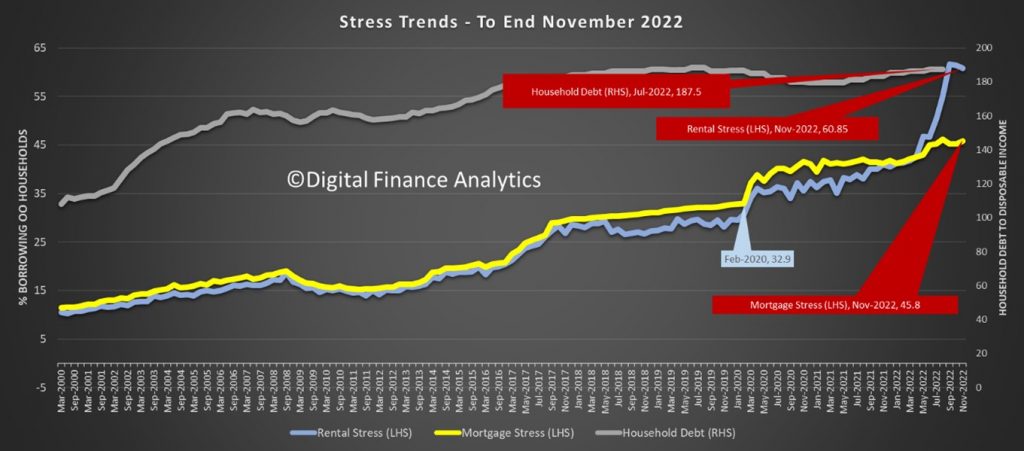

And the news is not good, in that both mortgage stress and rental stress – defined in terms of cash-flow in and out, continues to grow, following the eighth rate hike from the RBA, which was promptly passed on to households by way of higher mortgage rates, (though not reflected to the same extent in higher deposit account rates I might add). There was also a continued rise in average rents, thanks to intense competition, lower supply and leveraged investors. All this set against an average inflation rate expected to hit eight per cent soon.

There are many different definitions out there (from 30% of income, or taxable income; through to underwriting metrics) but we define stress in CASH FLOW terms. If households have more outgoings (excluding one off discretionary items) than income, we define them as stressed. If they have a mortgage, they are in mortgage stress; if renting then rental stress.

Investors with cash flow pressures are identified as stressed investors. We also aggregate the data to estimate total financial stress. Each expressed as a % of households, and count. The latter is the best measure in our view.

This month, more than 1.75 million households with an owner-occupied mortgage, or 45.8% of borrowers register as stressed, while more than 1.88 million renting households, or 60.85% are stressed. And the household debt to income remains very high, as reported by the RBA.

Analysis By State

In this slide, we highlight in yellow where the proportion of households in stress rose compared with last month, blue means a fall, and no highlight means no change. Tasmania and South Australia are now vying for top spot, both with more than half of household in a negative cash flow situation. WA and Victoria follow on, then NSW and the other states.

Rental stress is most significant in NSW, ACT and QLD. Investor stress is highest in NSW, because many investors are over-geared and experiencing significant rate hikes. Overall financial stress (an aggregated measure reveals that the state with the highest proportion of household in financial stress is the ACT.

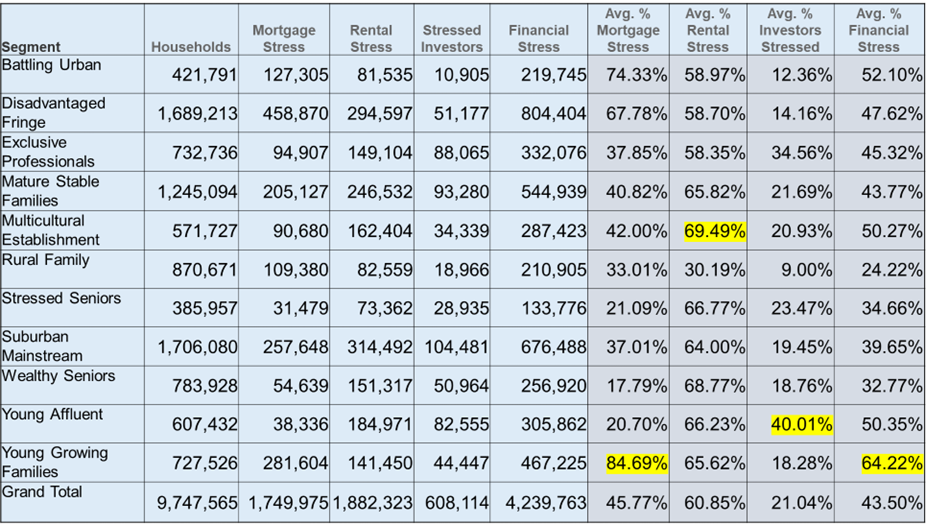

Analysis By Cohort

We analyse our data by different household segments or cohorts, as this provides an important lens to understand what is playing out across the country.

Mortgage stress is highest among Young Growing Families (which include many First Time Buyers) at 84.69%. We see also large counts of those on the Urban Fringe, as well as some more affluent households exposed. Rental stress is highest among first generation migrants at 69.49%. Investor stress is highest among Young Affluent households and overall financial stress is highest among Young Growing Families.

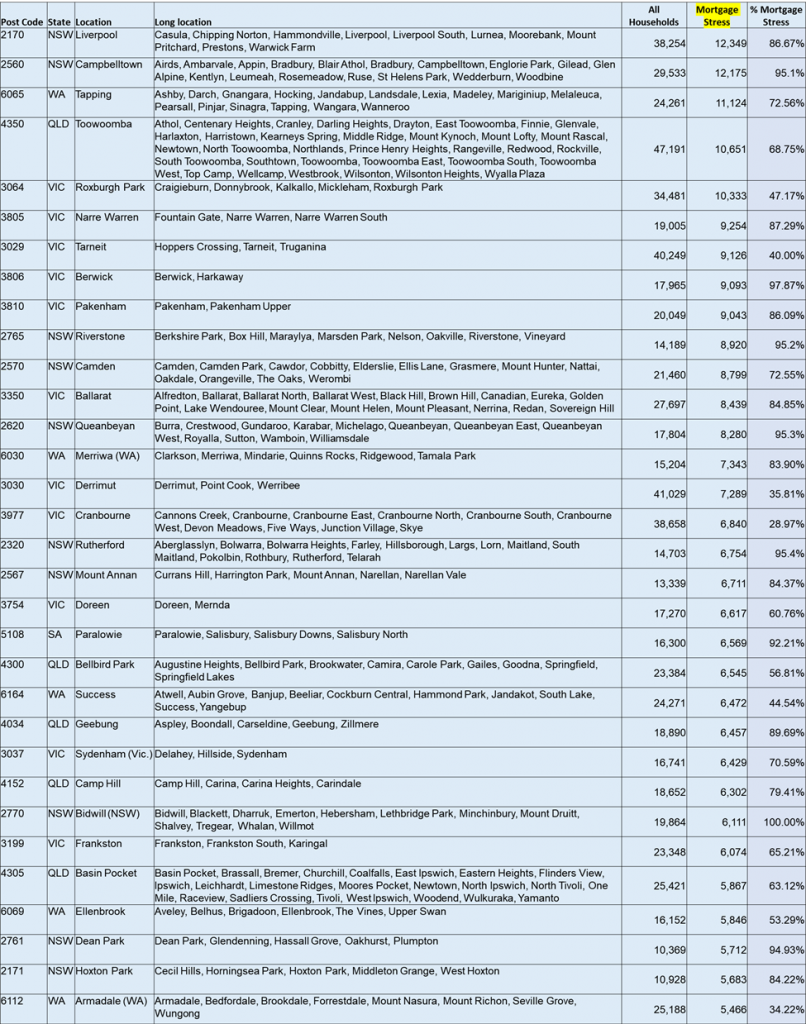

Whilst we continue to see stress building in the high growth suburbs, where many purchasers entered the market when mortgage rates were around 2%, we continue to see pockets of stress across different areas, including some which would generally be regarded as more affluent. Many households in these regions have large mortgages.

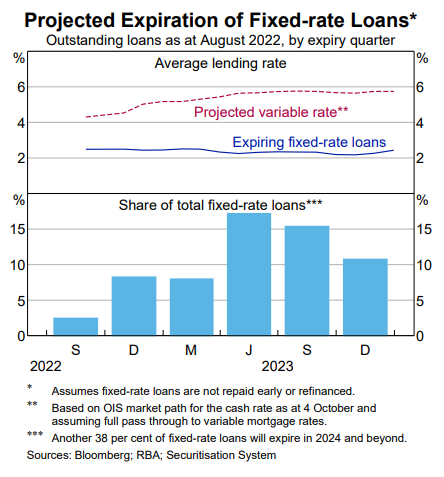

It is worth reflecting on the fact that about one quarter of mortgage holders have so far been insulated from mortgage rate rises because they are on fix term loans. However, many of these are due to reset next year, as the RBA showed in a recent report.

The expectation is that rates will still be high through 2023, and that mortgage delinquencies will rise, at the same time a property prices continue to slide. This is a perfect storm.

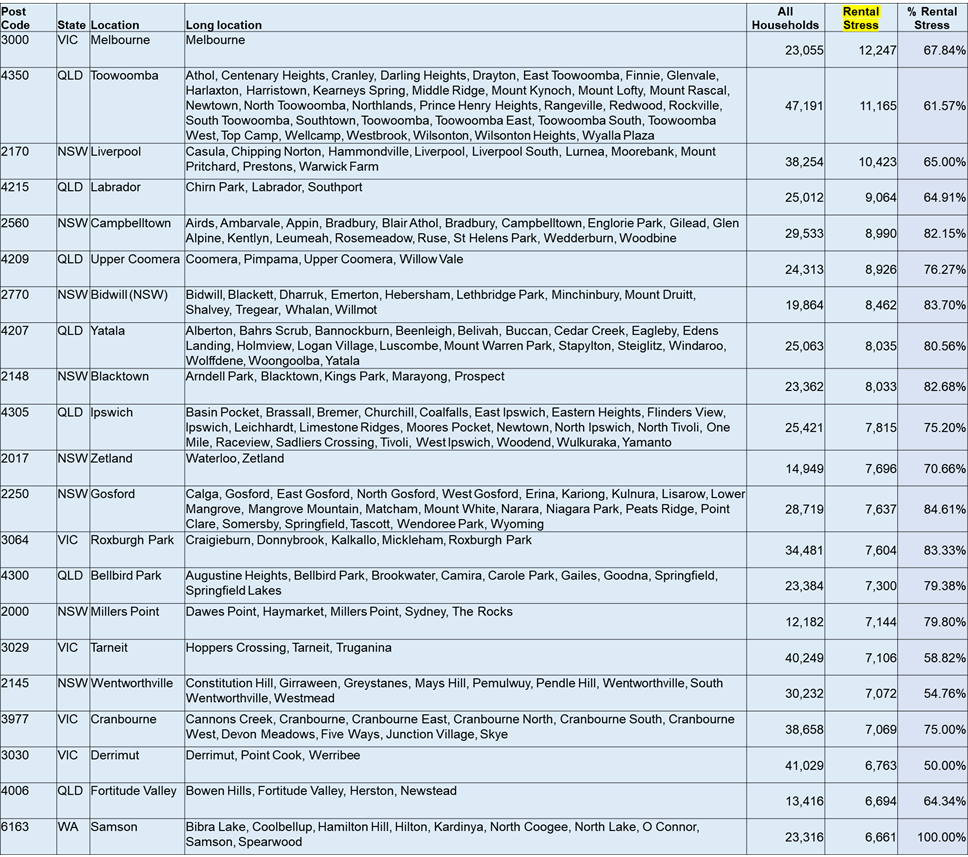

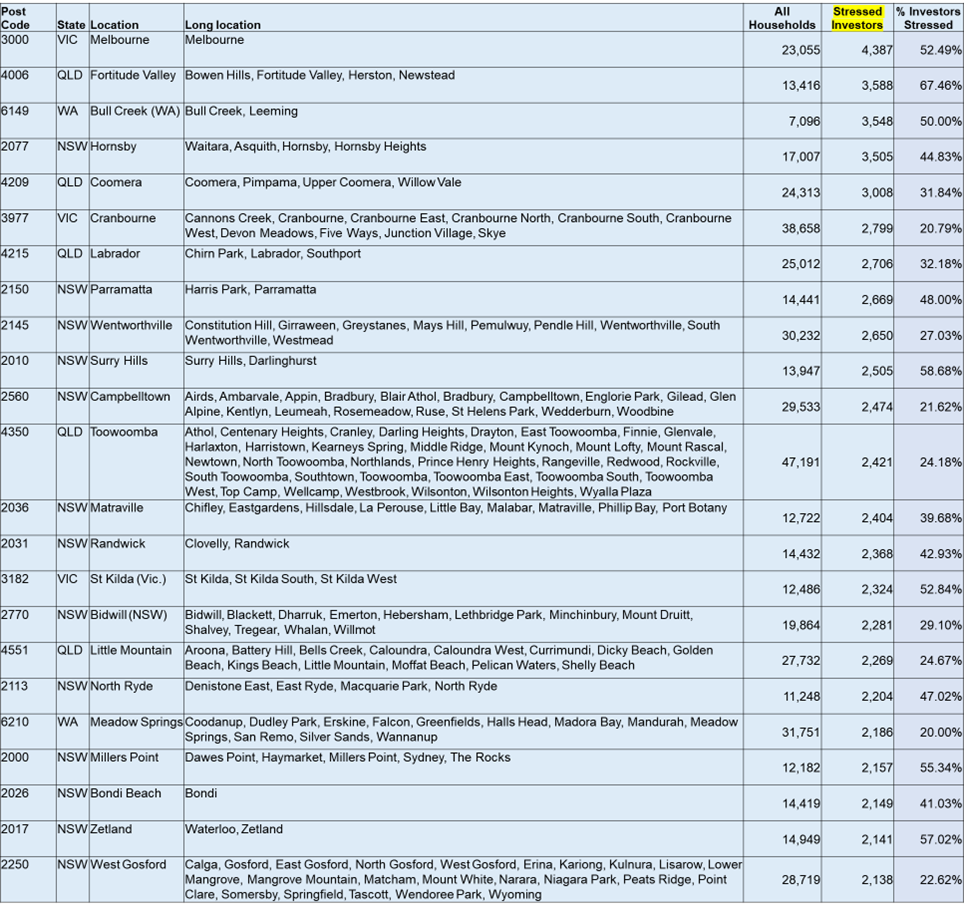

Post Code Analysis

We list the top post codes in each category, based on the COUNT of households.

Conclusions

We do not expect things to ease ahead, as interest rate rises continue to work though, and rental costs rise. Inflation is running hotter than expected, and the RBA still expects a peak around 8% but also staying high through 2023. As a result, households need to get to grips with their cash flow and prioritise important payments, such as mortgage and rental payments, over other perhaps less critical payments.

Households under mortgage pressure would do well to talk to their bank who do run hardship schemes designed to assist in times of crisis.

We also recommend the Government Debt Help Line on 1800 007 007 for people seeking unbiased free advice.

Finally, real wages growth remains below inflation, so households must consider the scenario where true incomes continue to shrink in real terms. As a result, stress levels will remain high for some time yet.