NAB released their Q3 Trading update and capital report today. They said that cash earnings declined by 1%, and compared to the prior corresponding period were down 3% reflecting higher investment spend and credit impairment charges.

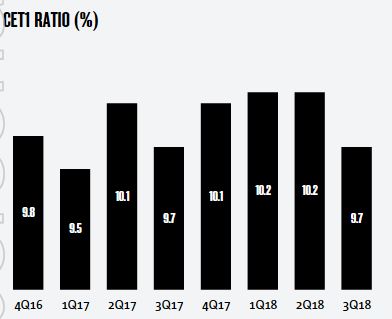

Their unaudited statutory net profit was $1.65 billion, and their CET1 ratio was 9.7%, which was down about 50 basis points from 1H18. The drop from 10.2% at March 2018, largely reflects the impact of the interim 2018 dividend declaration (63bps net of DRP) and seasonally stronger loan growth in the June quarter.

They expect to meet APRA’s ‘unquestionably strong’ target of 10.5% in an orderly manner by January 2020.

They expect to meet APRA’s ‘unquestionably strong’ target of 10.5% in an orderly manner by January 2020.

Their leverage ratio (APRA basis) was 5.3%, the liquidity Coverage Ratio (LCR) quarterly average was 132% and the Net Stable Funding Ratio (NSFR) was 113%.

While revenue was up 1% due to good growth in SME lending within Business & Private Banking and a strong contribution from New Zealand Banking, net interest margin declined slightly, reflecting elevated short term wholesale funding costs and ongoing intense home loan competition.

In addition, expenses rose 2% due to higher compliance costs, investment spend consistent with the accelerated strategy, and increased depreciation and amortisation.

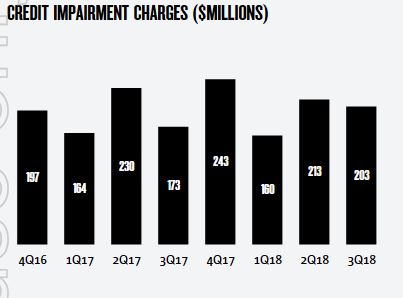

Credit impairment charges rose 9% to $203 million and included $25 million of additional collective provisions for forward looking adjustments (FLAs), bringing the total balance of FLAs to $547 million.

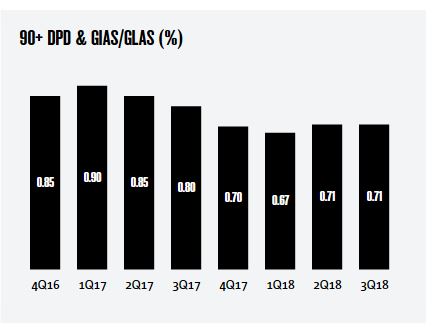

They say asset quality remains sound with the ratio of 90+ days past due and gross impaired assets to gross loans and acceptances steady at 0.71%.

They say asset quality remains sound with the ratio of 90+ days past due and gross impaired assets to gross loans and acceptances steady at 0.71%.

However, 90-Day past due residential mortgage loans stood at $2,015 million, at 30th June 2018, compared with $1,956 million in March 18, so delinquencies are rising. Impaired facilities also rose a little. $20 million of mortgages were written off in the quarter, compared with $10 million in the prior quarter.

However, 90-Day past due residential mortgage loans stood at $2,015 million, at 30th June 2018, compared with $1,956 million in March 18, so delinquencies are rising. Impaired facilities also rose a little. $20 million of mortgages were written off in the quarter, compared with $10 million in the prior quarter.

They also warned of further provisions for “unresolved compliance issues” in the next quarter. No guidance on the quantum, so far.

They reported that their priority Segments Net Promoter Score (NPS) declined from -9 in March to -14 in June, partly reflecting an overall industry decline, with NAB’s priority segments NPS now second of the major banks.