NAB has released their latest trading update, and it makes an interesting comparison with CBA yesterday. CBA reported a significant upswing in net interest margin (NIM) thanks to mortgage book repricing, whereas NAB says overall NIM was down, and excluding Institutional Banking, was flat.

As well as the inpact of the bank levy, NAB has grown their mortgage book faster than CBA, so it seems to highlight NAB trading volume for margin. CBA, on the other hand, in their briefing, acknowledged they may have slowed their mortgage acquisition too much, and will be now ramping up a bit.

As well as the inpact of the bank levy, NAB has grown their mortgage book faster than CBA, so it seems to highlight NAB trading volume for margin. CBA, on the other hand, in their briefing, acknowledged they may have slowed their mortgage acquisition too much, and will be now ramping up a bit.

Cash earnings declined by 1%, but were 3% up on the prior corresponding period at of $1.65b. Revenue was up 1% with good growth in Business and Private Banking and Corporate and Institutional (but at lower margin?). Expenses rose 4% due to the increased business investment, and expect 5-8% growth in expenses in FY18, then flatter in F19-20.

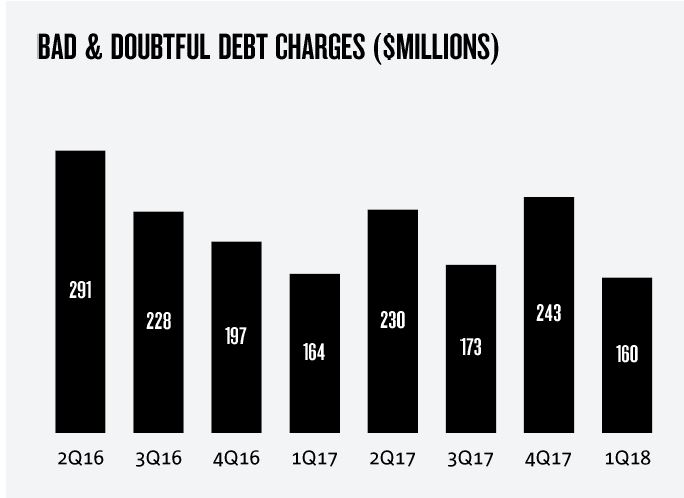

Bad and doubtful debts fell 23% to $160m, after lower specific charges, offset by collective provision increases for planned mortgage model changes. Last time they had a change to their collective provision overlays which lifted B&DD.

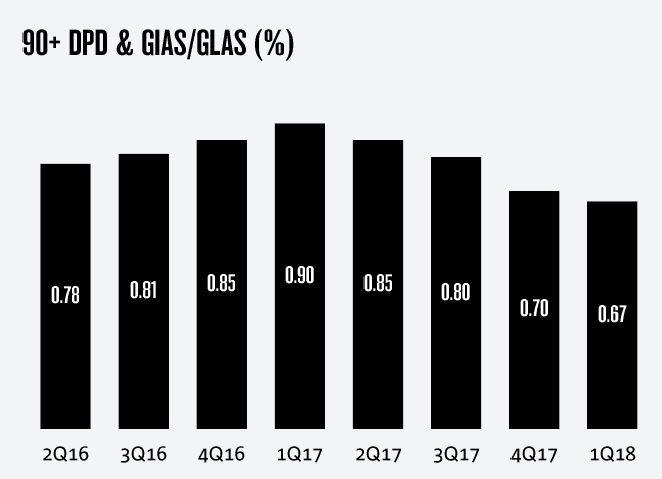

Asset quality improved, with 90+ days past due and gross impaired assets to gross loans down 3 basis points to 0.67%, thanks mainly to improvements in the New Zealand dairy sector. Their mortgage book of $327 billion had a 90 day past due of 0.55%, and weight risk ratio of ~31%.

Asset quality improved, with 90+ days past due and gross impaired assets to gross loans down 3 basis points to 0.67%, thanks mainly to improvements in the New Zealand dairy sector. Their mortgage book of $327 billion had a 90 day past due of 0.55%, and weight risk ratio of ~31%.

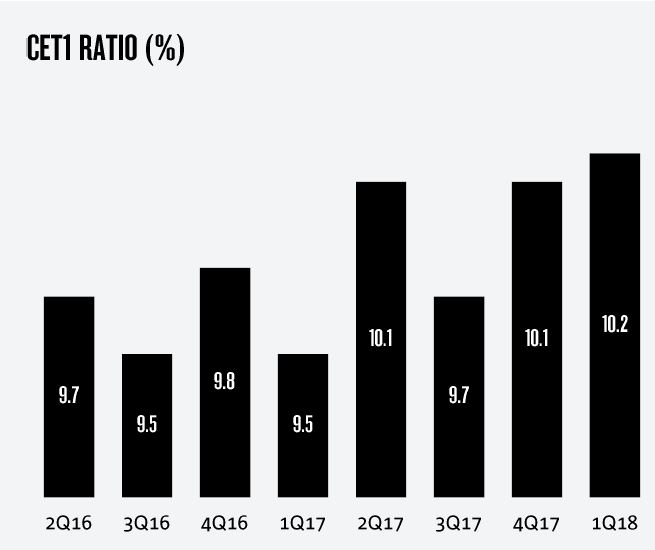

Group CET1 ratio was 10.2%, thanks to lower risk weighted assets and the 1.5% Dividend Reinvestment Plan discount for FY17. They expect to meet APRA’s unquestionable strong target of 10.5% by January 2020. The leverage ratio was 5.4% (APRA basis) compared with 5.5% in Sep 2017. The Liquidity Coverage Ratio was 126% and the Net Stable Funding Ratio was 110%.

Group CET1 ratio was 10.2%, thanks to lower risk weighted assets and the 1.5% Dividend Reinvestment Plan discount for FY17. They expect to meet APRA’s unquestionable strong target of 10.5% by January 2020. The leverage ratio was 5.4% (APRA basis) compared with 5.5% in Sep 2017. The Liquidity Coverage Ratio was 126% and the Net Stable Funding Ratio was 110%.

Nab said they were on track to make the estimated $1.5 billion increase in business investment, and cost savings of more than $1 billion are still being targeted by end FY20.

Nab said they were on track to make the estimated $1.5 billion increase in business investment, and cost savings of more than $1 billion are still being targeted by end FY20.