Mastercard has announced a new platform (in the US initially) which issuers can offers to their customers called Assemble. The first product allows millennials to manage money through a digital prepaid account, a mobile app and a payment card (virtual or physical).

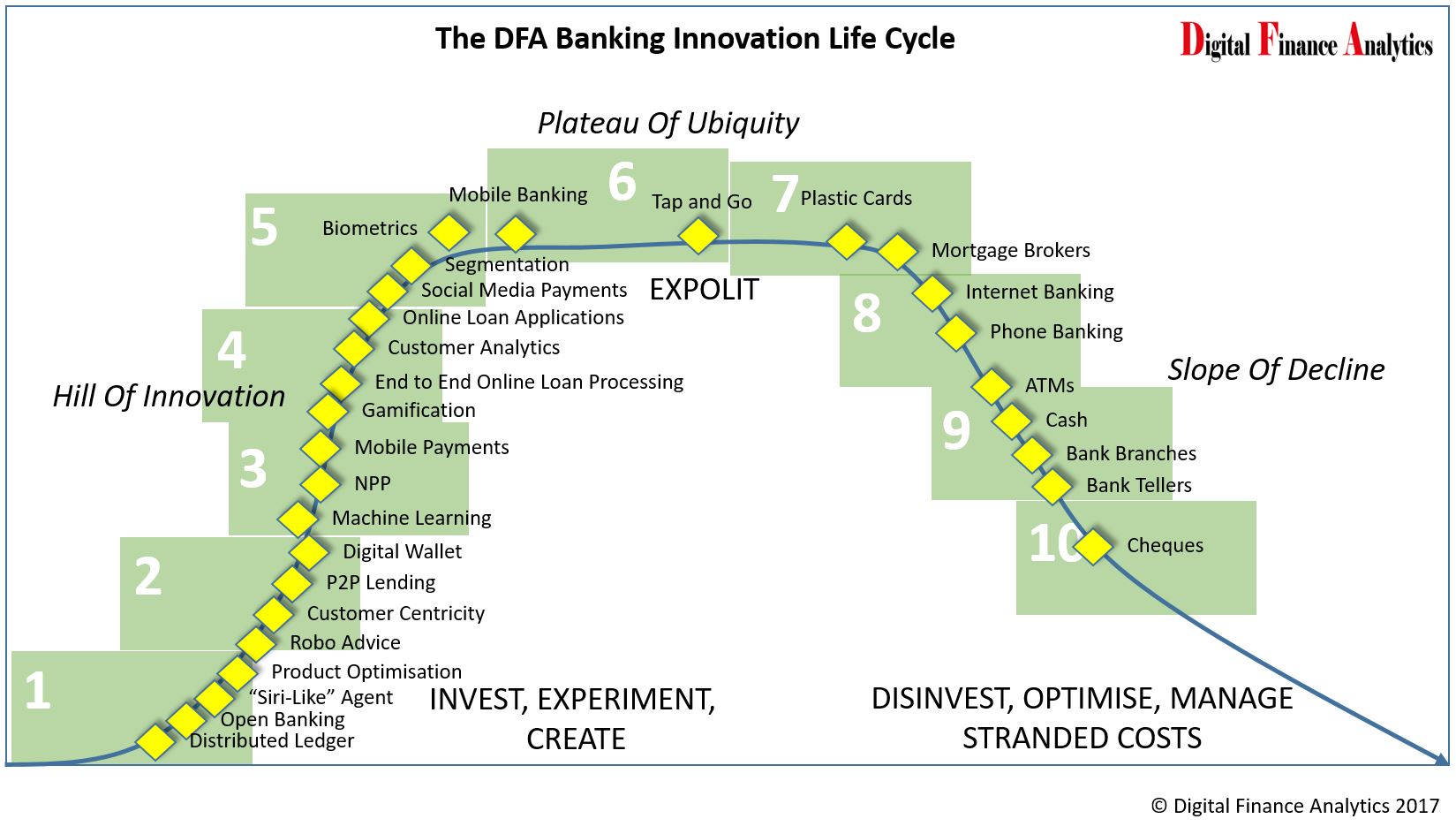

Its a great example of the emerging digital tools aimed to build loyalty, by assisting customers with additional money management features, delivered digitally, as predicted in our Banking Innovation Life Life Cycle.

Mastercard is currently developing additional use cases to support prepaid programs for additional segments such as underserved consumers and microbusinesses, and the gig economy. Mastercard Assemble for Millennials is available now in the United States with other markets being targeted within the next year.

Mastercard is currently developing additional use cases to support prepaid programs for additional segments such as underserved consumers and microbusinesses, and the gig economy. Mastercard Assemble for Millennials is available now in the United States with other markets being targeted within the next year.

In our fast-paced lives, each one of us is juggling a lot – careers, relationships, social events, families, the list is endless. So why should we stress about banking and trying to manage multiple apps? Why not have one centralized, secure account to cover all of our banking needs?

Mastercard has a new platform and product to do just that:

- Assemble is a prepaid innovation hub that issuers and partners will offer to customers with holistic money management capabilities including checking balances, budgeting, setting savings goals and making near-real time payments to almost anyone in the U.S. with a valid debit card via a P2P service powered by Mastercard Send.

- The first product available from Assemble is geared toward millennials and, along with the features above, offers consumers a simple, smart and safe way to manage money through a digital prepaid account, a mobile app and a payment card (virtual or physical).

“Prepaid is much more than just a way to safely store and use funds. It is a foundation to create new possibilities for consumers,” said Tom Cronin, senior vice president, Global Prepaid Product Development and Innovation, Mastercard. “This technology enables our partners to deliver best-in-class digital experiences today, as we work to address additional segments such as gig economy workers and underserved consumers and micro businesses.”

Mastercard Assemble not only bundles assets and services together but also enables these digital prepaid solutions to promote innovation, increase the speed to market, and provide customers with seamless and secure usage. Issuers and partners can choose to deploy a white-label version of the solution or to integrate specific functions into their current user interfaces through APIs.

While Mastercard Assemble for Millennials will be the first launch, the company is currently developing additional use cases to support prepaid programs for additional segments such as underserved consumers and microbusinesses, and the gig economy. Mastercard Assemble for Millennials is available now in the United States with other markets being targeted within the next year.