The analysis of the monthly banking stats out last week gives us the opportunity to look across the non-bank sector, relative to the banking sector by comparing the APRA data with the Reserve Bank data series.

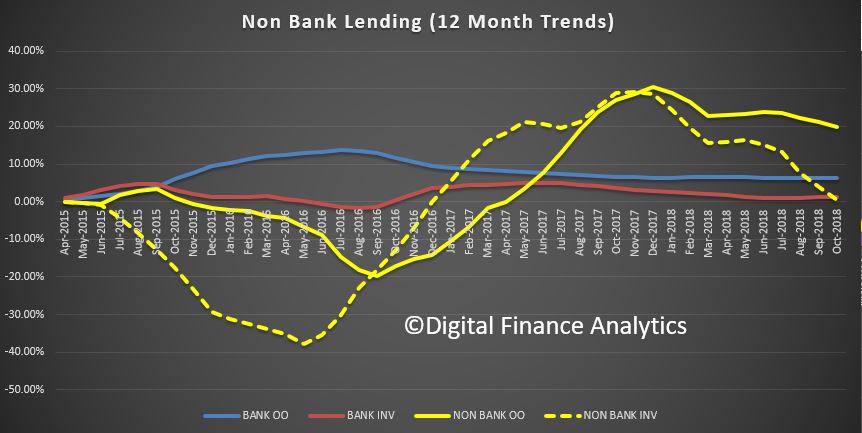

We have plotting the rolling 12 month trends, and this chart shows the results.

The striking observation is the relatively stronger growth rate relative to the banks supervised more directly by APRA. Granted APRA does have some responsibilities for the non-bank sector, but appear not to be their main focus.

All lenders have the same obligation with regards to responsible lending, but non-banks are generally more flush with cash, and less constrained by the capital requirements which crimp ADI’s.

Thus we can expect the growth on non-ADI mortgage lending to continue at a faster pace than the bank sector. As a result, we think more risks are building in the financial system.

Watch out for the wall down the road!