I caught up with Caroline Bowler, CEO of BTC Markets. The digital world is evolving fast, as Bitcoin reaches new recent highs. Whereto from here?

Go to the Walk The World Universe at https://walktheworld.com.au/

"Intelligent Insight"

I caught up with Caroline Bowler, CEO of BTC Markets. The digital world is evolving fast, as Bitcoin reaches new recent highs. Whereto from here?

Go to the Walk The World Universe at https://walktheworld.com.au/

We overview the recent shows on Walk The World, where I discussed deflation and inflation with Steve Van Metre and the recent In The Interests Of The People show with John Adams following his article on the question of Quantitative Easing and deflation.

Links to the full shows are below:

The Inflation Deflation Paradox With Steve Van Metre: https://youtu.be/ZfgvDsbTlws

IOTP: Exposing False Deflationary Propaganda https://youtu.be/xPCQ-e0MFGQ

And Steve’s recent discussion on Real Vision at https://youtu.be/h_HCIyc6MaA

Go to the Walk The World Universe at https://walktheworld.com.au/

In the latest spotlight, we look at post code 6058, near Perth airport.

Go to the Walk The World Universe at https://walktheworld.com.au/

I caught up with Economist and Author Harry Dent, ahead of his debate on Friday (Sydney time) with Peter Schiff, who I also interviewed last week.

Debate between Harry Dent and Peter Schiff 20th November 2020 http://crisisdebate.com

Go to the Walk The World Universe at https://walktheworld.com.au/

I caught up with Steve Van Metre to discuss the latest macro outlook.

Steven Van Metre, Certified Financial Planner™ Professional, (CA Insurance License #0D45202 & Investment Advisory Representative with Atlas Financial Advisors, Inc., a Registered Investment Advisory firm.) is a financial planner, portfolio manager, and President of Steven Van Metre Financial. He specializes in retirement income strategies and the direct management of client assets.

https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw/videos

Go to the Walk The World Universe at https://walktheworld.com.au/

Join us for a live discussion on investing in the current environment. I will be joined by Damin Klassen and Tim Fuller from Nucleus Wealth. You can ask as question live via the YouTube Chat.

What are the forces pulling the market higher, versus lower, and which will likely win out?

The latest from our property insider Edwin Almeida.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

An excellent piece of market analysis from Damien Klassen from Nucleus Wealth.

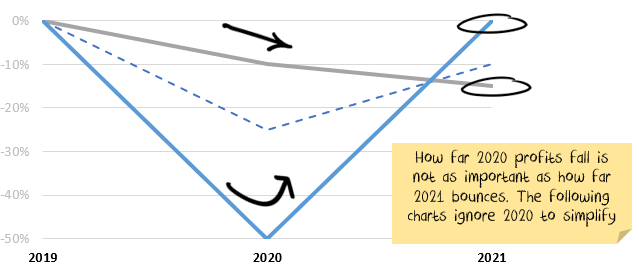

Investment markets have a host of both positive and negative factors fighting for supremacy. The real question is whether central banks and governments will engineer a continued suspension of capitalism. I was sceptical six months ago. I’m less sceptical now that capitalism will return anytime soon. On balance, however, there is still plenty of room for caution.

Short-term government policies to suspend capitalism (increased hurdle for bankruptcies, mortgage holidays, eviction moratoriums, banks not recognising bad debts, etc.) have morphed into medium-term policies. And, it is hard to see any government ready to exit. There is a quiet extension to each policy that lapses.

We took advantage of pre-election weakness to increase our risk exposure a little. But given the rise in markets since the election, the positive factors have mostly been reflected already. And, the positive factors tend to be short-term, the negative aspects tend to be medium-term.

Government stimulus: Global governments continue to add stimulus. The US has some question marks, and the stimulus won’t be as large as if Biden won Senate majority. But it would seem additional stimulus is highly likely.

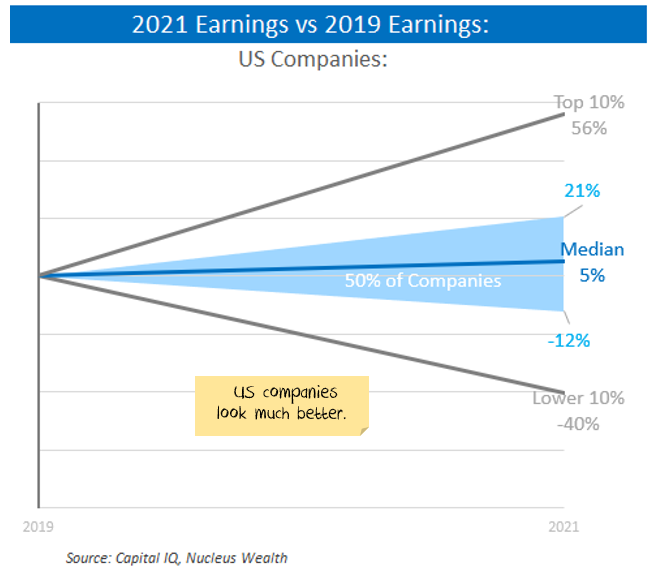

Low probability of US tax hikes: Subject to the Georgia senate run-offs, it looks unlikely the US Senate will pass Biden’s company tax rate increases. If passed, these would have reduced US earnings by around 10%.

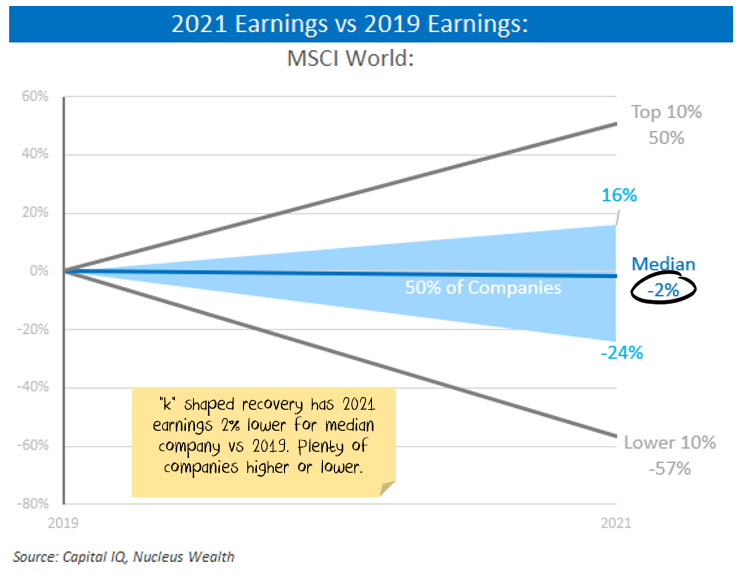

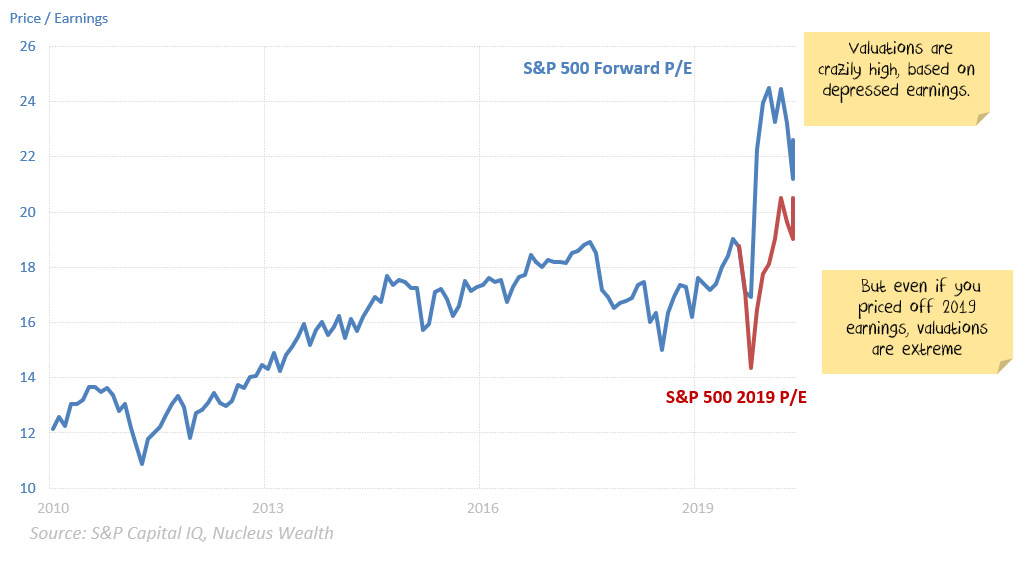

Earnings very good: 3rd quarter earnings were much better than expected. Analyst forecasts haven’t changed much, but that is better than usual! Typically, later year forecasts are far too optimistic and get revised down as they get closer. Forecast growth is 24% for 2021 and then 15% for 2022.

Inequality to remain high: No changes to taxes in the US = economic inequality likely to remain high. In Australia, there are tax cuts for the rich, reduced support for the poor. Travel limitations depressing spending for the rich. Plus stimulus tends to be relatively indiscriminate; some ends up in the right hands, some in the hands of those that don’t need it. Net effect: the rich have more money to put into investment markets.

Bankruptcies, evictions limited: in many countries bankruptcies are down 30%+, driven by a mix of stimulus and rule changes. Businesses feel richer if they haven’t had to write down bad debts. Not fixing the problem, just delaying the pain.

Mortgage repayment holidays: as above.

Wage growth very low: helpful to company profits.

Productivity: forced change/digitisation often results in better outcomes. Having to fire staff usually results in the least productive going first, increasing overall company productivity.

Low oil prices: keeping transport costs down.

Vaccine hope: successful trials give hope to an end of the virus.

Policy certainty: President Biden is far less likely than Trump to be unpredictable.

COVID in the Northern Hemisphere: It is ripping through populations. Importantly, hospitals are reaching capacity, which means lockdowns have begun again in Europe and seem highly likely in the US.

Valuation: Share market valuations are extraordinarily high.

Latent bankruptcies: Changing the rules so that companies and individuals who are otherwise bankrupt are allowed to increase their debt does not fix the problem. It also runs the risk that the bad actors not paying their bills start to pull down the good actors.

Low genuine credit growth: credit growth has been poor; banks are still tightening lending standards. But the credit growth also includes mortgage holidays. And companies borrowing to survive rather than to make productive investments. Which means genuine credit growth is lower than the already weak headline numbers. Economic growth has been tied at the hip to credit growth for the last decade. It is difficult to see what will replace easy money as the only thing holding economic growth up.

Short term gap in US economic conditions: There may not be stimulus until Biden takes power. If so, there are three months with limited government support while the virus sets new records. This might be enough to tip the economy into a funk and result in more job losses.

Inequality longer-term effects: the short term effect of increased inequality increases savings and investment and (probably) increases stock market valuations. The longer-term impact is depressed demand and profits. And more political upheaval.

Australian stimulus badly targeted: supply-side rather than demand-side.

Structural change: leading to weak demand, higher unemployment. There are industries like travel and tourism which will have to deal with lower sales and employment. The means job losses continue as former employees have to give up on finding a job and retrain for a new industry.

It bears repeating: the positive factors for investment markets tend to be short-term, the negative ones medium-term. Will there be “clear air” for a few months before the consequences begin? Maybe. The stock market has had a lot thrown at it and is still holding up.

On the flip side, the risks are not symmetrical. The upside appears more limited than the downside.

Damien Klassen is Head of Investments at Nucleus Wealth.

We look at the latest announcements from Victoria.

Next live event: https://youtu.be/IV-Ev2Sriqw

Go to the Walk The World Universe at https://walktheworld.com.au/

We deep dive on recent developments in the NZ property market, as the bubble created by the RBNZ expands, and they react to try to mitigate the risks.

Go to the Walk The World Universe at https://walktheworld.com.au/