I catch up with the CEO Of Infinigold Jon Deane as we discuss the concept of digitalised physical gold.

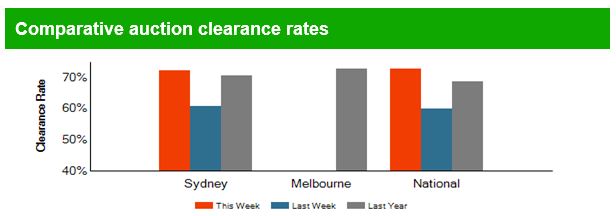

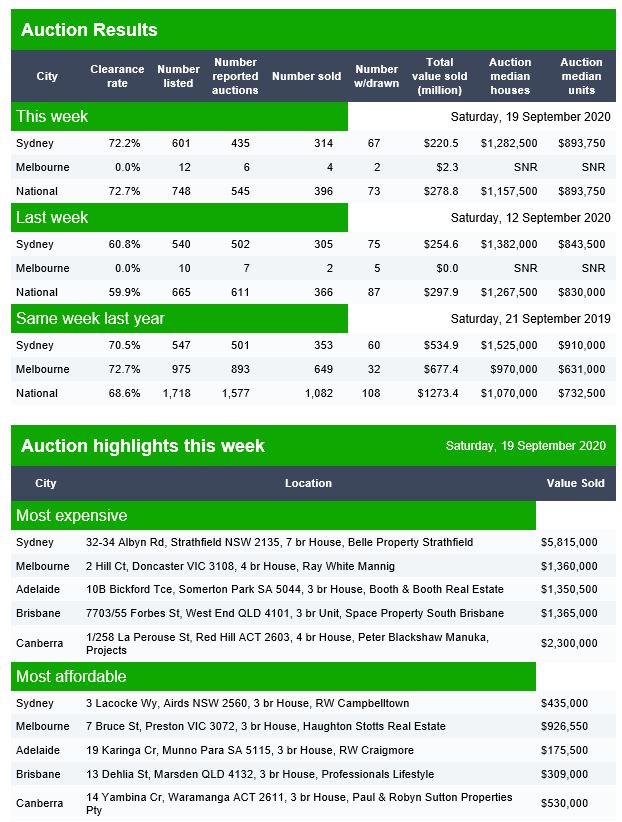

Auction Results 19 Sept 2020

Domain released their preliminary results for today. They note “from Thursday July 9 the Victorian government placed a ban on public real estate auctions as part of social distancing measures to slow the spread of COVID-19. The number of auctions withdrawn in the immediate weeks following the ban are likely to be higher than normal”.

Canberra listed 34 auctions, reported 34 with 27 sold, 1 withdrawn and 6 passed in to give a Domain clearance of 79%.

Brisbane listed 44 auctions, reported 39 with 14 sold, 4 withdrawn and 21 passed in to give a Domain clearance of 36%.

Adelaide listed 37 auctions, reported 28 with 18 sold, 2 withdrawn and 8 passed in to give a Domain clearance of 64%.

Inside The Debt Trap – With Royce Kurmelovs

I caught up with journalist Royce Kurmelovs, author of “Just Money”, a newly published book which examines how Australians became some of the most indebted people in the world.

Fair disclosure, I was interviewed by Royce as he researched the subject.

Let’s Talk Housing Crashes – With Tarric Brooker

The latest in our Friday night chats in which we look at the potential for a housing crash.

Journalist Tarric Brooker can be found at @AvidCommentator on Twitter.

Our Latest Perspective On The Finance, Housing And Mortgage Industries…

This is an edited version of a presentation and Q&A I gave to the investment banking community today.

The Bond King Rules! – With Steve Van Metre

I caught up again with US based Investment Manager and Macro Analyst Steve Van Metre to look at what the FED has been up to and what the implications may be. Where are the markets headed?

Steve’s Blog:http://stevenvanmetre.com/

Steve’s YouTube Channel: https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw

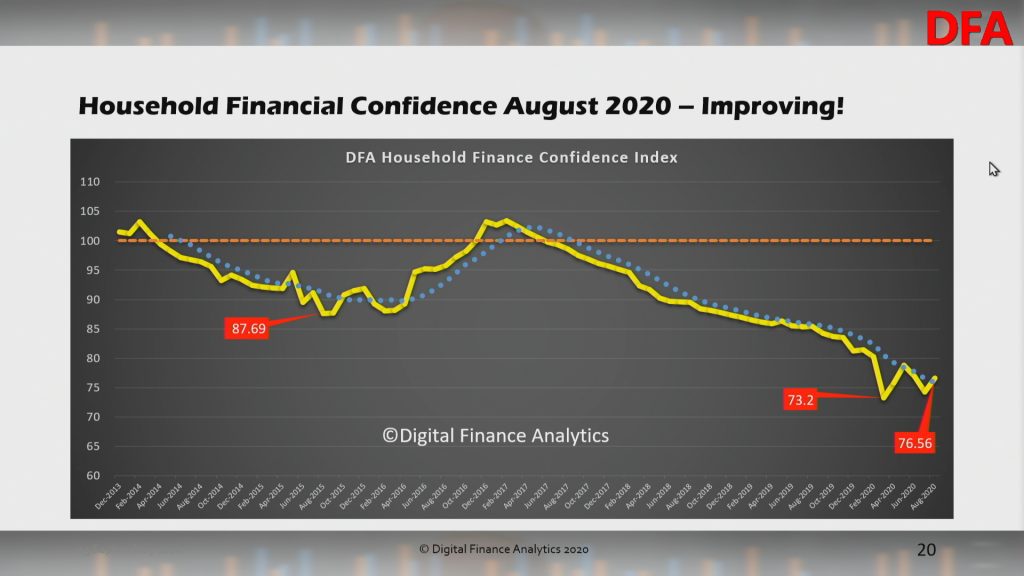

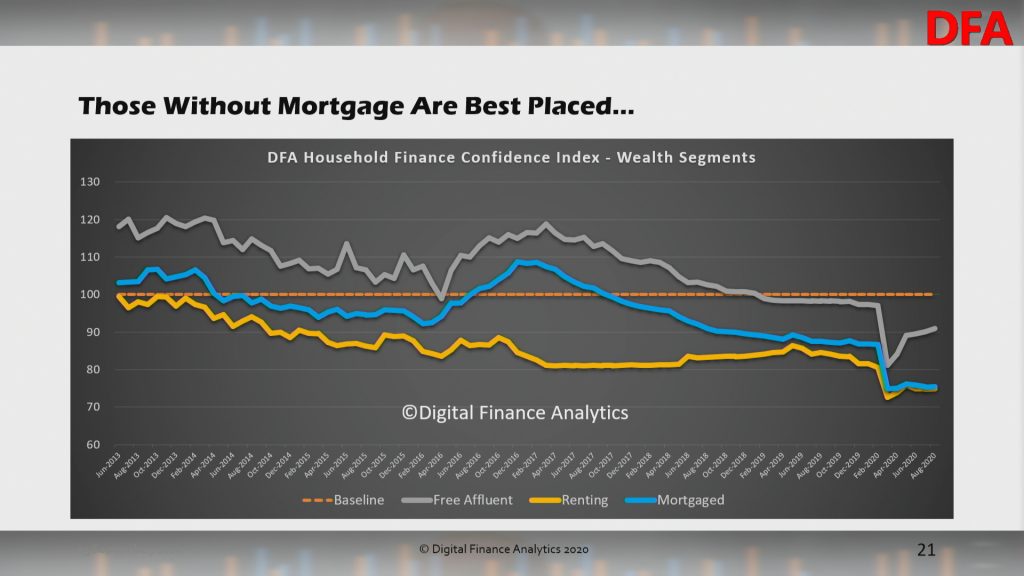

Household Financial Confidence Update August 2020

We have released the latest edition of confidence measures based on our surveys. You can watch our live stream replay where we discuss the results in detail.

The overall index recovered a little in August, but remains well below the 100 neutral setting at 76.56.

Within the cohorts, more affluent and mortgage free households are best placed, thanks to continued strength in stock markets. Those with mortgages and those renting, not so much. The massive levels of Government support, plus repayment holidays also helped, together with significant superannuation withdrawals.

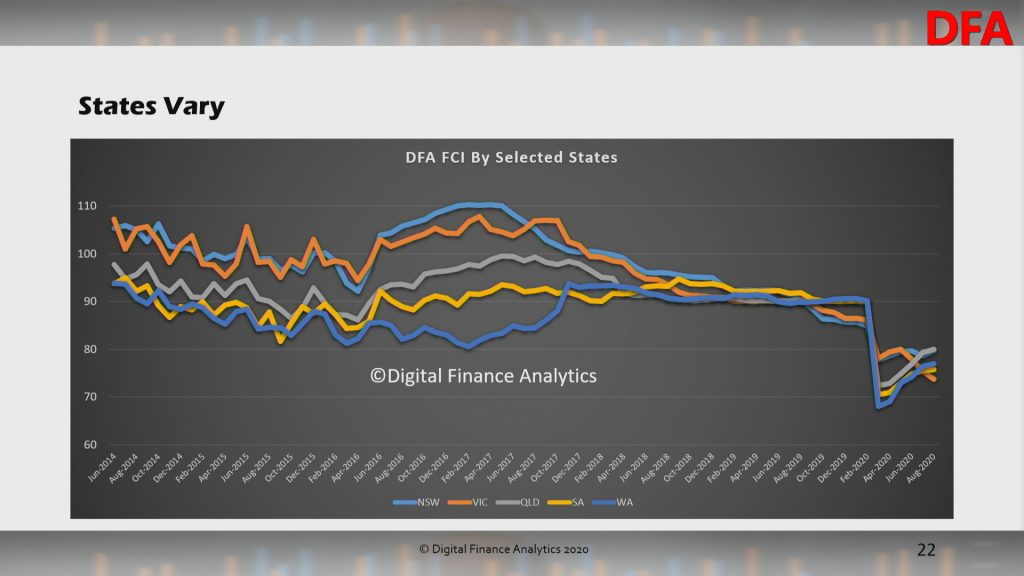

The state variations are striking, with a further fall in Melbourne in response to the latest lock-downs, while WA is looking stronger.

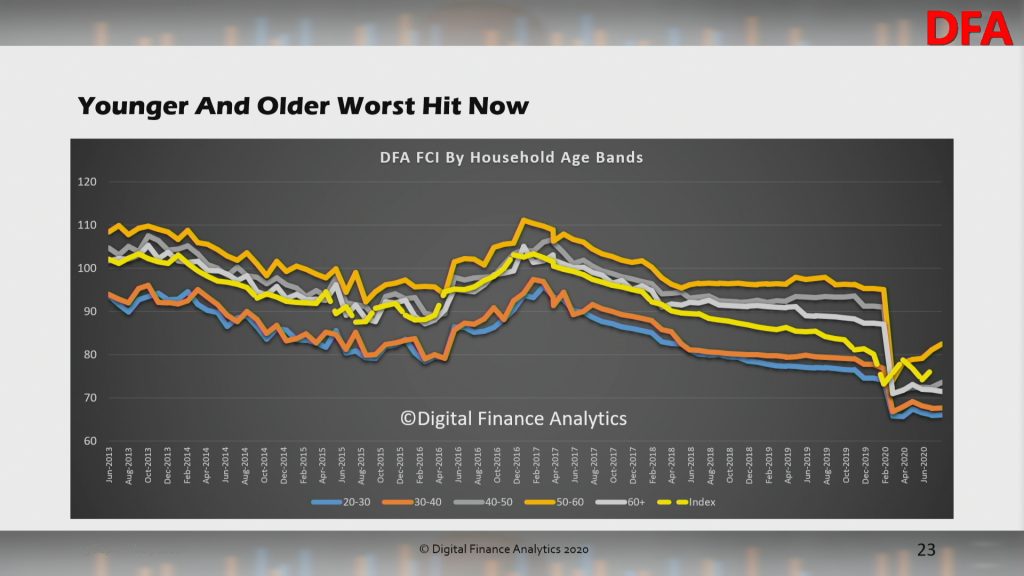

Across the age groups, younger and older households are more exposed, while late middle aged households, who have more financial resources, and less mortgage debt, are more positive.

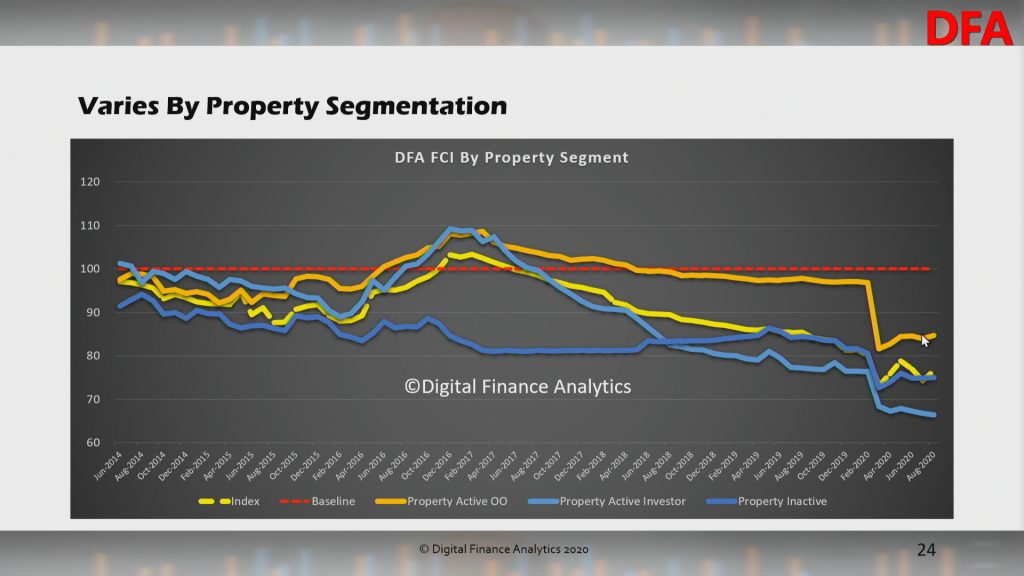

Across the property segments, owner occupied property holders are more positive relatively speaking, thanks to lower mortgage rates – this despite higher mortgage stress. However, property investors continue to wrestle with poor returns, limited capital growth, and pressure to commence repayments on mortgage balances. Many are still considering disposing of property in the months ahead. Renters are caught with more limited income, despite rents slipping in some areas. There is also concern in this cohort about the status of deferred rentals down the track.

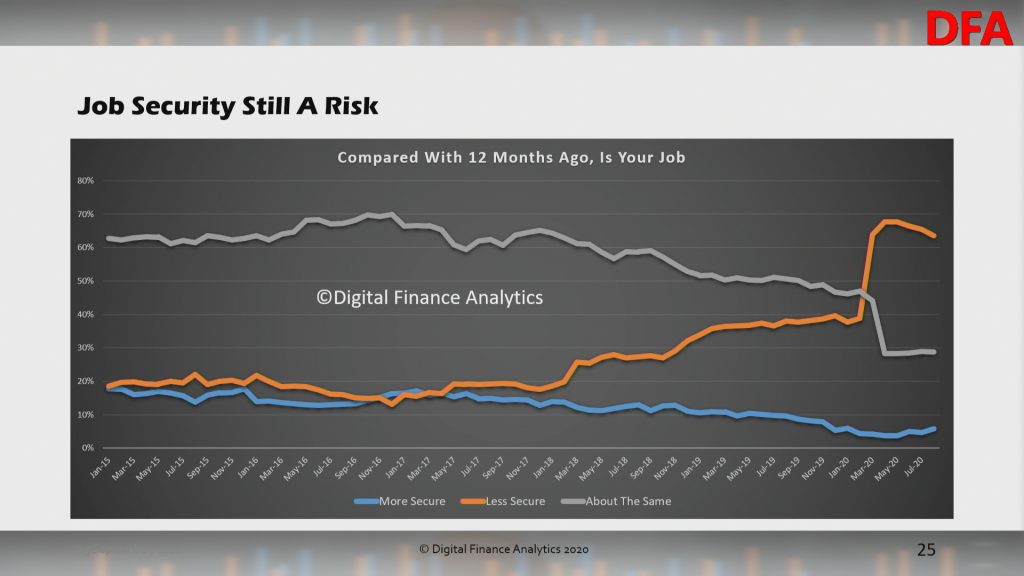

Within the moving parts of the index, job security remains a significant issue, though there was a slight easing in some areas, while in Melbourne things have degraded significantly. Many self-employed households are under severe pressure, with up to one in three concerned about the future of their business.

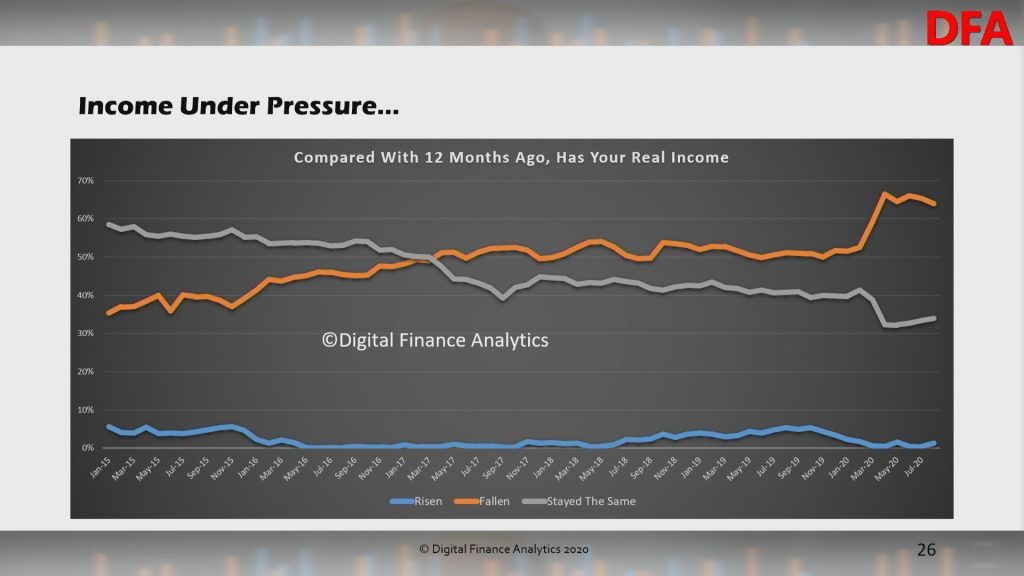

Income pressures remain to the fore, despite JobKeeper and JobSeeker. Some households have received higher incomes, though these will be reducing in September. Others have received no support despite income compression. The majority suggest real incomes have declined in the past year.

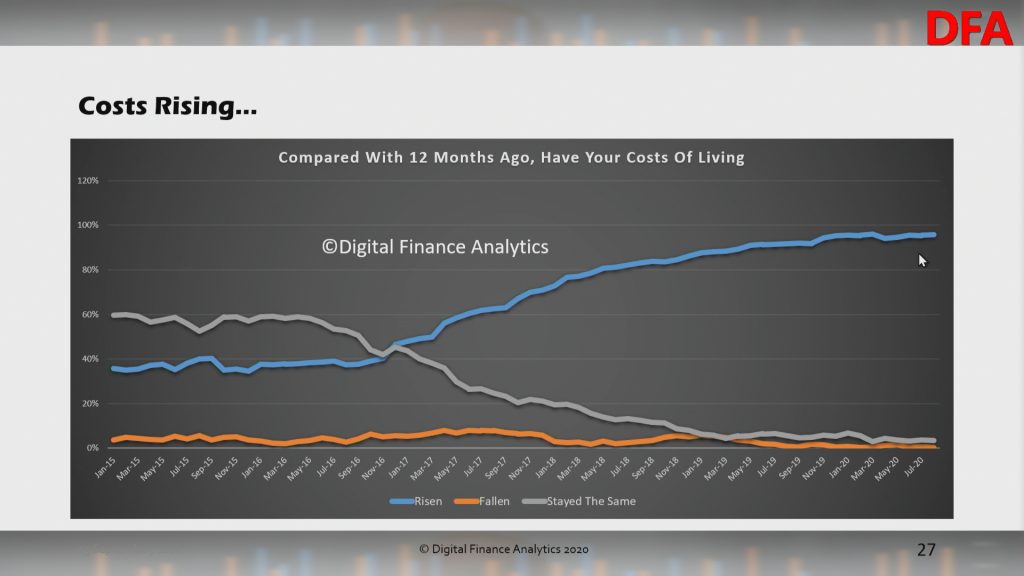

Costs of living continue to run above the official CPI figures. Food staples appears to be rising quite fast, despite lower spending by some households on transport and petrol. School fees and health care costs also figure.

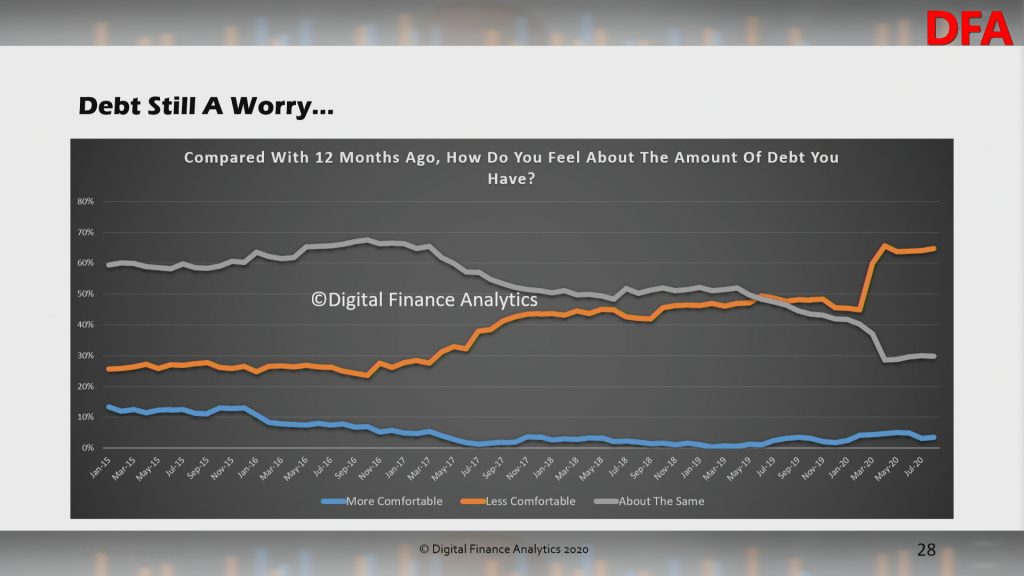

Households are under considerable debt pressure despite the current repayment holidays. Given income pressures, meeting future debt commitments registered as a significant risk. This is consistent with high levels of mortgage and rental stress.

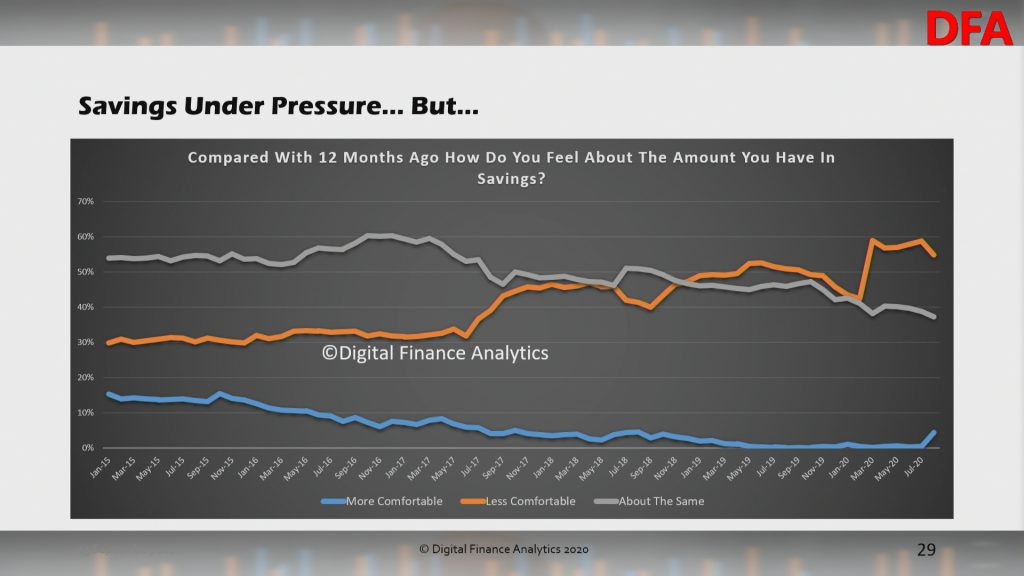

On the other hand, those receiving additional support, pulling money from superannuation, or repayment holidays are saving hard, as a hedge against future uncertainty. That said, many Australians reliant on income from bank savings continue to see their ability to service debt crushed by close to zero returns on deposits. Buy Now Pay Later facilities are in vogue to spread the costs of purchases, and as a way to manage cash flow. About 20% of users end up paying late costs, making this “free” credit expensive.

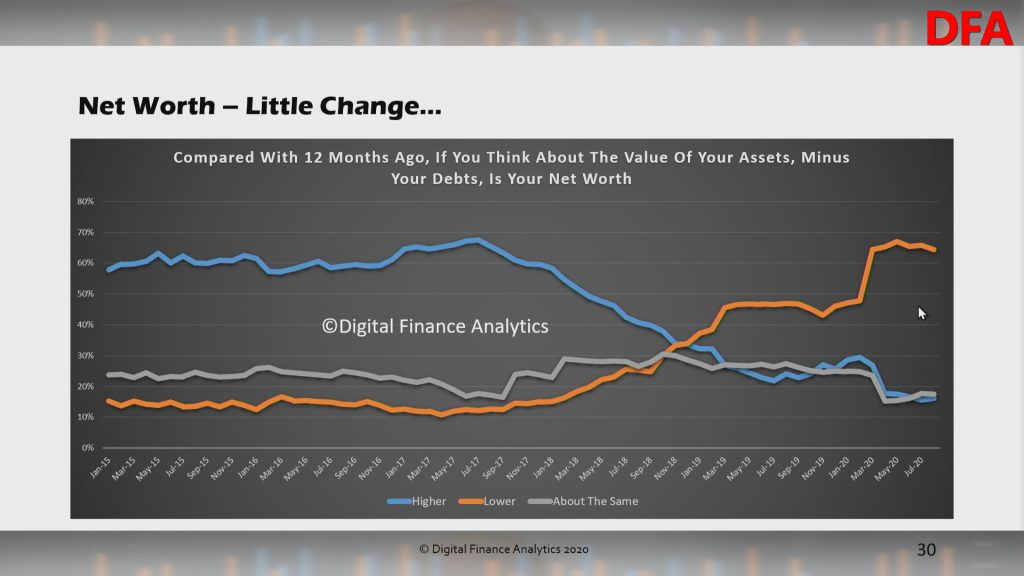

Finally, net worth remained relatively static as the elements in the index shifted. There is considerable confusion in the minds of many households who hold property, given the mixed data available about the property market. Many still believe the Government will stop home prices falling. Nevertheless, households remain cautious ahead of the impending cuts in support, and this does not bode well for greater consumption ahead. The major pain point is small businesses, may of whom have not been able to benefit from JobKeeper. This should be a focus for the Government in the upcoming budget.

FINAL REMINDER: DFA Live Tonight 8pm Sydney – Latest Household Confidence Update and Live Q&A

Join me tonight at 8pm Sydney for this weeks DFA live stream. We will be updating our latest survey results, looking at the RBA minutes out today, and we will also have our post code database online.

You can ask a question live via the YouTube chat and join the discussion.

Edwin’s Monday Evening Property Rant #3

Edwin Almeida and I discuss property in his latest rant.

@justthink1

From Melbourne’s Property Front Line – With Catherine Cashmore

I caught up with Catherine Cashmore, a Melbourne based buyers agent, educator and publisher. Note Catherine is audio only.

She is the Director of Cashmore & Co Real Estate Advocates, President of Prosper Australia, Editor of Fat Tail Media’s – Cycles, Trends, & Forecasts.

https://cashmoreco.com.au/

https://fattailmedia.com.au/ (Cycles, Trends, & Forecasts)

https://www.prosper.org.au/