Tonight we discuss the latest results from our surveys, to end June 2020. Where are the stress hot spots – and how are property investors fairing? Ask a question live via the YouTube chat – and we will have our postcode database on line to answer specific queries.

The Machinery Of Control – With Brian Martin

Brian Martin is a social scientist in the School of Humanities and Social Inquiry, Faculty of Law, Humanities and the Arts, at the University of Wollongong in NSW, Australia. He was appointed a Professor at the University in 2007, and in 2017 was appointed Emeritus Professor.

I discuss his latest book – Official Channels.

Official channels are things like grievance procedures, ombudsmen and courts. They are supposed to resolve problems and provide justice. However, trust in official channels can be misplaced: in many cases they may give only an illusion of a solution. In Official Channels, Brian Martin tells what he has learned about formal procedures set up to deal with problems associated with whistleblowing, sexual harassment, plagiarism, Wikipedia and other issues. He says it is unwise to put too much reliance on official channels and that more emphasis should be put on developing skills, changing cultures and exploring alternatives.

https://www.bmartin.cc/pubs/20oc/index.html

Official channels is available as a free download, by courtesy of the publisher. Irene Publishing is a non-profit operation, committed to providing works relevant to grassroots social change.

The Jobless Recovery – The DFA Daily 6th July 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Next Live Event:

GDP: Fact Or Fiction? – With Salvatore Babones

Associate Professor Salvatore Babones and I discuss GDP. How useful is it, and does it omit important elements which should be considered?

Whats On The Credit Cards? – With Steve Mickenbecker

Are you on the right credit card? If not you are probably paying too much. I discuss this important issue with Canstar’s Steve Mickenbecker.

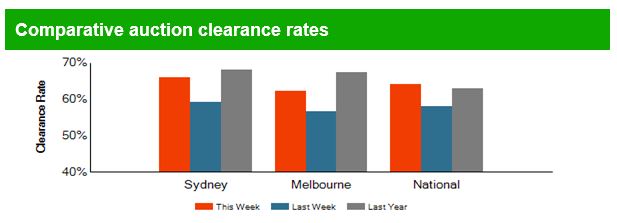

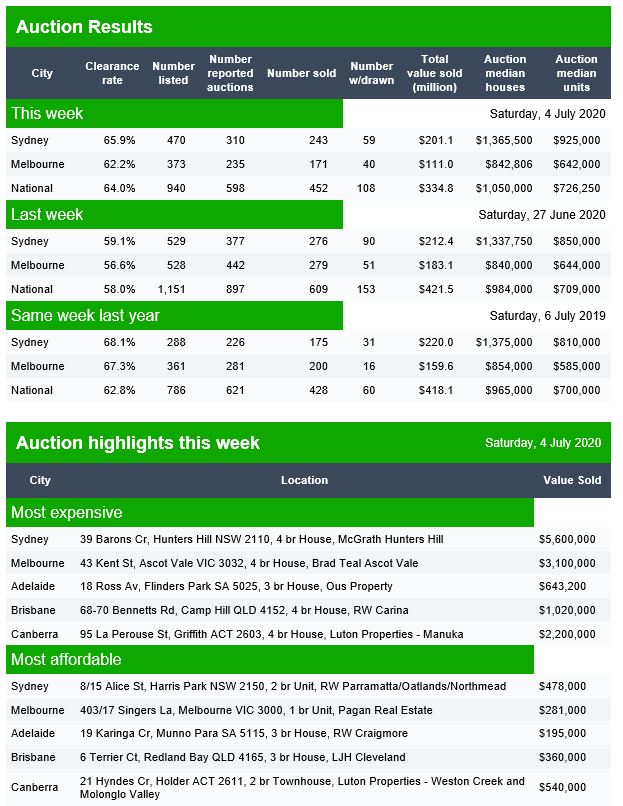

Auction Results 4th July 2020

Domain released their preliminary results for today.

Canberra listed 33 auctions, reported 24 with 22 sold, 2 withdrawn and 2 passed in to give a clearance rate of 85% according to Domain.

Brisbane listed 42 auctions, reported 15 with 6 sold, 7 withdrawn and 9 passed in to give a clearance rate of 27% according to Domain.

Adelaide listed 22 auctions, reported 14 with 10 sold, 0 withdrawn and 4 passed in to give a clearance rate of 71% according to Domain.

Hope Springs – The DFA Daily 4th July 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Secrets, Lies And That Approaching Cliff – With Tarric Brooker

My latest discussion with Journalist Tarric Brooker. We pick apart the stimulus and economic outlook.

The Pincer Movement – The DFA Daily 3rd July 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

What’s The Market Up To Now? – With Tony Locantro

More unvarnished truths from Tony Locantro, of Alto Capital in Perth.