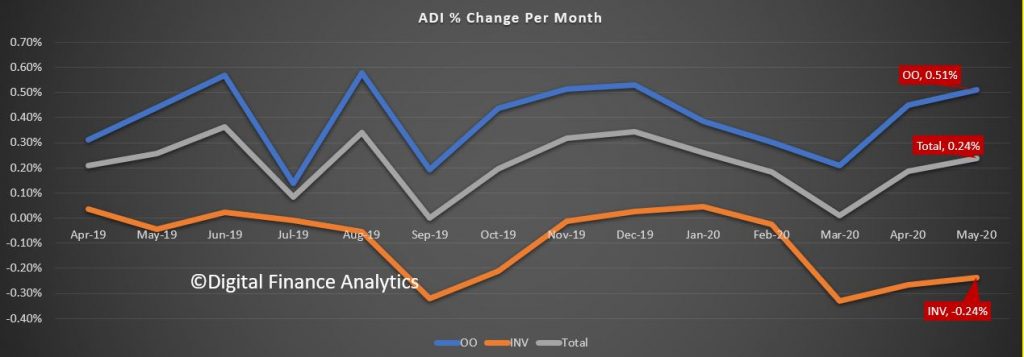

APRA and the RBA released their May loan numbers yesterday. These are stock numbers, taking account of repayments, refinances and new loans. APRA said that banks increased their overall residential property lending by 0.24%, with owner occupied loans up 0.51% and investor loans down again, this time 0.24%.

As result the proportion of loans for investment purposes dropped back to 36.3%. Total loans were 1.758 trillion dollars.

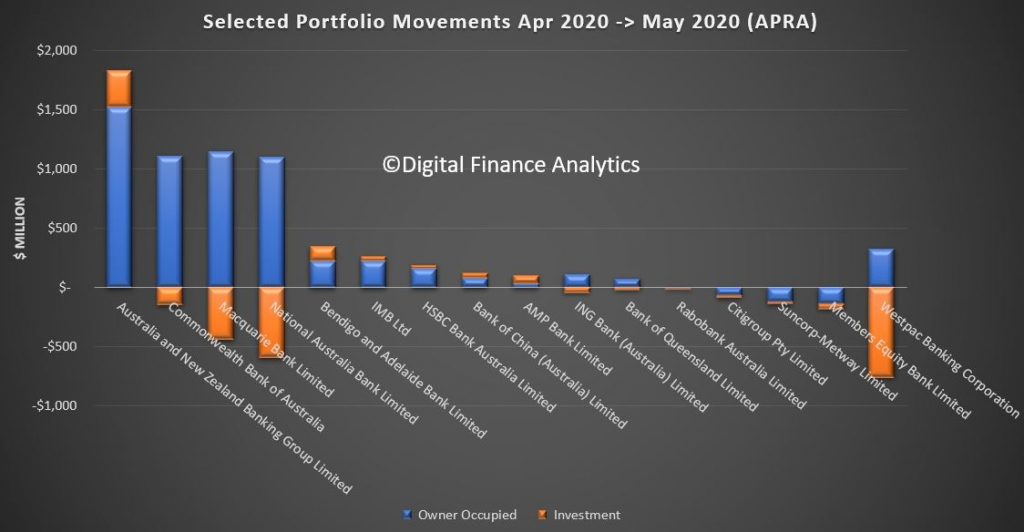

Within the individual lenders, Westpac dropped their investment portfolios, more than NAB, Macquarie and CBA, while ANZ expanded both investment and owner-occupied loans, as did Bendigo and Adelaide Bank and Bank of Queensland. Suncorp, Citigroup, and Members Equity Bank all reported lower balances to APRA this month.

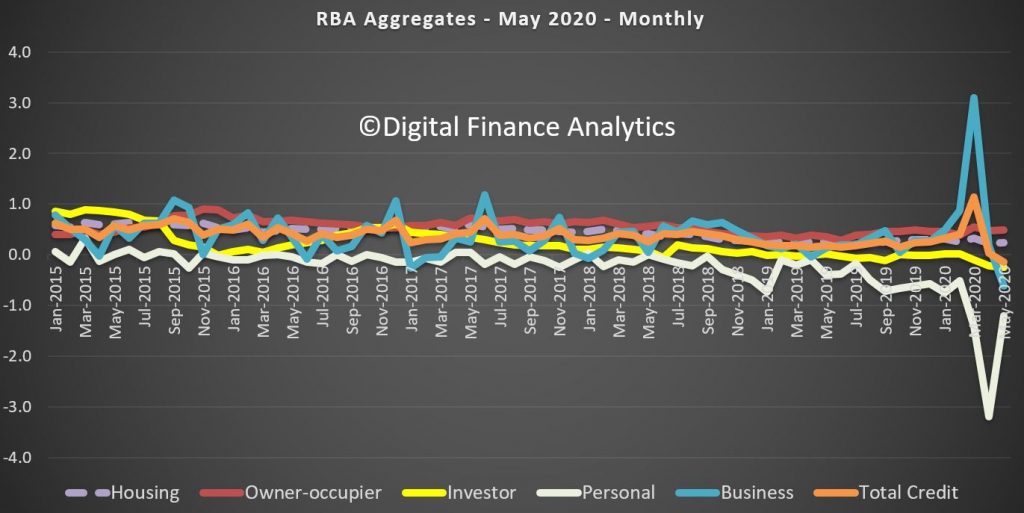

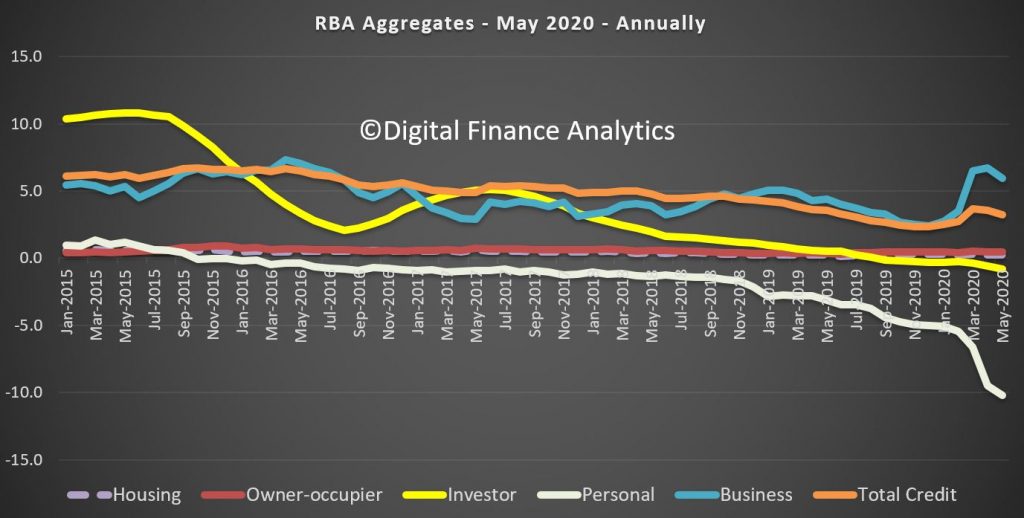

Turning to the RBA series, which includes the non-bank sector, Credit to the private sector contracted in the month of May, the first decline in credit since June 2011.Demand for credit has weakened across across businesses and households.

The RBA reported that the May decline in total credit of 0.1% included: a 1.2% contraction in personal; a 0.6% fall in business; and a weak 0.24% rise in housing (with the investor segment in decline).

Businesses are in survival mode now, having initially pulled down available credit lines, which led to a March spike of 3.1%, the largest monthly increase in business credit since the start of 1988.

Now they are moving into cut mode with expenditure and investment both slowing. We expect this to continue, along with more structural job cuts.

Personal household credit which makes up around 8% of total household credit fell, as confidence ebbs away. The temporary “lock-down” also impacted. In fact in the past 12 months personal credit is down more than 10%.

Overall housing credit was up 0.22% in April and by 0.24% in May, which translates into an annulaised 2.8%. It continues to weaken. Of course this is a function of confidence, off the back of COVID, plus rising underemployment, Investor Housing credit dropped -0.25% over the month, and down -0.8% across the year for May. Our research suggests many property investors are coming unglued as home prices fall and rents get crushed. Owner Occupied credit grew, up 0.49% over the month, or 5.4% annualised.

So to me the question will be the ongoing impact of underemployment, and the impact of the cliff, depending of what the banks do (will they continue to postpone repayments) and the shape of future government support, to say nothing of the passage of the virus.