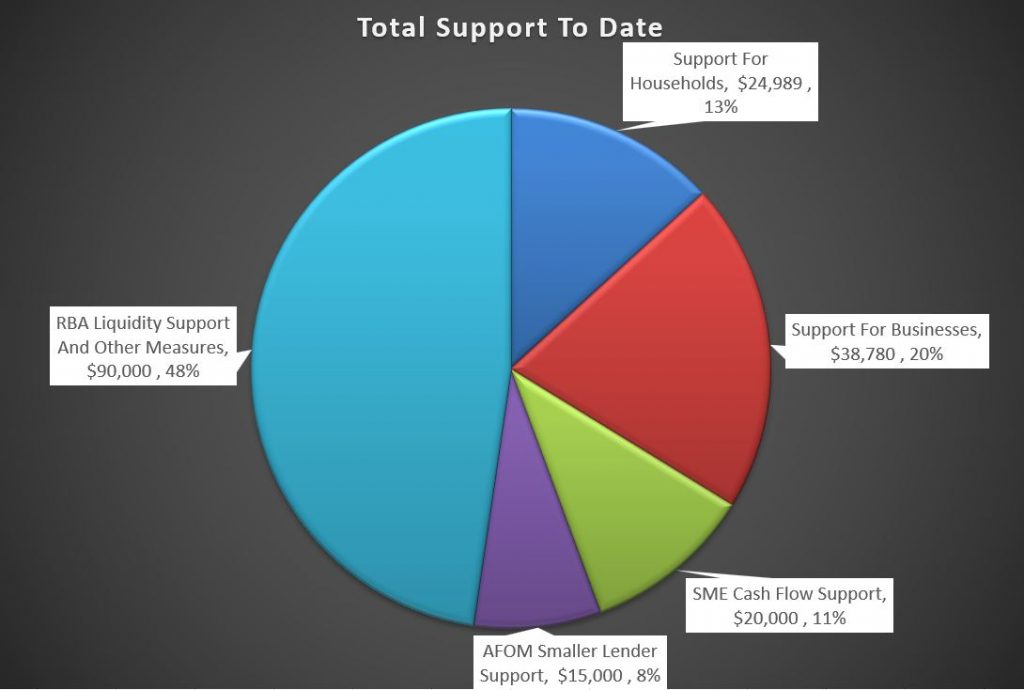

We look at the latest from the Government on fiscal response measures. How do they stack up?

Shields Up: Second Stimulus Package Worth $66bn But Only 13% Total To Date For Households

The Prime Minister And Treasurer released their second stimulus package today which is designed to shield the country from the current emergency, and to keep businesses from collapsing for at least the next 6 months. But a warning, watch how the RBA measures have been rolled into the total support now valued at $189 billion. This is deceptive. They want to make it look like a big number. It is not, yet!

In summary, small businesses can receive cash payments up to $100,000 and some welfare recipients will receive another $750 in payments, as Newstart is repurposed temporarily.

It builds on the measures included in the first $17.6 billion economic stimulus package announced more than a week ago.

ScoMo said “We cannot prevent all the many hardships, many sacrifices that we will face in the months ahead.

He made the point that the health-related issues are leading to a range of broader economic issues, as never before. The total packages are now worth around 9.7% of GDP – or around $189 billion dollars, and Treasury modelling indicates benefits to the national accounts in the June and September quarters to offset the big falls elsewhere. No one knows where results will land. But within that, $90 billion reflects the RBA’s liquidity injections, so the true Government direct support is much lower than advertised.

The UK initiatives, we recently discussed were 15% of UK GDP, so we are still doing things on the cheap in my view. More direct support for households needs to come.

The new measures include:

- Temporarily doubling the Jobseeker Payment, previously called Newstart

- Allowing people to access $10,000 from their superannuation in 2019-20 and 2020-21

- Guaranteeing unsecured small business loans up to $250,000

- Reducing deeming rates by a further 0.25 per cent

A second $750 payment will be automatically paid to an estimated 5 million people on July 13 on welfare. The first $750 payment, announced in the first stimulus package, will be paid on March 31.

The Government will temporarily double the Jobseeker Payment, previously called Newstart, providing people with an additional $550 a fortnight.

The payment will be available to sole traders and causal workers, provided they meet income tests. The Government will waive asset tests and waiting periods to access the Jobseeker Payment.

The Prime Minister said that “the nature of these payments and the purpose of these payments are changing.” to provide additional income support for vulnerable groups.

For small businesses and Not-for-profits with a turnover under $50 million can receive a tax-free cash payment of up to $100,000, with a minimum payment of $20,000 for eligible companies.

The Government says 690,000 businesses employing 7.8 million people and 30,0000 not-for-profits will be eligible for measures in the stimulus package. The payments will be delivered by the Tax Office as a credit on activity statements from late April.

In an agreement with the banks, the Commonwealth is also offering to guarantee unsecured loans of up to $250,000 for up to three years to businesses, interest free for 6 months.

In response the CBA said “The Commonwealth Bank will support as many of the Government supported loans as possible and in doing so make available up to $10 billion of additional unsecured credit to support small and medium businesses.” The ABA welcomed the move saying ” Banks stand ready to help their business customers get through this, whether it’s deferring their loan payments or providing more working capital. Today’s announcement of a second stimulus package, which includes an SME Guarantee scheme, will mean access to funds to see small businesses through this downturn”.

The Government will allow people to access up to $10,000 from their superannuation this financial year and in 2020-21.

People will not pay tax on they money they access and withdrawals will not affect Centrelink or veterans’ payments.

There will also be a temporary 50-per-cent reduction in superannuation minimum drawdown requirements for account-based pensions in 2019-20 and 2020-21.

On top of the deeming rate changes made at the time of the first package, the Government is reducing the deeming rates by a further 0.25 percentage points to reflect the latest rate reductions by the RBA. As of 1 May 2020, the lower deeming rate will be 0.25 per cent and the upper deeming rate will be 2.25 per cent. The change will benefit around 900,000 income support recipients, including Age Pensioners. This measure is estimated to cost $876 million over the forward estimates period.

The Government is moving quickly to implement this package. To that end, a package of Bills is being introduced into Parliament on 23 March 2020 for urgent consideration.

Subject to passage of the Bills through Parliament, the Government will then move to immediately make, and register, supporting instruments.

The National Cabinet will meet tonight to find a way to force Australians to adhere to social distancing, following the temporary closure of Bondi Beach after people failed to adhere to government spacing requirements.

There were clear signals of more draconian measures should people not keep their distance. The Government also said not to travel unless it was essential. Reality is slowly catching up with the community, but many are still looking the other way.

After The Ides Of March – The Property Imperative Weekly 21 March 2020

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

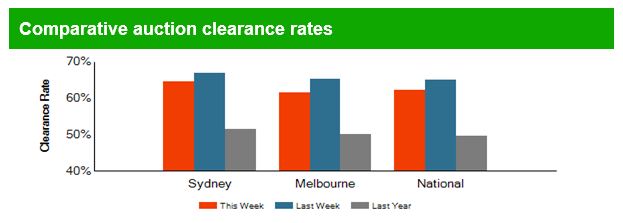

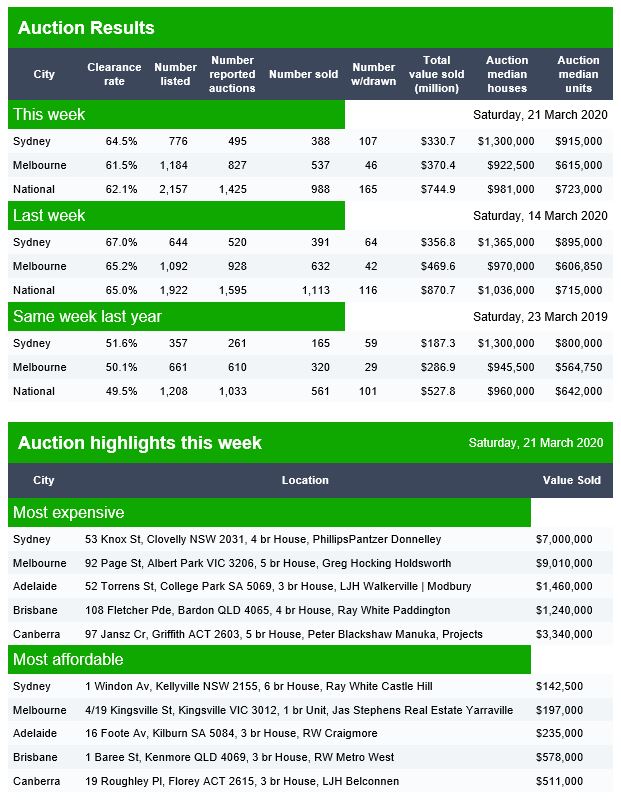

Auction Results 21 March 2020

Mark you diary. This just might be last results for some time. I attended (socially distanced) three house auctions today. Not one buyer turned up for any of them and the auctioneer went away tail between legs. These were premium properties which a few days ago I think would have sold.

That said, Domain released their preliminary results for today. The numbers sold appear down a bit (despite the media hype I noted saying there was frenzied buying parallel to toilet paper!). There were more listed for sale than last week.

Sydney listed 776 auctions, reported on 495, with 388 sold, 107 withdrawn and 107 passed in (weird coincidence) This gives a Domain clearance of 64%. [Last week final was 67%]

Melbourne listed 1,184 auctions, reported on 827 with 537 sold, 46 withdrawn and 290 passed in to give a Domain clearance of 62%. [Last week’s final was 65.2%]

Canberra listed 56 auctions, reported 38 and sold 26, with 2 withdrawn and 12 passed in, giving a Domain clearance of 65%.

Brisbane listed 95 auctions, reported 37 and sold 18, with 9 withdrawn and 19 passed in giving a Domain clearance of 39%.

Adelaide listed 47 auctions, reported 28 with 19 sold, 1 withdrawn and 9 passed in to give a Domain clearance of 66%.

UK To Support Employee Wages Direct

The UK has taken unprecedented actions to support households and businesses. It will be interesting to see what the Australian Government comes out with when they announce theirs. The UK is providing wages support, rental support, and more support for the small business sector.

Capital Economics said that it expected the unemployment rate to rise from just under 4% to about 6% due to the crisis. However, without this latest government intervention, that rate would have risen to the financial crisis level of 8%.

The UK Government has announced a new Coronavirus Job Retention Scheme. Any employer in the country – small or large, charitable or non-profit – will be eligible for the scheme. But it does not cover those on zero hours contracts, or are self employed.

Government grants will cover 80% of the salary of retained workers up to a total of £2,500 a month – that’s above the median income. Employers can top up salaries further if they choose to.

Employers will be able to contact HMRC for a grant to cover most of the wages of people who are not working but are furloughed and kept on payroll, rather than being laid off.

The Treasurer said “that means workers in any part of the UK can retain their job, even if their employer cannot afford to pay them, and be paid at least 80% of their salary”.

The Coronavirus Job Retention Scheme will cover the cost of wages backdated to March 1st and will be open initially for at least three months – and I will extend the scheme for longer if necessary.

There is no limit on the amount of funding available for the scheme.

In addition he announced that the Coronavirus Business Interruption Loan Scheme will now be interest free for twelve months, not 6 months.

And a further cash flow support through the tax system for businesses was announced, buy deferring the next quarter of VAT payments.

That is a direct injection of £30bn of cash to employers, equivalent to 1.5% of GDP.

They will be launching in the coming days a major national advertising campaign to communicate the available support for businesses and people.

To strengthen the safety net, the Universal Credit standard allowance, for the next 12 months, will be lifted by £1,000 a year, as well as increasing the Working Tax Credit basic element by the same amount

Together these measures will benefit over 4 million of our most vulnerable households.

As a result, every self-employed person can now access, in full, Universal Credit at a rate equivalent to Statutory Sick Pay for employees.

Taken this amounts to nearly £7bn of extra support through the welfare system to strengthen the safety net and protect people’s incomes.

UK homeowners can get a three-month mortgage holiday if they need it.

They also announced nearly £1bn of support for renters, by increasing the generosity of housing benefit and Universal Credit, so that the Local Housing Allowance will cover at least 30% of market rents.

They called these actions “an unprecedented economic intervention to support the jobs and incomes of the British people”.

Further measures will be announced next week, to ensure that larger and medium sized companies can also access the credit they need.

He said “we want to look back on this time and remember how, in the face of a generation-defining moment, we undertook a collective national effort – and we stood together”.

Fed Supports Liquidity Of US State and Municipal Money Markets

The Federal Reserve Board on Friday expanded its program of support for the flow of credit to the economy by taking steps to enhance the liquidity and functioning of crucial state and municipal money markets. Through the Money Market Mutual Fund Liquidity Facility, or MMLF, the Federal Reserve Bank of Boston will now be able to make loans available to eligible financial institutions secured by certain high-quality assets purchased from single state and other tax-exempt municipal money market mutual funds.

All U.S. depository institutions, U.S. bank holding companies (parent companies incorporated in the United States or their U.S. broker-dealer subsidiaries), or U.S. branches and agencies of foreign banks are eligible to borrow under the Facility.

Collateral that is eligible for pledge under the Facility must be one of the following types:

- U.S. Treasuries & Fully Guaranteed Agencies;

- Securities issued by U.S. Government Sponsored Entities;

- Asset-backed commercial paper that is issued by a U.S. issuer, is rated at the time purchased from the Fund or pledged to the Reserve Bank not lower than A1, F1, or P1 by at least two major rating agencies or, if rated by only one major rating agency, is rated within the top rating category by that agency;

- Unsecured commercial paper that is issued by a U.S. issuer, is rated at the time purchased from the Fund or pledged to the Reserve Bank not lower than A1, F1, or P1 by at least two major rating agencies or, if rated by only one major rating agency, is rated within the top rating category by that agency; or

- U.S. municipal short-term debt that: i.Has a maturity that does not exceed 12 months; and ii.At the time purchased from the Fund or pledged to the Reserve Bank: 1.If rated in the short-term rating category, is rated in the top short-term rating category (e.g.,rated SP1, MIG1, or F1, as applicable) by at least two major rating agencies or if rated by only one major rating agency, is rated within the top rating category by that agency; or 2.If not rated in the short-term rating category, is rated in the top long-term rating category (e.g., AA or above) by at least two major rating agencies or if rated by only one major rating agency, is rated within the top rating category by that agency.

- In addition, the facility may accept receivables from certain repurchase agreements. The facility at this time will not take variable rate demand notes or tender option bonds, but the feasibility of adding these and other asset classes to the facility will be considered in the future.Rate: Advances made under the Facility that are secured by U.S. Treasuries & Fully Guaranteed Agencies or Securities issued by U.S. Government Sponsored Entities will be made at a rate equal to the primary credit rate in effect at the Reserve Bank that is offered to depository institutions at the time the advance is made.

Advances made under the Facility that are secured by U.S. municipal short-term debt will be made at a rate equal to the primary credit rate in effect at the Reserve Bank that is offered to depository institutions at the time the advance is made plus 25 bps.

More Coordinated Central Bank Action

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to further enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

To improve the swap lines’ effectiveness in providing U.S. dollar funding, these central banks have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 23, 2020 and will continue at least through the end of April. The central banks also will continue to hold weekly 84-day maturity operations.

The swap lines amongst these central banks are available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses, both domestically and abroad.

The same information appeared on other Central Bank web site too.

Central Banks Are Struggling To Save The Global Financial System

Economist John Adams and Analyst Martin North look at the impact of the recent Central Bank interventions. But will it work?

How Much Debt Is Too Much? – 20 March 2020

Our latest summary of market event today with a distinctively Australian flavour.

Debt And Power – With Michael Hudson

In this post we discuss debt in the current context, and consider where the very high levels of debt will take us. And as importantly, who wins and who loses. Transcript is available for download.

Michael Hudson is an American economist, Professor of Economics, Author of Killing the Host and “and forgive them their debts,” among many earlier books.

Many articles and interviews are available on http://michael-hudson.com/

Debt and Power. Transcript, recorded 20th March 2020

Martin: Today Debt and Power. I’m Martin North from Digital Finance Analytics. Welcome to our latest post covering finance and property news with a distinctively Australian flavour.

Today it is my pleasure to introduce Michael Hudson, American Economist, Professor of Economics and author of “Killing the Host” and “and Forgive Them Their Debts”. In the current environment I think those are great titles. Michael welcome.

You have been following the economy and the question of debt for quite some time and I’d like to start the discussion with a simple question: How much debt is too much debt?

Michael: Too much debt is when it’s beyond the ability to be paid. At a certain point every debt grows beyond the ability to be paid because of the magic of compound interest. At 5 percent interest, a debt doubles every 15 years. If you can imagine since the whole debt take-off in 1945, the first 15 years gets you to 1960. Then, the debt doubles again by 1975, and doubles again by 1990, then again by 2005, and then today – 64 times the relatively small debt owed back in 1945, some 75 years ago. And the creation of yet new credit (peoples’ debt to the banks and to wealthy savers) has grown at a similar rate even without new lending taking place, so the debt overhead actually has grown much, much more than that 5% a year. It’s grown more like 15% per year. That is much faster than national income or GDP. This disparity in expansion paths means that more and more income and GDP needs to be paid each year, So, to answer your question, too much debt is when it can’t be paid – that is, can’t be paid without transferring property to creditors, reducing consumer spending and home ownership rates, and plunging the economy into austerity in which only the wealthy financial class is affluent.

What happens when a debt can’t be paid? Well, either you default and lose your property as creditors foreclose on your home or drive you into bankruptcy, or – if you’re a corporation – they drive you under and a corporate raider takes you over. Or else, you write down the debt.

Interest-bearing debt was first invented in the third millennium BC, maybe 2800 2700 in the ancient Near East. The first records are about 2500 BC. Interest rates were about 20%. Rulers were obliged to think about your question: how to maintain economic balance and avoid too much debt. The answer they found was that when each new ruler would take the throne, they would proclaim a Clean Slate. Its terms were basically those of the Judaic Jubilee Year, whose word deror was a cognate to Babylonian andurarum. This Babylonian practice was put in the middle of Mosaic law, in Leviticus 25. It returned land to debtors who had forfeited them to foreclosing creditors, and it freed debtors who had fallen into debt bondage. This periodically avoided too much debt, by regularly wiping out personal debts – mainly agrarian debts denominated in grains. However, business debts were left in place, to be settled among the well-to-do who could afford it.

Western civilization became Western by making a radical break from what went before. Classical Greece and Rome didn’t have any debt cancellations, because they didn’t have any palatial authority to do so. They had chieftains, but they didn’t have an independent palace with authority to overrule the ambitious families that became the oligarchy. So from the time that the Roman oligarchy overthrew the last king in 509 BC down to the time when Julius Caesar was killed in 44 BC, you had five centuries of debt revolts. The plebeians in Rome, like many Greeks, demanded the debts be cancelled.

That demand was what prompted the call for democracy in Greece and in Rome. They needed political democracy with everybody able to vote and serve in the government in order to have a government that could cancel the debts and redistribute the land.

But the oligarchy resisted this policy, seeking to hold onto its creditor claims that kept the population at large in dependency and outright bondage. In the 7th and 6th centuries BC, most Greek cities were overthrown by leaders called tyrants. They were basically reformers who overthrew the closed local aristocracies, cancelled the debts and redistributed land to the people. Solon abolished debt bondage in Athens in 594 BC (but did not redistribute land) via his “shedding of burdens,” his seisachtheia, referring to the debt burden. A similar radical restructuring occurred in Sparta.

But Greece ultimately was conquered, sacked and looted by Roman generals, first in 147 BC then in 88 BC under Sulla. Rome took over, and its oligarchy was intransigent. They accused popular leaders wanting to cancel the debts of “seeking kingship,” and usually killed them. They killed the Gracchi, they ended up killing Caesar, they killed Catiline when (having failed to become consul) organized an army to fight for debt cancellation.

Finally, the Emperor’s Emperor Hadrian and Marcus Aurelius cancelled debts in AD 118 and 178 respectively. By that time these debts were mainly tax arrears. After that, there were no debt cancellations. That makes Western civilization very different from the Near East. The legacy of Roman law is that you can’t cancel the debts, you can’t write them down. That means that again and again and again, debts are going to grow too big to be paid without forfeiting your land or forfeiting your liberty and falling into debt peonage, losing your means of support and going bankrupt.

That’s what we’re facing today. Is society going to say that all debts have to be paid, without regard for the economic and social consequences? Almost 90 percent of American debts are owed to the richest 10 percent of the population. I’m sure the situation is similar in Australia, and the 10 percent of course includes the London and the New York banks. So the question is whether you are going to let the economy’s wealth, income and property be sucked upward as a massive debt foreclosure? Or, are you going to restore equilibrium by wiping out this enormous overgrowth of debt.

You really should think of these debts as bad loans. A bad debt that can’t be paid means that there’s a bad loan. But modern economic orthodoxy agrees with the Roman oligarchy: All debts have to be paid, even if that destroys society and ends up in feudalism. We’re going along that route because that’s our individualist morality – even anti-social morality at this point. There is a reluctance, a cognitive dissonance, to recognize that debts are too big to be paid without imposing austerity that makes economies look like recent Greece or Argentina.

Martin: It’s a scary thought isn’t it. And is there a difference between public debt and private debt? In other words, does it behave in the same way?

Michael: As I think Steve Keen explained on your show before, the public debtors can’t go bankrupt domestically, because governments can simply print the money to monetize it, or just refuse to pay the debt. Private debt is created by what Steve calls endogenous banking. In other words, banks simply create credit (their customers’ debt) on a computer. A debt IOU is created as the bank’s asset, along with a credit for the borrower. So the balance sheet remains in balance, as assets (of the bank) and debts (of borrowers) reman constant. The word “savings” obscures the fact that creditor loans are simply created out of nothing but electric current to write a new balance sheet. And then, of course, interest has to be paid to the creditors.

Private debt is created for different reasons than public debt. Public banks would not lend for corporate takeover loans. They would not lend to corporate raiders, or for stock buybacks. They would not create junk mortgages way beyond the ability of borrowers to pay. Government debt would be extended presumably for spending for the public purpose – to increase economic growth and increase prosperity. Private debt these days has become largely dysfunctional. Its effect has often been to shift prosperity from 90% of the population to the 10% of the population that controls the banks and the creditors. So private debt has become corrosive and parasitic, while public debt is supposed to be handled well – except to the extent that the oligarchy has taken over the government.

In the United States since 2008, the Federal Reserve has created $4.5 trillion of credit to the stock and bond market and mortgage market to support prices for real estate. The aim has been to make housing more expensive, enabling the banks to collect on their mortgages and not go under. This credit keeps the debt overhead in place, thereby keeping the keep the financial system afloat instead of facing the reality that debt needs to be written down. Because if it is not written down, the “real” economy will be hollowed out. In that sense the financial overgrowth is largely fictitious wealth.

The Fed’s supply of $4.5 trillion isn’t called public debt, because it’s technically a swap, so it doesn’t appear as an increase in the money supply. The increase in the money supply will be what President Trump proclaimed today, March 19: $50 billion dollars to the airlines, and Boeing. Yet Boeing has spent $45 billion in the last ten years on stock buybacks. So Trump said, in effect, that if companies has spent 92 and 95 percent of all of their income just to buy shares and pay out dividends instead of investing it, the government will create money and give it to them all over again, because his priority -is how well the stock market is doing. In other words, how much does the “real” economy have to shrink in order to keep sucking up an exponentially growing volume of interest and stock-price gains to cover all this corporate debt, business debt and personal debt?

Martin: And so the obvious question then is who are Central Banks working for?

Michael: Central banks work for their clients the commercial banks. Until 1913 in the United States the Treasury did almost everything that the Federal Reserve is doing today. It moved money around the country. It had 12 districts. It intervened in markets. It did what a central bank did. But then JP Morgan and the bankers essentially anticipated Margaret Thatcher and Ronald Reagan, and pressed for a privatized central bank run out of Wall Street, Boston and Philadelphia, not Washington. They excluded Washington from the Fed’s board so as not to let the Treasury have a voice on it.

Their logic was that banking should only be regulated by the private sector, because only in that way could they turn the government from a democracy into an oligarchy. So that they created a central bank that acted on behalf of bankers, not the economy as a Treasury is supposed to do. So basically, the development of central banks for the Western countries has been a disaster to the extent that they represent financial interests instead of representing the economy as a whole. Protecting financial interests means sustaining growth in their product, debt overhead, instead of protecting the economy from finance and its bad loans that create a burdensome overhead for families and business.

Martin: Right. I suppose that explains why they are focused on financial stability rather than the prosperity of real people.

Michael: “Financial stability” is a deceptive term. It means increasing austerity for the economy you cannot have financial stability and economic stability at the same time. If the growth of debt and finance is exponential and the economy is growing in an S curve, then the economy has to shrink at a deepening rate in order to maintain stable compound-interest growth and even higher stock-market prices.

The relevant mathematics was developed already in Hammurabi’s day by 1800 BC. We have the cuneiform textbooks from which scribal students in Babylonia were taught. They were asked to calculate how fast a debt grows at an annual 20 percent (their normal commercial rate). How long does it take a debt to double at going 20 percent rate of interest? The answer is five years. How long does it take the quadruple? Ten years. How long to multiply 8 times? 15 years. How many 16 times? Well, that’s 20 years. And within a 30-year generation you have a debt multiplying 64 times.

We also have the scribal texts calculating how fast a herd of cattle grows. It grows in an S-curve. So you know that the gap between the rise of debt and the growth of a herd is increasingly wide.

Most of the loans that were not cancelled were in foreign trade, among merchants (and their debts to the palace, which advanced many textiles and other inventories to traders). These commercial debts were denominated in silver, while most domestic debts were denominated in grain. So unless Sumer could keep on trading abroad and making profits, debts were going to be too large to be paid. That’s when rulers would raise the sacred torch, like the Statue of Liberty, signalling a debt cancellation and they’d cancel the debts. If the crops failed they’d cancel the debts because if they didn’t cancel the debts then the small farmers would end up becoming bond-servants to their creditors, who often were tax collectors in the palace bureaucracy. They then would owe their labor to the creditors, and so couldn’t perform corvée labor building palaces, walls and other public building or even serve in the army. So it would have been civic suicide for a community not to cancel such debts.

Mesopotamian and other Near Eastern rulers were not idealistic utopians. They were simply being practical in realizing that debts grow faster than ability to be paid. All of their mathematics shown that. So their models 4000 years ago were more sophisticated than the models that are used today, which just assume that debts will remain a stable proportion of income and output.

Martin: So, I guess we’ve got this pile of debt and it’s growing as the recent central bank interventions are just adding more debt into the system. How do we get out of this mess?

Michael: The only way you can escape and maintain stable economic relations is to write down the debts. That means you have to let many banks and their loans go under. That almost happened in 2008. Sheila Bair, the Federal Deposit Insurance Corporation head, wanted to foreclose on one bank that she wrote was more incompetent and crooked than the others. That was the largest bank: Citibank. The problem is that its sponsors were President Obama, Robert Rubin and basically Wall Street. Rubin was Secretary of the Treasury under Bill Clinton, and had become head of Citibank. His protege Tim Geithner became the bagman for Citibank, and was made Secretary of the Treasury. Geithner blocked the Obama administration and Sheila Bair from taking over Citibank.

Here would have been a wonderful chance. You take over one of the worst bank in the United States – the bank that made the bad bets and so many junk mortgage loans that it was called a serial criminal by former S&L prosecutor Bill Black, now at the University of Missouri at Kansas City. Imagine if Citibank would have been taken into the public domain and made a public bank. It wouldn’t have made more crooked loans. It would have made loans for what people and business actually needed. But Obama invited the bankers to the White House, and promised to protect them from the “mob with pitchforks.” The mob with pitchforks were his own voters, his supporters, the people whom Hillary called deplorables – mainly indebted wage-earners. Obama said that he would protect the banks from loss and not to worry about Congressional reprisals.

Posing as a black civil rights icon, Obama bailed out the banks – his major campaign sponsors and donors – so generously that not only did they not go under, but they are now gigantic as a result of the bailouts and designation as Too Big to Fail (TBTF) driving out the small smaller banks. Obama didn’t write down the mortgages as he had promised voters. I think he was the worst U.S. president in a century, because the economy stood at what could have been a turning point with real hope and change. He’d promised to write down the mortgage debts to the realistic value of the buildings instead of the inflated value that Citibank, Bank of America and Wells Fargo and other crooked banks had put on them. Instead he let them go ahead foreclose on 10 million American homes.

That became a great wealth-producing activity as large Wall Street companies like Blackstone came in and bought up homes that were foreclosed on, for pennies on the dollar, and turned them into rental properties. That raised rents on Americans very rapidly. So the rentier sector got rich by squeezing the working-class, leaving them with little to spend on goods and services without going deeper into debt. So Obama’s policy basically imposed what is now more than a decade of austerity on the economy.

Since 2008, the GDP per 95 percent of the American population is actually shrunk. All the growth in America’s GDP has occurred only to the wealthiest 5% of the population. That’s Obamanomics, and it’s the Democratic Party policy – which is the main reason why President Trump was elected. He made a left run around Hillary and the Democratic Party. He’s doing it again today. That’s why most people expect that despite Trump’s mishandling of the virus crisis, he will move to the left of Joe Biden or Hillary or whomever the Democrats decide to run against him.

Martin: You’ve made an interesting connection between the political forces in the economy and the financial forces. Essentially, it’s those two against the people, isn’t it?

Michael: That’s what you call an oligarchy. It has the trappings of democracy because you can vote now for either Joe Biden or Donald Trump. They call that a democracy, but both of them work for Wall street and both of them represent the oligarchy. So it’s what the 19th century called a sham democracy.

Martin: Right, and so the appearance of what’s going on and the reality of what’s going on are actually quite different?

Michael: I think the appearance is actually what it is. They’re not getting away with it. The appearance is becoming clear: a corrupt takeover by the oligarchy deliberately impoverishing the rest of the population. You have the right-wing Fox News and Rush Limbaugh saying that the outbreak is a godsend to America. Look at look at how its stabilizing the economy: Number one, it wipes out mainly older people. They get sick the most rapidly. That means we can cut Social Security spending the elderly die off. It will help solve the pension shortfall. That’s looked at as positive. The disease will also end up reducing unemployment, I think of reporters who said that the world’s overpopulated.

But most of all, the crisis gave Trump an excuse to give enormous bailouts to Boeing and the airline companies that already were near insolvency as a result of their own debt problem. They hope to use the crisis not to revive the economy, but to just pound it into debt deflation, leaving the debts in place while bailing out the banks and the landlord class. While people are losing their jobs, especially part-time workers or those who work in retail stores, bars and restaurants. They are laid off and can’t pay their rent. Their employers often are small businesses who also can’t pay their rents. Already there are for rent signs all up and down the big streets here in New York. The threat is that the landlords will not be able to pay the banks, because they won’t have tenants. So there’s a rising wave of arrears for all kinds of debts.

The rate of arrears and missed payments is one way you tell when debts are too large to be paid. They are mounting and are up to 30 or 40 percent for student debts. They’re rising for automobile loans, and many mortgage debts are also in arrears. So basically the virus crisis has become a vehicle to bail out the both the landlord class and keep the banks afloat while sacrificing the wage-earning population.

Martin: So if you run history ahead over the next 3 to 5 years, let’s assume that they actually find a way to get the health issue under control. What you’re saying is at the end of it, most ordinary people will be hollowed out further, and power and authority will be ever more concentrated in the rich elite who own the banking system and also own the political system

Michael: That’s the trend. In the 1830s when Malthus’s successor at the East India Company’s Haileybury college, William Nassau Senior was asked about the million Irishman who were dying in the potato famine, he said, “It is not enough,” meaning that it wasn’t enough to balance the economy as it was then set up. His idea of equilibrium needed many more people to die. Even without having a Social Security “problem.”

When there’s poverty, suicide rates go up, and emigration accelerates. You can look at Greece in the last five years to see what happens when an economy becomes debt strapped. Lifespans shorten, people get sick, suicides rates rise. Greeks emigrate abroad. But Americans can’t emigrate, because they don’t speak a foreign language, and English-speaking countries have gone neoliberal.

It looks pretty bad, and there’s no economic doctrine that deals clearly enough with what’s happening to explain that if you have to pay this exponential growth in debt, you’re going to have less and less to buy goods and services. More and more stores are going to close and labor will be laid off. Nobody can afford to go to work. That’s what happens in a depression, and that is the game plan that’s called “financial stability,” as if it is the price that you have to pay to keep the bad-debt-based financial sector afloat.

Martin: Does that mean that unless we can find a completely different formula around democracy – and I assume that means focusing much more on public infrastructure public investments and all of those things – there’s no alternative? Who’s talking about that?

Michael: A few people you have had on your show seem to be talking about it. But we’re a small group of maybe 15 people who have a common discussion with each other.

Martin: So it is still a minority sport. Yet it seems to me to be probably the most critical debate we should be having, because we have the bulk of the population effectively being crushed by the way that the system is currently working. Yet everyone is told to look over there and watch Netflix rather than think about these more fundamental issues.

Michael: One of the problems is that since the late 1970s the University of Chicago and neoliberals have taken over the editorship of almost all the leading academic journals in this country, England and elsewhere. They’re run by doctrinaire advocates of privatization and deregulation to broadcast an oligarchic patter talk. I was teaching at the University of Missouri at Kansas City, the center of Modern Monetary Theory, but our graduates had difficulty getting hired at prestigious on universities, because in order to get hired by a prestigious university you have to publish in one of the journals run by the Chicago Consensus.

The key of free-market economics is that you can’t impose a free market unless you can exclude everybody who disagrees with you and shows how a free market will polarize the economy and lead to austerity. To impose a free market in Chile, for instance, they gave General Pinochet’s police permission to kill labor leaders, advocates of land reform, and to close every economics department in Chile except for the Catholic University that taught the Friedmanite Chicago dogma. So libertarianism is totalitarian. Libertarianism means a small government, and if government is small, then who’s going to do the planning? Every economy is planned, and if governments don’t do the regulating and planning, there’s only one alternative: Wall Street does the planning, or the City of London, including the planning for Australia, from what I understand.

Martin: Right. The consequence there is that freedom – which everybody sort of exposes as being the character of modern society – is probably less strong than many people think.

Michael: The Romans described Liberty as the ability to do whatever you want. They said that this meant that only the wealthy people could have Liberty to do whatever they want, including to foreclose and deprive debtors and other people of their Liberty.

Martin: Michael I found this a fascinating and interesting conversation and so critical

for people to understand. I really thank you for your time today. The good news is that there are many more articles interviews on your website michael-hudson.com, whom I understand is curated in Australia by a webmaster here, so that’s an interesting connection.

.