The Prime Minister And Treasurer released their second stimulus package today which is designed to shield the country from the current emergency, and to keep businesses from collapsing for at least the next 6 months. But a warning, watch how the RBA measures have been rolled into the total support now valued at $189 billion. This is deceptive. They want to make it look like a big number. It is not, yet!

In summary, small businesses can receive cash payments up to $100,000 and some welfare recipients will receive another $750 in payments, as Newstart is repurposed temporarily.

It builds on the measures included in the first $17.6 billion economic stimulus package announced more than a week ago.

ScoMo said “We cannot prevent all the many hardships, many sacrifices that we will face in the months ahead.

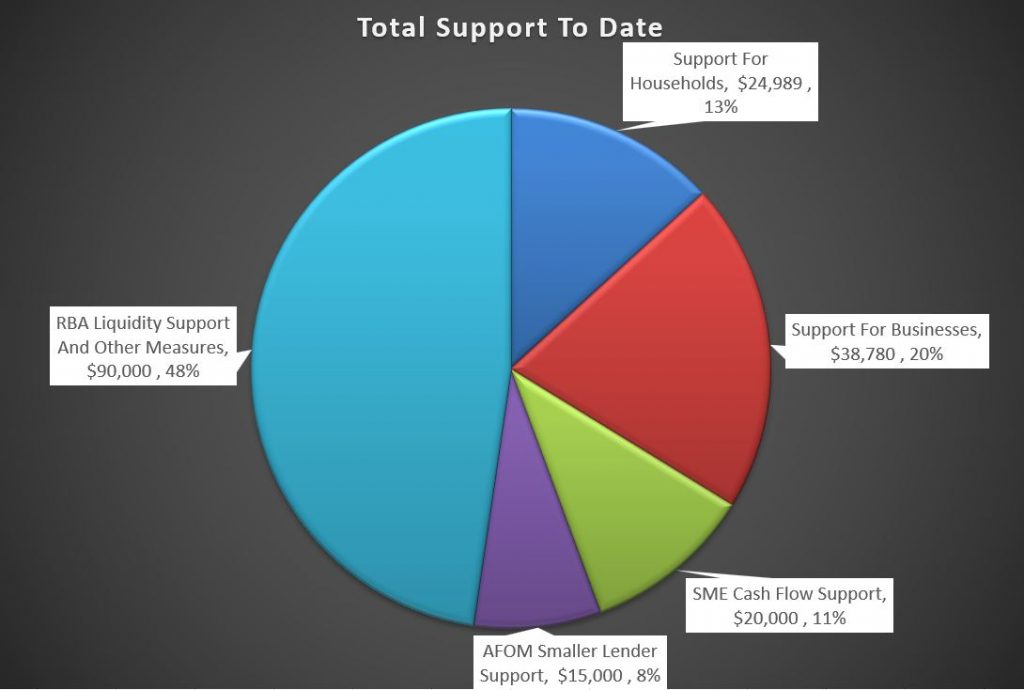

He made the point that the health-related issues are leading to a range of broader economic issues, as never before. The total packages are now worth around 9.7% of GDP – or around $189 billion dollars, and Treasury modelling indicates benefits to the national accounts in the June and September quarters to offset the big falls elsewhere. No one knows where results will land. But within that, $90 billion reflects the RBA’s liquidity injections, so the true Government direct support is much lower than advertised.

The UK initiatives, we recently discussed were 15% of UK GDP, so we are still doing things on the cheap in my view. More direct support for households needs to come.

The new measures include:

- Temporarily doubling the Jobseeker Payment, previously called Newstart

- Allowing people to access $10,000 from their superannuation in 2019-20 and 2020-21

- Guaranteeing unsecured small business loans up to $250,000

- Reducing deeming rates by a further 0.25 per cent

A second $750 payment will be automatically paid to an estimated 5 million people on July 13 on welfare. The first $750 payment, announced in the first stimulus package, will be paid on March 31.

The Government will temporarily double the Jobseeker Payment, previously called Newstart, providing people with an additional $550 a fortnight.

The payment will be available to sole traders and causal workers, provided they meet income tests. The Government will waive asset tests and waiting periods to access the Jobseeker Payment.

The Prime Minister said that “the nature of these payments and the purpose of these payments are changing.” to provide additional income support for vulnerable groups.

For small businesses and Not-for-profits with a turnover under $50 million can receive a tax-free cash payment of up to $100,000, with a minimum payment of $20,000 for eligible companies.

The Government says 690,000 businesses employing 7.8 million people and 30,0000 not-for-profits will be eligible for measures in the stimulus package. The payments will be delivered by the Tax Office as a credit on activity statements from late April.

In an agreement with the banks, the Commonwealth is also offering to guarantee unsecured loans of up to $250,000 for up to three years to businesses, interest free for 6 months.

In response the CBA said “The Commonwealth Bank will support as many of the Government supported loans as possible and in doing so make available up to $10 billion of additional unsecured credit to support small and medium businesses.” The ABA welcomed the move saying ” Banks stand ready to help their business customers get through this, whether it’s deferring their loan payments or providing more working capital. Today’s announcement of a second stimulus package, which includes an SME Guarantee scheme, will mean access to funds to see small businesses through this downturn”.

The Government will allow people to access up to $10,000 from their superannuation this financial year and in 2020-21.

People will not pay tax on they money they access and withdrawals will not affect Centrelink or veterans’ payments.

There will also be a temporary 50-per-cent reduction in superannuation minimum drawdown requirements for account-based pensions in 2019-20 and 2020-21.

On top of the deeming rate changes made at the time of the first package, the Government is reducing the deeming rates by a further 0.25 percentage points to reflect the latest rate reductions by the RBA. As of 1 May 2020, the lower deeming rate will be 0.25 per cent and the upper deeming rate will be 2.25 per cent. The change will benefit around 900,000 income support recipients, including Age Pensioners. This measure is estimated to cost $876 million over the forward estimates period.

The Government is moving quickly to implement this package. To that end, a package of Bills is being introduced into Parliament on 23 March 2020 for urgent consideration.

Subject to passage of the Bills through Parliament, the Government will then move to immediately make, and register, supporting instruments.

The National Cabinet will meet tonight to find a way to force Australians to adhere to social distancing, following the temporary closure of Bondi Beach after people failed to adhere to government spacing requirements.

There were clear signals of more draconian measures should people not keep their distance. The Government also said not to travel unless it was essential. Reality is slowly catching up with the community, but many are still looking the other way.