As Australia’s financial system adjusts to the coronavirus (COVID-19), financial regulators and the Australian Government are working closely together to help ensure that Australia’s financial markets continue to operate effectively and that credit is available to households and businesses.

Australia’s financial system is resilient and it is well placed to deal with the effects of COVID-19. The banking system is well capitalised and is in a strong liquidity position. Substantial financial buffers are available to be drawn down if required to support the economy.

The funding position of the banking system is strong. Australia’s financial institutions, market participants and market infrastructure providers have undertaken substantial investments in their operational capability to deal with the effects of the virus. At the same time, trading liquidity has deteriorated in some markets and financial institutions are having to adjust to a more volatile environment. The financial regulators are in regular contact with financial institutions, market participants and market infrastructure providers.

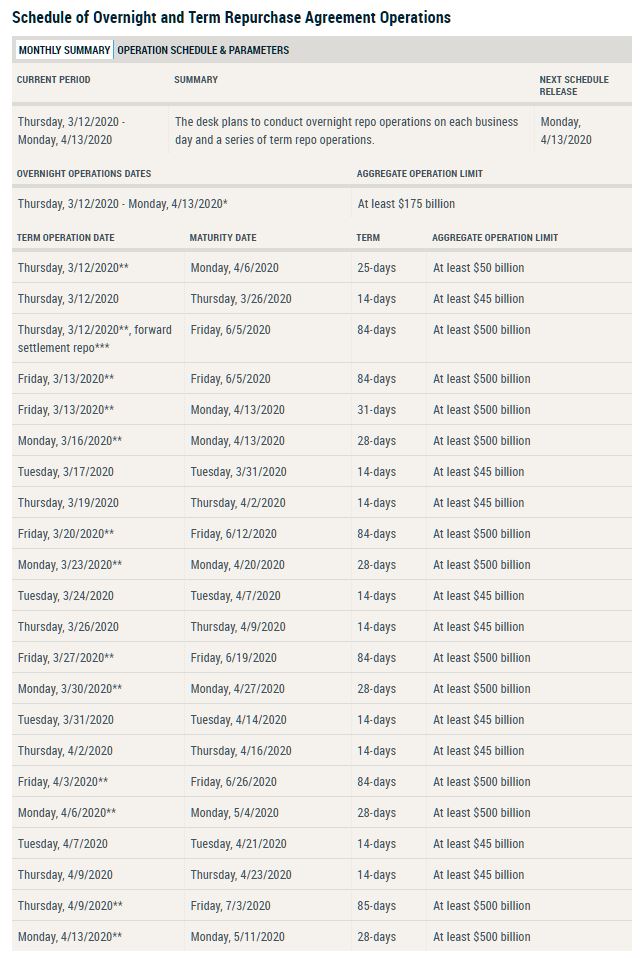

The RBA is continuing to support the liquidity of the system. As part of this support it will be conducting one-month and three-month repurchase (repo) operations until further notice. In addition it will conduct repo operations of six-months maturity or longer at least weekly, as long as market conditions warrant. The Australian Prudential Regulation Authority (APRA) is ensuring banking institutions pre-position themselves to take advantage of the RBA’s supportive measures.

Given the disruption being caused by COVID-19, Council members are examining how the timing of regulatory initiatives might be adjusted to allow financial institutions to concentrate on their businesses and assist their customers.

APRA and ASIC acknowledge the importance of the continued flow of credit to affected customers and industries in the current environment. Banks and other lenders are therefore encouraged to work constructively with affected customers during any period of disruption. For their part, APRA and ASIC will take account of the circumstances in which lenders, acting reasonably, are currently operating during the prevailing circumstances when administering their respective laws and regulations. Both agencies also stand ready to deal with problems firms may encounter in complying with the law due to the impact of COVID-19 through a facilitative and constructive approach. In particular, each agency will, where warranted, provide relief or waivers from regulatory requirements. This includes requirements on listed companies associated with secondary capital raisings, annual general meetings and audits. ASIC will also work with financial institutions to further accelerate the payment of outstanding remediation to customers as soon as possible.

The Council is meeting with major lenders later this week to discuss how they can best support households and businesses through this challenging period. The Council will be emphasising the importance of a continuing supply of credit, particularly to small businesses. It will be also discussing with the lenders whether there are impediments to lending that Council members could help to address.

The members of the Council of Financial Regulators remain in close contact with one another and with the Australian Government and their international peers. The Council will have its regular quarterly meeting on Friday 20 March at which the impact of COVID-19 on the financial system will be further discussed. The Council and the Australian Treasurer are also holding teleconferences at least weekly.

Council of Financial Regulators

The Council of Financial Regulators (the Council) is the coordinating body for Australia’s main financial regulatory agencies. There are four members: the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), the Australian Treasury and the Reserve Bank of Australia (RBA). The Reserve Bank Governor chairs the Council and the RBA provides secretariat support. It is a non-statutory body, without regulatory or policy decision-making powers. Those powers reside with its members. The Council’s objectives are to promote stability of the Australian financial system and support effective and efficient regulation by Australia’s financial regulatory agencies. In doing so, the Council recognises the benefits of a competitive, efficient and fair financial system. The Council operates as a forum for cooperation and coordination among member agencies. It meets each quarter, or more often if required.