We make some suggestions to ease cash flow.

Caveat Emptor! Note: this is NOT financial or property advice!!

"Intelligent Insight"

We make some suggestions to ease cash flow.

Caveat Emptor! Note: this is NOT financial or property advice!!

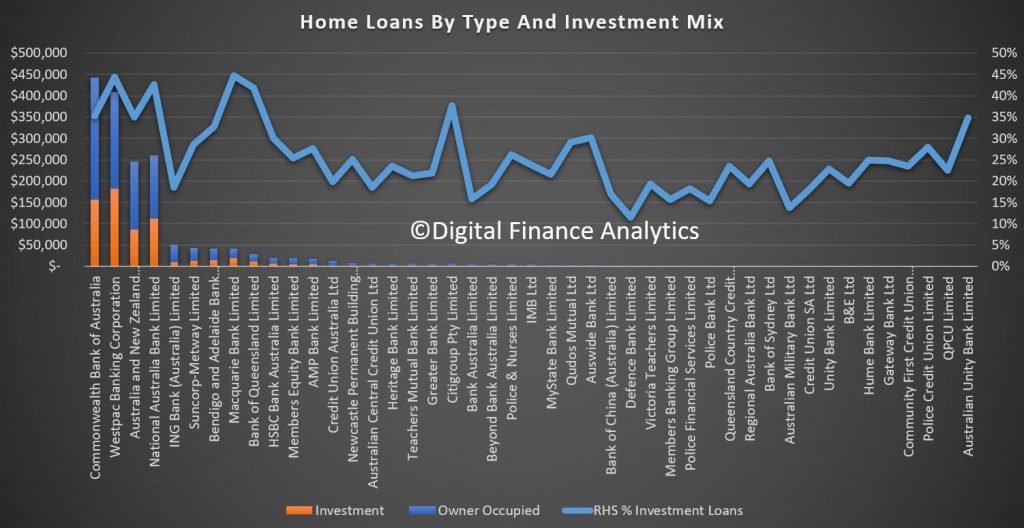

APRA has released their monthly banking stats to the end of November 2019. They are of course in the process of a major revision of these statistics, but we are now beginning to get some trend data down to the individual ADI level. The data is based on gross balances outstanding by owner occupied and investment loans, but it does not show where new loans were added, or loans repaid. So little flow data can be imputed.

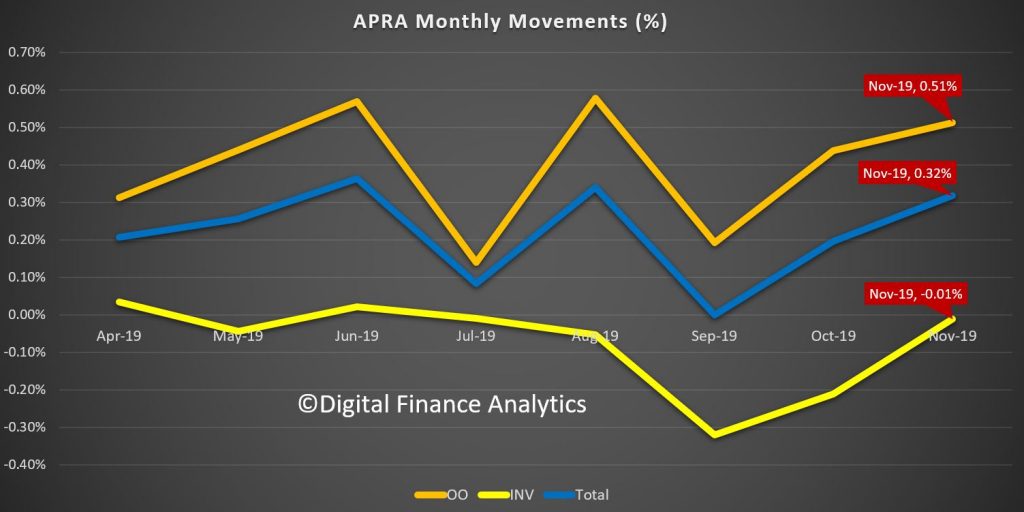

Total owner occupied loans rose 0.51% or $5.58 billion dollars in November to $1.09 trillion dollars, while investment loans fell 0.01% or $75 million dollars to $643 billion dollars. The share of loans for investment purposes fell again to 37%.

The trend movements show some improvement relative to earlier months. Total loans rose 0.32% in the month, which would given an annualised 3.8%.

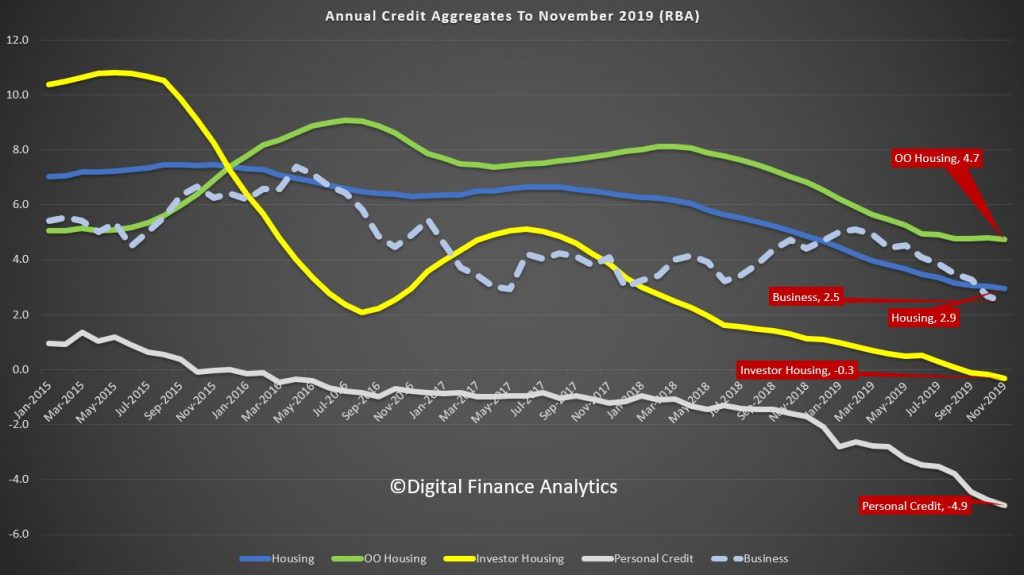

The RBA data released before Christmas showed that total loan growth over the past year for mortgages fell to the lowest ever (2.9%), which suggests that non-banks may be lending less now. But we cannot be sure of this.

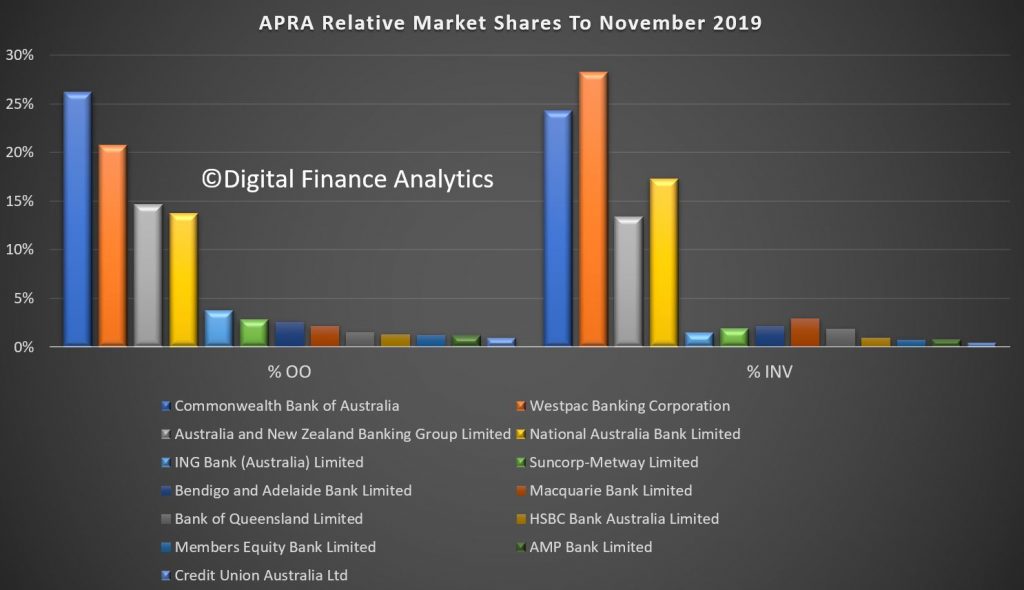

We can also look at individual lenders. The relative shares of the largest players hardly changed, with CBA the largest owner occupied lender, while Westpac has the largest share of investment loans.

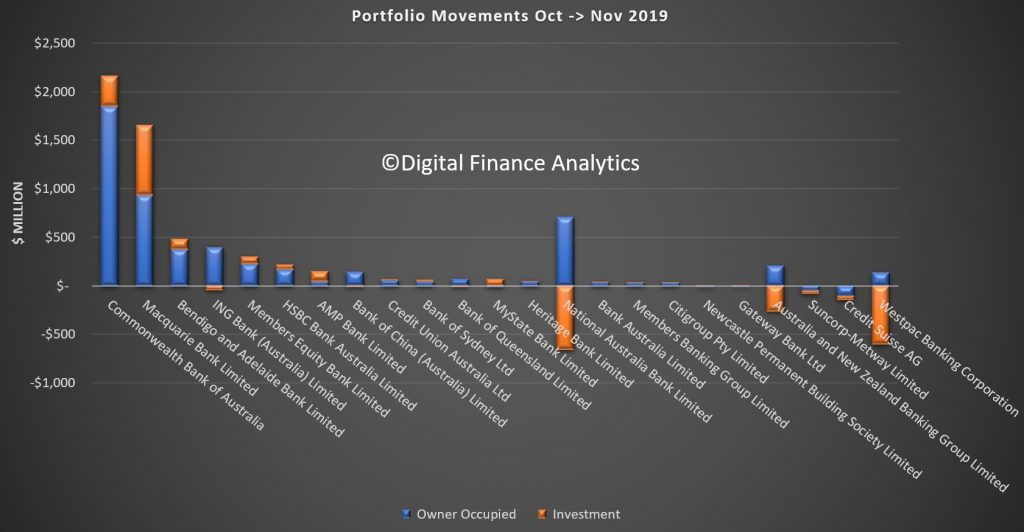

However, the relative movements this month underscored divergent results from lenders. CBA and Macquarie both saw significant growth in loans in the month, with Macquarie writing net more investment loans than any other lender at $718 million dollars. Bendigo Bank and AMP Bank are also chasing investment lending. On the other hand, ING dropped their investment loan balances, alongside the other big lenders, with NAB down $661 million, ANZ down $263 million and Westpac down $602 million. Suncorp and Credit Suisse both dropped their owner occupied and investment loan portfolios.

Finally, the relative proportion of loans for investment purposes reveals that Macquarie has 44.8% of its loans for this purpose, Westpac at 44.5%, NAB at 42.6% and Citi at 37.7%. Bearing in mind investment loans are intrinsically more risky, this is worth watching.

So, some small uplift in net volume of loans, but not equally spread across the sector, which suggests different players have different underwriting settings.

And the growth in lending suggests the household debt ratio is set to continue to rise, despite its already stratospheric level.

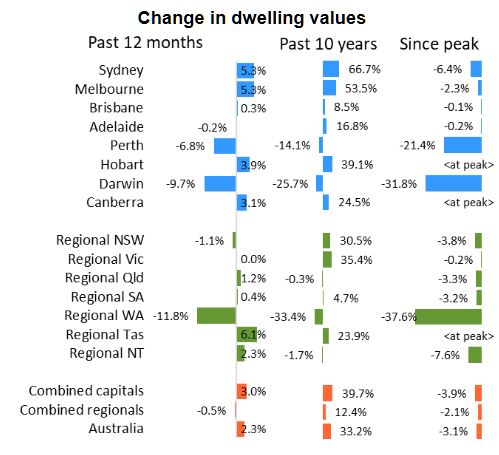

CoreLogic released their updated data to end December 2019 today.

They confirm a 1.1% rise in national dwelling values over the month, and a 4.0% increase over the quarter to finish out 2019 on a positive note.

This result represents the fastest rate of national dwelling value growth over any three month period since November 2009. Darwin was the only region among the capital cities and ‘rest-of-state’ areas to record a fall in values over the month, with a -0.5% decline.

CoreLogic head of research Tim Lawless said, “Although the monthly capital gains trend remains fast-paced, the 1.1% rise in December was softer relative to the 1.7% gain in November and the 1.2% rise in October. This would suggest that the pace of capital gains may have been dampened by higher advertised stock levels or worsening affordability pressures through early summer.”

Despite a strong rebound over the second half of 2019, property values across most regions of Australia are still below their previous record highs. Nationally, the CoreLogic index recorded a peak in October 2017; dwelling values remained 3.1% below their record high at the end of 2019. If the current quarterly rate of growth persists into 2020, the national housing market will record a nominal recovery in March as dwelling values push higher to new record highs.

Tim Lawless said, “A nominal recovery in housing values implies home owners are becoming wealthier, which may also help to support household spending. However, the flipside is that housing affordability is set to deteriorate even further as dwelling values outpace growth in household incomes, signaling a set-back for those saving for a deposit.”

Comprehensive credit reporting will soon leave unprepared finance providers with unprofitable business models while it spurs those ahead of the curve to further success, says credit and risk consultant Andrew Tierney, via AustralianBroker.

The news that most consumers can now benefit from comprehensive credit reporting should come as a wake-up call to finance providers who have yet to embrace the digital era.

All four major banks are now providing credit bureaux with detailed customer transaction data relating to credit card usage, personal loans, mortgages and other financial commitments.

CCR is poised to reshape our industry. ‘Game changer’ may be an overused phrase – but in this case it’s accurate. For this reason, it surprises me that there are a large number of credit providers still stuck in the analogue era, who show no signs of wanting to change. They aren’t benefiting from CCR and don’t seem to want to.

For example, while talking to a subprime lender just last week about what he was doing to meet this new challenge, he said his company already treated all applicants as subprime, with an interest rate that reflected the level of risk. He didn’t need transaction data direct from the applicant’s current account to help him make a decision, so why fix something that had been generating profits for as long as he could remember?

I can’t imagine how those with this mindset, determined to carry on as they have done, will still be in business in 10, maybe even five years’ time.

While many don’t see it at first, there’s eventually a light-bulb moment that arrives once you spell out how CCR is going to impact their business.

For the lender I mentioned, all it took was me pointing out that legislation requires lenders to use all the tools available to understand the risk a loan presents to the client. Without tapping into CCR, is he really doing this?

What defence will he have for not utilising CCR when the regulator comes knocking on his door? Cost isn’t a factor. There is no need for any major investment in back-office infrastructure or IT when you can tap into CCR and open data at little cost via platforms provided by tech companies.

Was he prepared for legal action that he could face, as a result of not fully checking affordability?

Further, there is the risk exposure that comes from not knowing the size that your liability could be in the future. As we all know, the regulator has been moving the due diligence goalposts for us.

By the end of our talk, the time investment he was willing to devote to this had grown exponentially. Now, he is days away from taking full advantage of CCR.

However, CCR should not be viewed simply as a big stick when it poses many more business benefits.

As recently calculated by Kevin James at Equifax, $20bn in extra loans could be granted to consumers over just one year by giving lenders granular detail on customers’ debt and repayment habits. The real-time transaction history at the point of application gives lenders the data needed to allow loans that previously would have been turned down.

Suddenly, a slice of business that used consultantto be a ‘no’ could become a ‘maybe’, then a ‘yes’. Because this decision will be largely automated, it will be possible to use true risk-based pricing for the first time, with loan terms designed specifically for a borrower.

Those that lag in this business are undoubtedly going to be left behind.

It won’t be long before they see a change in demographic in their pipeline. The profile of hopeful borrowers they are used to dealing with will change, as previous ‘nos’ find they can go to more mainstream sources and become ‘yeses’. Why would borrowers be willing to pay a higher rate of interest when they can get a lower one that is specifically tailored to their situation?

Finance providers who stubbornly remain behind the times may also find the likely ‘nos’ will begin to target firms that do not use CCR or open data, because they know their transaction data will not stand up to the same level of scrutiny and they are more likely to sneak by to approval.

Those who do not embrace these changes are going to have the rug pulled out from underneath them in the not-too-distant future. Their business model that has always been profitable could lose its edge overnight.

If doubt remains, remember that none of us need to think very hard to come up with examples of analogue businesses that have long been left behind.

We had a number of viewers ask about the DFA Studio set-up, so today we explore the studio, from soup to nuts.

We highlight some of the main issues this year, and also our most popular posts of the year. Wishing all our followers a happy new year!

Our top posts for this year:

The Real Issues Behind The Cash Ban

Lynette Zang And The “Great Reset”

The Cash Ban Breakthrough – The Game’s Afoot!

Harry Dent LIVE: How To Survive And Thrive From the Volatile Times Ahead

Harry Dent Says The Bubble Still Has To Burst!

The “Good News” On Property Prices?

A Conversation With Steve Keen: Part One – The Debt Problem

A Conversation With Steve Keen: Part 3 – Ecology and Energy; The New Horizon

Four Corners 21 Aug 2017 – Betting On The House

The Reality Of Bank Deposit Bail-In

The Real Problem With Low Interest Rates

The Reserve Bank will consider quantitative easing once rates fall to 25 basis points. It’s a tool that has been used by other countries, often with devastating consequences for society. Via InvestorDaily.

Australia is in uncharted territory, economically speaking. We’re latecomers to the low-rate party and we’re still getting used to it. Home owners are loving it but retailers are not. Unemployment is low but a record number of Aussies want to work more. It’s a strange time.

The Reserve Bank of Australia only has a few options left if it fails to hit its inflation target and lift economic growth. It can continue to reduce the cash rate and even go into negative rates, as the European Central Bank (ECB) had done. The ECB benchmark deposit rate was cut by 10 basis points in September to negative 0.5 per cent. The ECB also reintroduced its quantitative easing program of buying 20 billion euros ($32 billion) worth of government and corporate bonds every month in an effort to prevent the European economy from sliding off a cliff.

The ECB has been using QE on and off since 2009 in an effort to lift inflation. In 2015 the central bank began purchasing 60 billion euros worth of bonds each month. This increased to 80 billion euros in April 2016 before coming back down to 60 billion a year later.

In the UK, the Bank of England bought gilts (British government bonds) and corporate bonds during its QE program during the global financial crisis in 2009. QE programs also took place in 2011 and 2016.

Meanwhile, the US Federal Reserve has undertaken three separate rounds of QE, the last of which it began tapering in June 2013. The US halted its program in October 2014 after acquiring a total US$4.5 trillion of assets.

When a QE program takes place, a central bank begins buying securities with money that didn’t exist before the QE process began. They are essentially printing money and giving it to large corporates and the government through the purchase of these bonds, the logic being that the proceeds will be used to buy new assets (like mortgages) and invest, which in turn will drive the economy.

The money doesn’t directly hit the wallets of consumers. Unlike “helicopter money”, which the Rudd government dished out during the financial crisis, QE has a much more indirect impact on consumers. Financially speaking.

But the broader political and social impacts have had a lasting psychological effect on the populations of Europe and the US.

“If we look at the experience offshore, QE has been great at raising the level of assets in conjunction with a permanently lower interest rate,” Fidelity International’s Anthony Doyle said this week.

“QE has stimulated asset price growth. The ‘haves’ have benefited compared to the ‘have nots’; income inequality has grown across the economies that have implemented quantitative easing and socially we have seen big shifts to the Right or to the Left in terms of the political spectrum.

“If you think about Donald Trump, Elizabeth Warren, Bernie Sanders, Jeremy Corbyn, Brexit, Boris Johnson. The next decade could be characterised by moves to the Right or Left here as well if we follow a path that other economies have pursued.”

AMP Capital chief economist Shane Oliver told Investor Daily that QE “probably helps people who have shares and property more than it does people who have bank deposits.”

Prior to the election of Mr Trump in 2016, Luis Zingales of the University of Chicago Booth School of Business told Bloomberg that central bank policies are largely to blame for the rise of populism.

Here in Australia, the Reserve Bank will have to consider the impact that QE could have on a society that has witnessed a banking royal commission that exposed widespread misconduct within the financial services industry.

If the impact on Europe and the US of QE on the people is anything to go by, Australia is well placed to split down the middle and begin gathering on the far edges of the political spectrum.

We were late to the low rate party. We might just be late to the populism party too.

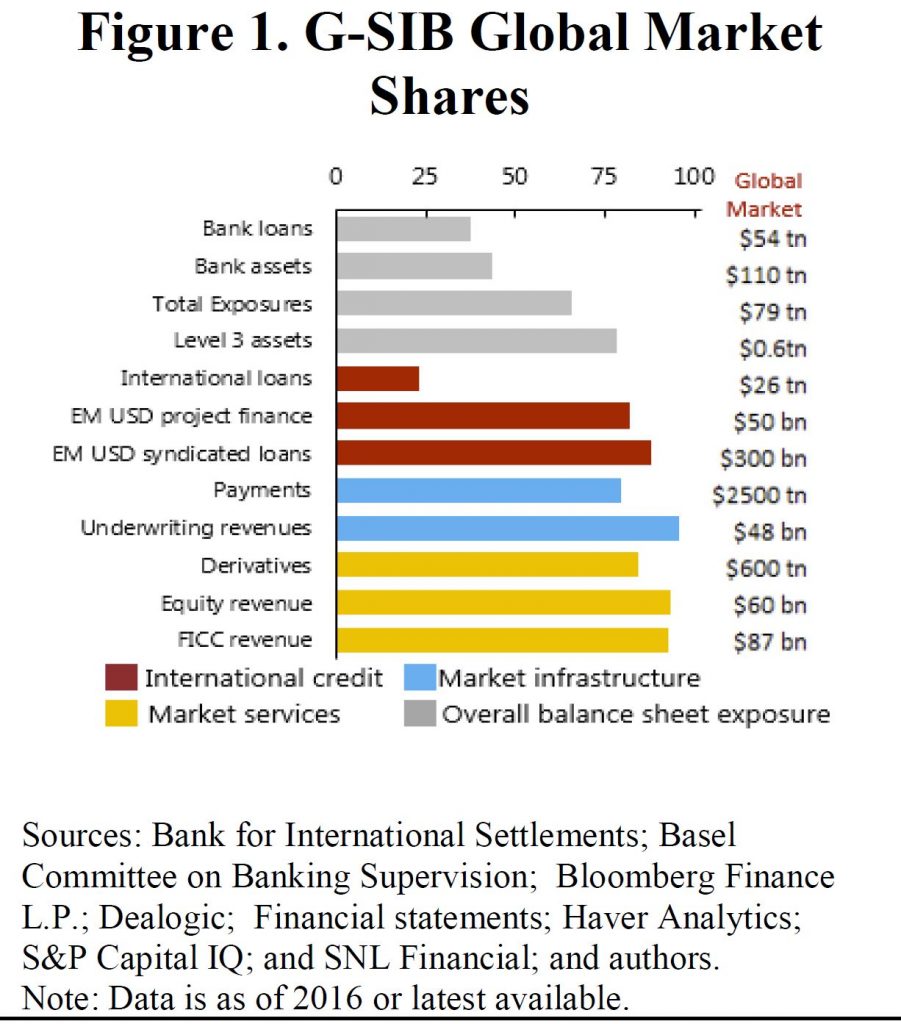

We look at an IMF working paper which maps the footprint of the top 30 banks (GSIBs) globally.

They control up to 75% of business lines.

The 2019 Consumer Pulse Report from financial comparison site Canstar surveyed over 2,000 Australians to get insight into current trends and how they’re likely to play out into the future. Via Australian Broker.

According to the data, less Australians are worried about mortgage interest rate movements than in years previous. Just 7% named it as their biggest financial concern for the year ahead in 2019 as compared to 9% last year.

However, concern over debt as a whole has risen, with 7% naming mounting debt levels as their leading concern for the year ahead as compared to 5% in 2018.

Just over a quarter (26%) of Australians reported they spend more than they earn, don’t save regularly and don’t limit their debts. The average debt outside of property loans rests at $48,809.

The respondents communicated credit cards are their biggest downfall, giving way to “accidental debt” through spending rather than the considered decision of taking out a loan and, without the discipline of a fixed repayment plan, it tends to linger longer.

Of those surveyed, 67% said their debt is in the form of a credit card, 17% a car loan, 16% a personal loan, 10% buy now pay later, and 20% other.

Nearly half (43%) of those with debt say they think about it on a daily basis.

Nearly a quarter (24%) doesn’t have any savings at all – the same percentage as in 2018, showing a lack of improvement in savings habits. Of those not saving, close to three quarters (74%) indicated they live pay cheque to pay cheque.

Younger generations continue to live at home longer while they save for their financial goals, be it a holiday, a car or a home, with respondents saying adult children should move out by the age of 34.

Home loan repayments as a percentage of the average income are now at a similar level as they were before the Global Financial Crisis (GFC); however, the RBA cash rate is approximately one-tenth of the pre-GFC cash rate, meaning repayments have been reduced.

Canstar expects worry to intensify when interest rates start to rise, and says now is the time to be getting a good deal.

Economist John Adams and Analyst Martin North look at recent Hansard records where the Banks discussed their plans for negative interest rates.

The link between the Cash Restrictions Bill and potential Negative Rates are very real, no conspiracy theory here – but fact!