Economist John Adams and Analyst Martin North reflect on last week’s Canberra visit when John had 14 (yes 14) meetings about the Cash Restrictions Bill. But John also came away with some more disturbing conclusions about our politicians.

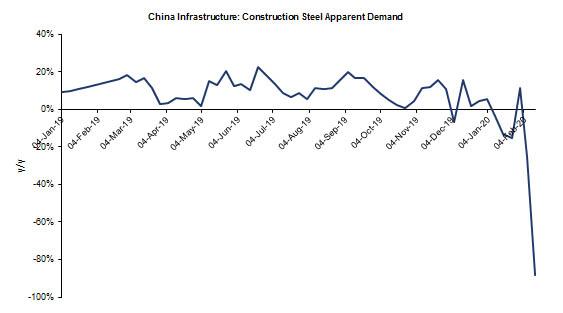

What If China Turns To Austerity Rather Than Stimulus?

The current popular view is that in response to the Covid-19 problem, the central bank will stimulate, and this will support the local, and therefore global economy. One reason why markets are sanguine.

There is just one problem with this. China’s Global Times (one external voice of the Government) headed a piece “China should get ready for belt-tightening following virus outbreak”. Maybe China will not stimulate the economy by rolling out another massive monetary stimulus. This is potentially a game changer.

With the Chinese economy taking a major hit from the outbreak of the novel coronavirus pneumonia (COVID-19), the central government appears to pursue fiscal austerity as part of the efforts to pull through the difficult times.

While it is generally expected that fiscal stimulus and monetary easing will undoubtedly be the two main tools of central authorities for alleviating downward pressure on the economy and for maintaining macroeconomic stability, given the past experience and the financial risks currently facing China, a flood of spending programs seems no longer on the financial regulators’ list of choices for stimulating the economy.

“China will face decreased fiscal revenues and increased expenditures for some time to come, and the fiscal operation will maintain a state of ‘tight balance.’, Chinese Finance Minister Liu Kun wrote in an article published on Qiushi, a magazine affiliated with the Communist Party of China Central Committee. In this situation, it won’t be feasible to adopt a proactive fiscal policy by expanding the fiscal expenditure scale. I, and instead, policies and capital must be used in a more effective, precise and targeted way,” Liu said. Chinese Finance Minister Liu Kun wrote in an article published on Qiushi, a magazine affiliated with the Communist Party of China Central Committee.

Liu’s article sent a clear signal that China would not stimulate the economy by rolling out another massive monetary stimulus.

Due to the major impact of the coronavirus outbreak on businesses across the country, the Ministry of Finance has already made it clear that it would continue to reduce the tax burden on enterprises, which will undoubtedly weigh down the already slowing fiscal income. And a potential decrease in fiscal revenues directly points to the limited room for splashing out on unnecessary programs. China’s fiscal revenues grew 3.8 percent in 2019, the slowest growth since 1987, while fiscal expenditures during the same year gained 8.1 percent compared with the previous year, outpacing economic growth.

Therefore, to maintain a “tight balance,” the Chinese economy will have to tighten its belt by curbing non-essential expenditures while expanding investment in a precise and targeted manner.

There has been a consensus call among economists and economic observers for the fiscal deficit ratio to break the 3 percent GDP mark temporarily so that more space could be given to fiscal expenditures to stabilize the economy amid the epidemic.

However, it should be noted that fiscal space constraint is not the key reason for belt-tightening. Past experience with massive stimulus already showed that a flood of investments could lead to many consequences like high levels of local government debts, and to the detriment of high-quality economic growth.

In 2019, China’s fiscal expenditures reached 23.9 trillion yuan ($3.4 trillion), of which only 3.5 trillion yuan was spent by the central government, and the rest by local governments.

In this sense, governments at all levels should be prepared for belt-tightening in the future to come.

This could have significant consequences for us all!

Trump’s ‘blue collar boom’ is more of a bust for US workers

If you thought workers’ hourly pay was finally rising, think again. Via the US Conversation.

At first glance, the latest data – which came out on Feb. 7 – look pretty good. They show nominal hourly earnings rose 3.1% in January from a year earlier.

But the operative word here is nominal, which means not adjusted for changes in the cost of living. Once you factor in inflation, the picture changes drastically. And far from representing a “blue collar boom” – as the president put it in his State of the Union address – the real, inflation-adjusted data show most U.S. workers have not benefited from the growing economy.

As an economist who studies wage data, I think it’s paramount that we take a step back and look at what the data really show.

The effect of inflation and fringes

The Bureau of Labor Statistics comes out with two sets of data on wages.

Business journalists and financial markets tend to focus on the monthly data. These figures are only reported in nominal or current terms because the inflation data doesn’t come out until later.

A more complete set of wage and pay data is reported quarterly. The latest release came out in December for the third quarter. These figures are not only adjusted for inflation but also include fringe benefits, which account for just under a third of total compensation.

At first blush, it makes sense to focus primarily on the first set. Newer data is, well, newer, and market participants and companies prefer the latest information when making decisions about investments, hiring and so on.

But the effect of inflation means that the same US$1 bill buys less stuff over time as prices increase.

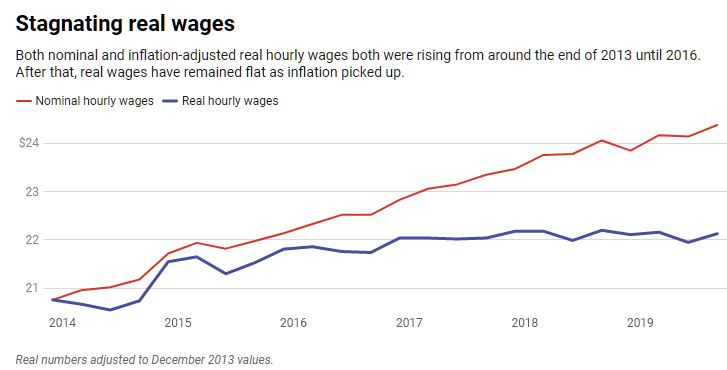

From December 2016 to September 2019, nominal wages rose 6.79% from $22.83 to $24.38. But after factoring in inflation, average wages barely budged, climbing just 0.42% in the period.

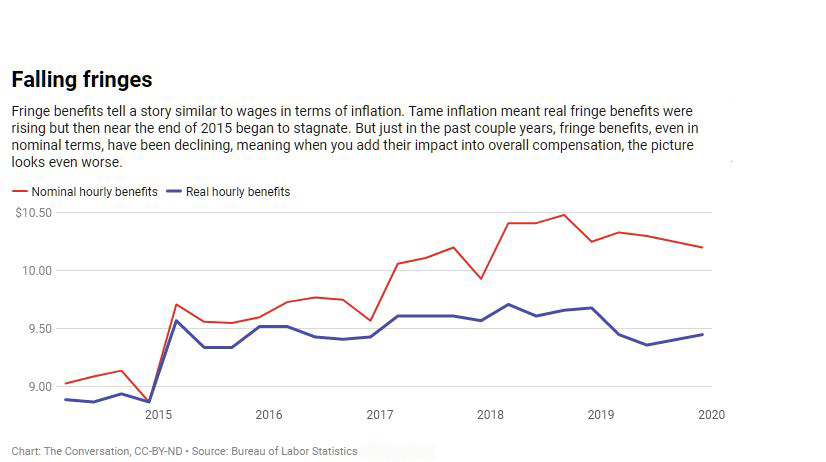

Incorporating fringe benefits into the picture adds another wrinkle.

The inflation-adjusted or real value of fringe benefits, which include compensation that comes in the form of health insurance, retirement and bonuses, declined 1.7% in the three-year period.

Altogether, that means total real compensation slipped 0.22% from the end of 2016 to September 2019.

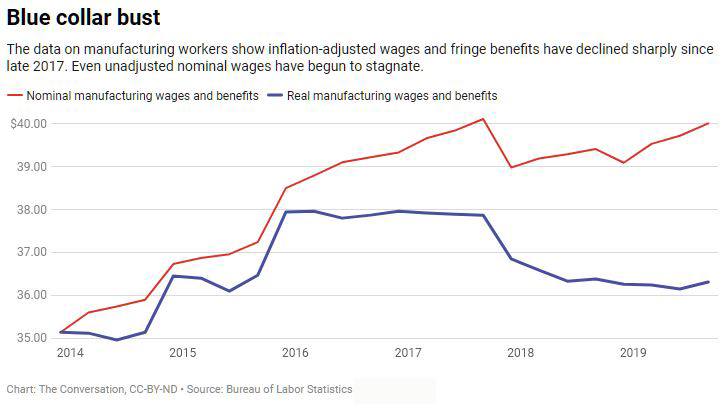

Of course, workers in different sectors have fared differently. The Trump administration has singled out manufacturing workers – who it says are the main beneficiaries of its trade war and other policies intended to support the sector – as having benefited from a “blue collar boom” in wages.

The nominal data for manufacturing workers hardly support a boom but they do show an increase of 2.22% since Donald Trump took office.

The adjusted data, however, make it look more like a bust, with wages plunging 3.88% in the period. And, again, the situation is worse when we add in fringe benefits, which brings the decline to 4.33%.

So next time you read a story about a rise in pay, try to see if it reports the wage data in nominal or real terms, and if it includes fringe benefits too. If it’s only nominal wages, the numbers may mean a lot less than they seem.

Author: David Salkever, Professor Emeritus of Public Policy, University of Maryland, Baltimore County

Real Time “Vironomics”

We look at some real time data to judge the economic impact of covid-19.

Find more at https://digitalfinanceanalytics.com/blog/ where you can subscribe to our research alerts

February live event: https://youtu.be/w3UNMB2deFM

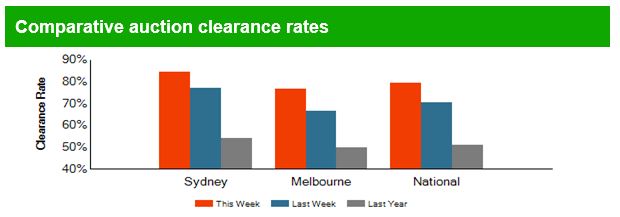

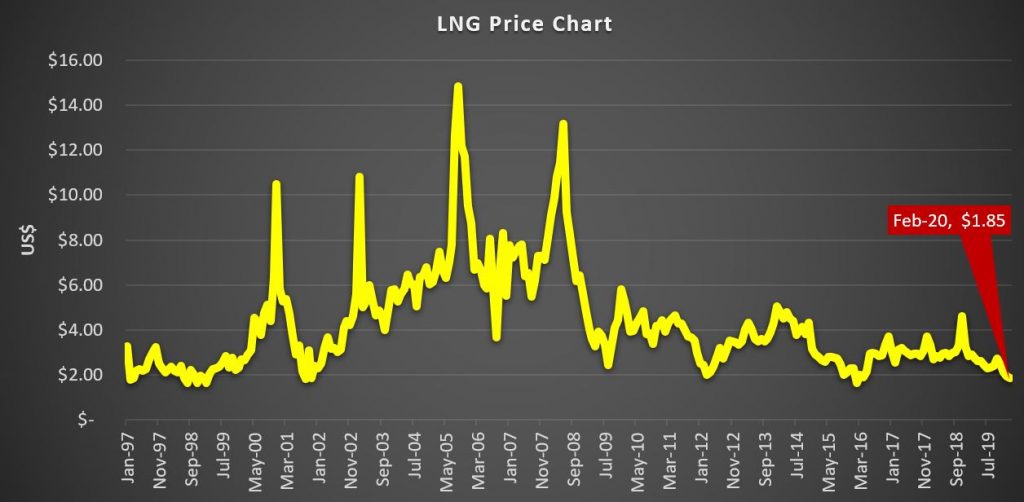

Auction Results 15 Feb 2020

Domain has released their preliminary auction results for today.

The volumes are still pretty strong, with Sydney ahead of Melbourne.

Canberra listed 41 auctions, reported 28 and sold 26, with 1 withdrawn and 2 passed in, giving a Domain clearance of 90%.

Brisbane listed 81 auctions, reported 53 and sold 35, with 2 withdrawn and 18 passed in to give a Domain clearance of 64%.

Adelaide listed 53 auctions, reported 31 and sold 25, with 2 withdrawn and 6 passed in to give a Domain clearance of 76%.

Misdirection Rules – The Property Imperative Weekly 15 Feb 2020

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Next live event: https://youtu.be/w3UNMB2deFM

Contents:

00:20 Introduction 01:30 US Markets 04:00 Fed and Repo 05:40 Yield Curve Inversion 09:00 Bitcoin and speculation 09:50 UK 10:20 RBS 12:40 Eurozone 14:00 China 16:25 Australian Market 17:00 Property and Auctions 18:45 Monetary Policy 20:15 APRA Stress Tests 21:30 Markets

Covid-19 Scenarios

It is too soon to know for sure how the current virus event will play out. Reading the various informed and ill-informed views has been interesting, with some playing it down to a mere scratch on the global economy, while others are playing it up as a potential catastrophe. And social media it seems has started to prune out some of the more dire and outlandish rumors, which is a good thing.

We have had a significant number of requests for an “update” so its time to do just that. And lets start with the latest from the Australian Bankers Association. They say:

Australian small businesses financially impacted by the spread of the coronavirus are being urged to contact their bank to access assistance on offer which can include deferred loan payments, waiving fees and restructuring loans.

Australian Banking Association CEO Anna Bligh said any small business should not tough it out on their own if they are financially impacted by the effects of the coronavirus.

“Thousands of businesses have had a horror start to the year with drought, bushfires and floods. Now the coronavirus having a severe impact on both their ability to create products and also export them to markets overseas,” Ms Bligh said.

“Banks have hardship teams in place to walk businesses through the assistance on offer if they have been impacted by events outside of their control.

“Any business financially impacted by the effects of the coronavirus, such as tourism operators, growers and exporters of fresh produce and those reliant on international education should contact their bank to access the assistance on offer,” she said.

The type of assistance offered will depend on individual circumstances, but can include a deferral of scheduled loan repayments, waiving fees and charges and interest free periods or no interest rates increases, or debt consolidation to help make repayments more manageable.

This is more than PR, as we know businesses in some sectors are already feeling the pain. Tourism will be the first cab off the rank. We discussed the importance of the tourist dollar from China relating to the bushfires recently. This just makes things worse.

Foreign visitors generated $45.2 billion in income to the economy, up 4.7% on the previous year. This was generated from 8.7 million international visitors, up 2.5%, with an average spend per trip of $5,219.

Within the $45.7 billion, $17.1 million came from holidays, $13.2 billion from education, $7.5 billion from visiting family and relatives, $4.1 billion on business, $2.2 billion on business and $1.2 billion for other reasons.

Visitors from China accounted for $12.3 billion of spend, of which $3.2 billion was holidays and $7.1 billion on education. This came from 1.3 million visitors, with an average spend per trip of $9,235.

The United States was second, with $4.0 billion spent, of which $2.0 billion was for holidays and $300 million on education. This came from 771,000 visitors with an average spend per trip of $5,200.

Next was the United Kingdom with $3.3 billion spent, with $1.4 billion on holidays. And $1.3 billion on visiting family and friends, and just $68 million on education. We had 669,000 visitors from the UK and their average spend was $4,959.

New Zealand accounted for $2.6 billion in spend, of which $1.1 billion was holidays, 0.7 billion on families and friends and just $76 million on education. Interestingly they accounted for $1.3 million visits and their average spend was $2,032. That may tell you something about our Kiwi cousins!

Across the states and territories, NSW received $11.5 billion, of which $3.6 billion was for holidays, $4.7 billion for education and $1.4 billion for visiting relatives. The average spend per trip was $2,610. Of this around $1 billion was from regional NSW, mainly holidays at $381 million and education $362 million.

Victoria accounted to $8.8 billion, of which $2.3 billion was holidays, $4.0 billion education and $1.5 billion was visiting relatives and friends. The average trip was worth $2,810. Regional Victoria earned $594 million from international tourism, of which $249 million was holiday related from international visitors.

In Queensland, international tourism was worth $6 billion, including $2.8 billion for holidays, $1.7 billion for education and $830 million for visiting families and friends.

Within that Gold Coast generated $1.3 billion, including holidays at $755 million and education at $335 million, Brisbane was $2.8 billion comprising holidays $644 million and education $1.3 billion, and regional QLD generated $1.8 billion, of which holidays was $1.4 billion.

So China accounted for 26.9% of tourist income, contributing 18.7% of holiday spend and a massive 53.8% of education related travel spend.

Which takes us to the University sector. Moody’s did some recent analysis on this.

The emergence of the coronavirus in the Asia-Pacific region has the potential to significantly reduce international student numbers, and

thus tuition revenue, particularly as countries impose restrictions on international travel to contain the spread of the virus. Australian

universities will face the greatest immediate credit risk given their relatively high concentration of Chinese students, their proximity to

the main regions affected by coronavirus and the fact that the outbreak coincides with the start of their academic year. The impact will be less immediate for universities in the US, Canada, the UK and Singapore but will ultimately depend on the severity and length of the outbreak.Impact will be greatest on Australia universities because of high proportion of international students and timing of academic year

A relatively high proportion of international students, especially from China, leaves Australian universities more exposed than

universities in other countries to the impact of the coronavirus on student numbers and the resulting potential for lower revenue.As shown in Exhibit 1, the Australian Group of Eight (Go8) universities have the highest concentration of international students in Australia with the Chinese cohort representing around 60% of their international student enrollments. Heightened travel restrictions will impact universities more broadly than just international enrollments, also affecting in exchange programs, field schools, placements or other programs.

The timing of the Australian academic year also heightens the exposure for the country’s universities. It begins in February/March 2020 and follows Lunar New Year celebrations, during which travel between Australia and China is high. Some of the international intake for 2020 is already in the country, but others still need to travel to Australia. Delays in travel will impact university revenue and require countermeasures, which currently include deferring the start of semester, delayed on-campus classes and increased online access where possible.

By contrast, most students from China studying in Canada, the UK, Singapore and the US have already returned for exams and the start

of second semesters, before the outbreak and the quarantine/travel advisories started.

If coronavirus is quickly contained – meaning within several months – the effect on Australian universities is likely to be manageable, with revenue deferred (not lost) and no change to credit quality. The anticipated coronavirus-related disruption of the international cohort will be manageable for semester 1, 2020, with those best-placed benefitting from having built significant reserves of cash and liquid investments (excluding endowments) in recent years.

However, if the current outbreak is not contained quickly, the revenue effect and drawdown of cash reserves has the potential to be significant. Highly attractive to international students, Australian universities are vulnerable to negative shocks affecting individual

student markets. If regional travel is affected to the degree it was during the Severe Acute Respiratory Syndrome (SARS) outbreak in

2003, travel between Asia – particularly China – and Australia will likely be significantly affected in the next two to three quarters. The

SARS outbreak was contained within six months.Although the Go8 exhibit the highest exposure to international students, the size and diversification of their revenue bases, and their strong global brands, partly mitigates their exposure to negative shocks. An escalation of the coronavirus outbreak is likely to be manageable for these universities in 2020, given their liquidity positions and the likelihood that international student volumes will recover once the spread has been contained.

Several universities are undertaking capital expansion programs, but these are made up of discrete elements and therefore can be

scaled back if necessary. Countermeasures available to the universities are most likely to flow through i) expenditure controls, such as flexible workforce arrangements reflecting higher levels of casual and sessional staffing levels, ii) additional cash reserves accrued in recent years due to strong performance, particularly by the Go8, iii) deferral of discretionary capital expenditure, and iv) access to cash and investments (excluding endowments) as well as short term debt markets.

This they concluded that Australian universities face more immediate credit risk from coronavirus outbreak

We think the combined damage across education and tourism is going to be north of $2 billion per month, with an accelerating risk as the duration of the crisis continues.

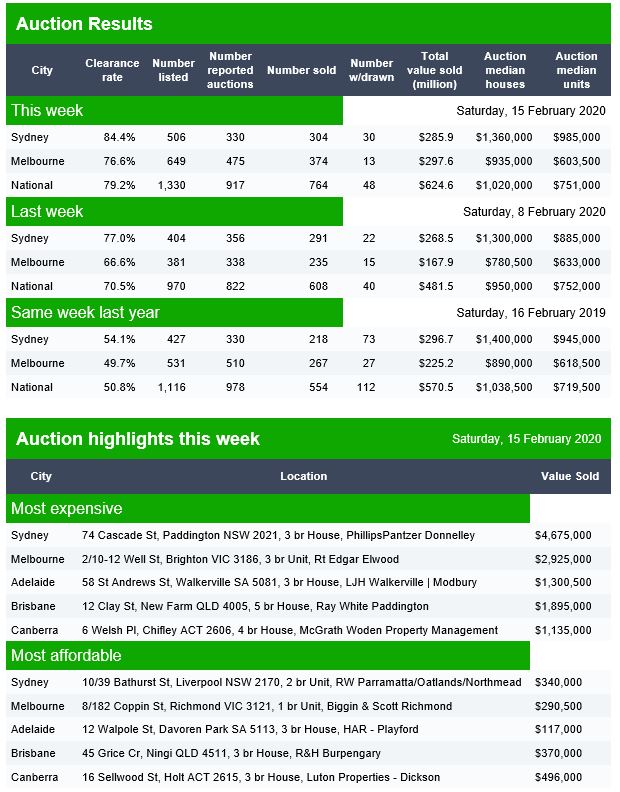

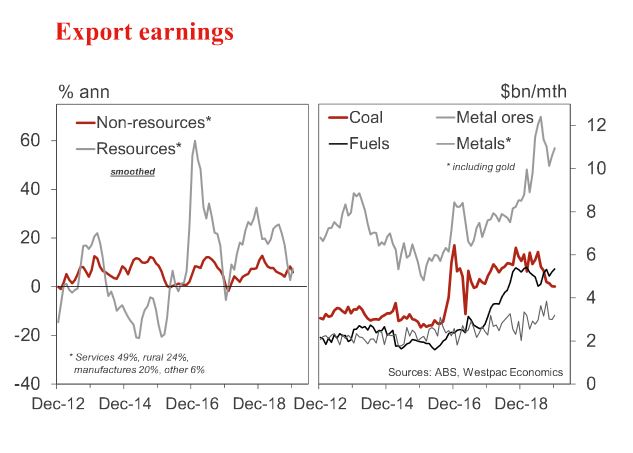

The economic slow-down in China is also reducing demand for our exports, including iron ore, LNG and coal. Iron ore is a bellwether, and the price dropped to around US$78 on the 3rd February to a current price of around US$85.14 MYEFO made the point that a $10 fall in the price translates to around a $3.3 billion hit to Australia’s account.

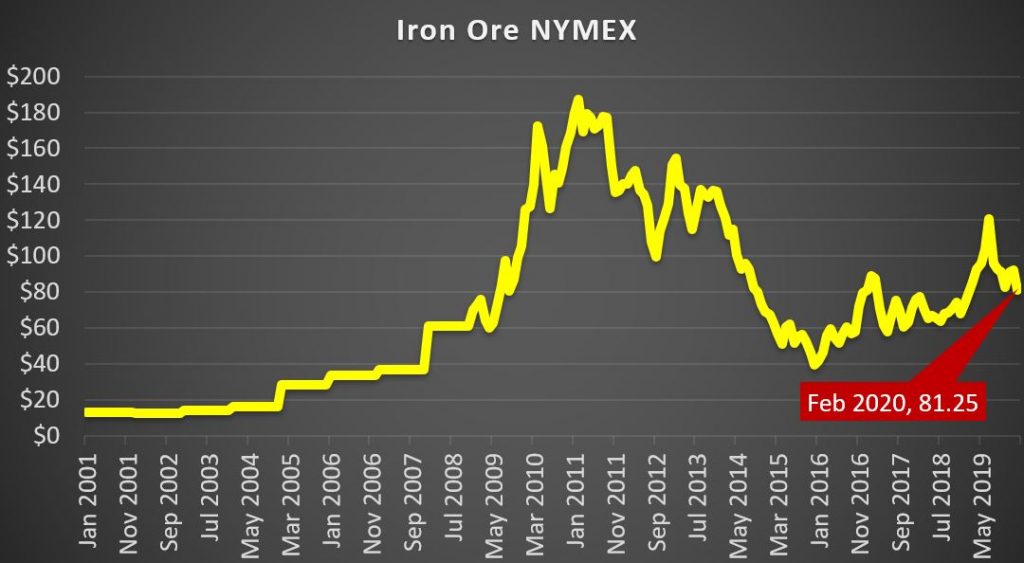

LNG prices are also lower, around US$1.85, which again could translate to lower revenue on our exports.

Thermal coal prices are also lower, with prices below US$70 now appearing.

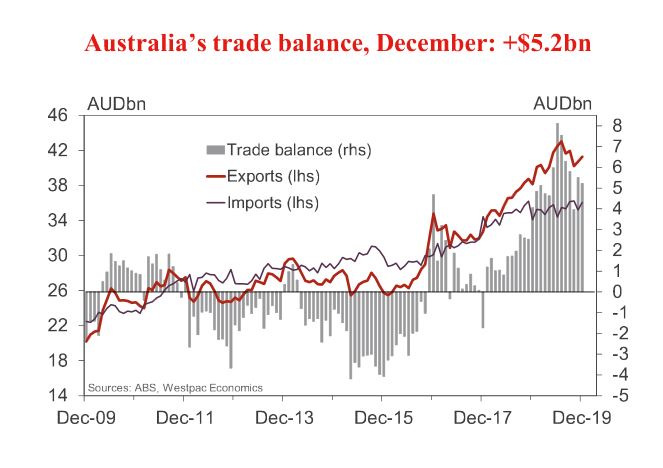

So, our largest exports appear to be exposed to lower prices, as demand eases. The latest trade balance showed a positive $5.2 billion to December

But exports are contingent on precisely those commodities which are weakening. Again the question is how much, and for how long.

Initial modelling suggests that a fall of $4-5 billion net income is likely based on know variables, per month. But again more, if this continues.

Then will there be a second order impact from consumer and business sentiment? Data out today from the Westpac-Melbourne Institute shows that

sentiment remains weak overall. At 95.5, the Index remains well below the long run average of 101.4 and firmly in pessimistic territory (readings below 100 indicate that pessimists outnumber optimists). This downbeat mood has prevailed since mid-2019 and coincided with a marked slowdown in consumer demand that looks to have carried into early 2020. The lift in sentiment this month likely reflects easing concerns around bushfires and comes despite some significant negative developments, most notably the

coronavirus outbreak abroad.

Against this, the escalating coronavirus outbreak looks to have had only a limited effect on consumer sentiment. While surprising, this is similar to the experience during the SARS outbreak in 2003 which had little or no impact on sentiment in Australia, although it had a material impact on confidence elsewhere, China in particular.

Business confidence has evaporated and business conditions have stabilised at weak levels, suggesting that the economy is trending sideways – stuck in the slow-lane. These were the key messages from the private business surveys late in 2019. They remain the key messages as the 2020 year begins – as evident in the NAB survey for January, which was conducted from January 21 to February 3.

Falling forward orders suggest weak business conditions are likely to persist near-term. In January, the business conditions index was unchanged at +3, which is below the long-run average (of +6 dating back to 1997). The January outcome matches the average since last April, to be well down from +18 in mid-2018. The economy decelerated sharply in the second half of 2018, into 2019. Business confidence rose by 1pt to be at -1 in January, a well below average reading.

The lack of confidence is understandable given the subdued economic backdrop, as well as recent events, notably the bushfires and the outbreak of the coronavirus in China, our number one trading partner. That points to the risk of weak equipment spending in coming quarters.

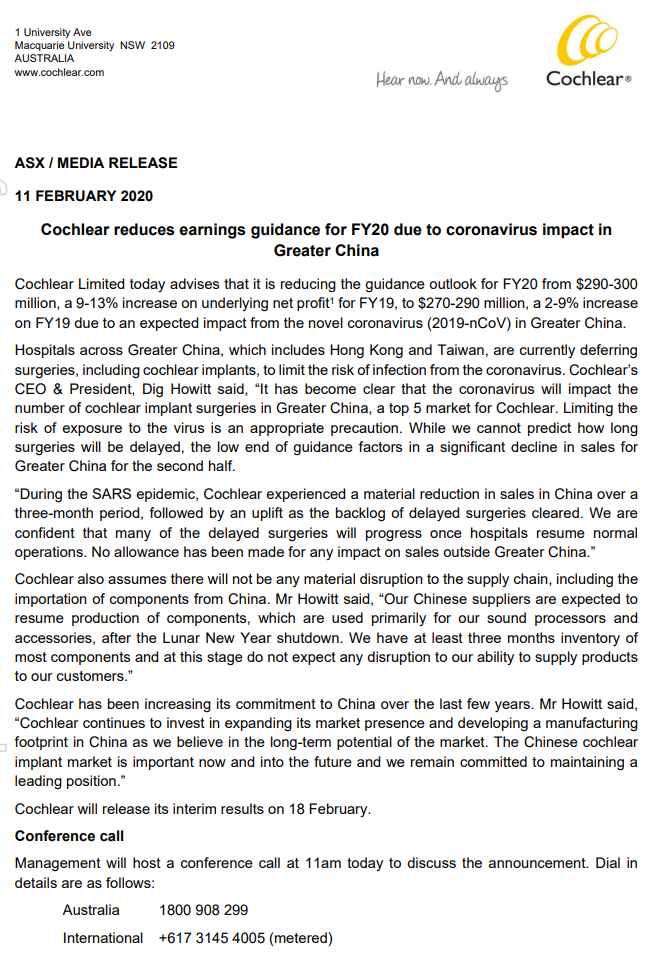

We expect to see more profit warnings like we got from Cochlear the hearing aid specialists, warning that their guidance for FY20 will drop from $290-300 million to $270-290 million, due to the expected impact of the 2019-nCoV in Greater China.

Watch the airlines, other travel and education sectors, as well as supporting service industries. Banks are at the end of chain as it were, so in the short term, not much to see, but that could change later as businesses begin to topple.

So, then the question becomes, will the virus threat dissipate anytime soon? Probably not.

As CNN reported, yesterday, China said it has confirmed 59,804 cases on the mainland, an increase of 15,152 cases from the previous day.

The death toll from the coronavirus outbreak in the country now stands at 1,367, according to China’s National Health Commission.

Only two deaths have occurred outside of mainland China.

World Health Organisation (WHO) officials described China’s decision to broaden their definition of what constitutes a confirmed case as a necessary measure.

However, the major increase in the number of deaths and cases of the coronavirus appears to dash hopes that the outbreak was levelling off.

It comes as additional cases were confirmed on the quarantined cruise ship docked in the Japanese city of Yokohama, and in the US, where the Centres for Disease Control and Prevention warned the country “can and should be prepared for this new virus to gain a foothold.”

In the UK too, a new case was confirmed Wednesday in London, with health officials warning that more were likely to follow.

WHO officials had previously expressed some optimism at the apparently stabilising outbreak in China, but even then they cautioned that the virus could still spread elsewhere.

“This outbreak could still go in any direction,” WHO Director General Tedros said Wednesday.

“We have to invest in preparedness,” Tedros said, adding that richer countries should help invest in countries with a weaker health system. He warned the virus could “create havoc” if it reaches a country whose health system is not capable of handling such an epidemic.

Speaking at a US Senate hearing on Wednesday, Scott Gottlieb, former commissioner of the US Food and Drug Administration, said that testing has not been done aggressively enough and should be expanded to cover more symptoms.

“I think that we should be leaning in very aggressively to broaden diagnostic screening right now, particularly in communities where there was a lot of immigration, where these outbreaks could emerge, to identify them early enough that they’ll be small enough that we can intervene to prevent more epidemic spread in this country,” he said.

Gottlieb pointed to Singapore, which has now identified around 50 cases, to make a point about the US, which receives similar numbers of travellers from China every year.

“On a statistical basis, there’s no reason to believe that if Singapore got implants of this virus, we didn’t. You would expect them to be identified earlier in Singapore” as a densely populated island, he said. “But it does suggest, at least to me, that we probably have some community spread right now that we just haven’t identified yet.”

And As the number of coronavirus cases jumps dramatically in China, a top infectious-disease scientist warns that things could get far worse: Two-thirds of the world’s population could catch it. As reported by Bloomberg.

So says Ira Longini, an adviser to the World Health Organization who tracked studies of the virus’s transmissibility in China. His estimate implies that there could eventually be billions more infections than the current official tally of about 60,000.

If the virus spreads to anywhere near that extent, it will show the limitations of China’s strict containment measures, including quarantining areas inhabited by tens of millions of people. WHO Director-General Tedros Adhanom Ghebreyesus has credited those steps with giving the rest of China and the world a “window” in which to prepare.

Quarantines may slow the spread, but the virus had the opportunity to roam in China and beyond before they went into effect, Longini said. The country boosted its count of those infected by almost 15,000 on Thursday after widening the diagnosis methods.

Longini’s modeling is based on data showing that each infected person normally transmits the disease to two to three other people. A lack of rapid tests and the relative mildness of the infection in some people also makes it difficult to track its spread, he said.

Even if there were a way to reduce transmission by half, that would still imply that roughly one-third of the world would become infected, Longini said.

“Unless the transmissibility changes, surveillance and containment can only work so well,” Longini, co-director of the Center for Statistics and Quantitative Infectious Diseases at the University of Florida, said in an interview at WHO headquarters in Geneva. “Isolating cases and quarantining contacts is not going to stop this virus.”

He’s not alone in warning of the possibility of a far greater spread. Neil Ferguson, a researcher at Imperial College London, estimated that as many as 50,000 people may be infected each day in China. Gabriel Leung, a public health professor at the University of Hong Kong, has also said close to two-thirds of the world could catch the virus if it is left unchecked.

The estimates of spread are part of a spectrum of possibilities that could unfold as the epidemic progresses, said Alessandro Vespignani, a biostatistician at Northeastern University in Boston. The next few weeks may provide more information about how easily the disease spreads outside China, particularly if more measures are put in place to control it, he said.

“People change behaviors” in response to disease, he said. “This is kind of a worst-case scenario. It’s one of the possibilities.”

More data need to be gathered to gain a better idea of how far the virus is likely to range, said David Heymann, an infectious disease expert at the London School of Hygiene & Tropical Medicine who oversaw the WHO’s response to SARS in 2003. “We’re seeing countries outside of China that have been able to contain the outbreak pretty well.”

“I’m not saying they’re wrong,” he said of estimates from the likes of Longini and Leung. “I’m saying the models will be refined as more information comes to light.”

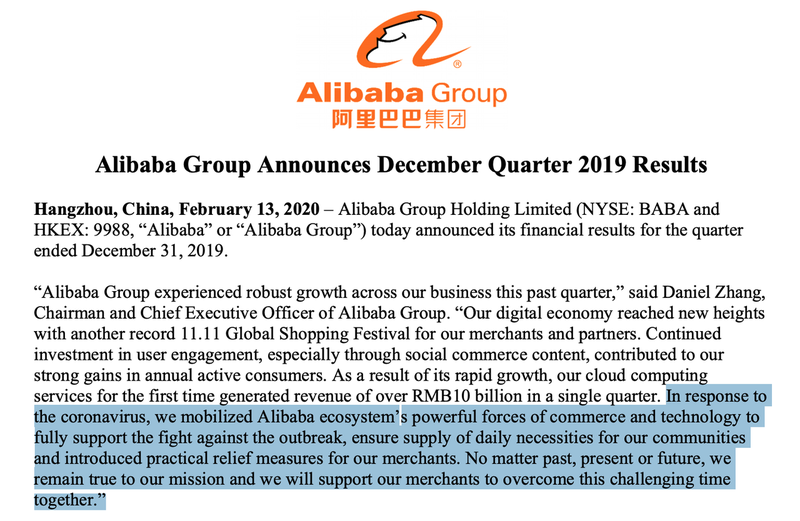

So, I think we need to consider the risks of a longer more severe event than SARS. And to underline this, Alibaba Group’s CEO Daniel Zhang warned Thursday that the Covid-19 outbreak in China is developing into a “black swan event” that could have severe consequences for China and the global economy. As reported in Zerohedge.

Zhang told analysts during a conference call that the company’s fiscal third-quarter results beat expectations but warned of near-term impacts related to the deadly virus outbreak.

He said Alibaba’s revenue jumped 38% YoY for the quarter and promoted “robust growth” due to a record Single’s Day.

Alibaba Group’s CFO Maggie Wu said it’s “too early to quantify the impact” Covid-19 will have on its business and other operating segments across Asia.

Wu said the virus shuttered major manufacturing hubs across the country and led to hundreds of millions of people in quarantine.

She said demand for goods and services has declined, and the delay of the workforce getting back to work could further hinder economic growth.

Wu suggested that Alibaba is “not immune to this imbalance of supply and demand,” otherwise known as a “shock,” but says the company sees an opportunity in the virus crisis (a great way to spin it).

She emphasized the outbreak is a “one-off occurrence” and by “helping customers through difficult times” that enables the company to drive long-term growth. But she provided no timetable of when the company thinks the confirmed cases and deaths will peak.

However, there’s only so much the company can spin by pushing investors away from looking at short term impacts by giving them optimistic views about the distant future.

Wu said overall revenue growth for 1Q would be negative as the economic shock from the virus has already shut down two-thirds of the Chinese economy.

The shock Alibaba is warning about was also outlined last month by former Morgan Stanley Asia chairman Stephen Roach, in which he said the global economy could already be in a period of vulnerability, where an exogenous shock, such as the Covid-19, could be the trigger for the next worldwide recession.

“With the world economy operating dangerously close to stall speed, the confluence of ever-present shocks and a sharply diminished trade cushion raises serious questions about financial markets’ increasingly optimistic view of global economic prospects,” Roach said.

The “black swan” warning was also repeated by Freeport-McMoRan CEO Richard Adkerson several weeks ago after he said the outbreak of the virus in China is a “real black swan event” for the global economy.

And why are corporations and a former top investment manager warning about “black swan” events in China and across the world?

Well, it’s because as China’s economy screeches to a halt, so will the world. This comes at a time when central bank ammo to thwart below-trend growth has been exhausted.

So too soon to call the effect, but we can sure see the potential instruments of weaker growth, nay recession, on the horizon.

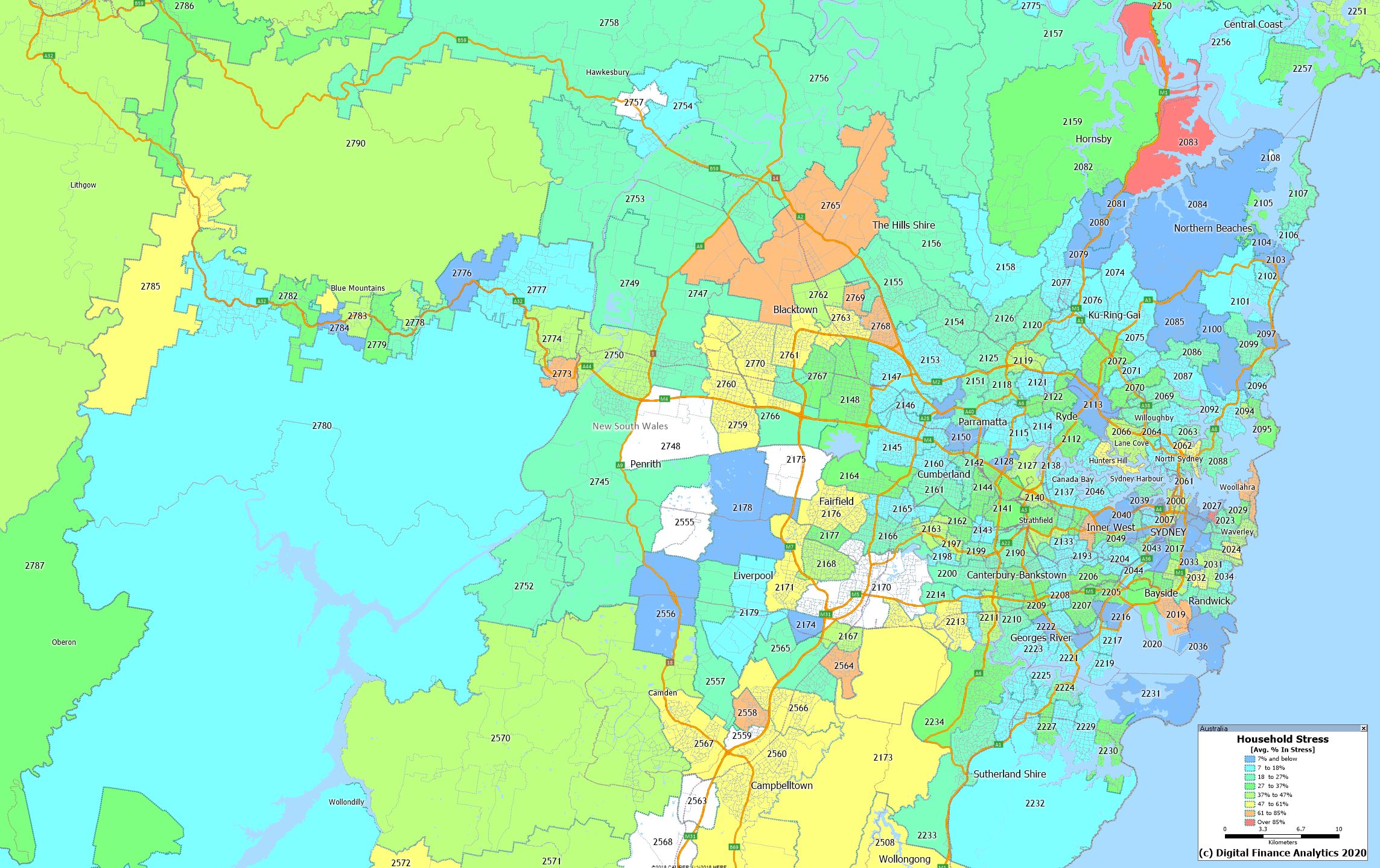

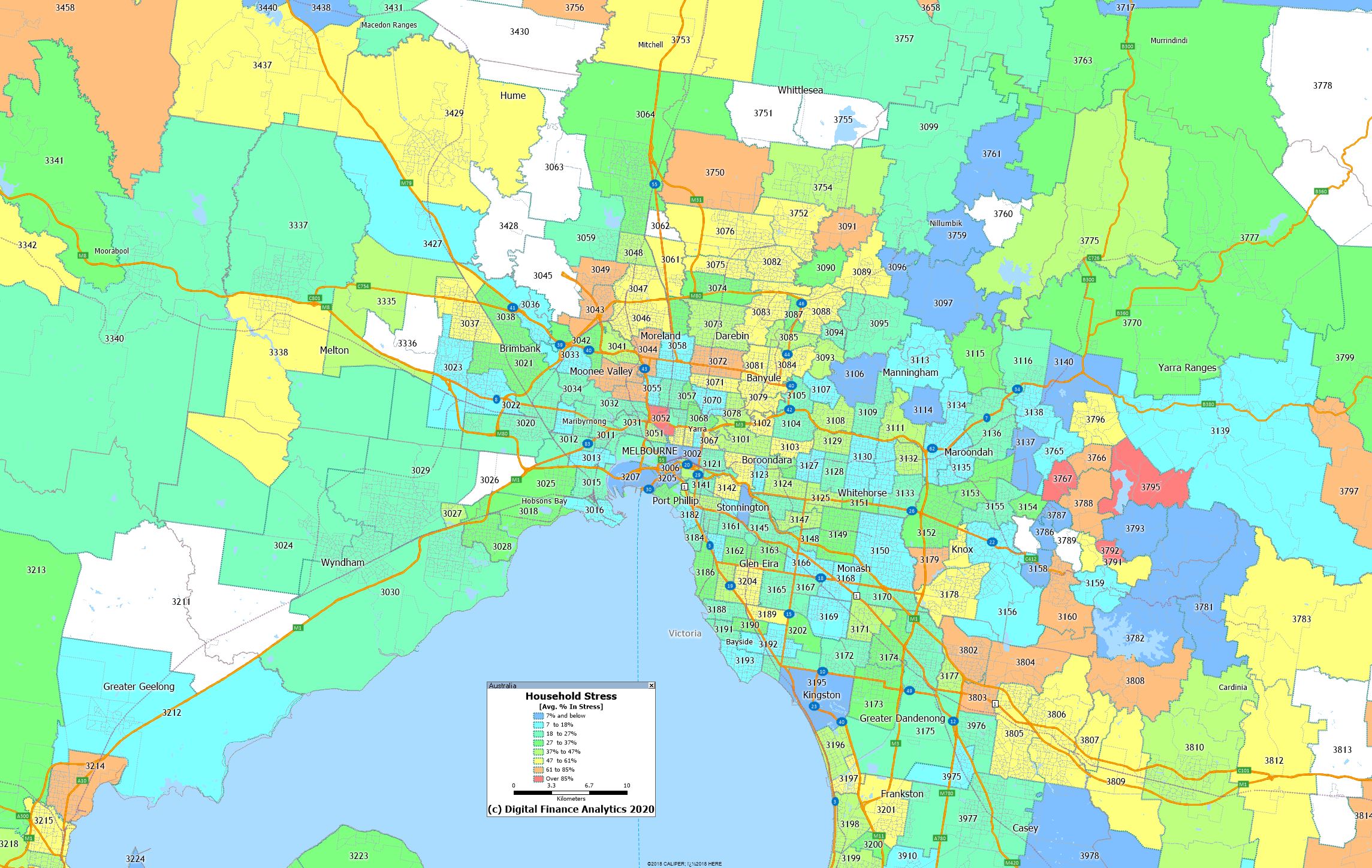

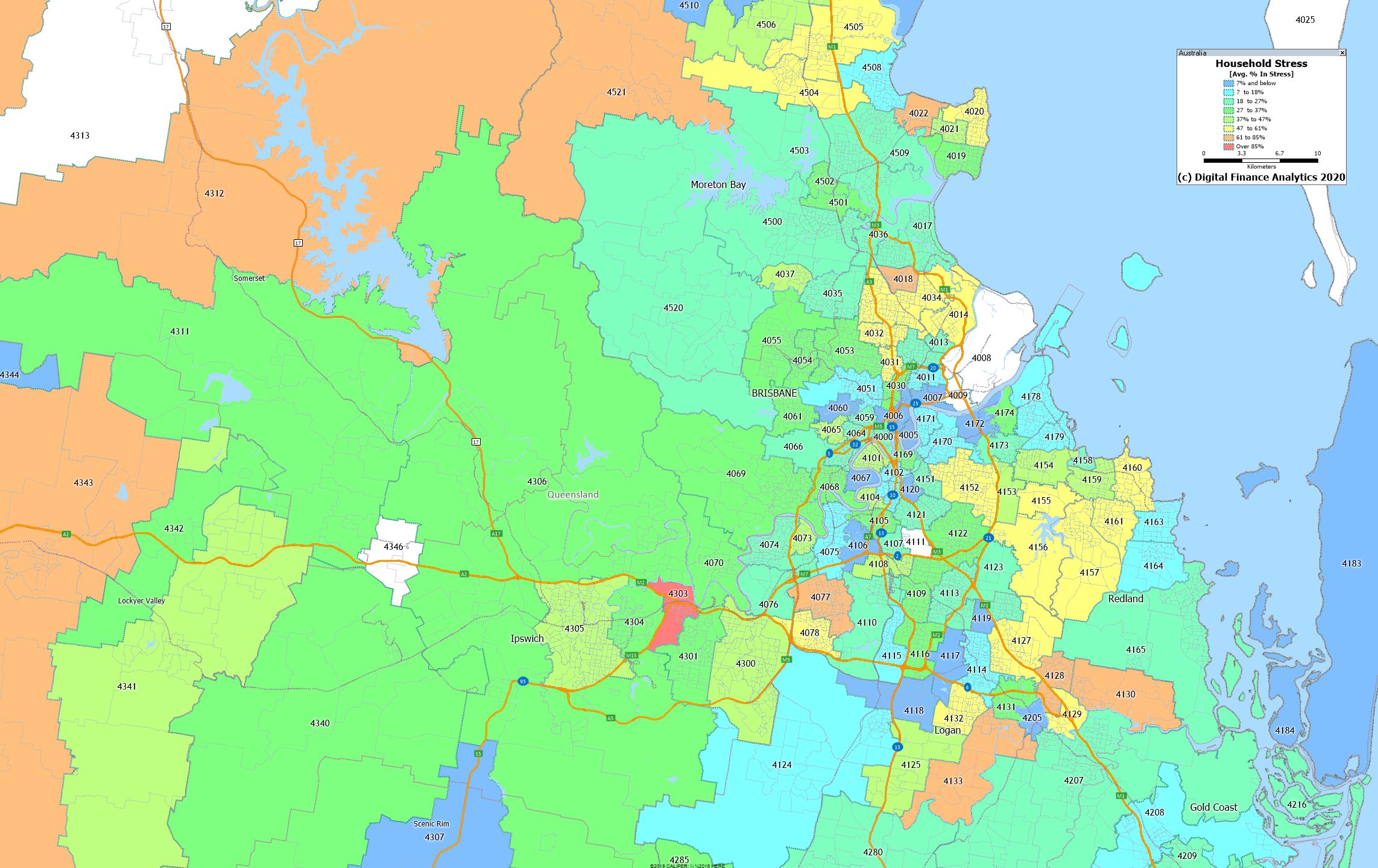

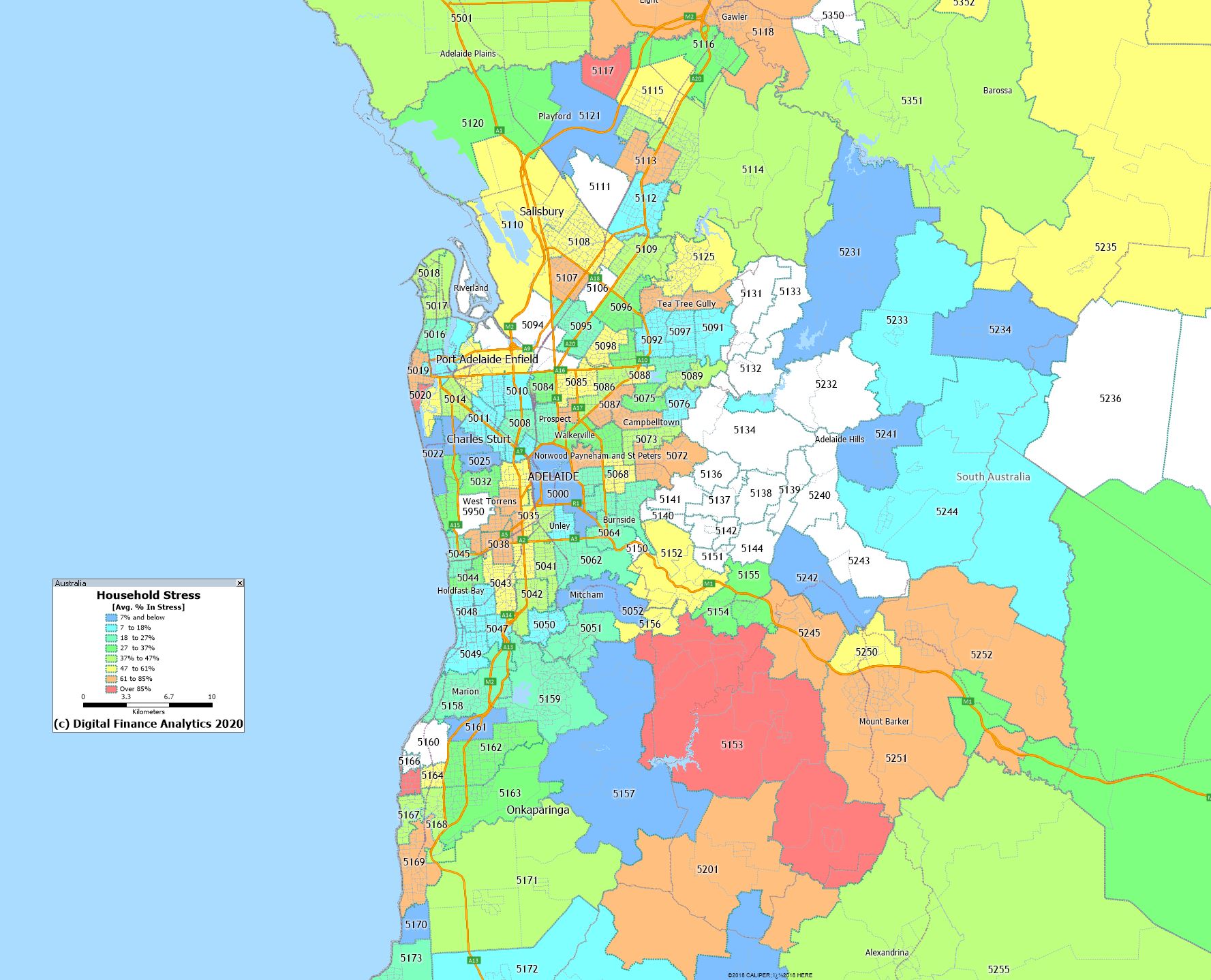

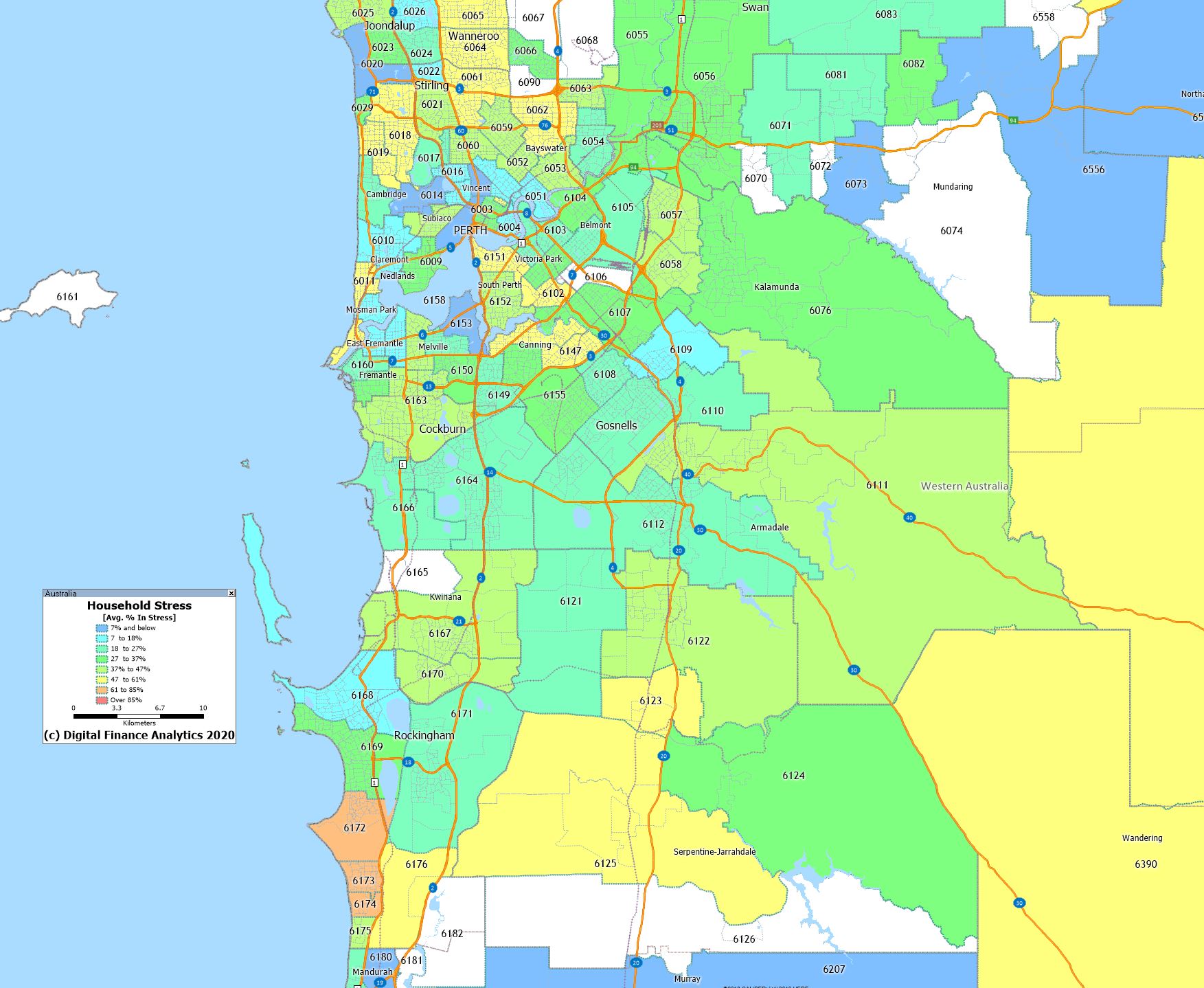

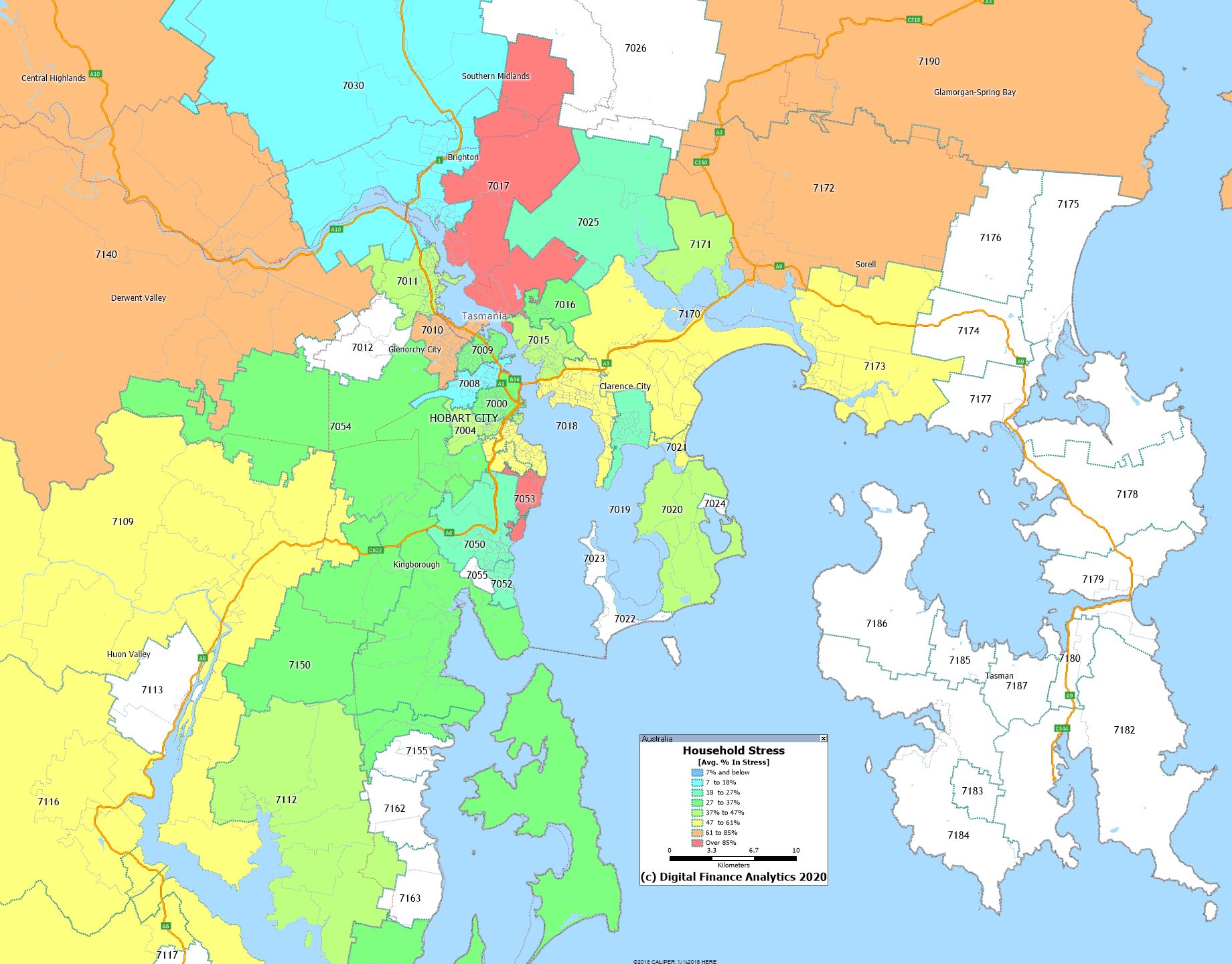

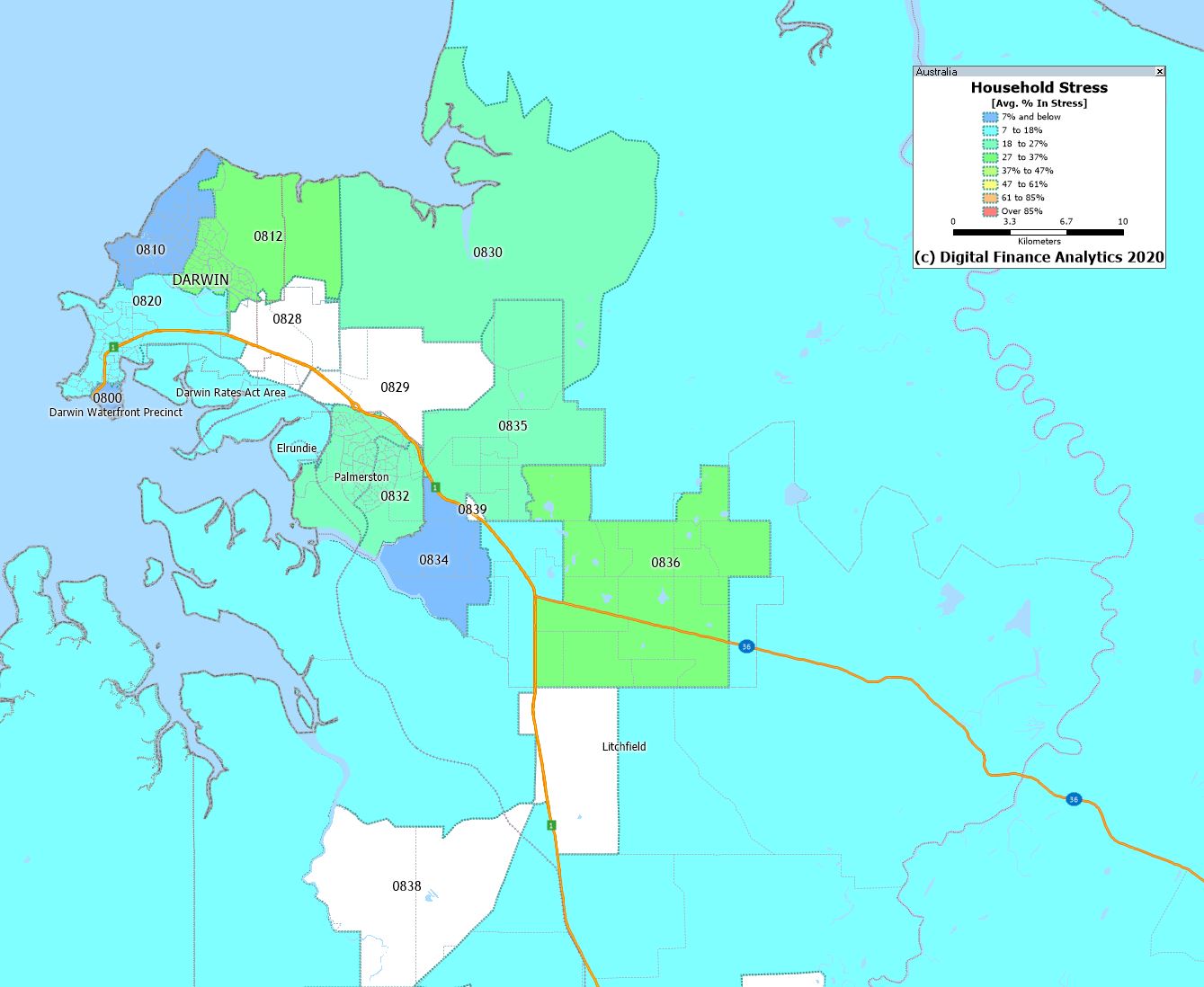

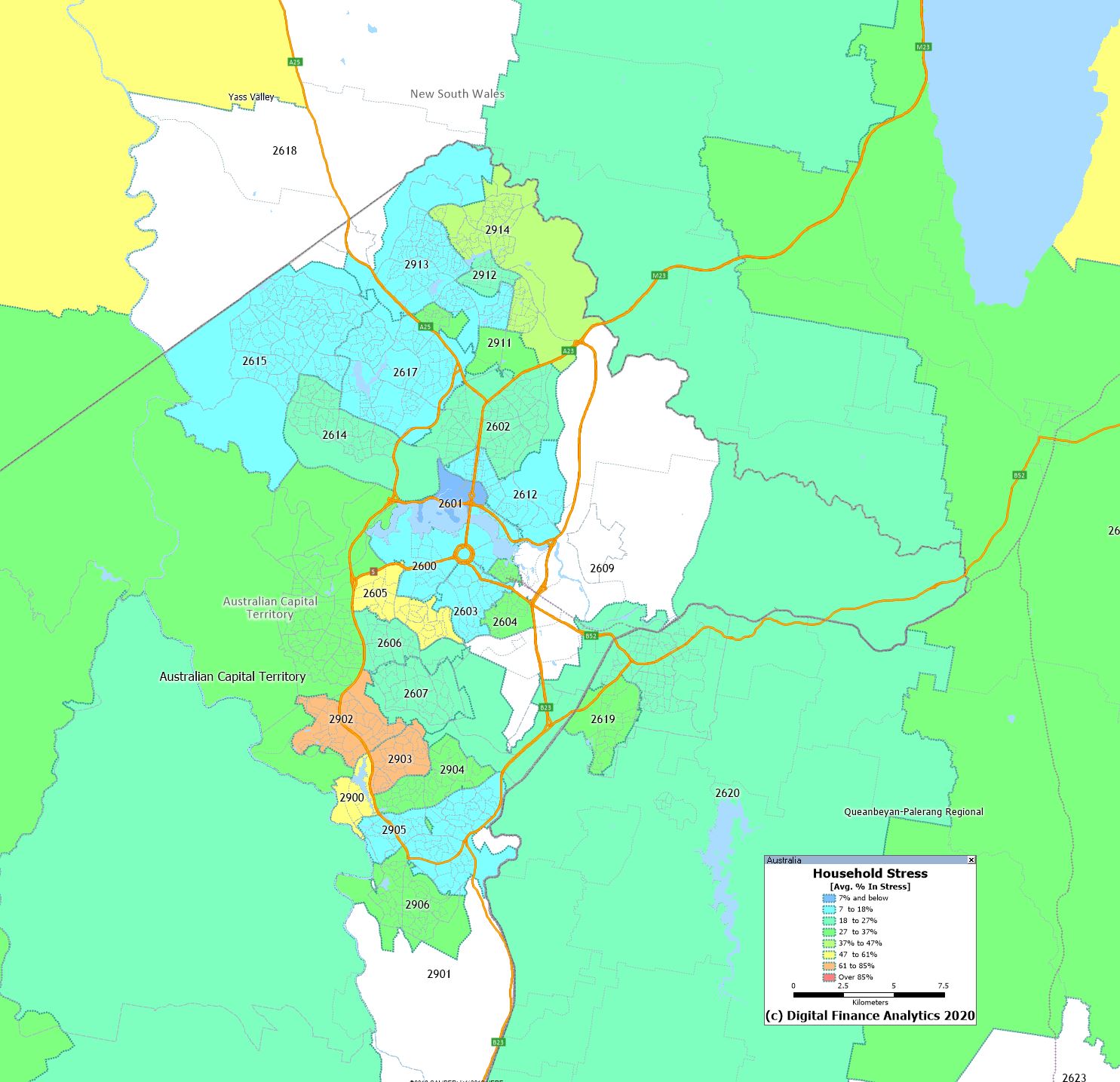

Mapping Mortgage Stress

We have had many requests for updated mortgage stress maps, so today we include the latest post code level analysis – with data to end January 2020. We as showing the proportion of households in each state in stress, centered on the main urban centres. You can click on the maps to load and view the original capture.

Sydney

Melbourne

Brisbane

Adelaide

Perth

Hobart

Darwin

ACT

You can read more about our stress analysis here:

Queensland’s Debts Are Spiralling Out Of Control

Economist John Adams and Analyst Martin North discuss the Queensland economy with Campbell Newman, who was at the helm of the state during an attempt to get debt under control.

What happened, and what does this tell us about community expectations, and their appetite for ever more debt?

Household Financial Confidence Finds A Floor

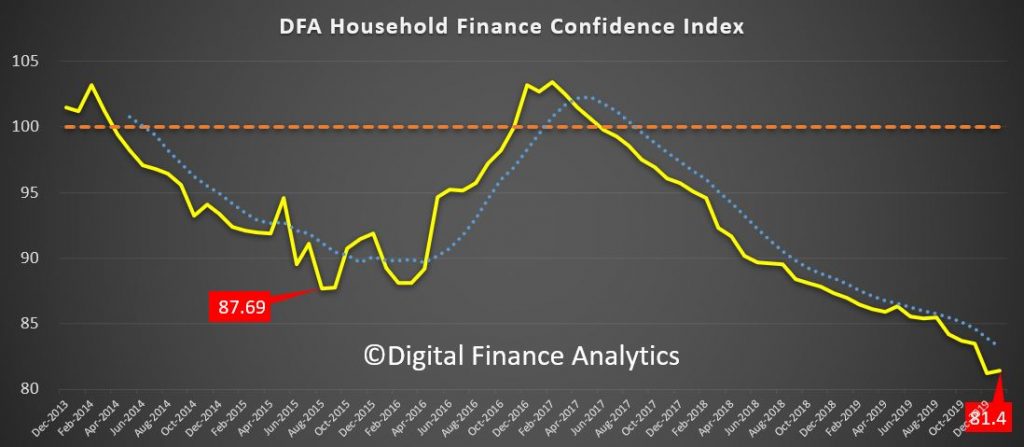

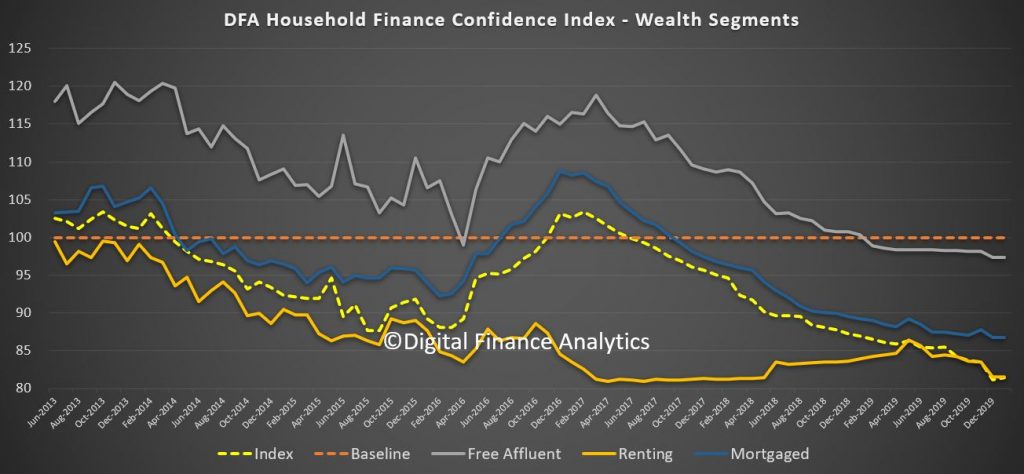

The latest results from our household surveys revealed that household financial confidence recovered just a little in recent weeks, but is still in ultra-low territory and well below the neutral 100 measure, at 81.4.

So far, the impact of virus concerns have not translated into households finances, whereas the bushfires, floods and other local events are having a more direct impact.

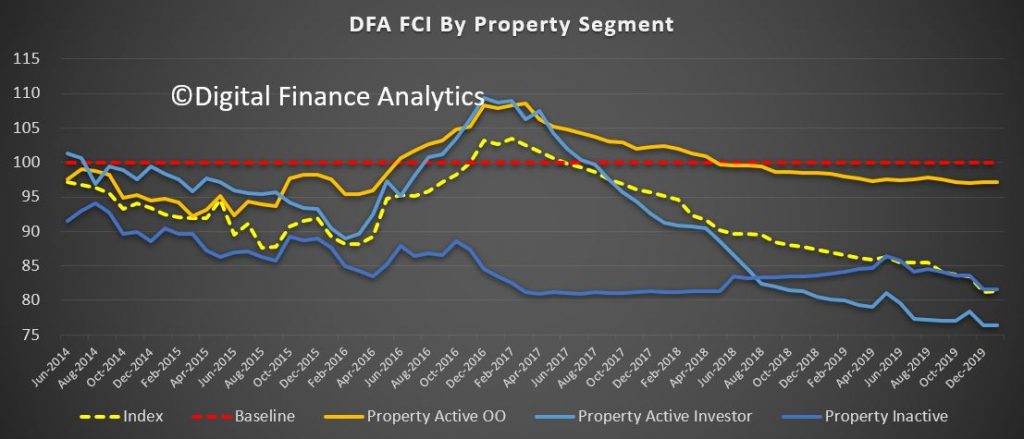

Across the property segments, owner occupied households are the most positive, thanks to rising prices in some locations and lower interest rates on some mortgages. Property investors and those renting remain more bearish, as rental costs continue in the doldrums.

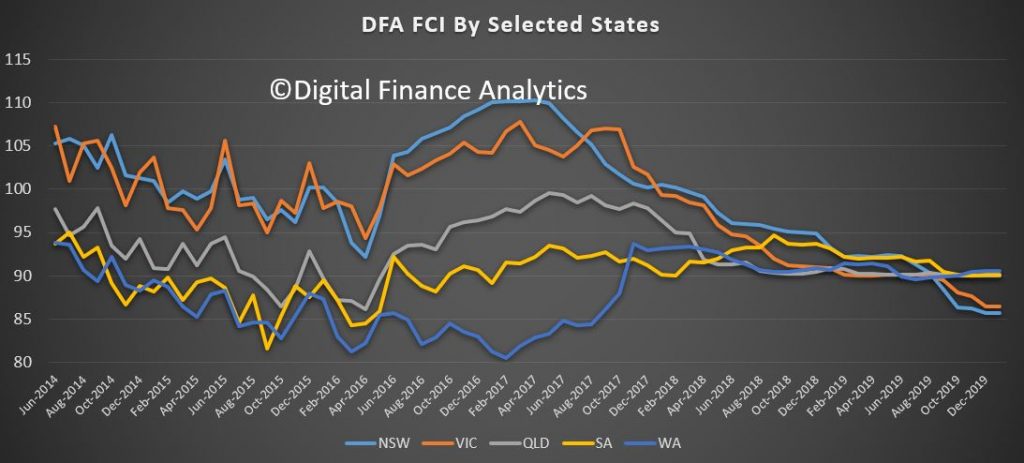

Across the states the recent trends continue, with both NSW and VIC households under greater financial pressure compared with WA, QLD and SA. Much of this is debt related as the average mortgage size grows ever larger in the two largest states.

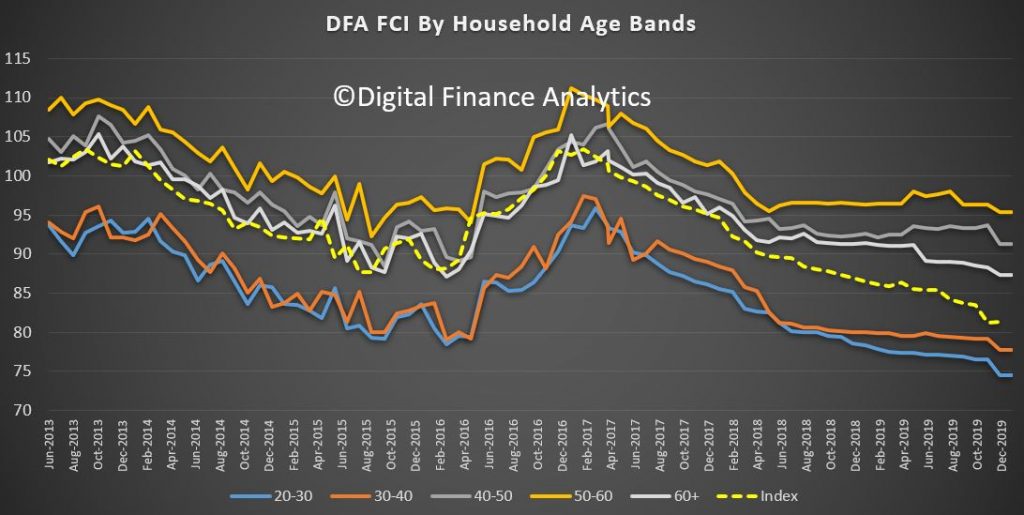

We continue to see pressure among younger households building relative to those in the older cohorts. Much of the pressure comes from housing costs one way or another.

Those mortgage free and owning property are relatively better placed than those with a mortgage, or renting. This is because housing costs are such a large element in a budget whether servicing a mortgage or paying rent.

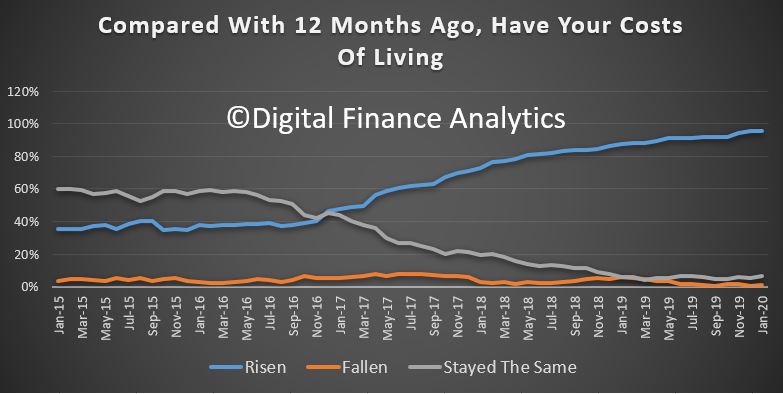

Looking in more detail at the moving parts, living costs continue to rise disproportionately, thanks to more expensive fresh food (drought related), child care and school fees rising fast, accelerating healthcare costs and continued high energy and fuel costs. 95% see their costs higher than a year ago. More are having difficulty with council rates and other regular commitments.

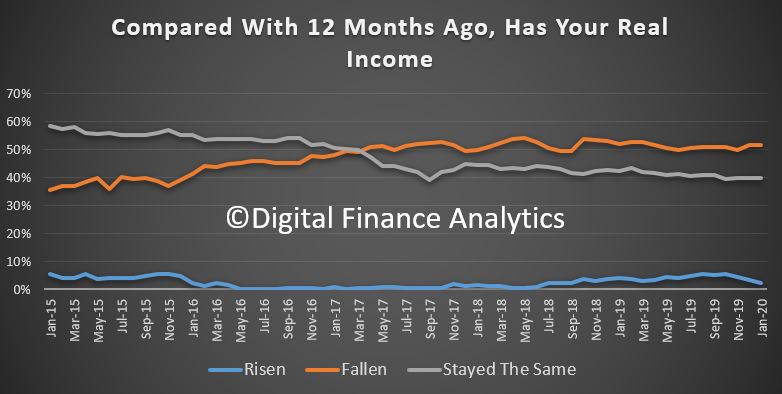

Income growth is muted at best, with 51% saying their income has been reduced in real terms over the past year, with both wages growth sluggish, and income from savings on deposits crashing as the cash rate is cut, and banks squeeze margin. Returns from share investments on the other hand are doing better. Those with spare income are preferring to pay debt down, rather than spend.

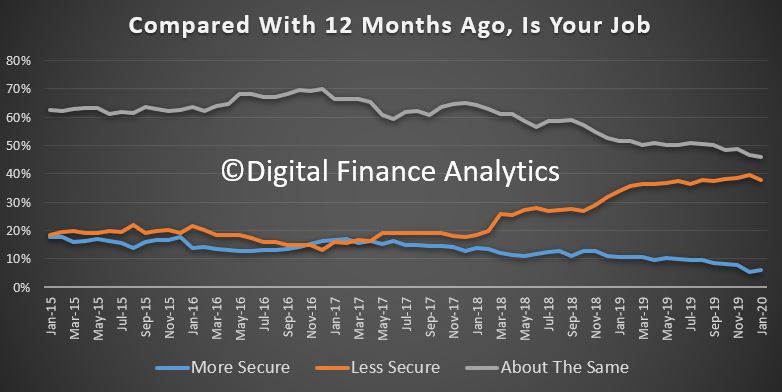

Job prospects are also sluggish, with just 6% feeling more secure than a year ago, while 38% are feeling less secure. We continue to see a pattern of multiple jobs, rising part-time jobs, less overtime and gig economy roles on the rise; all creating greater concerns about job security. Underemployment remains a critical issue for many.

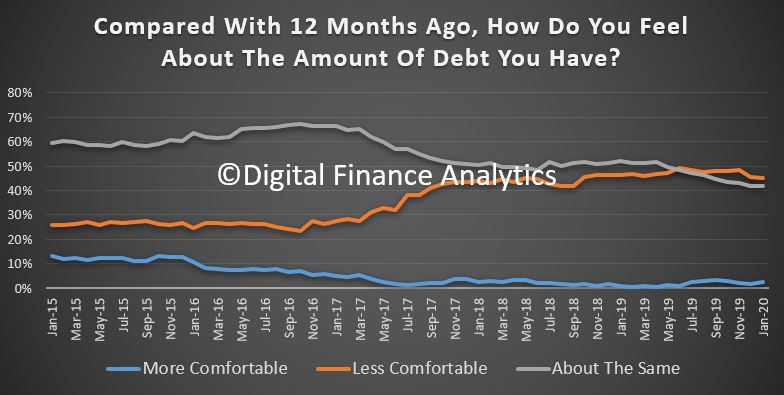

Turning to loan finances, some have been able to refinance to lower rate mortgages (and others appear to be missing the opportunity to switch and save), while some households are unable to transfer to a lower rate thanks to underwriting constraints. Households are able to grab a larger loan now lending standards have been loosened. Lower rates mean that 42% remain about the same with regards to confidence, while 45% are less comfortable than a year ago. We also note a rise in the use of unsecured debt, and buy-now pay-later (which will be the subject of an upcoming article based on new data we have captured). De-leveraging continues among those who can afford it.

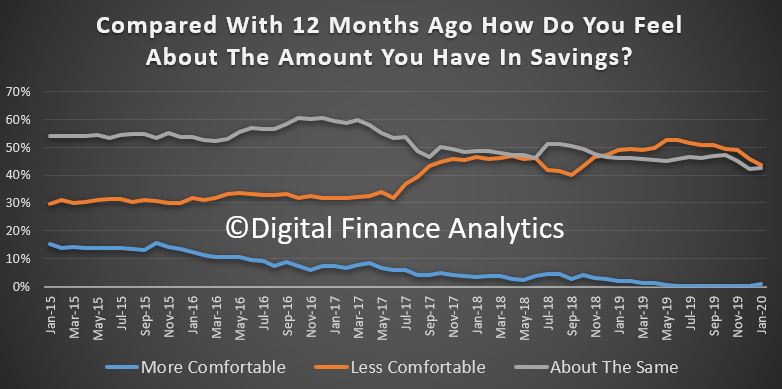

On the savings front, those with market investments continue to enjoy paper capital growth, while dividends remains relatively stable. But those with term deposits continue to see rate compression and there is a move from term accounts to call accounts as the margin between the two have fallen further. More than 3 million households rely on income from bank deposits, and the reduction in the returns from deposits is having a dramatic impact on many. That said, many households remain adamant that they do not want to take on more market risk, so reluctantly accept lower income – which in turn flows to lower spending. 43% feel less comfortable than a year ago. Many are dipping to savings, and using capital for living expenses, something which may not be sustainable.

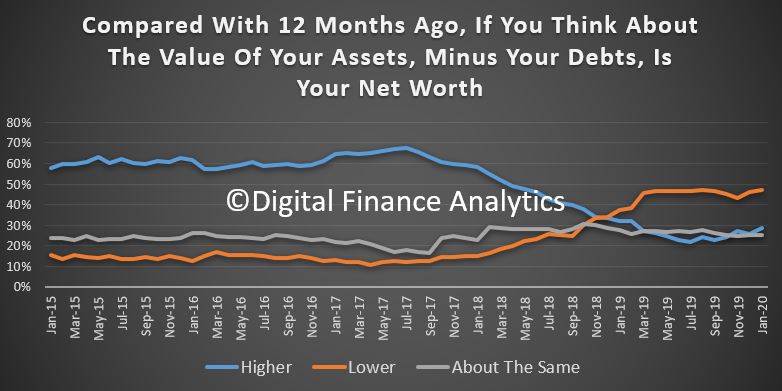

Finally, putting all this together we look at net worth – assets minus loans and other liabilities. The upturn in home prices reported in the media have flowed through to more expectations of growing wealth. 28% now have higher net worth than a year ago. That said 47% have lower net worth, thanks to rising expenses, and little in the way of savings. 24% reported no change. We note some significant differences between the more affluent segments and suburbs where net worth is rising (and supported by rising market investments) compared with regional areas and the urban fringe where there is no evidence of any wealth effect – so far. This is continue to dampen spending.

So, to conclude, we appear to have reached something of a floor in household financal confidence, but the journey back to more balanced settings will only be achieved once real incomes start to rise. Meantime the property recovering and wealth illusion may help a bit, but there is little here to suggest a rise in consumer spending. Many households are trapped in a high housing cost situation (either mortgage debt or rent) and with continued pressure in costs of living, the pressures will remain for some time to come.

The question is, what if anything might break the trend? Well income growth if it came, would assist on the upside, but then if growth stalls further thanks to the second order impacts from the virus, the confidence floor might just disappear. Households are in a finely balanced predicament.