The latest trade figures, RBA decision and market movements all signal important economic messages. We examine the data.

Mortgage Stress Strikes Higher Again

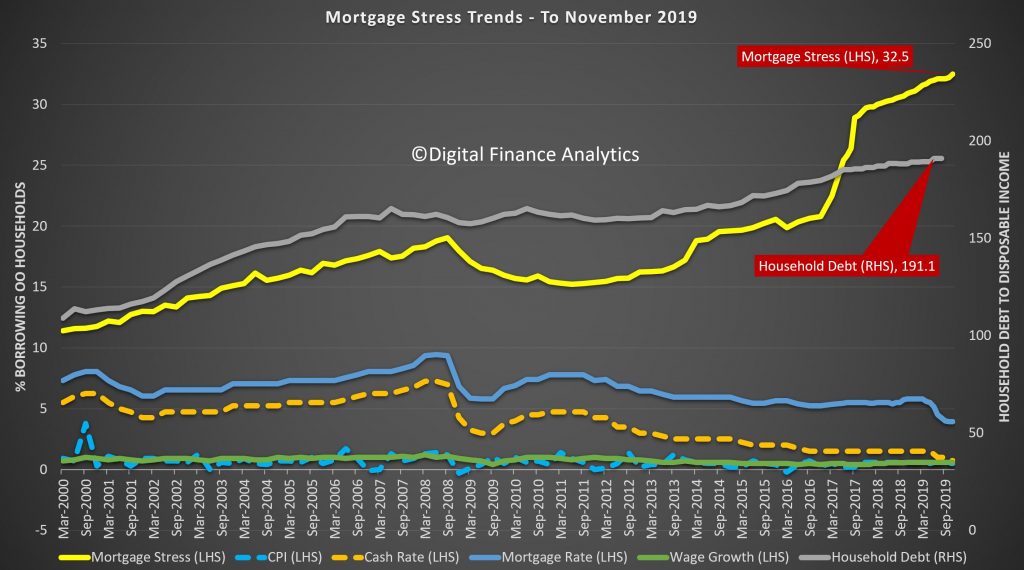

DFA has released our mortgage stress survey results to the end of November. And after a couple of months going sideways, thanks to some rate cuts and tax refunds, the trajectory has gone sharply higher again this month.

One factor which is now biting is the switch from interest only loan to principle and interest loan repayments, which has lifted average monthly repayments by more than 20% for some. In addition the underemployment and unemployment factors are playing in, as is the drought. In fact, the drought now appears to be right up there in terms of directly hitting regional unemployment as well as lifting food prices more generally. This all suggests that even more stress is baked in ahead.

The proportion of households now in mortgage stress, based on an assessment of their cash flow (money in, compared with money out, including mortgage repayments where appropriate), has now lifted to 32.5% of households.

This equates to 1,082,000 households, the highest ever measured in our surveys. Worse, more are slipping into risk of mortgage default, according to our forward modelling*. More are also in severe stress, reaching over 80,000 for the first time. These households are more likely to default ahead.

Household debt to income remains at an all-time high. In addition, more continue to raid deposits to make ends meet.

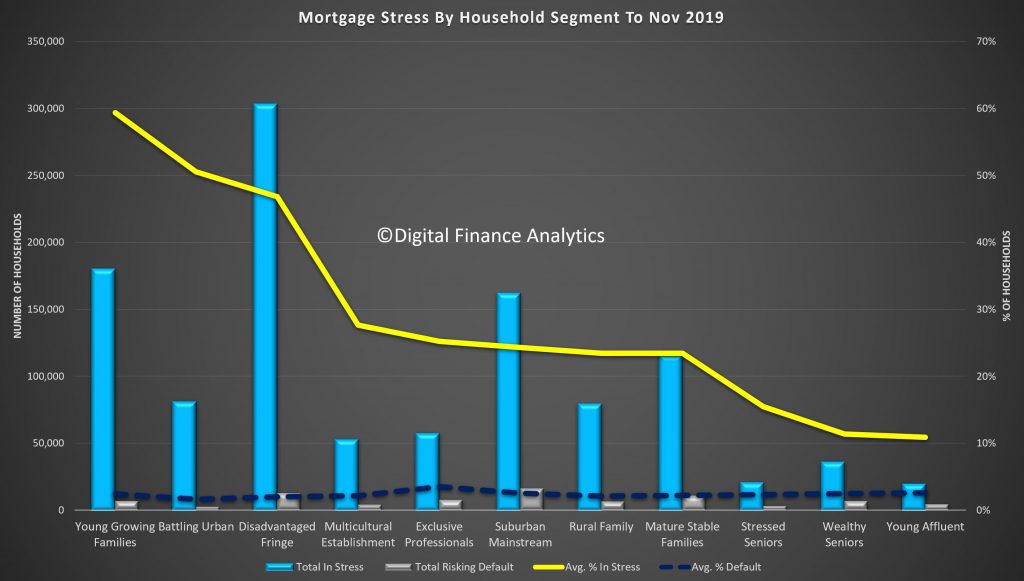

Across the DFA household segments we continue to see some variations between cohorts. Young Growing families have the highest stress, and many first time buyers are represented in this group. The largest counts are located on the urban fringe, and many of these households are living on newly build high density estates. However, stress continues to spill over into more affluent groups, and here the impact of the IO loan switch is quite strong. Some of these are living in the high rise sector, where construction issues are also biting.

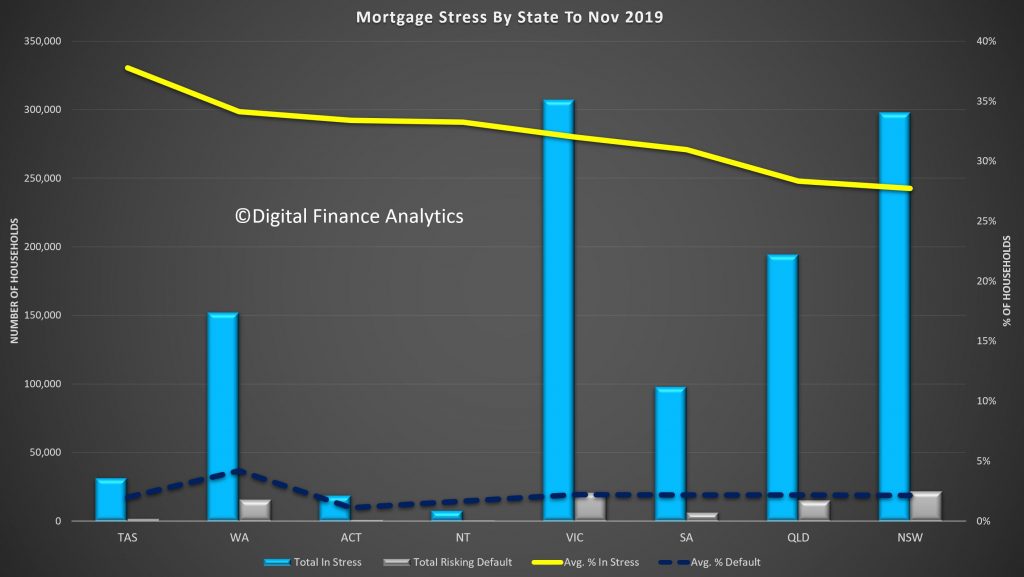

Across the states Tasmania has the highest proportion in stress, thanks to low wages, and recent price hikes, but the largest number of households in any one state is in Victoria. However, the default rates look to be rising faster in Sydney, where values are more extended relative to incomes.

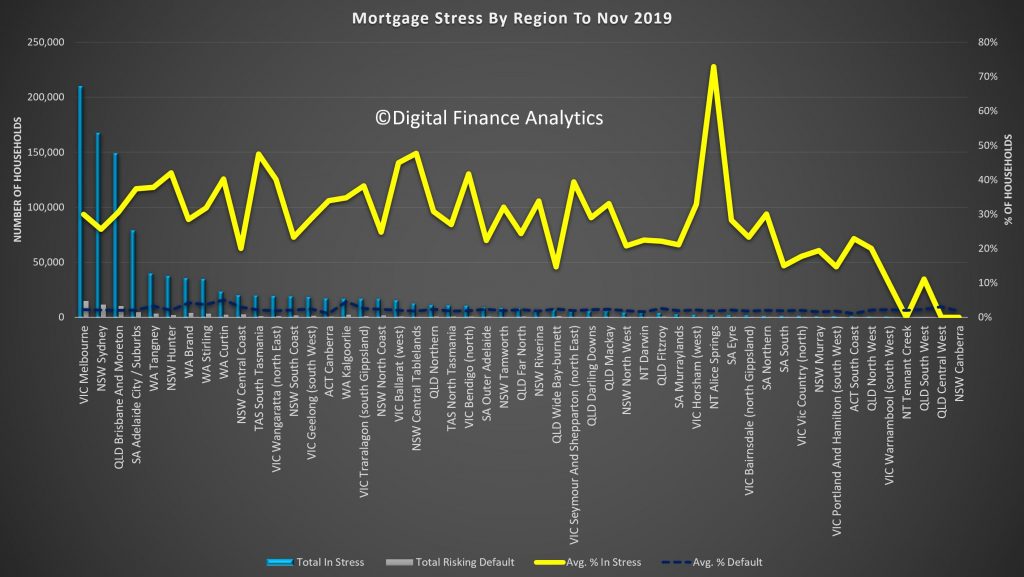

At a regional level, the largest counts are in the main urban centres of Melbourne and Sydney as expected, although stress is spilling out more widely into regional centres.

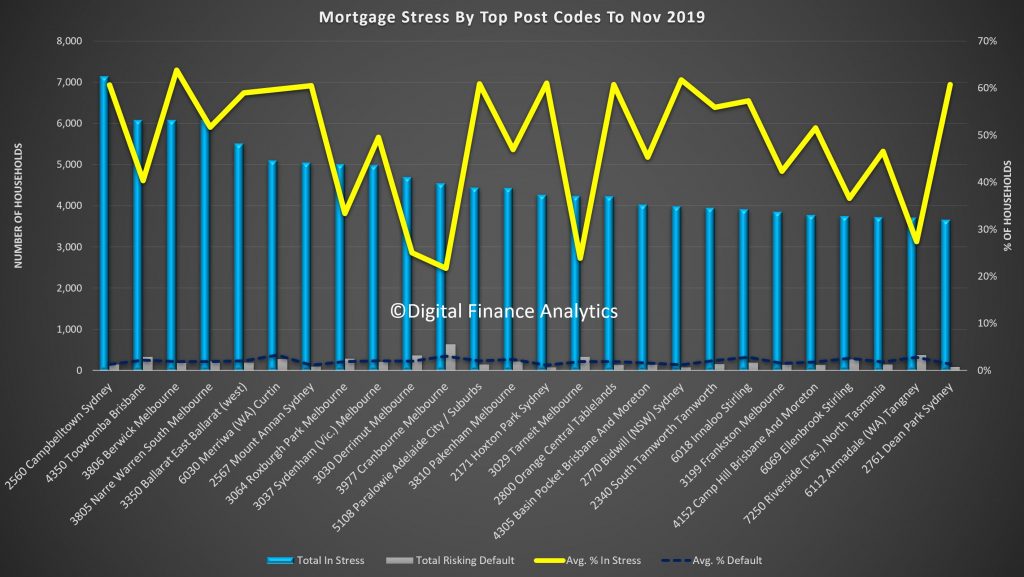

And our top post codes continues to centre in on the urban fringe, with Campbelltown, Toowoomba and areas around Melbourne including Berwick and Narre Warren all showing the largest counts of stressed households. Cranbourne 3977 has the highest count of potential defaults this month. Postcodes in WA are still under pressure as the economic grind continues.

*Note: last month we briefing misreported the household stress figure at 1.77 million not 1.07 million. This was corrected within a few moments of posting. You can see the previous post here.

Our surveys are based on a rolling 52.000 household sample, which equates to around 0.5% of households.

RBA Holds, For Now

As expected the RBA held the cash rate today, but still leaves the door open for cuts next year. Given the weaker economic data we are seeing, those further cuts are pretty much assured.

At its meeting today, the Board decided to leave the cash rate unchanged at 0.75 per cent.

The outlook for the global economy remains reasonable. While the risks are still tilted to the downside, some of these risks have lessened recently. The US–China trade and technology disputes continue to affect international trade flows and investment as businesses scale back spending plans because of the uncertainty. At the same time, in most advanced economies unemployment rates are low and wages growth has picked up, although inflation remains low. In China, the authorities have taken steps to support the economy while continuing to address risks in the financial system.

Interest rates are very low around the world and a number of central banks have eased monetary policy over recent months in response to the downside risks and subdued inflation. Expectations of further monetary easing have generally been scaled back. Financial market sentiment has continued to improve and long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are at historically low levels. The Australian dollar is at the lower end of its range over recent times.

After a soft patch in the second half of last year, the Australian economy appears to have reached a gentle turning point. The central scenario is for growth to pick up gradually to around 3 per cent in 2021. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, the upswing in housing prices and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending. Other sources of uncertainty include the effects of the drought and the evolution of the housing construction cycle.

The unemployment rate has been steady at around 5¼ per cent over recent months. It is expected to remain around this level for some time, before gradually declining to a little below 5 per cent in 2021. Wages growth is subdued and is expected to remain at around its current rate for some time yet. A further gradual lift in wages growth would be a welcome development and is needed for inflation to be sustainably within the 2–3 per cent target range. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation is expected to pick up, but to do so only gradually. In both headline and underlying terms, inflation is expected to be close to 2 per cent in 2020 and 2021.

There are further signs of a turnaround in established housing markets. This is especially so in Sydney and Melbourne, but prices in some other markets have also increased recently. In contrast, new dwelling activity is still declining and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The easing of monetary policy this year is supporting employment and income growth in Australia and a return of inflation to the medium-term target range. The lower cash rate has put downward pressure on the exchange rate, which is supporting activity across a range of industries. It has also boosted asset prices, which in time should lead to increased spending, including on residential construction. Lower mortgage rates are also boosting aggregate household disposable income, which, in time, will boost household spending.

Given these effects of lower interest rates and the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting while it continues to monitor developments, including in the labour market. The Board also agreed that due to both global and domestic factors, it was reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

Consumers Using Loyalty Schemes Are At Risk

Improvements to customer loyalty schemes and broader legislative reforms are required to protect consumers using loyalty schemes, according to the ACCC’s final report into customer loyalty schemes released today. There is an emerging risk of real consumer harm if individual consumers were to be charged inflated prices based on profiling derived from their data.

The report recommends loyalty schemes, such as frequent flyer, supermarket and hotel operators, better inform consumers, improve their data practices and stop automatically linking members’ payment cards to their loyalty scheme profiles. It also calls for broader changes to consumer and privacy law.

“We are calling on companies that offer loyalty schemes to improve both their data practices and how they communicate with consumers, to help consumers understand how these programs operate,” ACCC Chair Rod Sims said.

“Even simple changes, such as more prominently alerting customers that their points are about to expire, for example, in the subject line of an email, could help prevent a consumer from losing points earned over several years.”

The ACCC is also concerned that the profiling of consumers based on the data collected by some schemes, including through the sharing of consumer insights with third parties, could result in consumers receiving increasingly targeted advertising. This could also potentially result in different consumers being offered different prices for an identical product or service.

“Many consumers are increasingly concerned about receiving targeted advertising, in some cases from companies that they have never dealt with before,” Mr Sims said.

“There is also an emerging risk of real consumer harm if individual consumers were to be charged inflated prices based on profiling derived from their data. For example, if a person’s frequent flyer data or online search history indicates they can only travel on certain dates, or otherwise based on their income, geographic location or other information collected through the loyalty scheme they may be charged extra.”

Another major concern with loyalty schemes are privacy policies that are very vague and seek broad consents and discretions from consumers about how they’re going to collect, use and disclose their data.

“Many consumers would be shocked to find that some supermarket schemes continue to collect their customers’ data at the checkout even when they do not present their loyalty cards. They do this by tracking customers’ credit or debit cards from previous transactions,” Mr Sims said.

“When a customer chooses not to present their loyalty card, we think it is reasonable that they would not expect their data to be collected for that transaction, and we are therefore calling on the relevant schemes to stop this practice.”

While some loyalty scheme operators made changes after the ACCC commenced its review and released its draft report, the ACCC remains concerned about certain practices that a number of loyalty schemes continue to engage in.

The ACCC’s report reinforces recommendations from its Digital Platforms Inquiry Final Report regarding privacy and consumer law.

”We also recommend that unfair contract terms be prohibited, rather than simply being voidable, and that a new law against certain unfair trading practices be considered,” Mr Sims said.

“Our recommendations would protect consumers and help ensure consumer trust in loyalty schemes, in the digital economy and in data-based innovation, which is a benefit for the broader economy.”

Tips for consumers about loyalty schemes are at Customer loyalty schemes.

The ACCC encourages consumers to report concerns regarding the practices of their loyalty schemes.

Background

The ACCC commenced its review of customer loyalty schemes in early 2019 after competition and consumer issues arising from customer loyalty schemes were announced as a 2019 priority.

The ACCC and the various state and territory Australian Consumer Law (ACL) regulators received about 2000 reports about loyalty schemes in the five years to December 2018.

The ACCC’s final report was based on analysis of information voluntarily provided by loyalty program providers and consumers, research, and consultation and written submissions in response to the draft report released on 5 September 2019.

More information about the project is available at Customer loyalty schemes review.

Dwelling Approvals Down – Another Nail?

The ABS data out today was weak, and a further signal of economic decline.

Who’s Moved The Fridge?

A Bill was introduced into Parliament today to enforce independent audits of our major banks. We discuss this important step in the transformation of banking in Australia.

The Long And The Short Of It…

An important discussion about the long, medium and short term economic trends, and how this impacts investment strategy, with Nucleus Wealth‘ s Damien Klassen.

Damien runs the investment side of Nucleus, selecting stocks suggested by analysts and implementing the asset allocation.

Note: DFA has no business or financial relationship with Nucleus Wealth.

Caveat Emptor! Note: this is NOT financial or property advice!! Please note the disclaimer in the show.

Dwelling Approvals Fall Again In October

Data from the ABS today shows that the number of dwellings approved fell 0.8 per cent in October 2019, in trend terms, and has fallen for 23 months. Private dwellings excluding houses also fell, by 0.5 per cent.

The seasonally adjusted estimate for total dwellings approved fell 8.1 per cent in October, driven by a 11.3 per cent decrease in private dwellings excluding houses. Private sector houses fell 7.0 per cent.

The value of total building approved fell 0.7 per cent in October, in trend terms, and has fallen for two months. The value of residential building fell 1.2 per cent, while non-residential building fell 0.2 per cent.

Number of total dwelling units

The trend estimate for Australia fell 0.8% in October.

Number of private sector houses

The trend estimate for private sector houses approved fell 0.9% in October.

Number of private sector dwellings excluding houses

The trend estimate for private sector dwelling units excluding houses fell 0.5% in October.

Value of new residential building

The trend estimate for the value of new residential building approved fell 1.3% in October and has fallen for eight months.

Value of alterations and additions to residential building

The trend estimate for the value of alterations and additions to residential building fell 0.1% in October and has fallen for seven months.

Value of non-residential building

The trend estimate for the value of non-residential building approved fell 0.2% in October after rising for 14 months.

Across the states and territories, dwelling approvals fell in the Northern Territory (11.1 per cent), New South Wales (4.6 per cent), Queensland (1.4 per cent), and Western Australia (1.0 per cent). Tasmania (4.5 per cent), South Australia (3.1 per cent), Australian Capital Territory (3.1 per cent), and Victoria (1.3 per cent) recorded increases, in trend terms.

Approvals for private sector houses fell in New South Wales (2.3 per cent), Victoria (1.7 per cent), Western Australia (0.2 per cent), and Queensland (0.1 per cent). South Australia rose 2.0 per cent, in trend terms.

New South Wales

The trend estimate for total number of dwelling units approved in New South Wales fell 4.6% in October. The trend estimate for the number of private sector houses fell 2.3% in October.

Victoria

The trend estimate for total number of dwelling units approved in Victoria rose 1.3% in October. The trend estimate for the number of private sector houses fell 1.7% in October.

Queensland

The trend estimate for total number of dwelling units approved in Queensland fell 1.4% in October. The trend estimate for the number of private sector houses fell 0.1% in October.

South Australia

The trend estimate for total number of dwelling units approved in South Australia rose 3.1% in October. The trend estimate for the number of private sector houses rose 2.0% in October.

Western Australia

The trend estimate for total number of dwelling units approved in Western Australia fell 1.0% in October. The trend estimate for the number of private sector houses fell 0.2% in October.

Central Banks Under The Microscope

Who owns central banks, and how accountable are they? We start a series looking at these important questions.

Hopes And Fears – The Property Imperative Weekly 30th Nov 2019

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents

00:20 Introduction

00:55 US Markets

01:30 Trade Talks

05:15 Japan

05:55 Eurozone

06:20 Germany

07:10 UK

08:25 China

10:40 Australian Section

10:40 Westpac

13:30 Westpac NZ

14:30 Home Sales (HIA)

15:40 Net Government Debt

18:25 RBA on QE and Wages

19:00 Property prices and auctions

20:50 Markets