In the latest in our occasional series on digitally disruptive innovators, we look at Tradeplus24.

Note DFA is not paid for this article. Our sole focus is to share insights into the disruption which is occurring across the Finance Sector. Trade Receivables in no exception.

I caught up with ex-Nab exec Adam Lane, Managing Director of Tradeplus24 Australia, who is leading the charge into Australia of the Credit Suisse-backed alternative lending start-up. Headquartered in Switzerland, this is a first step in its international expansion plans after raising 120 million Swiss francs (AUD173.6 million) in debt and equity in February. Tradeplus24 was founded in 2016.

(Left To Right Kelvin Rossely, CRO, Adam Lane MD Australia)

Adam explained that Australia was an excellent jumping-off point because it parallels British regulation, and the necessary data is available, thanks to the early adoption of cloud-based accounting services here. There is a clear need to offer credit to the SME sector, and he believes the regulatory and political environment is right to launch. The fact that commercial brokers already operate here, and Adam’s experience via NAB completed the deal.

The start-up will target SME’s with a turnover of $3-50 million annually, and a flow of account receivables. They will offer variable credit lines range between $500,000 and $10 million.

We know from our DFA SME surveys that many businesses are finding it too difficult to get finance to support their business, and often a bank will require property as collateral which means firms are locked into relationships which are far from perfect. In addition, traditional lenders are struggling to structure cash-flow finance smaller than $5 million, and alternative lenders typically not providing loans above $250,000, so there is a niche to exploit.

Tradeplus24 does not require property as collateral, rather it collateralises the trade receivables, and relies on its digital platform to asses new business and manage existing firms. Thus, while its credit limits may be comparative with significant lenders like Scottish Pacific, Tradeplus24’s automated credit technology assesses SME supply chain data and calculates risk down to individual invoices in real time, making it as fast, agile, and accurate as tech-based alternative lenders.

They are targeting sectors including manufacturing and supply chain, labour hire, etc, any with a large receivables book. They are avoiding the construction sector.

Facilities are offered on a 12-month term, but experience shows that typically firms require help over 3-5 years to take their business to the next level. An application fee is charged at 1% of the facility and 1% ongoing fee annually, and the typical interest rate is in the range of 7-9%. They structure transactions by harnessing insurance to underwrite the account receivables of SME’s, which removes risk for funders and enables Tradeplus24 to offer more competitive rates.

It is a digital play. This is unlike other players who generally handle paper-based information, and run a “shadow” ledger for customers, requiring more time and effort to maintain and manage. One reason why Trade24Plus is so named.

Adam said

“We’ve enjoyed immense and rapid success in our home market of Switzerland in just two years of operations, including attracting investment from the likes of Credit Suisse, SIX Group, and Berliner Volksbank, but we always had global expansion in mind when we developed the business,” said Adam Lane, Managing Director of Tradeplus24 Australia.

“We believe several characteristics of the Australian business lending market and wider economy make our offering uniquely well-positioned for success in this market.

“Lack of competition in Australia not only reduces the need for banks and larger lenders to innovate, but also means they’re free to release capital largely under their own terms. To this end, banks regularly take a charge over an entire business and also secure the loan against the owner’s personal property assets. They also struggle to lend without property as security, which is a major factor contributing to the current shortage of capital for Australian SMEs.

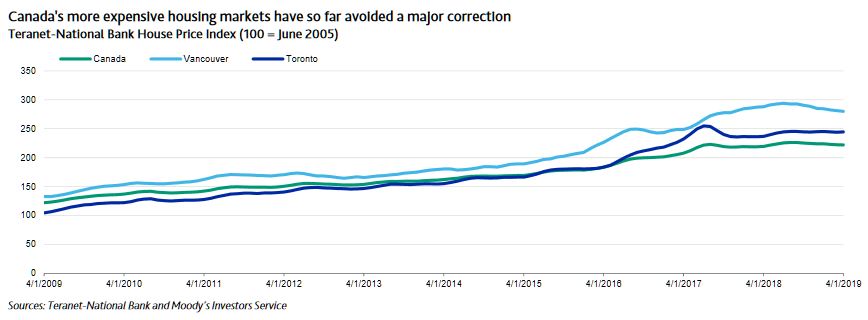

“Secondly, Australia’s weakening housing market is also compounding the inability of business owners to secure funding by offering property as collateral for further borrowing, with many ‘running out’ of adequate security to offer.

“Finally, the Banking Royal Commission has put everyone on notice when it comes to credit; there is simply less of it flowing through the economy as a whole. These factors combined create an urgent need for more innovative business credit solutions which don’t require a borrower to put up property assets as collateral.”

Tradeplus24 is currently in the advanced stages of negotiating a nine-figure debt facility and is exciting about making a difference by enabling many Australian SMEs to reach their growth potential.

They are in the throes of testing and expect to be in operation by early July 2019.

To me this is a classic demonstration of how smart digital disruption can really make a difference to businesses. Such innovation should be welcomed.