The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Switzer and Keen: https://youtu.be/uU2jwUihIcs

"Intelligent Insight"

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Switzer and Keen: https://youtu.be/uU2jwUihIcs

I review the final Senate report into Banking Separation with Robbie Barwick from the CEC.

The RBA released their quarterly Statement On Monetary Policy today. Expect rate cuts, and QE later as the AUD is allowed to slide, as a decade of wrong policy is now coming home to roost. Plus they are tracking the labour market as a key determinate of policy using the wobbly ABS series data, looking past weaker inflation, and hoping for wages growth.

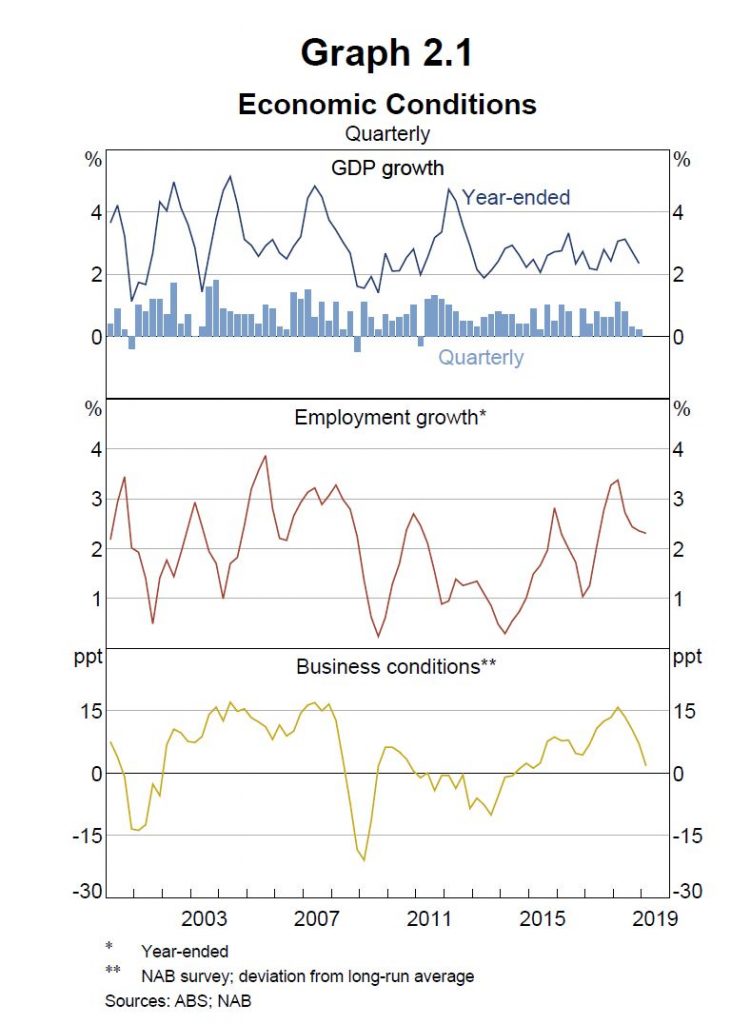

Growth in the Australian economy has slowed and inflation remains low. Subdued growth in household income and the adjustment in the housing market are affecting consumer spending and residential construction. Despite this, the labour market is performing reasonably well, with the unemployment rate steady at around 5 per cent. Underlying inflation has been lower than expected, at 1½ per cent over the year to the March quarter, with pricing pressures subdued across much of the economy.

GDP growth is expected to be around 2¾ per cent over both 2019 and 2020. This is lower than previously forecast, reflecting the revised outlook for household consumption spending and dwelling activity. Stronger growth in exports and, further out, work on new mining investment projects are expected to support growth. Forecasts for inflation have also been revised lower. Trimmed mean inflation is expected to be around 1¾ per cent over 2019 and then increase gradually to 2 per cent in 2020 and a touch above 2 per cent by early

In the near term, CPI inflation is expected to run a little above the rate for trimmed mean inflation, driven by the recent increase in petrol prices.

The Australian dollar is currently around the low end of the narrow range it has been in for some years. Sovereign bond rates in Australia have continued to decline relative to those in the major economies. This has tended to counteract the upward pressure on the exchange rate that would otherwise have come from rising prices for Australia’s key commodity exports.

Conditions in the established housing market remain soft. Housing prices have continued to decline in the largest cities, although the pace of decline has eased a bit recently. Some other indicators, including auction clearance rates, have improved a little since the end of last year, but generally point to continued soft conditions. Prices have also been declining in many other cities and regional areas.

Despite strong employment growth and some recovery in growth of average hourly earnings, growth in household income was very low over Non-labour sources of income have been subdued and are likely to remain so for a while, given the effects of the drought on farm incomes and of soft housing market conditions on the earnings of many other unincorporated businesses. Strong growth in tax payments has also subtracted from disposable income growth over recent years.

Weak growth in household income poses a key risk to the outlook for household consumption, especially in the context of falling housing prices and the need for many households to service high levels of debt. Some recovery in income growth is likely, because employment growth is expected to remain solid, wages are expected to increase and the tax offset for low and middle-income taxpayers is set to come into effect in the second half of this year.

At its recent meeting, the Board focused on the implications of the low inflation outcomes for the economic outlook. It concluded that the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable while also having inflation consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labour market at its upcoming meetings.

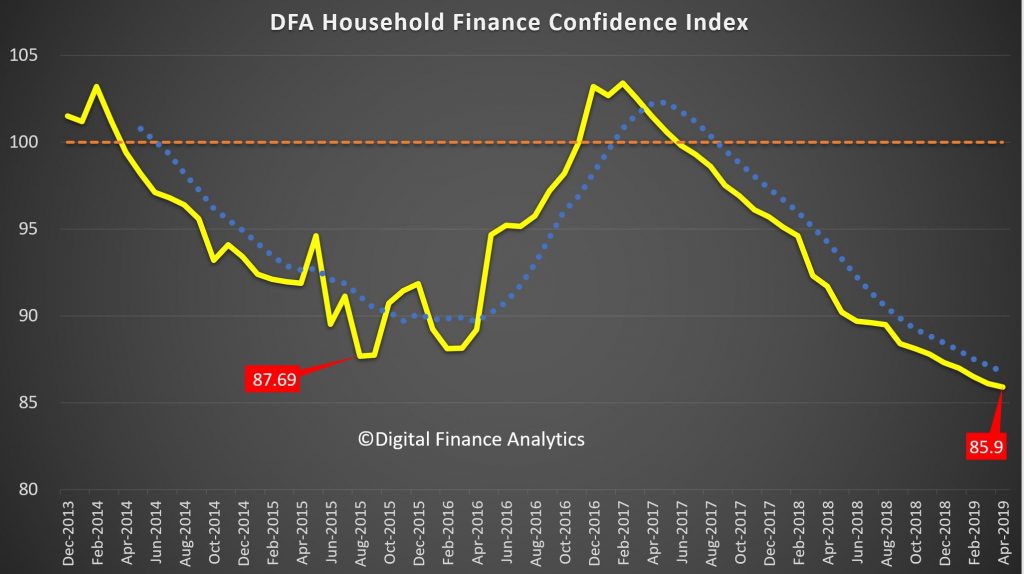

We have released the April 2019 edition of our confidence index, based on our rolling 52,000 household survey. The index fell again, to an all time low.

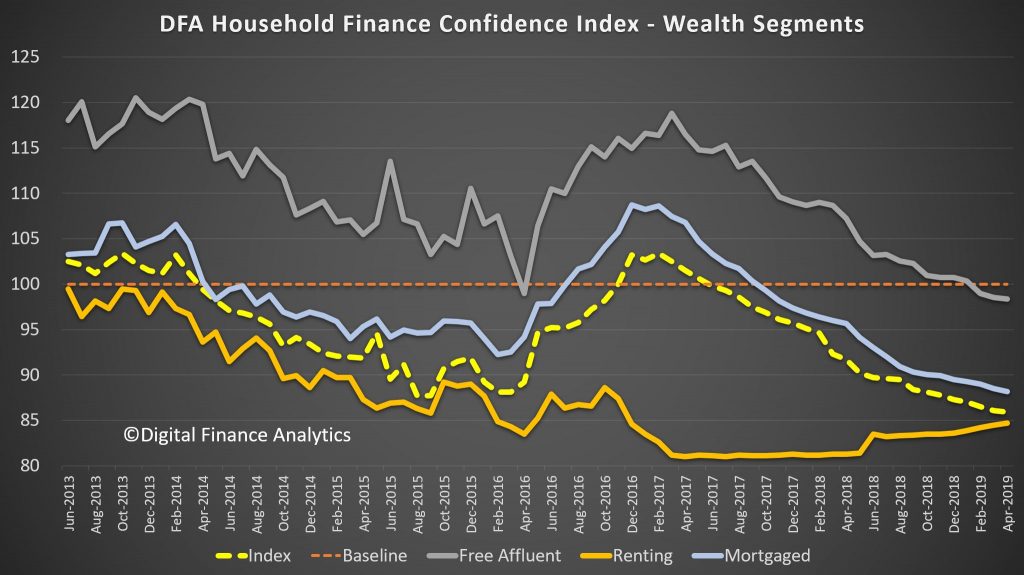

All wealth segments declined (even those without a mortgage), but those leveraged up are really concerned now.

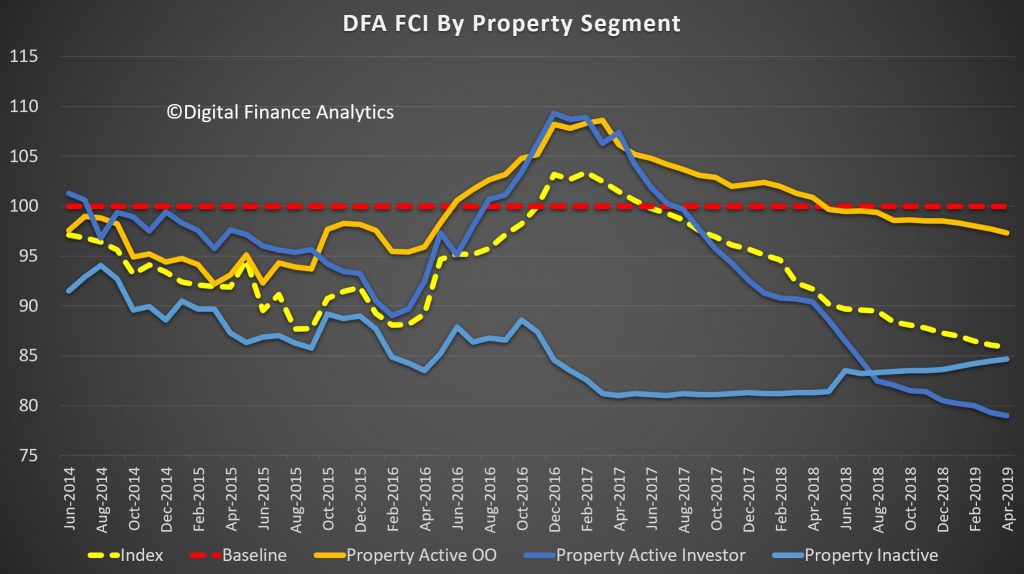

Property Investors continue to take a bath, thanks to lower capital values, falling rental returns, switching from interest only to principal and interest, and fears about negative gearing changes.

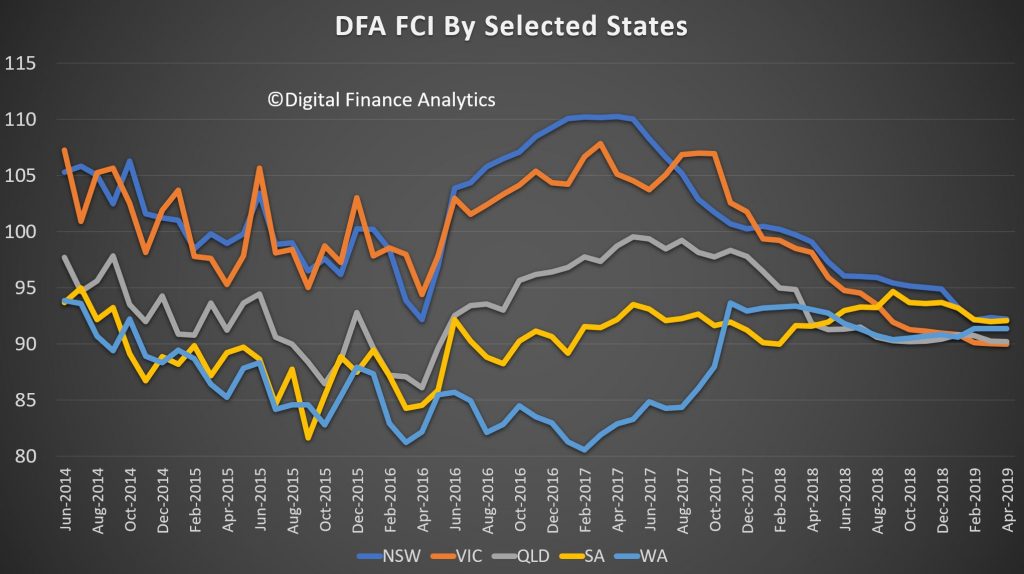

The selected states continue to converge.

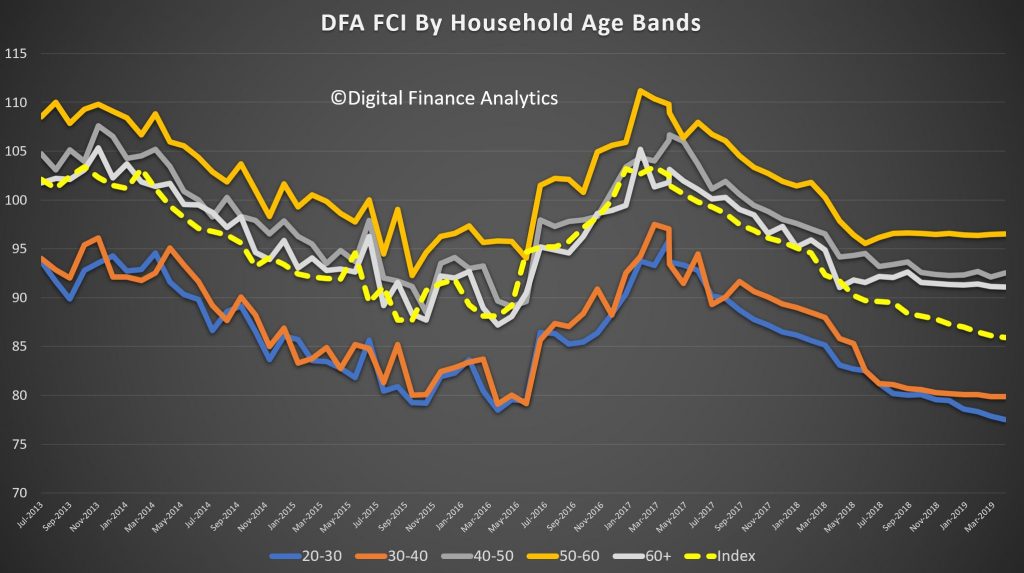

Younger households are the most concerned. Older, less leveraged households are more positive relatively, but still below long term averages.

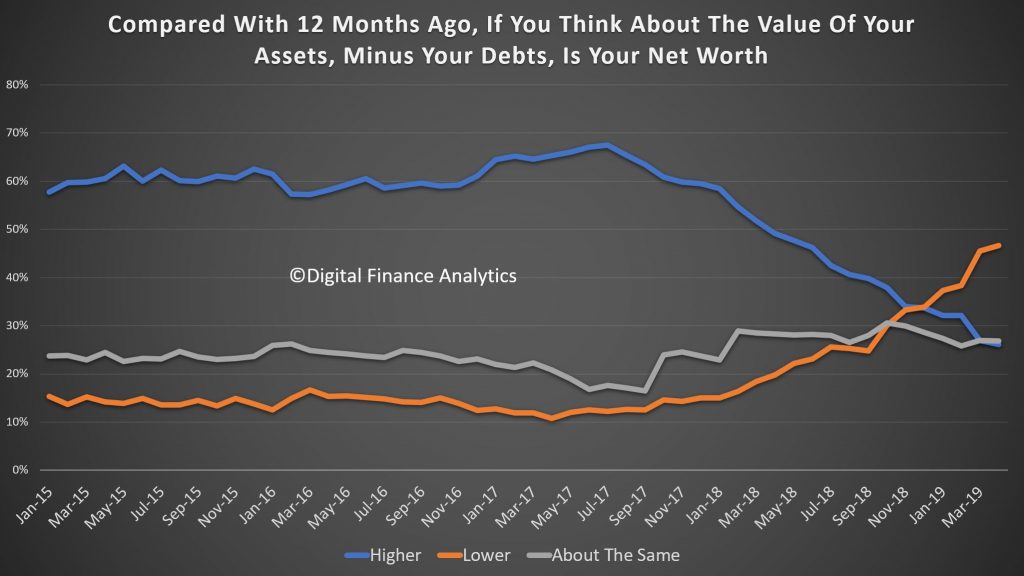

In the video we look at the various drivers to the index, but the conclusion is that more households are seeing their net worth declining. Much of this is thanks to property values continuing to fall.

Regretfully, I cannot see anything on the horizon to change this trajectory. So expect more falls ahead!

I discuss MMT (Modern Monetary Theory) with Steven Hail from the University of Adelaide, who makes the case for a different way to think about public debt, and the potential benefits of running a (controlled) deficit.

Hybrid real estate agency Purplebricks has announced its exit from Australia after two and a half years of trading, citing “challenging” market conditions and “execution errors” as the reasons for its decision. Via The Real Estate Conversation.

In a statement released on the London Stock Exchange, the Group said the Australian business had “not delivered the progress the Board expected”, and had subsequently “been put into an orderly run down with immediate effect, pending closure.”

Purplebricks Group CEO Vic Darvey described it as a “difficult decision”.

“We’ve been operating here for two and half years and, unfortunately, we have been unable to make the progress in the Australian market that we’ve wanted, despite the tireless efforts of our employees,” he said.

“Our present intention is that, over the next few months, we manage the process of closing down the Australian business in an orderly way, attempting to minimise disruption for both our people and our customers.

“We will take no further listings in Australia, but intend to engage with our customers to finalise all existing agreements.

“This is not a decision we have taken lightly, but with market conditions becoming increasingly challenging, we do not believe that the prospective returns in Australia are enough to justify continued investment.

“The business remains committed to our current customers.”

Purplebricks’ exit from Australia is a “win for consumers of professional real estate services”, according to Real Estate Insitute of Australia Deputy President Hayden Groves.

The hybrid real estate agency announced it was leaving Australia on Tuesday, having “not made the progress the board expected” in the country.

While Mr Groves sympathised with those who had “been duped”, he said the news was not surprising.

“Purplebricks agents were encouraged were incentivised to list, with little interest in the outcome for the client,” he said.

“This was always going to prove an unsustainable model given PB’s claims of being ‘proper agents’ and their employees needing to list dozens of properties each year to barely make a living.

“Purplebricks was essentially a private seller platform pretending to be real estate agents.”

It’s not the first time the Dethridge Groves Director has been critical of the Purplebricks sales model.

In September last year, he said the agency was blurring the lines “between the offering they are providing the community and what a proper professional agent does” after it unveiled a new service involving an all-inclusive fee of $8,800 including GST when selling with the company.

Mr Groves also accused the agency of misleading the public with advertisements which read “they’re real people, they’re proper real estate agents”.

“We contend that it’s entirely appropriate that if an agent fails to complete the job they’re employed to do,(to successfully negotiate the sale of the vendor’s property), then they shouldn’t be paid,” he said in June 2018.

“This is a fundamental principle of an agents’ fiduciary responsibility at common law and by statute.”

The Official Cash Rate (OCR) has been reduced to 1.5 percent. They signalled risks from China and Australia, and that lower mortgage rates might help household finances and housing.

The Monetary Policy Committee decided a lower OCR is necessary to support the outlook for employment and inflation consistent with its policy remit.

Global economic growth has slowed since mid-2018, easing demand for New Zealand’s goods and services. This lower global growth has prompted foreign central banks to ease their monetary policy stances, supporting growth prospects.

However, there is uncertainty about the global economic outlook. Trade concerns remain, while some other indicators suggest trading-partner growth is stabilising.

Domestic growth slowed from the second half of 2018. Reduced population growth through lower net immigration, and continuing house price softness in some areas, has tempered the growth in household spending. Ongoing low business sentiment, tighter profit margins, and competition for resources has restrained investment.

Employment is near its maximum sustainable level. However, the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly in 2019. Consequently, inflationary pressure is projected to rise only slowly.

Given this employment and inflation outlook, a lower OCR now is most consistent with achieving our objectives and provides a more balanced outlook for interest rates.

Summary record of meeting – May 2019 Statement

The Monetary Policy Committee agreed on the economic projections outlined in the May 2019 Statement in order to provide a sound basis on which to form its OCR decision.

The Committee noted that inflation is currently slightly below the mid-point of the inflation target, and that employment is broadly at the targeted maximum sustainable level. However, the members agreed that given the recent weaker domestic spending, and projected ongoing growth and employment headwinds, there was a need for further monetary stimulus to meet its objectives.

The Committee agreed that the risks to achieving its consumer price inflation and maximum sustainable employment objectives were broadly balanced around the projection. Possible alternative outcomes were noted on the upside and downside.

A key downside risk relating to the growth projections was a larger than anticipated slowdown in global economic growth, particularly in China and Australia, New Zealand’s largest trading partners. The Committee agreed that the projections adequately captured the observed global slowdown and its impact on domestic employment and inflation.

The Committee noted that additional stimulus from central banks had underpinned growth and reduced the likelihood of a more-pronounced slowdown. With some indicators of global growth improving in recent months, a faster recovery in global growth was possible. However, on balance, the Committee was more concerned about a continued slowdown rather than a faster recovery.

The Committee discussed other potential risks to domestic spending. The members acknowledged the importance of additional spending from households, businesses, and the government, to meet their inflation and employment targets. However, they noted several important uncertainties.

The Committee noted upside and downside risks to the investment outlook. Capacity pressure could see investment increase faster than assumed. On the downside, if sentiment remained low as profitability remains squeezed, investment might not increase as anticipated over the medium term. It was also noted that firms’ ability to invest is constrained by the current competition for resources.

A potential source of additional demand discussed by the Committee included government spending being higher than currently projected, in view of the current strength of the Crown balance sheet. This view was balanced by the impact of any increase in government investment being delayed, for example due to timing of the implementation of new initiatives and current capacity constraints in the construction sector. The implications for monetary policy remain to be seen.

Some members noted that with lower mortgage rates and easing of loan-to-value requirements, any possible pick-up in the housing market could support household spending growth more than anticipated.

The Committee noted that employment is currently near its maximum sustainable level. However, it was agreed that the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly in 2019.

The Committee agreed that overall risks to the inflation projection were balanced. The Committee noted the outlook for inflation is below the target mid-point for longer than projected in the February Statement.

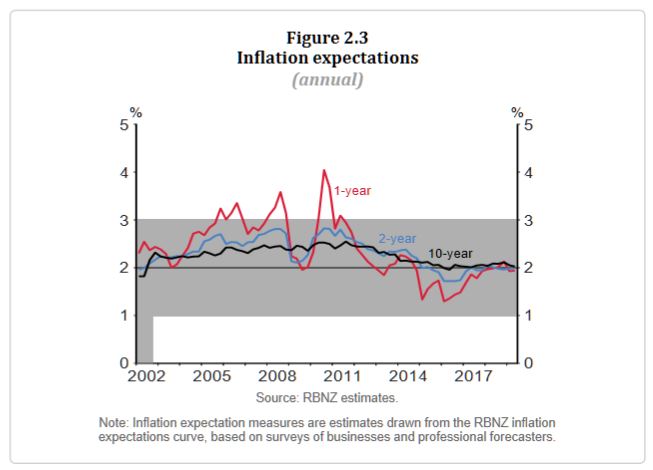

The recent period of rising domestic inflation was discussed. The Committee noted that the near-term outlook was more subdued due to lower capacity pressure. It was also noted that cost pressures remain elevated, and that there is a risk firms may pass these costs on as higher consumer prices by more than assumed. However, it was agreed that inflation expectations remain well anchored at the mid-point of the target range.

The Committee also noted the relatively subdued private sector wage growth, despite businesses suggesting that the inability to find labour is a significant constraint on their growth. The Committee noted the limited pass-through of the nominal wage growth to consumer price inflation.

Some members noted slower global growth reducing imported inflation was a downside risk to the inflation outlook.

The Committee reached a consensus that, relative to the February Statement, a lower path for the OCR over the projection period was appropriate. The lower path reflected the economic projections and the balance of risks discussed, and is consistent with both inflation and employment remaining near the Committee’s objectives.

After discussing the relative benefits of holding the OCR and committing to a downward bias, versus cutting the OCR now so as to establish a more balanced outlook for interest rates, the Committee reached a consensus to cut the OCR to 1.50 percent.

Economist John Adams visited the Melbourne suburb of DonnyBrook (3064), and sees parallels to Ireland before the great crash.

We discuss the implications.

We review today’s economic news, the RBA decision, and the current state of household finances via our mortgage stress report.

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. They reinforced the labour market as the key to future rate moves, looking past lower inflation. That is a pretty strong signal about what would lead to a cut. They are still reciting stronger growth than many believe is feasible.

Franking, cutting now would be using using up the limited ammo they have, for no good reason. Savers will be relieved!

The outlook for the global economy remains reasonable, although the risks are tilted to the downside. Growth in international trade has declined and investment intentions have softened in a number of countries. In China, the authorities have taken steps to support the economy, while addressing risks in the financial system. In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up.

Global financial conditions remain accommodative. Long-term bond yields are low, consistent with the subdued outlook for inflation, and equity markets have strengthened. Risk premiums also remain low. In Australia, long-term bond yields are at historically low levels and short-term bank funding costs have declined further. Some lending rates have declined recently, although the average mortgage rate paid is unchanged. The Australian dollar is at the low end of its narrow range of recent times.

The central scenario is for the Australian economy to grow by around 2¾ per cent in 2019 and 2020. This outlook is supported by increased investment in infrastructure and a pick-up in activity in the resources sector, partly in response to an increase in the prices of Australia’s exports. The main domestic uncertainty continues to be the outlook for household consumption, which is being affected by a protracted period of low income growth and declining housing prices. Some pick-up in growth in household disposable income is expected and this should support consumption.

The Australian labour market remains strong. There has been a significant increase in employment, the vacancy rate remains high and there are reports of skills shortages in some areas. Despite these positive developments, there has been little further progress in reducing unemployment over the past six months. The unemployment rate has been broadly steady at around 5 per cent over this time and is expected to remain around this level over the next year or so, before declining a little to 4¾ per cent in 2021. The strong employment growth over the past year or so has led to some pick-up in wages growth, which is a welcome development. Some further lift in wages growth is expected, although this is likely to be a gradual process.

The adjustment in established housing markets is continuing, after the earlier large run-up in prices in some cities. Conditions remain soft and rent inflation remains low. Credit conditions for some borrowers have tightened over the past year or so. At the same time, the demand for credit by investors in the housing market has slowed noticeably as the dynamics of the housing market have changed. Growth in credit extended to owner-occupiers has eased over the past year. Mortgage rates remain low and there is strong competition for borrowers of high credit quality.

The inflation data for the March quarter were noticeably lower than expected and suggest subdued inflationary pressures across much of the economy. Over the year, inflation was 1.3 per cent and, in underlying terms, was 1.6 per cent. Lower housing-related costs and a range of policy decisions affecting administered prices both contributed to this outcome. Looking forward, inflation is expected to pick up, but to do so only gradually. The central scenario is for underlying inflation to be 1¾ per cent this year, 2 per cent in 2020 and a little higher after that. In headline terms, inflation is expected to be around 2 per cent this year, boosted by the recent increase in petrol prices.

The Board judged that it was appropriate to hold the stance of policy unchanged at this meeting. In doing so, it recognised that there was still spare capacity in the economy and that a further improvement in the labour market was likely to be needed for inflation to be consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labour market at its upcoming meetings.