The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Non Banks Bloom As Credit Impulse Slows Again

The February data from APRA for ADI’s and the credit aggregates from the RBA were released today. The headline news is the rate of housing credit growth continued to slow.

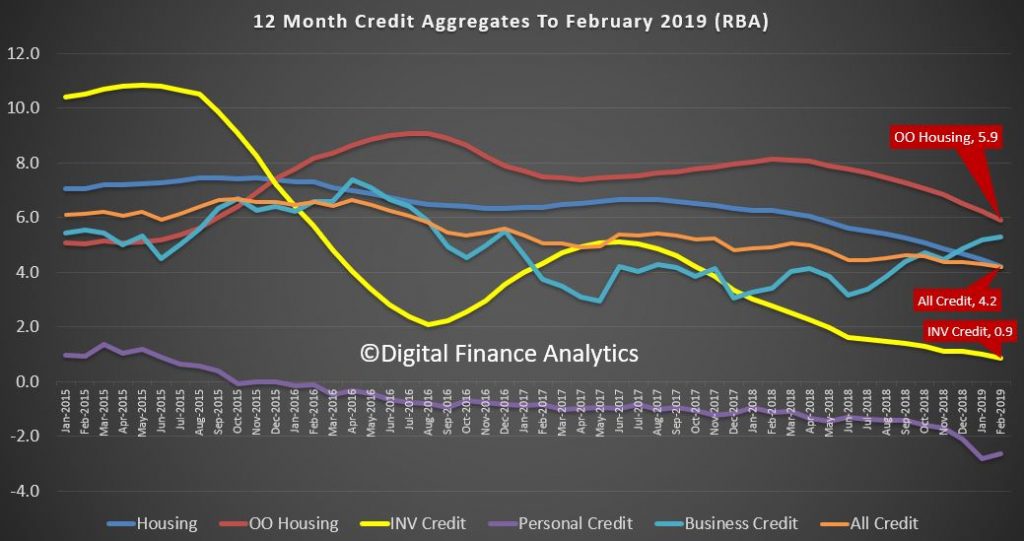

This is quite starkly shown in the RBA’s 12 month series, with total credit annualised growth now standing at 4.2%. Housing credit also fell to the same 4.2% level, from 4.4% a month ago. The fall continues. Within the housing series, lending for owner occupation fell below 6% – down to 5.9% and investment housing lending fell to 0.9% annualised.

The seasonally adjusted RBA data showed that last month total credit for housing grew by 0.31%, up $5.6 billion to $1.81 trillion, another record. Within in that owner occupied lending stock rose 0.42%, seasonally adjusted to $1.22 trillion, up $5.11 billion. Lending for investment property rose 0.09%, or $0.5 billion to $595 billion. Personal credit fell slightly, down 0.07% and business credit rose 0.42% to $960 billion, up $4.06 billion.

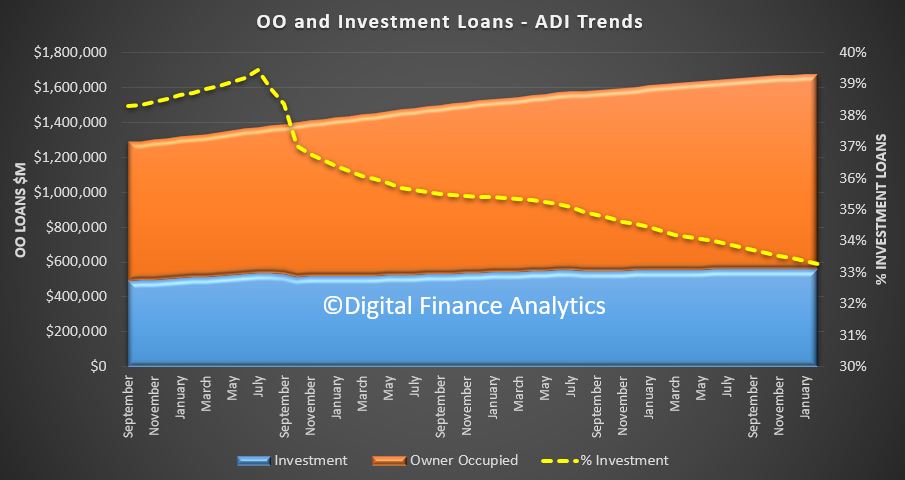

The APRA data revealed that ADI growth was lower than the RBA aggregates. Some of this relates to seasonal adjustments plus, as we will see a rise in non-bank lending. The proportion of investment loans less again to 33.3% of loans outstanding.

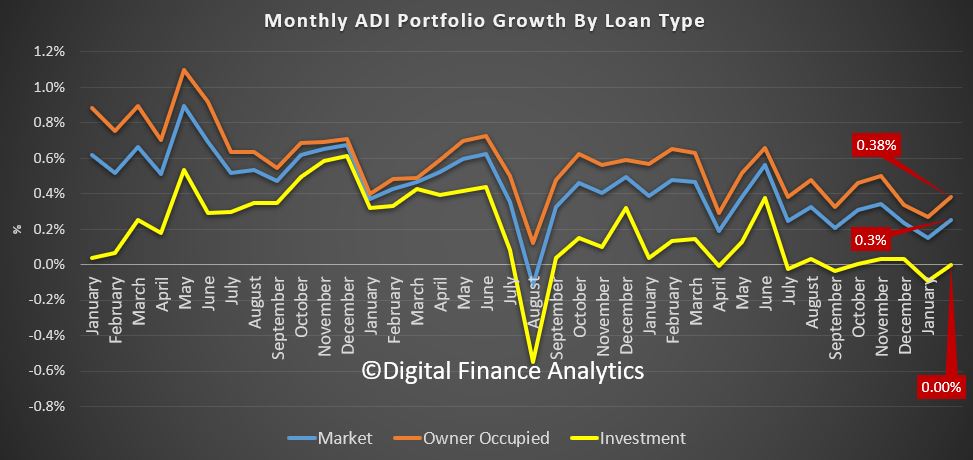

Total owner occupied loans were $1.11 trillion, up 0.38%, or $4.2 billion, while investor loans were $557 billion, flat compared with last month. This shows the trends month on month, with a slight uptick in February compared to January, as holidays end and the property market spluttered back to life. The next couple of months will be interesting as we watch for a post-Hayne bounce in lending and more loosening of the credit taps, but into a market where demand, is at best anemic.

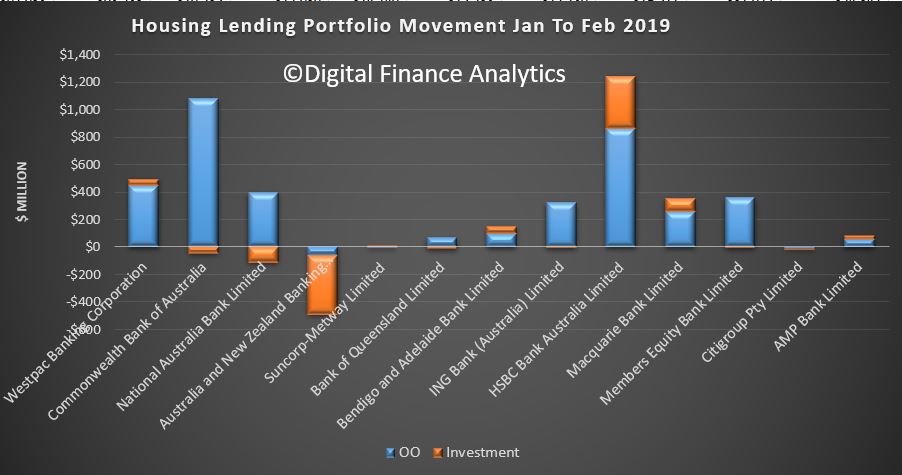

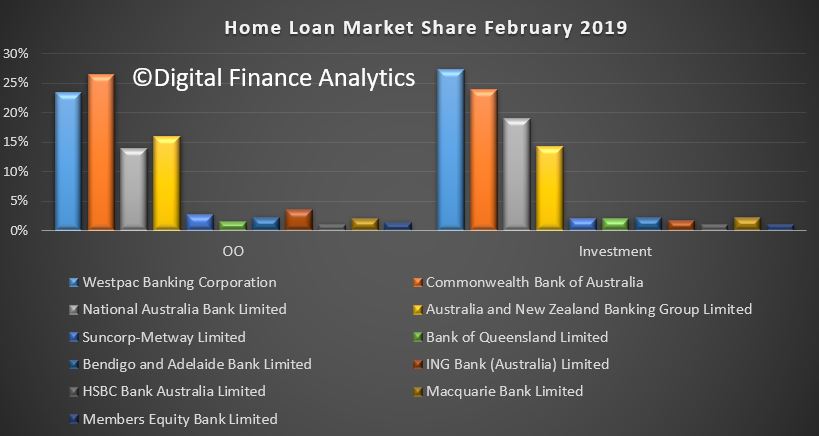

The portfolio movements are interesting (to the extent the data is reported accurately!), with HSBC growing its footprint by more that one billion across both investor and owner occupied lending. Only Westpac, among the big four grew their investor loans, with ANZ reporting a significant slide (no surprise they said they had gone too conservative, and recently introduce a 10-year interest only investor loan). Macquarie and Members Equity grew their books, with the focus on owner occupied loans.

The overall portfolios did not vary that much, with CBA still the largest owner occupied lender, and Westpac the largest investor lender.

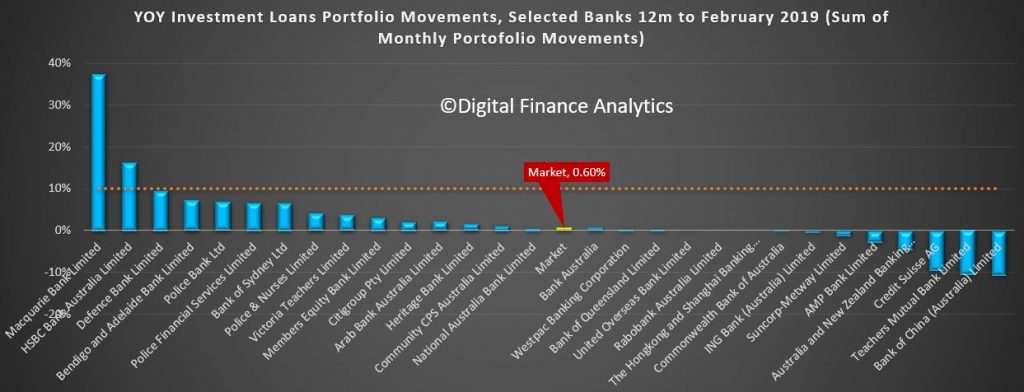

The 12 month investor tracker whilst obsolete in one sense as APRA has removed their focus on a 10% speed limit, is significant, in that the market is now at 0.6% annualised.

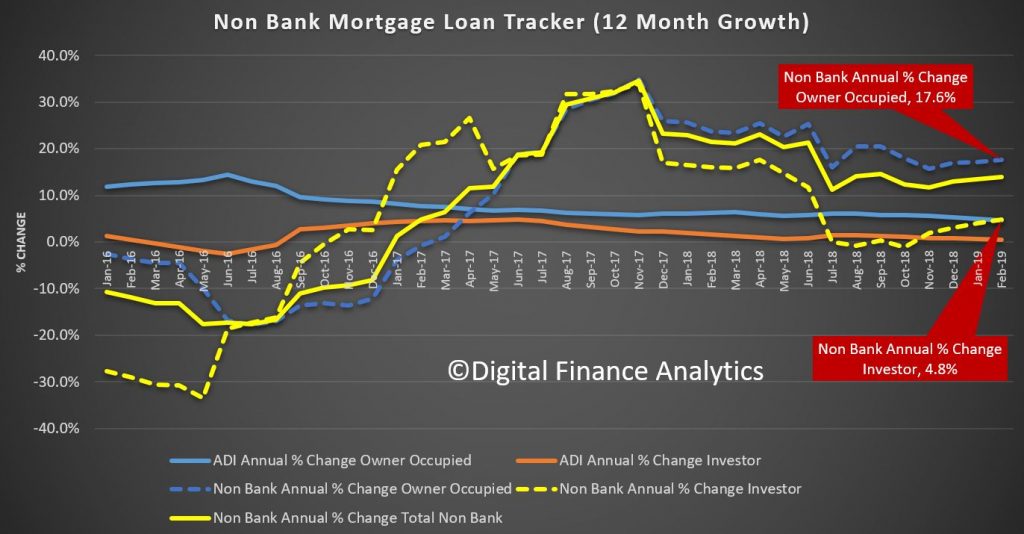

But the final part of the story is the non-bank lending. This has to be derived, and we know the RBA data is suspect and delayed. But the gap between the RBA and APRA data shows the trends.

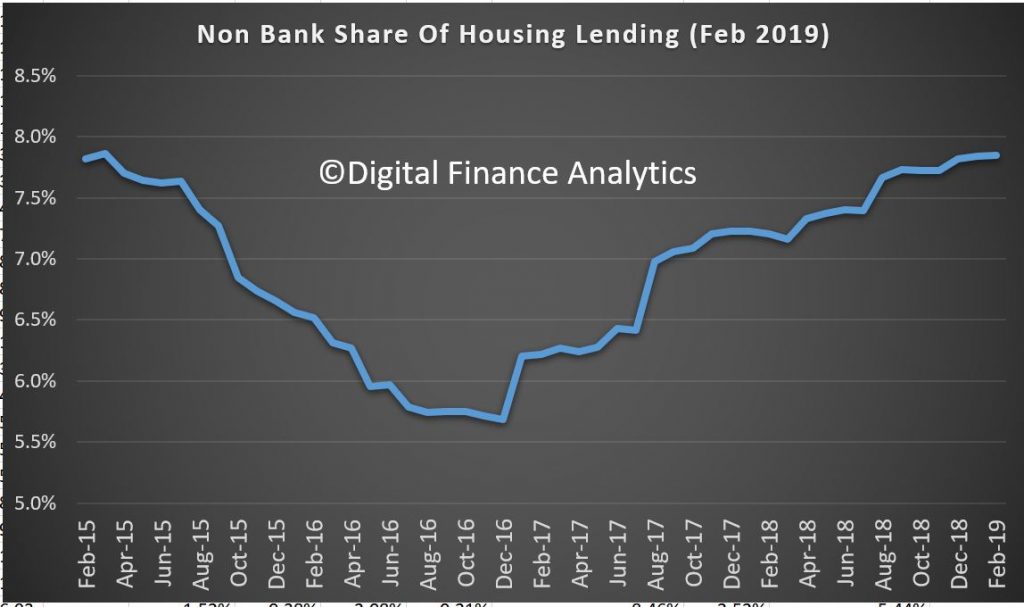

Non Bank annualised owner occupied credit is growing at 17.6%, and investor lending at 4.8%. It is clear the non-banks, with their weaker capital requirements, and greater funding flexibility are making hay. Total non bank credit for housing is now around $142 billion or around 7.8% of housing lending. This ratio has been rising since December 2016, and kicked up in line with the tighter APRA rules being applied to the banks.

We have out doubts that APRA is looking hard enough at these lending pools, especially as we are seeing the rise of higher risk “near-prime” offers to borrowers who cannot get loans from the banks.

So to conclude the rate of credit momentum continues to ease – signalling more home prices ahead. The non-banks sector, currently loosely regulated by APRA is growing fast, and just the before the US falls around the GFC, risks are higher here. And finally, and worryingly, household debt is STILL growing… so more stress and financial pressure ahead.

RC issues ‘not unique to Australia’, says former Coutts boss

A Hong Kong-based banker has applauded Australia for shedding light on issues within its financial sector and warned that the issues revealed by the royal commission are widespread across the globe, via InvestorDaily.

CFA Institute managing director, Asia Pacific, Nick Pollard has held a number of senior banking roles, including the MD of exclusive British bank Coutts and CEO of Coutts Asia.

Speaking to Investor Daily, Mr Pollard said that while the major banks in Australia have shown a clear interest to be rid of their troubled wealth businesses, the fact remains that people need wealth management and financial advice.

“The challenge for Australia, which is the challenge the rest of the world has, is how do you ensure the demands of the customers are able to be met by organisations that can provide that advice in a fair and transparent way?

“The industry as a whole hasn’t been very good at that over the last few years. That’s why regulators have become involved and it has become tougher to operate in this climate.”

While the Hayne royal commission has cast a shadow over the Australian financial services sector over the past 12 months, Mr Pollard believes the conversations that are now being had off the back of the inquiry reflect a positive approach that other markets are yet to benefit from.

“What Australia is doing, which many countries aren’t, is bringing this out into the public domain and having those critical conversations and hopefully can look forward with some optimism that the industry is owning up to the fact that it need to improve and needs to do something about it,” he said.

“In many ways, the issues that are coming out of the royal commission don’t just apply to Australia. Don’t think that the rest of the world has got these things right. If there is any kind of introspection by those in the financial services communities of Hong Kong and Singapore it is ‘Where do we stand on these issues?’

“At least Australia has been bold enough to being this out into the public domain.”

According to global research consultants Cerulli Associates, Australia remains an attractive market for investment managers and asset consultants, both local and global.

While the royal commission has caused significant reputational damage, Cerulli Associated managing director for Asia, Ken Yap, said super funds in particular will still need to make exactly the same decisions about asset allocation, currency hedging, and liquidity as they always did, and nothing in the royal commission is likely to make them choose any different underlying managers than they have done in the past.

RMBS risks rising fast as house prices fall

Christopher Joye published an interesting analysis on Livewire. “All of this analysis would look worse if we marked everything to market at the end March, as house prices have continued to fall”, he said.

Exactly, as prices fall risks rise.

In assessing whether to get long or short residential mortgage-backed securities (RMBS), we undertake a great deal of quantitative analysis, including revaluing the homes that protect these bonds at regular intervals and developing globally unique RMBS default and prepayment indices. (Regular readers will know that we exited most of our RMBS in February 2018.)

As house prices fall, the loan-to-value ratios underpinning an RMBS issue rise in lock-step, which reduces the equity protecting the bond. Using Bloomberg data on the current amortised value of the home loans in all Australian RMBS pools, the LVR distribution of the loans, and the geographic location of the properties, we have marked-to-market all the 2017, 2018 and 2019 issues after accounting for the amortisation or pay-down of loans through to the end of February 2019.

What we find is some huge increases in the share of an RMBS issue’s assets with LVRs over 90% compared to the leverage reported when the bond was originally sold to investors (often jumping from 5% of loans to 15% to 20% of loans).

We have also documented some recent RMBS deals where the share of loans that are underwater, or have LVRs over 100%, has increased strikingly, including one transaction where more than 1-in-10 loans appear to be underwater.

All of this analysis would look worse if we marked everything to market at the end March, as house prices have continued to fall.

It is possible that there is a difference between the CoreLogic index price changes and the individual property changes, but we have used the state-wide indices and deals with metro biases (as is common) would likely have even poorer performance than these numbers imply. Also, the automated property valuation models used to revalue individual homes are commonly based on the CoreLogic indices.

At the same time as the equity protecting RMBS is shrinking, we have demonstrated that RMBS default rates are trending higher back to GFC peaks using our compositionally-adjusted hedonic index of RMBS arrears. This is consistent with the RBA’s data on mortgage arrears, which I have enclosed below our index chart.

There is also the problem of declining mortgage prepayment rates, which is blowing out the expected life of RMBS bonds (adversely impacting assumed credit spreads) as borrowers struggle to prepay loans at the same rate as they have done in the past.

And finally, we have had an incredible surge in RMBS supply, with the highest level of issuance since the heady days before the GFC (about $100bn of supply since the start of 2017), which will inevitably put pressure on these bonds’ prices.

After we banged the table about these risks early last year, S&P belatedly warned in November:

- “Falling property prices pose a greater risk for the lower-rated tranches of less-seasoned transactions, particularly for loans underwritten at the peak of the property cycle;”

- “The RMBS sector is now facing more elevated risk than it was 12 months ago. Alongside high household debt and low wage growth are emerging risks such as lower seasoning levels in new transactions and increasing competition.”

- “Lower-rated tranches of more recent transactions with lower seasoning levels are more exposed to this risk, particularly for loans underwritten in the past 12 months, at the peak of the property cycle”

- “Less-seasoned loans and highly leveraged loans are most exposed to a more protracted decline in property prices.”

- “Loans originated in more recent years, at the peak of the property boom, will be more exposed to property price declines, particularly those with higher loan-to-value (LTV) ratios.”

Is It Up ORR Is It Down?

Property expert Joe Wilkes and I discuss central banks’ drive to cut the cash rate, in an attempt to reinflate the property bubble. And New Zealand is a case in point.

Consumers Confusing Different Types of Financial Advice – ASIC

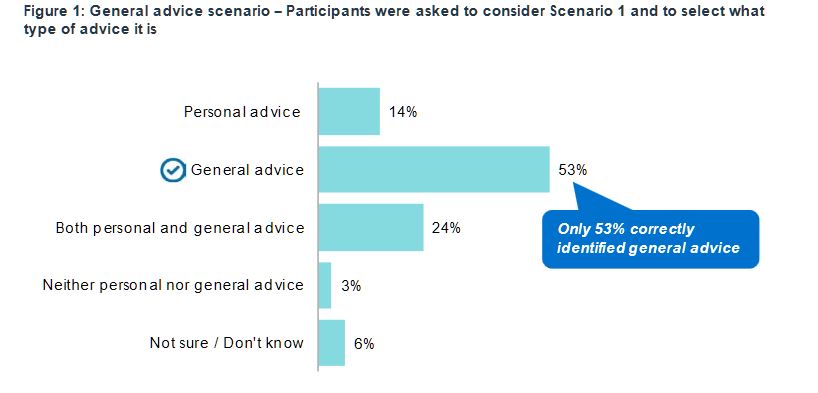

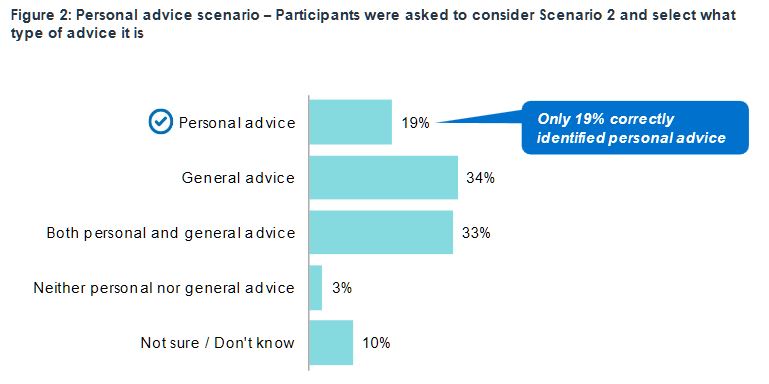

ASIC has released new research revealing many consumers confuse ‘general’ and ‘personal’ advice exposing them to greater risk of poor financial decisions.

The ASIC report, Financial advice: Mind the gap (REP 614), presents new independent research on consumer awareness and understanding of general and personal financial advice, identifying substantial gaps in consumer comprehension.

“This disturbing gap in understanding whether the advice they are getting is personal or not means many consumers are under the false premise their interests are being prioritised, when no such protection exists,” said ASIC Deputy Chair, Karen Chester.

Millions of Australians will likely seek financial advice at some stage in their lives. When they do, it is critical they understand whether that advice is personal, whether it is tailored to their circumstances and does the adviser have a legal obligation to act in their interest.

“The survey not only revealed consumers are not familiar with the concepts of general and personal advice, but only 53 per cent of those surveyed correctly identified ‘general’ advice. And even when provided the general advice warning, nearly 40 per cent of those surveyed wrongly believed the adviser had an obligation to take their personal circumstances into account,” Ms Chester said.

The report highlights the importance of consumer awareness and understanding of the distinction between personal and general advice with the Future of Financial Advice (FOFA) protections only applying when personal advice is provided. These include obligations for advisers to act in their client’s best interests, to provide advice that is appropriate to their client’s personal circumstances and to prioritise their client’s interests. These obligations do not apply when general advice is provided.

“The survey also revealed that the responsibilities of financial advisers, when providing general advice, is not well understood. Nearly 40 per cent of those surveyed were unaware that advisers were not required by law to act in their clients’ best interests,” Ms Chester said.

ASIC anticipates the need for financial advice to grow, reflecting an ageing population and many financial products, especially retirement products, becoming more complex. ASIC reports that much of the advice is likely to be general advice, and while appropriate in some circumstances, it is inevitably of limited use.

“ASIC is seeing increased sales of complex financial products under general advice models – so not tailored to personal circumstances – leaving many consumers, especially retirees, exposed to the potential risk of financial loss. And whilst the Financial Services Royal Commission, and the Government’s response, dealt with the most egregious risks of hawking of complex financial products, consumer confusion about what is personal and general advice needs to be addressed,” Ms Chester said.

The report’s findings reinforce those of the Murray Financial System Inquiry and the Productivity Commission reports on the financial and superannuation systems. Those reports made recommendations about the use of the term ‘general advice’, which is likely to lead to false consumer expectations as to the value of and protections afforded advice received.

Ms Chester said, “This consumer research is timely. It comes as the Government is considering policy recommendations on financial advice from the Productivity Commission’s twin reports on Australia’s financial and superannuation systems. And at a time when the financial system itself undergoes much change, following the intense scrutiny of the Financial Services Royal Commission, including considering new financial advice and distribution business models”.

The report includes quantitative and qualitative research commissioned by ASIC and undertaken by independent market research agency, Whereto Research. The research used hypothetical advice scenarios to test consumer recognition of when general and personal advice was being provided, and awareness of adviser responsibilities when being given each type of advice.

Report 614 Financial advice: Mind the gap is the first stage in ASIC’s broader research project into consumer experiences with and perceptions of the financial advice sector. Additional research by ASIC will get underway in 2019 to identify a more appropriate label for general advice and consumer-test the effectiveness of different versions of the general advice warning.

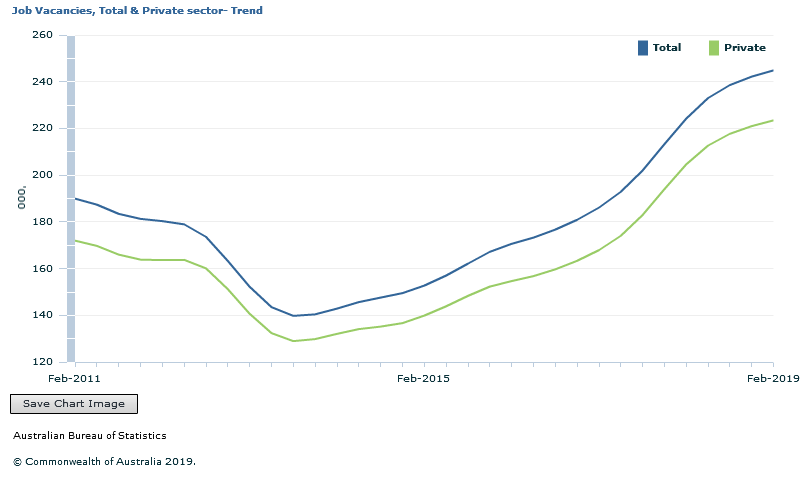

Growth in job vacancies eases further in February

The number of job vacancies in Australia increased by 1.1 per cent over the February 2019 quarter, according to new trend figures from the Australian Bureau of Statistics.

Bruce Hockman, Chief Economist at the ABS, said that job vacancies continued to grow but at a slower rate than in 2018.

“Growth in the quarterly trend measure of job vacancies eased further to 1.1 per cent, which was well below the 5.2 per cent seen a year ago,” Mr Hockman said.

“This was consistent with the recent slowing in other economic indicators.”

Over the year, job vacancies increased by 9.2 per cent, with private sector vacancies increasing by 9.2 per cent and public sector vacancies by 9.4 per cent.

The seasonally adjusted number of job vacancies increased by 1.4 per cent over the February 2019 quarter.

In original series terms, New South Wales contributed the most to the growth in vacancies over the year, with health care and social assistance, and construction the two leading industries.

A Further Update On Mortgage Loan Approvals

We discuss the findings from today’s House Economics Committee questioning of NAB’s new CEO, and look specifically at the issue of mortgage loan approvals.

Next New Zealand Cash Rate Move Is Likely Down

The Reserve Bank NZ said today the Official Cash Rate (OCR) remains at 1.75 percent. Given the weaker global economic outlook and reduced momentum in domestic spending, the more likely direction of our next OCR move is down.

Employment is near its maximum sustainable level. However, core consumer price inflation remains below our 2 percent target mid-point, necessitating continued supportive monetary policy.

The global economic outlook has continued to weaken, in particular amongst some of our key trading partners including Australia, Europe, and China. This weaker outlook has prompted central banks to ease their expected monetary policy stances, placing upward pressure on the New Zealand dollar.

Domestic growth slowed in 2018, with softness in the housing market and weak business investment contributing.

We expect ongoing low interest rates, and increased government spending and investment, to support economic growth over 2019. Low interest rates, and continued employment growth, should support household spending and business investment. Government spending on infrastructure, housing, and transfer payments also supports domestic demand.

As capacity pressures build, consumer price inflation is expected to rise to around the mid-point of our target range at 2 percent.

The balance of risks to this outlook has shifted to the downside. The risk of a more pronounced global downturn has increased and low business sentiment continues to weigh on domestic spending. On the upside, inflation could rise faster if firms pass on cost increases to prices to a greater extent.

We will keep the OCR at an expansionary level for a considerable period to contribute to maximising sustainable employment, and maintaining low and stable inflation.

Shadow treasurer says government has ‘got it wrong’ on trail

In a clear stance on Labor’s trail position, Chris Bowen MP has said that the government’s response to the banking royal commission has “got it wrong”, particularly in regard to its “backflip” on removing trail from next year; via The Adviser.

Speaking at the AFR Banking & Wealth Summit on 26 March, Chris Bowen, shadow treasurer and federal member for McMahon, reaffirmed the Australian Labor Party’s stance on trail commission payments to mortgage brokers.

In the final report for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, commissioner Kenneth Hayne recommended that “changes in brokers’ remuneration should be made over a period of two or three years, by first prohibiting lenders from paying trail commission to mortgage brokers in respect of new loans, then prohibiting lenders from paying other commissions to mortgage brokers”.

Following the release of the report, the Coalition government’s official response initially suggested that it would seek to ban trail for new loans from 1 July 2020, but Treasurer Josh Frydenberg announced earlier this month that government would instead postpone any decision on removing trail until after a review of mortgage broker remuneration has been undertaken in three years’ time.

Meanwhile, the Labor Party’s response called for the removal of trail for new mortgages from 1 July 2020 and for a standardised upfront commission as a proportion of the loan amount. It suggested that commissions should be capped at 1.1 per cent “so that banks can’t offer brokers incentives to choose their products”.

‘A big tick to a big flick’

Speaking at the AFR Banking & Wealth Summit today, Mr Bowen slammed the government for its “backflip” on trail commissions, stating that they continued to “get it wrong” on the royal commission recommendations.

He said: “I’m normally not too partisan at these events, I normally steer away from political commentary – at least through much of my speech, but given we are at the business end of the term, with the federal election less than 50 days away, I’m sure you’ll appreciate some plain speaking.

“The choice is between an opposition prepared to make big calls, and get those calls right, versus a government that has got the big calls wrong.”

Mr Bowen outlined that commissioner Hayne was “very clear” in his observations, which he said included the observations that “the interest of customers was relegated to second place far too often; too often, consumers were being left in the dark about how products or services are acquired and delivered; and too often, financial services entities were breaking the law and not held to account for their actions”.

“Those actions that were revealed through the royal commission had given the entire sector a bad name,” Mr Bowen said.

“They needed, and need, to be dealt with. These are systemic failures in our financial services industry when it comes to providing community standards and expectations.”

Emphasising that the government had previously called the royal commission a “populist whinge”, “regrettable”, a “reckless distraction” and a “QC’s complaints desk”, Mr Bowen added: “They got the big call wrong. And they also continue to get it wrong now, in terms of the recommendations.

“That’s probably most clear in relation to mortgage brokers.”

Mr Bowen elaborated: “A few days after the royal commission was handed down, the government told us that they were implementing the royal commission recommendation on trail commissions and said the royal commission recommendation was getting a ‘big tick’. No nuance, no discussion, just simply that this would be implemented.

“Now the reasons given by the commissioner on this issue were clear: The chief value of trail commissions to the recipient, to put it bluntly, is that they are money for nothing, [he said].

“And these are not new issues. The Productivity Commission found trail commissions have the effect of aligning the broker’s interests with those of the lender, rather than those of the borrower. The case was clear.”

Mr Bowen therefore called the government’s change in stance on trail as “a backflip with triple pike”.

“Just weeks after giving a recommendation a big tick, it was given the big flick,” he said, noting that it took “just 35 days to backflip on a major reform of phasing out trailing commissions for mortgage brokers”.

However, the shadow treasurer said that “there was, and is, a strong case for thinking carefully about the royal commission recommendation and ensuring we protect competition in banking. That’s exactly what we did,” he said.

“We consulted with mortgage brokers, we consulted with banks and financial institutions – particularly the smaller ones.

“We came up with a different way of removing conflicted remuneration for mortgage brokers. We announced that we would have legislated a flat upfront commission rate to avoid mortgage brokers’ advice being conflicted by the rate of the commission offered,” he said.

Mr Bowen concluded: “It’s one thing to achieve the objectives of the royal commission recommendation in another way, as Labor has done; it’s another thing to completely abrogate any policy action, as the Treasurer has done.

“When we make big calls – and we’ve made quite a few of them – we stick to them, fight for them, and seek to mandate for them, which is what we’ll be doing, presumably, on the 11th of May [for the federal election].

“We will implement 75 recommendations of the royal commission in full. The government cannot say that and already we are seeing consumer groups being very concerned that the government is already walking away from other recommendations,” he said.

Broking industry continues engagement with ALP

While the shadow treasurer has reaffirmed the party’s stance on trail commissions, the broking industry continues its work in engaging and educating ALP members on the benefits of trail.

Indeed, just last week, a group of nearly 100 representatives from the mortgage industry met shadow assistant treasurer and federal member for Fenner, ACT, Dr Andrew Leigh, at the QT Hotel in Canberra for the Future of Mortgage Lending forum, organised by AFG in partnership with Connective and Mortgage Choice, in which the need for trail was hotly discussed.

Speaking to The Adviser about the event last week, AFG’s Mark Hewitt said that the purpose of the meeting was to have a town hall type discussion with economist-turned-politician Dr Leigh, and to outline how Labor’s plans to remove trail for new loans from next year could impact borrower outcomes.

“We wanted to get the point across to Dr Leigh about the unintended consequences of abolishing trail and the impacts that could have on the brokers’ ability to provide an ongoing service to their clients,” Mr Hewitt said.

“Labor’s focus was very centred on talking about them being the first to move on commissions, but the sentiment in the room was definitely around the abolition of trail and why it was not a good idea.

“What was particularly impressive to me was the care and concern that the brokers in the room had for their customers and also their concern about the unintended consequences of having their remuneration front-loaded in the way that Labor is proposing.”

He continued: “We were talking about the impacts that the removal of trail might have on brokers’

to provide ongoing service to clients and also the fact that the model without trail doesn’t provide any incentive for an ongoing customer relationship.”

Mr Hewitt told The Adviser that Dr Leigh “was very receptive to the messages in the room and was very impressive and engaging”.

“It takes a fair bit of courage as well, as he was the only person in the room who thought that abolishing trail was a good idea, but he stood by the party line while still engaging and being respectful to the counter arguments,” Mr Hewitt said.

“We were very pleased with how it went because it’s a continuing conversation – and it was a two-way conversation, hearing both sides, which is what we wanted to achieve,” AFG’s general manager for broker and residential added.