The Basel Committee has published the results of its latest Basel III monitoring exercise based on data as of 31 December 2016. For the first time, the report provides not only global averages but also a regional breakdown for many key metrics. Data is included from 4 Australian “Group 1” banks and 1 “Group 2” bank.

Overall, banks now hold more capital, which is a good thing. Tier 1 capital ratios improved from 7.4% to 13.5%. In 2011 Tier 1 capital ratios were more than two percentage points lower in Europe and the Americas compared with the rest of the world. This relationship has now reversed.

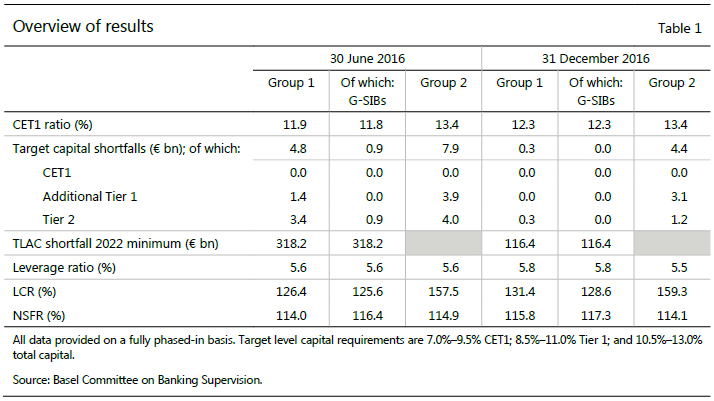

- Compared with the previous reporting period (June 2016) the average Common Equity Tier 1 (CET1) capital ratio under the fully phased-in Basel III framework has increased from 11.9% to 12.3% for Group 1 banks while is stable for Group 2 banks.

- All Group 1 banks would meet the CET1 minimum capital requirement of 4.5% and the CET1 target level of 7.0% (ie including the capital conservation buffer). This target also includes the G-SIB surcharge where applicable.

- There is no CET1 capital shortfall for Group 2 banks both at the minimum and target levels.

- Applying the 2022 minimum requirements, 12 of the 25 G-SIBs reporting total loss-absorbing capacity (TLAC) data have a combined shortfall of €116.4 billion, compared with €318.2 billion at the end of June 2016.

- Group 1 banks’ average Liquidity Coverage Ratio (LCR) improved by 5.0 percentage points to 131.4%, while the average Net Stable Funding Ratio (NSFR) increased from 114.0% to 115.8%. For Group 2 banks, the LCR and NSFR are more stable.

- CET1 capital ratios for Group 1 banks have increased by 5.1 percentage points from 7.2% to 12.3% since June 2011, total capital ratios have increased by 6.6 percentage points from 8.7% to 15.3%.

- Tier 1 capital ratios improved from 7.4% to 13.5%, mainly driven by increases in capital which more than offset a slight overall increase in risk-weighted assets (RWA).

- In 2011 Tier 1 capital ratios were more than two percentage points lower in Europe and the Americas compared with the rest of the world. However, this relationship has reversed in the meantime. The reasons are twofold. First, the increase in capital since June 2011 was lower in Europe as compared to the other regions. Second, RWA fell for European Group 1 banks while RWA increased for banks in the Americas and, in particular, the rest of the world.

- Since 2011, annual profits after tax have always been higher in the Americas and the rest of the world than in Europe.

- Overall, around 20% of the profits have been generated by Group 1 banks in Europe, more than 30% in the Americas and almost half in the rest of the world.

- Conversely, almost 60% of the CET1 capital raised has been raised by Group 1 banks in Europe.

Data have been provided for a total of 200 banks, comprising 105 large internationally active banks. These “Group 1 banks” are defined as internationally active banks that have Tier 1 capital of more than €3 billion, and include all 30 banks that have been designated as global systemically important banks (G-SIBs). The Basel Committee’s sample also includes 95 “Group 2 banks” (ie banks that have Tier 1 capital of less than €3 billion or are not internationally active).

The Basel III minimum capital requirements are expected to be fully phased-in by 1 January 2019 (while certain capital instruments could still be recognised for regulatory capital purposes until end-2021). On a fully phased-in basis, data as of 31 December 2016 show that all banks in the sample meet both the Basel III risk-based capital minimum Common Equity Tier 1 (CET1) requirement of 4.5% and the target level CET1 requirement of 7.0% (plus any surcharges for G-SIBs, as applicable). Between 30 June and 31 December 2016, Group 1 banks continued to reduce their capital shortfalls relative to the higher Tier 1 and total capital target levels; in particular, the Tier 2 capital shortfall has decreased from €3.4 billion to €0.3 billion. As a point of reference, the sum of after-tax profits prior to distributions across the same sample of Group 1 banks for the six-month period ending 31 December 2016 was €239.5 billion. In addition, applying the 2022 minimum requirements for Total Loss-Absorbing Capacity (TLAC), 12 of the G-SIBs in the sample have a combined incremental TLAC shortfall of €116.4 billion as at the end of December 2016, compared with €318.2 billion at the end of June 2016.

The monitoring reports also collect bank data on Basel III’s liquidity requirements. Basel III’s Liquidity Coverage Ratio (LCR) was set at 60% in 2015, increased to 70% in 2016 and will continue to rise in equal annual steps to reach 100% in 2019. The weighted average LCR for the Group 1 bank sample was 131% on 31 December 2016, up from 126% six months earlier. For Group 2 banks, the weighted average LCR was 159%, slightly up from 158% six months earlier. Of the banks in the LCR sample, 91% of the Group 1 banks (including all G-SIBs) and 96% of the Group 2 banks reported an LCR that met or exceeded 100%, while all Group 1 and Group 2 banks reported an LCR at or above the 70% minimum requirement that was in place for 2016.

Basel III also includes a longer-term structural liquidity standard – the Net Stable Funding Ratio (NSFR). The weighted average NSFR for the Group 1 bank sample was 116%, while for Group 2 banks the average NSFR was 114%. As of December 2016, 94% of the Group 1 banks (including all G-SIBs) and 88% of the Group 2 banks in the NSFR sample reported a ratio that met or exceeded 100%, while 100% of the Group 1 banks and 96% of the Group 2 banks reported an NSFR at or above 90%.

Note that in general, the estimates presented generally assume full implementation of the Basel III requirements as agreed up to end-2015 based on data as of 31 December 2016. The main part of this report does not reflect any standards agreed since the beginning of 2016, such as the revisions to the market risk framework which are presented separately in a special feature. No assumptions have been made about banks’ profitability or behavioural responses, such as changes in bank capital or balance sheet composition, either since this date or in the future. Furthermore, the report does not reflect any additional capital requirements under Pillar 2 of the Basel II framework, any higher loss absorbency requirements for domestic systemically important banks, nor does it reflect any countercyclical capital buffer requirements.