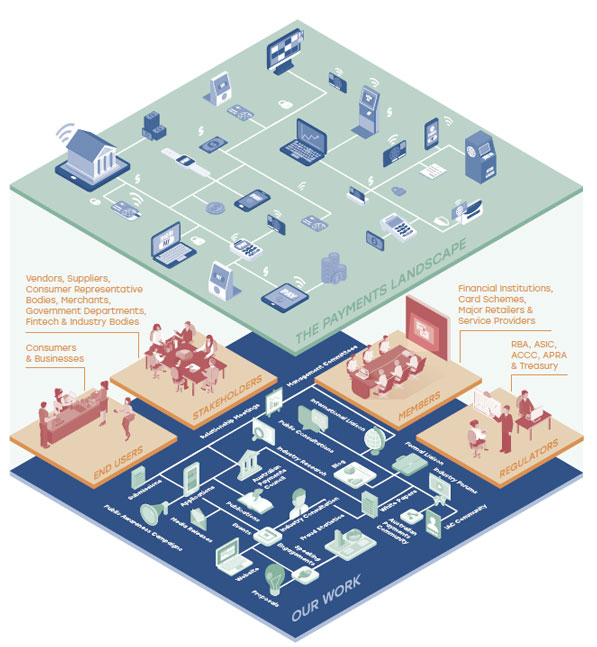

The Australian Payments Clearing Association (APCA) has released their annual review. APCA has 103 members including Australia’s leading

financial institutions major retailers, payments system operators and other payments service providers.

They say “this has been a landmark year for Australia’s digital economy. With accelerated adoption of electronic payment methods, fewer cash and cheque transactions and increased support for Fintech organisations, we’re at the forefront of a global trend”.

- Australians used their cards 12.1% more often, and spent 6.7% more on them than in 2015.

- With 75% of facetoface transactions estimated to be “tap and go”, Australia leads the world in contactless uptake.

- Direct entry transactions grew by 7.2% in number and 2.6% in value.

- On average, every Australian over the age of 15 has 3 payment cards.

- Online spending by Australians grew by 13.5%

- There is 1 point-of-sale terminal for every 20 Australians over the age of 15.

- This year, there were over 3.3 billion direct entry (direct debit and direct credit) transactions, a 7.2% increase on the previous year. The total value of

direct entry transactions grew 2.6% to $14.4 trillion.- Debit cards at point-of-sale in Australia continue to grow strongly, with a 13.3% increase in number, and 8.9% increase in value this year.

- Credit card volumes increased by nearly 9.8% this year, the strongest increase in the last decade, and a likely reflection of consumer confidence. Similarly, credit card values grew by 5% this year to $310 billion, up from $295 billion in 2015.

- Australians spent $689,470 million on their payment cards in 2015, whilst Fraud accounted for 0.07% of this total.

The decline in cheques and cash is accelerating as ATM withdrawals dropped by 6.6%, compared to 4.9% in 2015 and Cheques use dropped by 17.2%, compared to 15.7% in 2015.

On the other hand, Australia has one of the highest smartphone

penetration levels globally, and 59% of Australians with smartphones have used them to pay for goods or services. Tablets are an important part of the puzzle. 71% of Australians over the age of 18 have made a payment using a mobile phone or tablet.Investment continues in Fintech, with 70 members forming its peak body, and $438m invested in the Fintech market in Australia.

The New Payments Platform (NPP) is a major industry initiative to develop new infrastructure for Australian payments. It will provide Australian governments, businesses and consumers with a fast, versatile, data-rich payments system for making their everyday payments. The industry is taking a unique layered approach that separates the basic infrastructure, which connects all financial institutions, from “overlay” services – innovative, customised payment services. APCA is providing corporate services to NPP Australia Limited, the company it established in December 2014 to oversee the build and operation of the NPP.

In October 2015, NPP Australia reached agreement with Australia’s premier bill payment system provider – BPAY – to deliver the first overlay service to use the NPP once it is operational in the second half of 2017. This initial convenience service will let consumers immediately transfer funds to and from their banking accounts via their mobile phone, tablet, or via the internet.