The RBA released their credit aggregates to end May 2018 – the ying, to APRA’s yang… This is a market level view, including belated and partial data from the non-bank sector, so its always a larger set of numbers than the APRA ADI set, which we discussed previously.

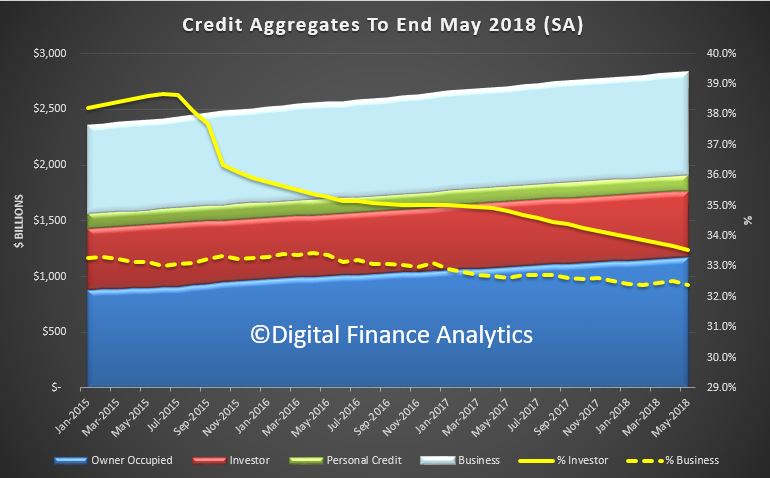

The RBA data shows that total housing lending rose 0.37% from last month, up $6.6 billion to $1.76 trillion. Within that, owner occupied housing rose 0.55% or $6.5 billion, and investment lending rose just 0.02% or $220 million. Personal credit fell again, and business lending fell 0.3% down $2.5 billion to $917 billion, all seasonally adjusted.

Investment lending made up 33.5% of all housing loans, down from 33.7% the previous month, and continues to slide, as expected. However the drop in business credit meant the proportion of commercial lending fell to 32.4% of all lending.

Investment lending made up 33.5% of all housing loans, down from 33.7% the previous month, and continues to slide, as expected. However the drop in business credit meant the proportion of commercial lending fell to 32.4% of all lending.

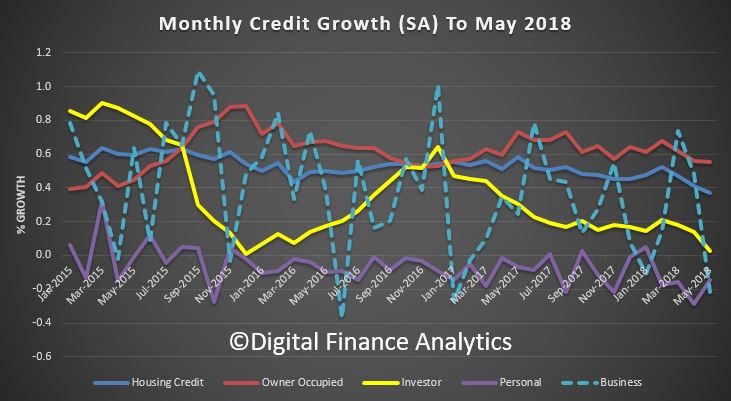

The monthly growth trends show the fall in business lending, and the fall-off in investor lending, all seasonally adjusted, which in the current environment may well be writing the volumes down too far.

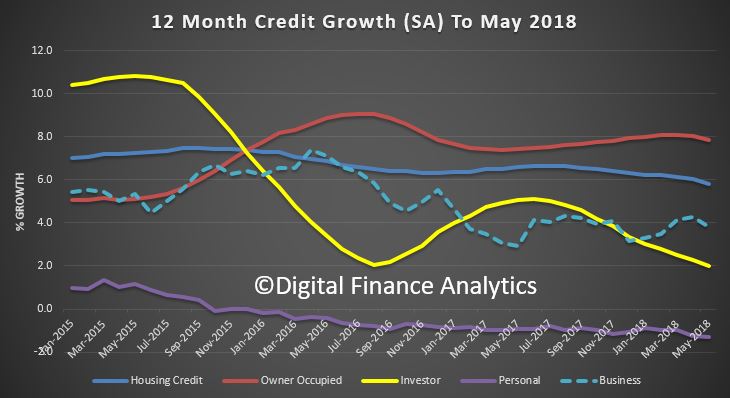

The 12 month rolling trend shows owner occupied housing still running at 7.9%, well above inflation and wage growth, while investor lending has a read of 2%, which is the lowest see since the RBA series started to be published in 1991. Have no doubt, investor lending is fading.

The 12 month rolling trend shows owner occupied housing still running at 7.9%, well above inflation and wage growth, while investor lending has a read of 2%, which is the lowest see since the RBA series started to be published in 1991. Have no doubt, investor lending is fading.

Personal credit dropped an annualised 1.3%, the largest fall since the fall out from GFC in 2009. Business lending was around 3.8% annualised and slid a little.

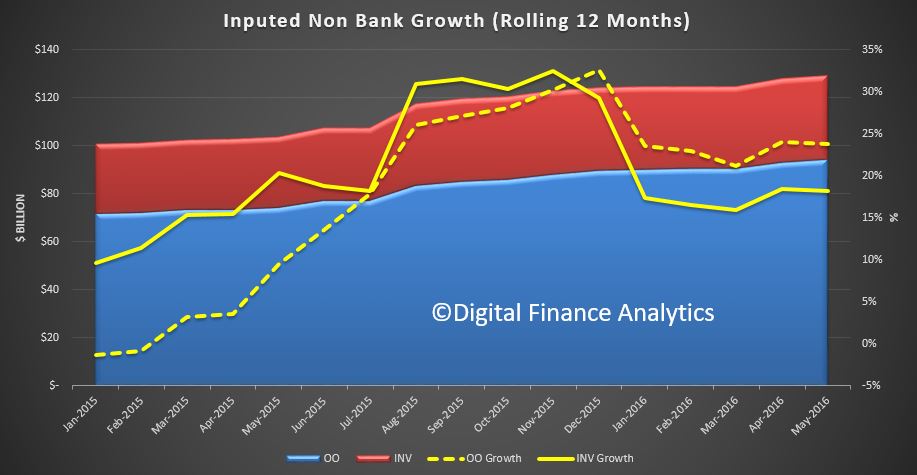

Finally, the non-bank contribution to lending growth can be imputed by subtracting the APRA ADI data from the RBA market data. This is an inexact science because of timing and coverage issues across the data. But it tells an interesting story, with non-bank growth rates sitting at around 20% for owner occupied loans and around 18% for investor loans, on a twelve month rolling basis. So we can see where some of the slack in the system is being taken up as non-banks flex their muscles. Regulation of this sector is a concern, as Moody’s highlighted recently. APRA has this responsibility, but how actively they are looking at this segment of the market, when data is so hard to acquire is a moot point. My guess is they are light on.

Finally, the non-bank contribution to lending growth can be imputed by subtracting the APRA ADI data from the RBA market data. This is an inexact science because of timing and coverage issues across the data. But it tells an interesting story, with non-bank growth rates sitting at around 20% for owner occupied loans and around 18% for investor loans, on a twelve month rolling basis. So we can see where some of the slack in the system is being taken up as non-banks flex their muscles. Regulation of this sector is a concern, as Moody’s highlighted recently. APRA has this responsibility, but how actively they are looking at this segment of the market, when data is so hard to acquire is a moot point. My guess is they are light on.