The Reserve Bank New Zealand says that risks to New Zealand’s financial system have eased over the past six months, but vulnerabilities persist. In particular, households remain exposed to financial shocks due to their large mortgage debt burden.

But they are easing the loan to value restrictions from January 2019.

- Up to 20 percent (increased from 15 percent) of new mortgage loans to owner occupiers can have deposits of less than 20 percent.

- Up to 5 percent of new mortgage loans to property investors can have deposits of less than 30 percent (lowered from 35 percent).

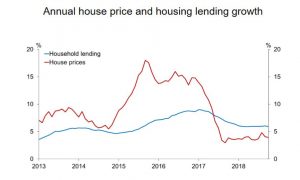

They say that both mortgage credit growth and house price inflation have eased to more sustainable rates, reducing the riskiness of banks’ new housing lending. In response, we are easing our loan-to-value ratio (LVR) restrictions on banks’ new mortgage loans. If banks’ lending standards are maintained we expect to further ease LVR restrictions over the next few years.

Debt levels also remain high in the agriculture sector, particularly for dairy farms, implying ongoing financial vulnerability. Balance sheets need to be further strengthened. In the medium-term, an industry response to a variety of climate change-related challenges appears likely, requiring investment.

While domestic risks have eased, global financial vulnerability has risen. Significant build-ups in debt and asset prices, and ongoing geopolitical tensions, overhang financial markets. This vulnerability is highlighted by the current elevated price volatility in equity and debt markets. New Zealand’s exposure to these global risks has reduced somewhat, as New Zealand banks have become less reliant on short-term, and foreign, funding.

The domestic banking system remains sound at present. We are using this period of relative calm to reassess whether the banking system has sufficient capital to weather future extreme shocks. Our preliminary view is that higher capital requirements are necessary, so that the banking system can be sufficiently resilient whilst remaining efficient. We will release a final consultation paper on bank capital requirements in December.

The banking system remains profitable, reflecting banks’ low operating costs and strong asset performance. While positive overall, banks’ low costs have been partly achieved through underinvestment in core IT infrastructure and risk management systems in New Zealand. This was highlighted in our review of bank’s conduct and culture with the Financial Markets Authority. We will be jointly reviewing banks’ responses to our review in March 2019, and following up as required.

CBL Insurance Ltd was placed into full liquidation by the High Court on 12 November. Aside from CBL, the insurance sector as a whole is meeting its minimum capital requirements. However, capital strength has declined and a number of insurers are operating with small buffers. The insurance industry must ensure it has sufficient capital to maintain solvency in all business conditions. Our ongoing review of conduct and culture in the insurance sector with the Financial Markets Authority will illuminate the industry’s risk management capability. The review will be released in January 2019.

Just another con story to keep all the hot air under the housing and stock market! Does the West have ANY honest political parties and individuals today? Yes, they do, but MSM does a very good job of squashing them to death with lies and deceit, not accidentally either. The current establishment is corrupt, the current establishment has broken the social contract with the people, we vote for them they are supposed to represent us, main street, but they don’t, instead they continue to support wall street! This is also Treason, is it not?

What can Australia learn from this? Should banks and government seek to to improve the lot of distressed interest-only borrowers?