The Reserve Bank of New Zealand has released a discussion paper in which they consult on proposals to lift the capital held by banks in New Zealand.

The expected effect on banks’ capital is an increase of between 20 and 60 percent. This represents about 70 percent of the banking sector’s expected profits over the five-year transition period. They expect only a minor impact on borrowing rates for customers.

They say “Banks currently get the vast majority of their money by borrowing it (usually over 90 percent), with the rest coming from owners (usually less than 10 percent). The Reserve Bank is proposing to change this balance by requiring banks to use more of their own money. This proposal is consistent with steps taken by other banking regulators after the Global Financial Crisis”.

Banks currently get the vast majority of their money by borrowing it (usually over 90 percent), with the rest coming from owners (usually less than 10 percent). The Reserve Bank is proposing to change this balance by requiring banks to use more of their own money. This proposal is consistent with steps taken by other banking regulators after the Global Financial Crisis.

If banks increase their capital, they will be more resilient to economic shocks and downturns, which will strengthen New Zealand’s banking system and economy.

Because the level of a bank’s capital can have an impact on the interest rate it charges on its loans, it is possible that higher capital requirements could make it more expensive for New Zealanders to borrow money from a bank. While we certainly take this into account, we think this impact should be minimal.

Another potential impact is that bank owners would earn less from their investment in the bank. While we agree that this is likely to be the case, we believe this cost would be more than offset by the benefits of a safer banking system for all.

The key changes are:

Limit the extent to which capital requirements differ between the Internal Ratings-Based approach (IRB) and the Standardised approach, by re-calibrating the IRB approach and applying a floor linked to the Standardised outcomes. This reflects one of the principles of the Capital Review: where there are multiple methods for determining capital requirements, outcomes should not vary unduly between methods. In essence, there should be as level a playing field as possible, both between IRB banks and between IRB and Standardised banks;

These proposals are expected to raise risk-weighted assets (RWA) for the four IRB-accredited banks to approximately 90 percent of what would be calculated under the Standardised approach;

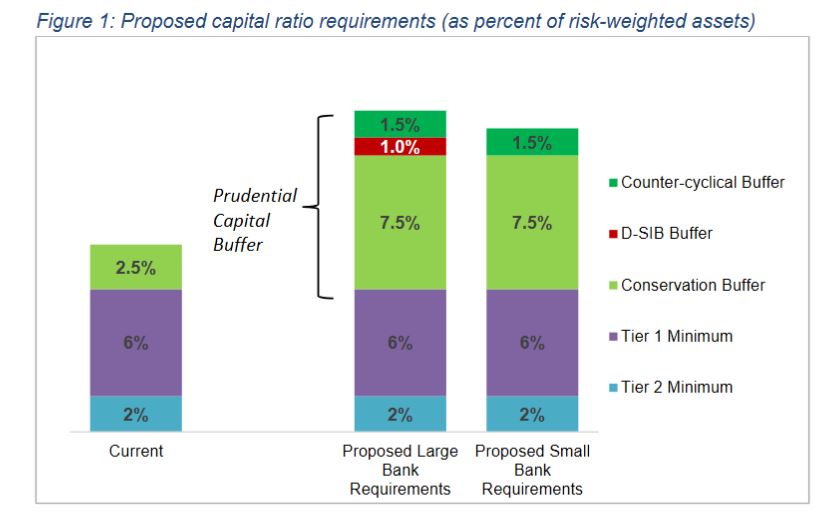

Set a Tier 1 capital requirement (consisting of a minimum requirement of 6 percent and prudential capital buffer of 9-10 percent) equal to 16 percent of RWA for banks deemed systemically important, and 15 percent for all other banks;

Assign 1.5 percentage points of the proposed prudential capital buffer requirements to a countercyclical component, which could be temporarily reduced to 0 percent during periods of exceptional stress;

Assign 1 percentage point of the proposed prudential capital buffer requirement to D-SIB buffer, to be applied to banks deemed to be systemically important;

Retain the current Tier 2 capital requirement of 2 percent of RWA, but raise the question of whether Tier 2 should remain in the capital framework; and

Staged transition of the different components of the revised framework over the coming years.