The ABS released the latest retails sales data today to January 2019. As expected it is a weak result, up 0.1% as the pressure on households continues, well below the 0.3% expectation, and of course this will translate to weaker household consumption ahead, as underscored by yesterdays GDP out turn.

Annual sales growth has slowed to 2.9%

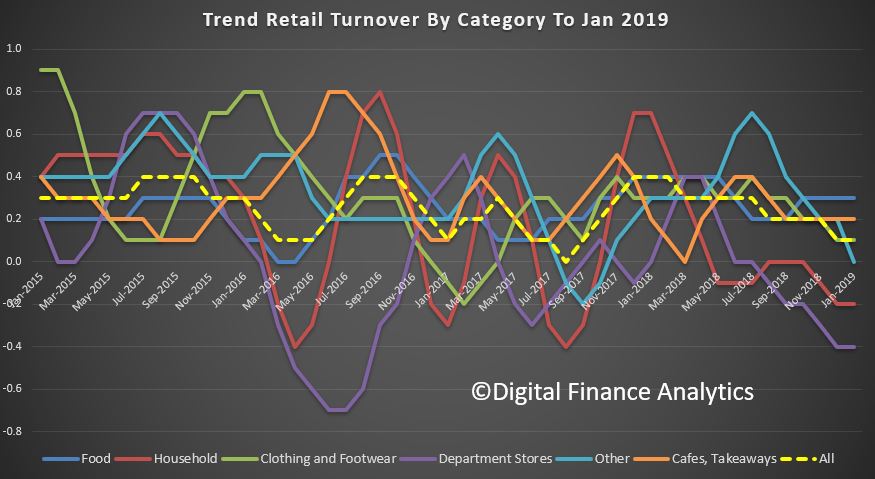

Turnover categories food rose 0.3% (3.7% over the past year), Household goods down 0.2% (down 0.1% over the past year), clothing and footwear up 0.1% (up 3.3% over the past year), department stores down 0.4% (and down 0.4% over the past year), cafes and takeaway up 0.2% (up 2.7% in a year) and other categories were flat (and up 4.3% over the past year).

This suggests that discretionary spending is heavily contained, as households spend on necessities such as food and clothing. It also shows a considerable slowdown in the more recent months.

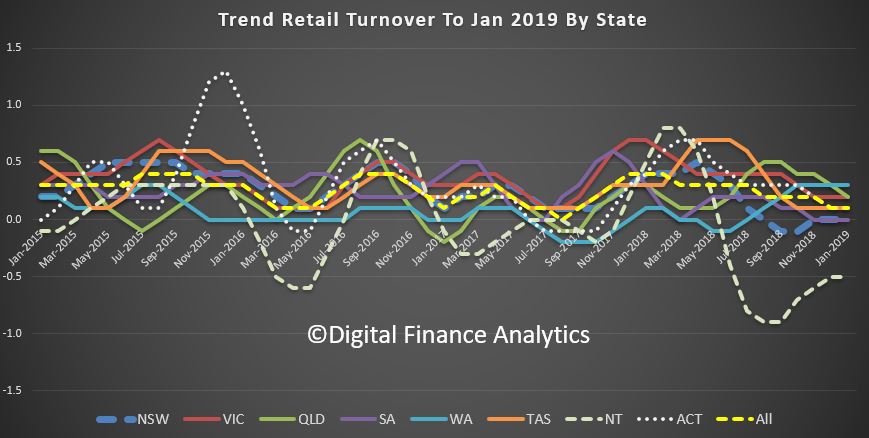

Across the states, in trend terms, NSW turnover was flat across the quarter and up 1.9% over the past years; VIC was up 0.2% in the quarter and 4.4% over the year, QLD was up 0.2% and 3.4% over the past 12 months, SA was flat this quarter and up 1.2% over the year, WA was up 0.3% and 1.4% over the year, TAS was up 0.1% and 4.5% over the past 12 months, NT was down 0.5% over the quarter and down 2.9% over the year and ACT up 0.1% and 4.5% over the year.

The surprise is the turnover is stronger in WA and QLD, but weak in NSW, where of course households are coping with large mortgages and flat incomes (despite very low unemployed).

All this points to pressure on the retail sector and on the economy more generally.

Just a note here, we continue to use the trend series, as the “seasonally adjusted” numbers are less stable.

Finally, its worth noting that online retail turnover contributed 5.6 per cent to total retail turnover in original terms in January 2019, which is unchanged from December 2018. In January 2018, online retail turnover contributed 4.7 per cent to total retail.