Increased trade tensions have raised the risk that new measures may be taken that would have a much greater impact on global economic growth than those enacted so far, Fitch Ratings says.

The US investigation into auto tariffs, possible additional US tariffs on Chinese imports, and the likely reactions of other countries and blocs, point to a potential serious escalation, albeit with an impact that falls short of across-the-board tariffs imposed on all major trade flows.

The US administration’s continuing focus on reducing bilateral trade deficits and the response by China, the EU, Canada and Mexico to existing measures, have increased tensions. So far the scale of tariffs imposed has been too small to materially affect our forecasts for world growth, as we noted in our most recent “Global Economic Outlook”. The additional tariffs raised are very small relative to the GDP of the affected countries and regions.

However, further measures mooted by the US would mark a significant escalation. The initiation of a Section 232 investigation into whether auto imports weaken the US economy and impair national security affects US imports of new cars and car parts that were worth USD322 billion last year. The threat of an additional USD200 billion of tariffs on Chinese imports could prompt China to apply tariffs to all imports of goods and services from the US, which were worth USD188 billion in 2017. China could also retaliate with non-tariff barriers.

It remains to be seen whether US announcements are simply negotiating positions that may be modified. But the detailed preparation of, and justification for, such measures and the possibility of instant and strong retaliation by trading partners present growing risks to trade. If tensions rise further, the US hardens its stance and fully withdraws from NAFTA (which is not our base case), this would magnify the impact. The imposition of high tariffs on US auto imports would represent an existential threat to NAFTA.

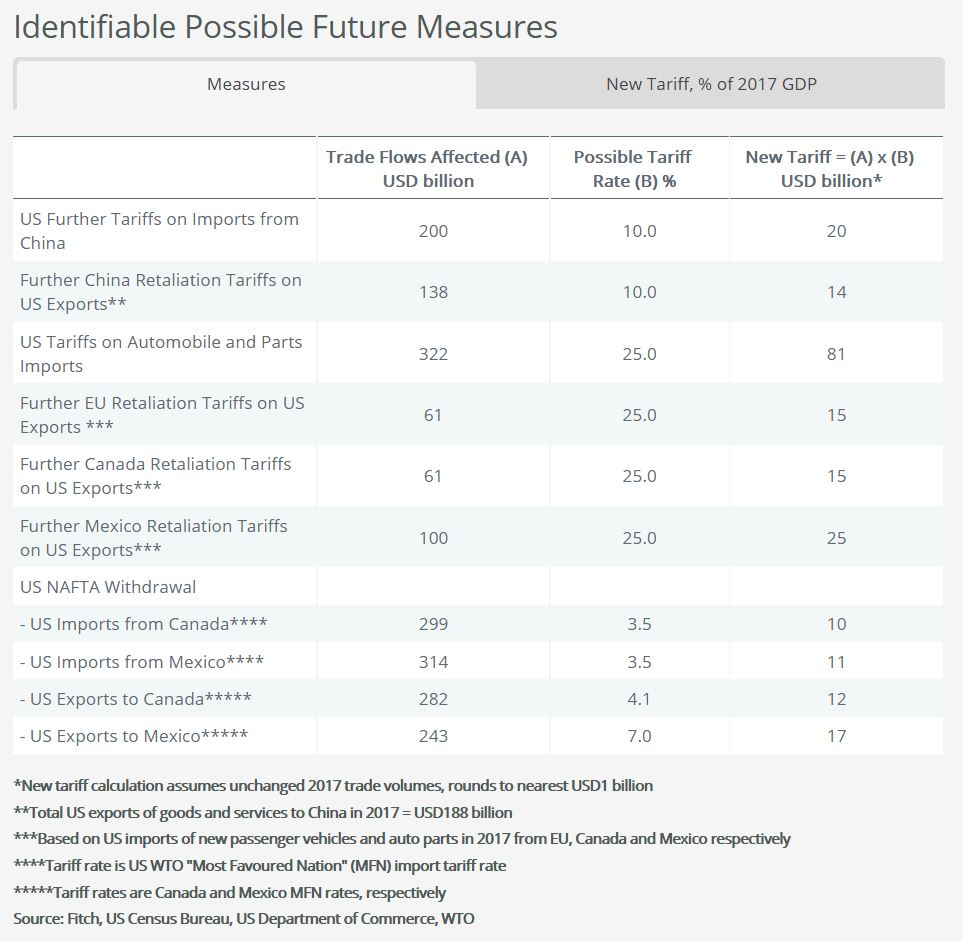

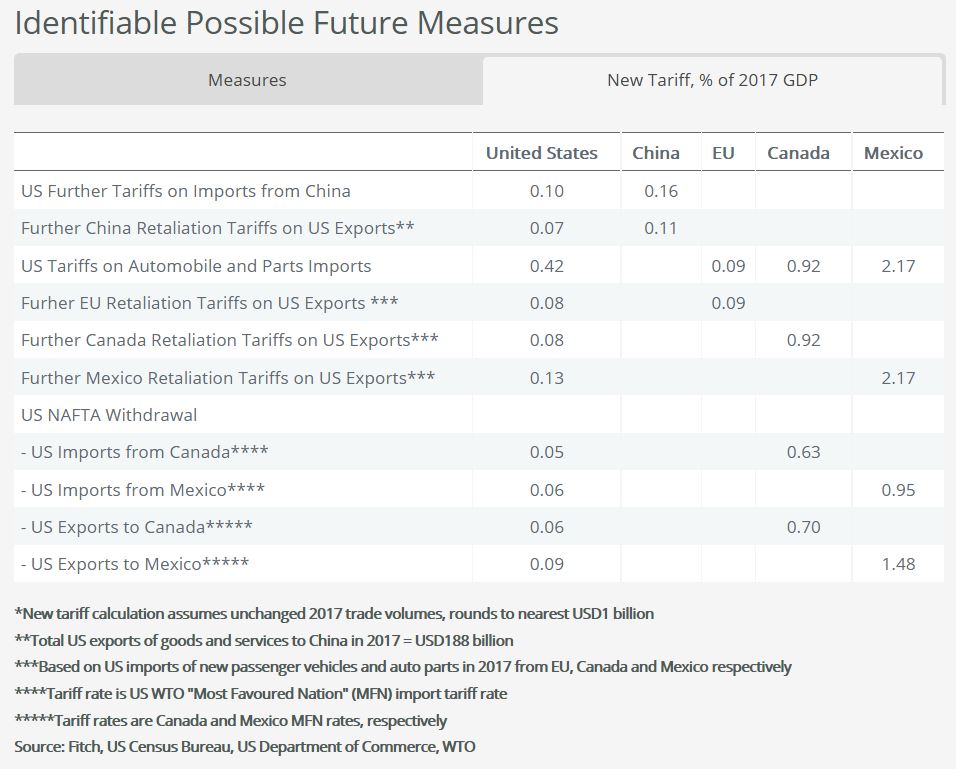

Table 2 outlines a scenario in which the US imposes auto tariffs at 25% and additional tariffs on China. Trading partners retaliate symmetrically – in line with their recent responses to US steel tariffs – and NAFTA collapses. This scenario coupled with the existing measures would affect close to USD2 trillion of global trade flows.

Our calculations are not behavioural estimates of the impact of tariffs on GDP, which would be highly dependent on the effect on trade volumes. Nevertheless, scaling the measures relative to the size of the economy helps us to compare outcomes with the trade war scenario analysis we carried out in our study “Global Macro Scenario: US Trade Protectionism and Retaliation” last year.

In this scenario, our calculations would imply a shock to US import prices around 35% to 40% of the size of the shock examined in the trade war scenario, in turn suggesting a potential impact on US GDP growth of around 0.5pp. This would be broadly consistent with some other estimates. The US Tax Foundation estimates that if all tariffs announced by the US and other jurisdictions were fully enacted, US GDP would fall by 0.44% in the long run.

Our base case remains that blanket geographical tariffs between major countries are unlikely, and this was reflected in our unchanged forecasts for global growth in June’s “Global Economic Outlook”. But the downside risks to global growth from trade policy have increased.

A major global tariff shock would have adverse supply side impacts, raising costs for importers and disrupting supply-chains, while reducing consumers’ real wages. The global multiplier effect of lower US imports could be significant. US outward FDI (the largest source of FDI globally) would probably fall. Along with weaker confidence and lower investment, a global tariff shock would also hit job creation.