The RBA updated their E2 Household Finances – Selected Ratios to end March, released at the end of June. So they are yet to reflect the latest downturn in home prices and rising debt. But the trajectory is clear and should be ringing alarm bells.

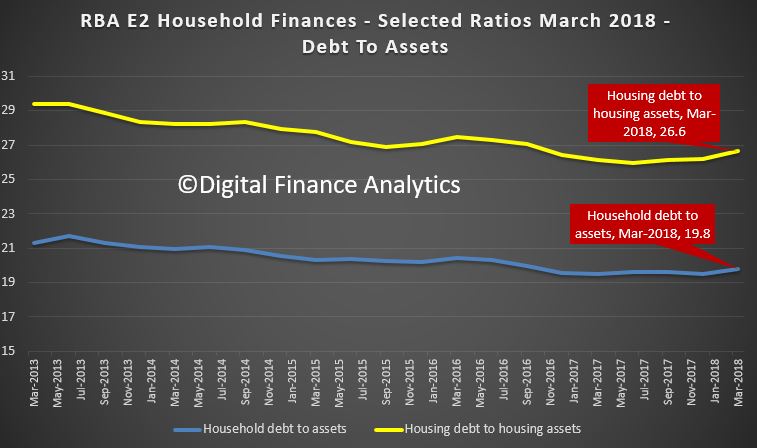

First the ratio of household debt to housing assets and total assets is going up, reflecting mainly falls in property prices. The rate is accelerating, confirming that while debt is still rising, values are not. Expect more ahead.

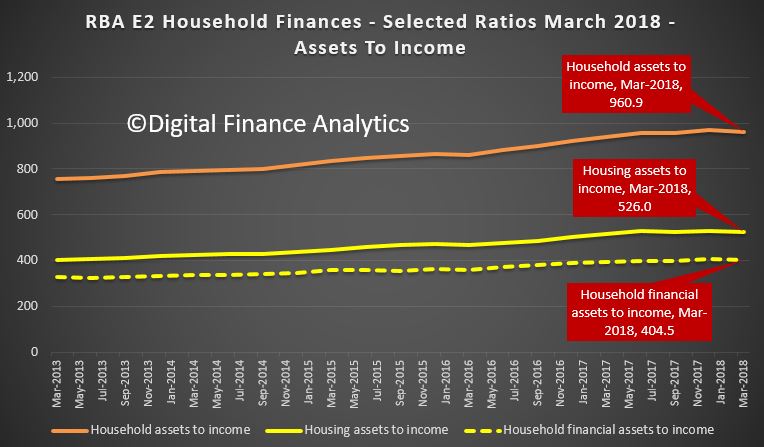

The ratios of assets to income are falling, having been rising for year, again reflecting falls in home prices. So while incomes are flat in real terms, asset values are falling faster.

The ratios of assets to income are falling, having been rising for year, again reflecting falls in home prices. So while incomes are flat in real terms, asset values are falling faster.

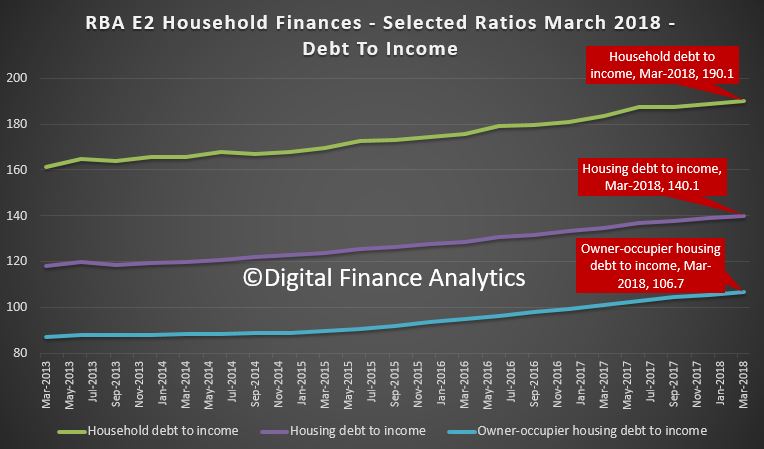

And finally, the killer, the household debt to income ratios continues higher, this despite the greater focus on lending quality, and reduced “mortgage power”. The household debt to income ratio is now at 190.1, the housing debt in income 140.1, and the owner occupied housing debt to income is 106.7. In fact this is moving up more sharply as lenders have focused on owner occupied lending.

And finally, the killer, the household debt to income ratios continues higher, this despite the greater focus on lending quality, and reduced “mortgage power”. The household debt to income ratio is now at 190.1, the housing debt in income 140.1, and the owner occupied housing debt to income is 106.7. In fact this is moving up more sharply as lenders have focused on owner occupied lending.

Combined this shows the problems in the household sector. No surprise then that mortgage stress is going higher. We release the June data tomorrow.

Combined this shows the problems in the household sector. No surprise then that mortgage stress is going higher. We release the June data tomorrow.

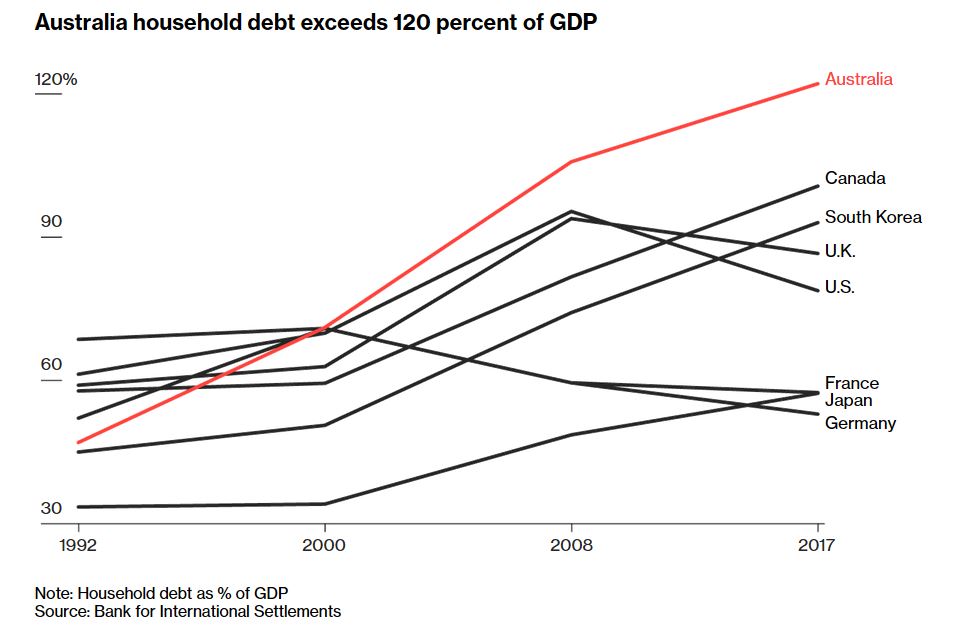

Remember that the debt to GDP ratio is highest in Australia compared with other countries.