Moody’s says that last Wednesday, the US Securities and Exchange Commission adopted amendments to the rules governing alternative trading systems (dark pools) that will increase transparency around trading data and execution.

The new rule is credit positive because it will require dark pools to provide standardized and detailed public disclosures, enhancing their oversight. The new disclosures take effect January 2019.

The increased disclosure requirements will improve reporting and oversight by dark-pool operators, which are typically large banks and independent and specialized trading firms such as Liquidnet Holdings, Inc. We expect these improvements to increase customer confidence in dark-trading venues, allowing customers to assess potential conflicts of interest or the potential for leakage of subscriber information from the dark pools to its broker-dealer operator or affiliates. The tougher reporting requirement standards will also strengthen dark pools’ internal oversight and compliance framework, which should limit future regulatory penalties, a credit positive.

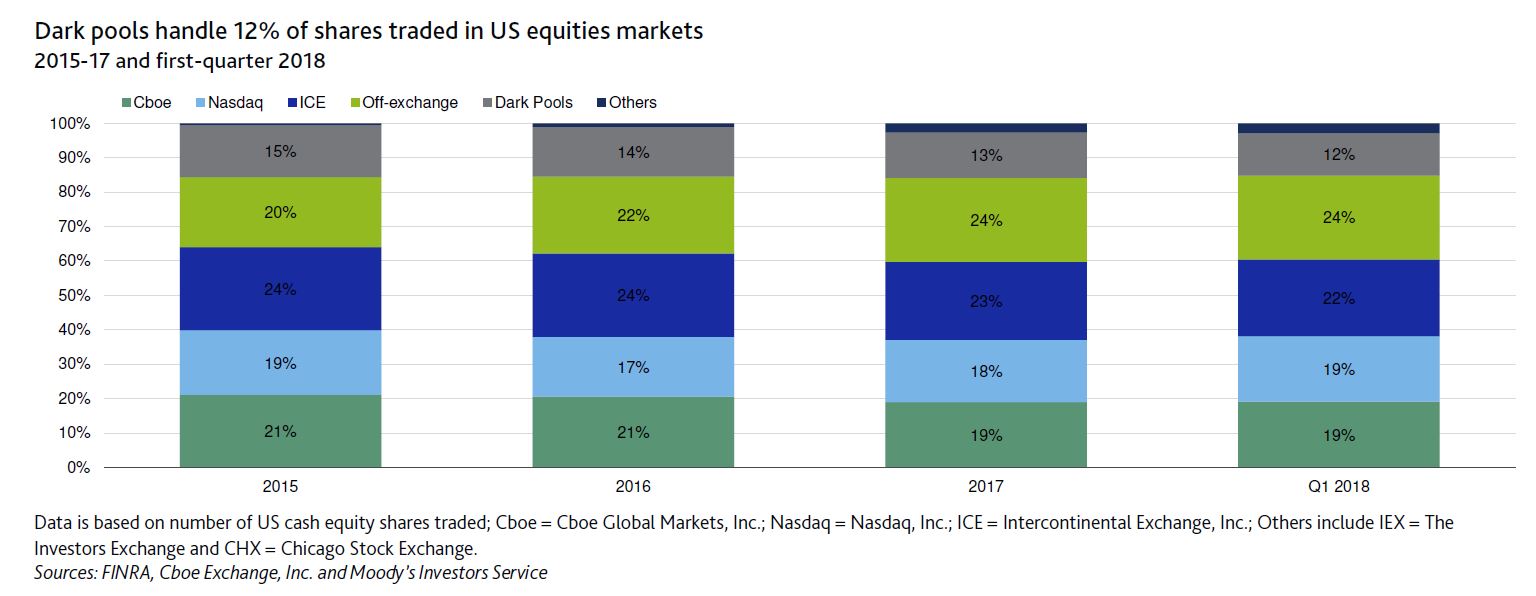

Dark pools are a type of off-exchange trading venue that institutional investors actively use because they provide anonymous execution and minimize market effects. Dark-pool trades remain subject to national market system regulatory requirements, chief among them that trades must be executed at or better than the national best bid-offer price – the price that corresponds to the most competitive, publicly visible resting order on so-called bright venues such as exchanges. As of first quarter 2018, dark pools processed around 12% of all US equity trading volume

In recent years, the SEC and the New York Attorney General have scrutinized dark pools. Securities regulators investigated whether banks misled institutional investors participating in their dark pool trading venues and favored high frequency traders. A number of dark-pool operators agreed to settle charges relating to disclosure failures or other securities law violations. Most prominently in 2016, subsidiaries of Barclays Bank PLC (A2/A2 stable, baa31) and Credit Suisse AG (A1/A1 stable, baa2) agreed to settle separate cases. Barclays paid $70 million and Credit Suisse paid $84.3 million to resolve claims that their dark pools failed to continuously monitor the trading venues against predatory trading, to treat subscriber information confidentially and other disclosure shortfalls.

The new reporting requirements include the disclosure of information regarding ownership of a dark pool and its broker-dealer and arrangement between the dark pool and affiliate broker-dealers. A dark pool will also be required to disclose the type of subscribers it caters to, order types, fees and other operational information.