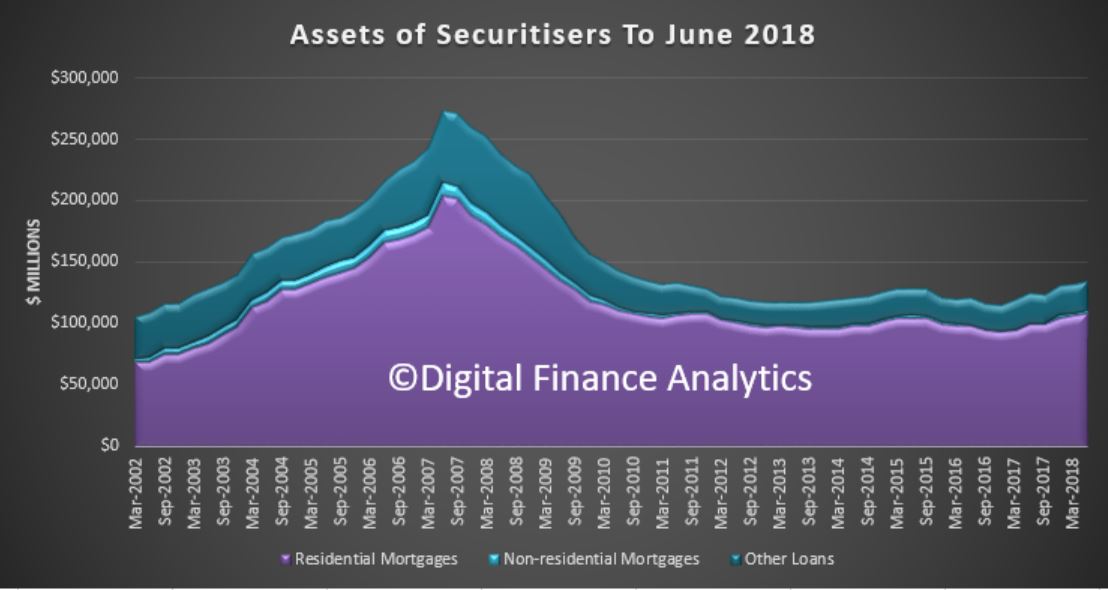

The ABS released their June 2018 data today relating the securitised loans in Australia “Assets and Liabilities of Australian Securitisers“.

In the past year residential mortgages securitised rose by 8.9% to $108.8 billion. Overall securitised assets rose by 8.2%, which shows mortgage assets grew stronger than system.

This reflects what we have seen in the market with non-bank and some bank lenders using this funding channel. The rise of non-bank securitisation is a significant element in the structure of the market. As major lenders throttle back their lending standards, more higher risk loans are moving into the non-bank and securitised sectors. Of course a decade ago it was the securitised loans which took lenders down in the US and Europe.

This reflects what we have seen in the market with non-bank and some bank lenders using this funding channel. The rise of non-bank securitisation is a significant element in the structure of the market. As major lenders throttle back their lending standards, more higher risk loans are moving into the non-bank and securitised sectors. Of course a decade ago it was the securitised loans which took lenders down in the US and Europe.

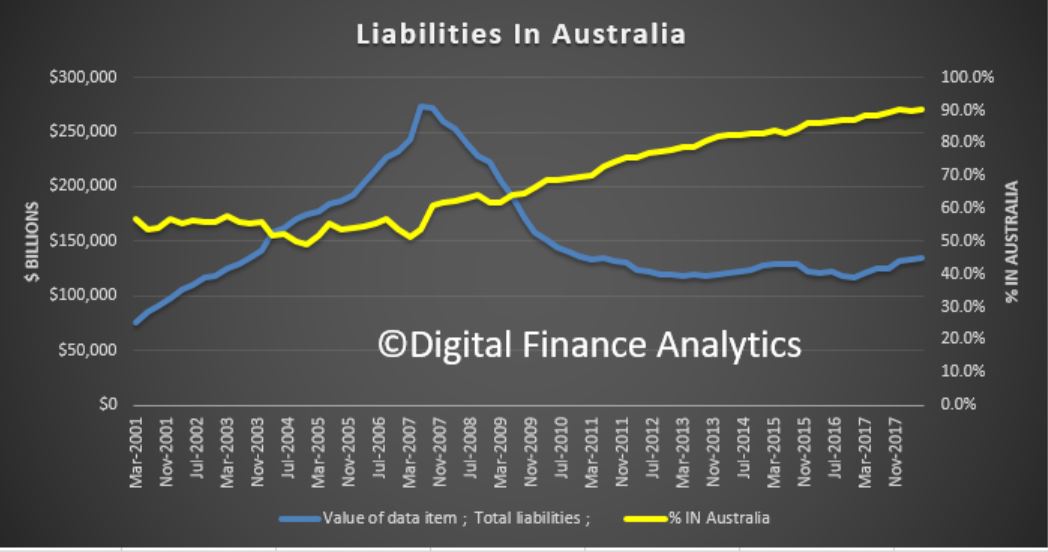

The growth we are seeing here is in our view concerning, bearing in mind the more limited regulatory oversight. Plus. on the liabilities side of the balance sheet, around 90% of the securities are held by Australian investors, a record.

This includes a range of sophisticated investors, including super funds, wealth managers, banks, and high-net worth individuals. But the point to make is that if home price falls continue, the risks in the securitised pools will grow, and this risk is fed back to the investor pools.

This includes a range of sophisticated investors, including super funds, wealth managers, banks, and high-net worth individuals. But the point to make is that if home price falls continue, the risks in the securitised pools will grow, and this risk is fed back to the investor pools.

Another risk-laden feedback loop linked to the housing sector, and one which is not fully disclosed nor widely understood. The fact that the securitised pools are rated by the agencies does not fill me with great confidence either!