The FSB defines shadow banking as “credit intermediation involving entities (fully or partially) outside the regular banking system.”

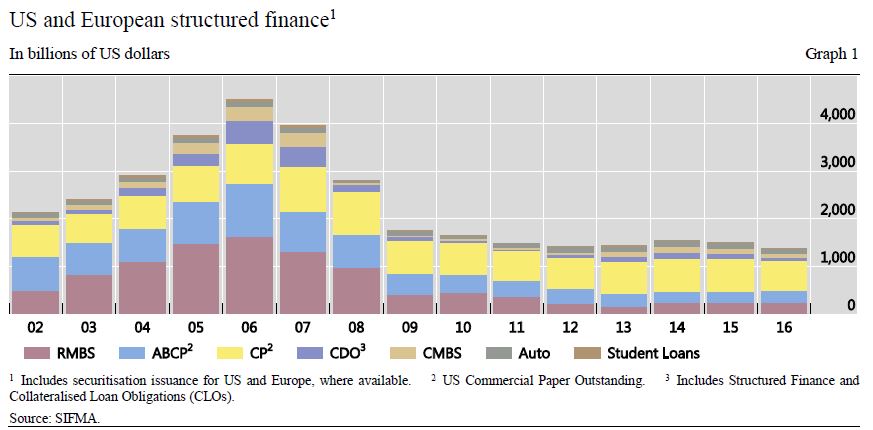

The aspects of the shadow banking activities generally considered to have made the financial system most vulnerable and that contributed to the financial crisis have declined significantly and are generally no longer considered to pose financial stability risks. This decline is due in part to regulatory reforms, changing risk appetite, and rejection of particular products and funding models. Other elements of shadow banking, such as MMFs and repos, also experienced declines from previously elevated levels.

The FSB has been publishing the results from its annual global shadow banking monitoring exercise since 2011. The FSB published the results from its most recent 2016 monitoring exercise in May. The results found that activity-based, narrow measure of shadow banking was $34 trillion in 2015, increasing by 3.2% compared to the prior year, and equivalent to 13% of total financial system assets and 70% of GDP of these jurisdictions. The narrow measure figure represents shadow banking risks before policy measures are applied.

The FSB has been publishing the results from its annual global shadow banking monitoring exercise since 2011. The FSB published the results from its most recent 2016 monitoring exercise in May. The results found that activity-based, narrow measure of shadow banking was $34 trillion in 2015, increasing by 3.2% compared to the prior year, and equivalent to 13% of total financial system assets and 70% of GDP of these jurisdictions. The narrow measure figure represents shadow banking risks before policy measures are applied.

In response to a request from the G20, the Financial Stability Board (FSB) today published an assessment of the evolution of shadow banking activities and risks since the global financial crisis, and the adequacy of post-crisis policies and monitoring to address these risks.

This assessment highlights that the aspects of shadow banking considered to have contributed to the global financial crisis have declined significantly and generally no longer pose financial stability risks.

The assessment also describes how, since the financial crisis, policies have been introduced to address financial stability risks from shadow banking:

- Authorities are establishing system-wide oversight and monitoring frameworks to assess the financial stability risks from shadow banking, so that appropriate policy measures can be taken. This includes annual monitoring exercises by the FSB since 2011 to assess global trends and risks in the shadow banking system.

- Authorities have taken steps to address banks’ involvement in shadow banking, including through enhanced consolidation rules for off-balance sheet entities and strengthened bank prudential rules.

- Authorities have acted to reduce liquidity and maturity mismatches, and also leverage in the shadow banking system, including through regulatory reforms of money market funds and recommendations on securities financing transactions.

- National and regional reforms have been undertaken to address incentive problems and opaqueness associated with securitisation, alongside increases in capitalisation of banks’ securitisation related exposures.

However, a rise in assets held in certain investment funds has increased the risks from liquidity transformation. These developments underscore the importance of effective operationalisation and implementation of the FSB’s January 2017 policy recommendations to address structural vulnerabilities from asset management activities.

At present, the FSB has not identified other new financial stability risks from shadow banking that would warrant additional regulatory action at the global level. However, since shadow banking evolves over time, authorities should continue to monitor vigilantly and address promptly emerging financial stability risks.

To these ends FSB member authorities have agreed the following recommendations:

- Enhance system-wide oversight of shadow banking and policy responses to address the identified risks by: (i) establishing a systematic process for assessing financial stability risks from shadow banking, and ensuring that any entities or activities that could pose material financial stability risks are brought within the regulatory perimeter; (ii) addressing identified gaps in risk-related data; and (iii) removing impediments to cooperation and information-sharing between authorities.

- Strengthen the monitoring of shadow banking activities and data collection. The FSB will assess the data availability and make improvements to its annual monitoring exercise as appropriate in 2018.

- Complete the remaining policy development at the international level and implement the agreed policy recommendations to reduce risks and arbitrage opportunities across jurisdictions and sectors. In this regard, it is important that: (i) the Basel Committee on Banking Supervision completes its guidelines on step-in risk; (ii) the International Organization of Securities Commissions effectively operationalises the FSB recommendations to address structural vulnerabilities from asset management activities in line with the agreed timeline; and (iii) national/regional authorities implement agreed policy recommendations in a timely and consistent manner.

Mark Carney, Chair of the FSB, said “This assessment confirms the extent of the transformation of shadow banking into resilient market-based finance. It concludes that the agreed policies, once fully and effectively implemented, will be adequate to address existing risks. Of course, since shadow banking activities will inevitably evolve over time, FSB member authorities will strengthen surveillance to support ongoing risk assessments and guide any future regulatory response”.

Klaas Knot, Chair of the FSB Standing Committee on Assessment of Vulnerabilities and President of De Nederlandsche Bank, said “While we have achieved a great deal, authorities need to remain alert to risks from shadow banking. It is important for authorities to continue to improve data availability, risk analysis and information sharing so as to be able to identify new sources of systemic vulnerabilities in a timely manner”.

Norman Chan, Chair of the FSB Standing Committee on Supervisory and Regulatory Cooperation and Chief Executive of the Hong Kong Monetary Authority said “While the growth in asset management activities provides new sources of credit and investment to our financial system, it reinforces the need to effectively operationalise and implement the FSB’s asset management recommendations to address structural vulnerabilities from such activities”.

The FSB has been established to coordinate at the international level the work of national financial authorities and international standard setting bodies and to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. Through its six Regional Consultative Groups, the FSB conducts outreach with and receives input from an additional approximately 65 jurisdictions.