The latest edition of the Scottish Pacific SME Growth Index has been released. It gives an interesting snapshot on the critically important SME sector in Australia. Once again, as in our own SME surveys, cash-flow is king. 90% of SME owners said they faced cash-flow related issues. That said, the non-bank sector, including Fintechs need to do more to raise awareness of the solutions they offer.

SME business confidence is on the rise finds small business owners forecasting revenue to improve during the first half of 2018.

There appears to be a splitting of the pack in SME fortunes, with a greater number of previously “unchanged” growth SMEs moving into positive or negative growth.

For most SMEs cash flow has improved compared to 12 months ago, however one in 10 say they are worse off now. The number of SMEs reporting significantly better cash flow (27%) and better cash flow (42%) will hopefully act as a major driver of new capital expenditure and business investment demand.

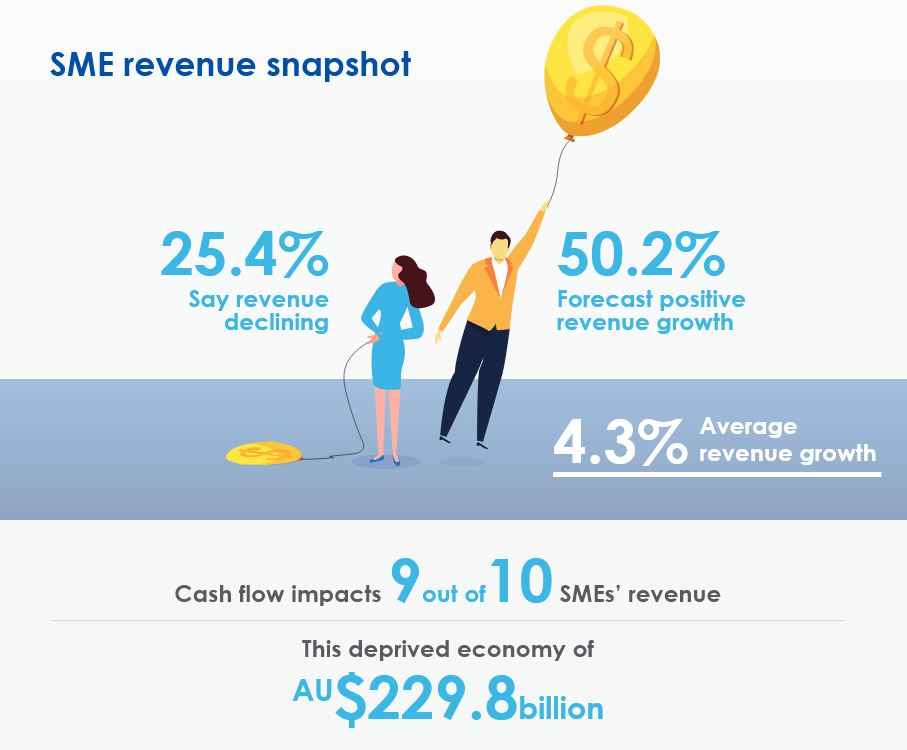

Despite this reported rise in cash flow, nine out of 10 SMEs say they had cash flow issues in 2017 and nine out of 10 say these issues impacted on revenue. On average, small businesses say that better cash flow would have increased their 2017 revenue by 5-10%.

For SMEs with plans to invest in expansion over the next 6 months, 24% of them report they will fund that growth by borrowing from their main relationship bank – continuing a downward trend, and well short of the high of 38% who nominated this option to fund growth in the first round of the Index in September 2014.

21.7% of SMEs say they plan to use non-bank lenders to fund upcoming growth (with 90.8% planning to use their own funds). Non-bank lending intentions have trended upwards since the first Index, closing the gap between bank and non-bank lending intentions. Despite these intentions, more than 91% of SMEs responded in H1 2018 that in the previous 12 months they had not accessed any non-bank lending options to provide working capital for their business.

So while SMEs seem unsatisfied with traditional banks, they are not yet fully accessing opportunities available to them in the non-banking sector.

Results show that growth SMEs are five times more likely to use alternative lending options than declining growth SMEs, with debtor finance the most popular option. The growth potential for the non-bank lending sector is significant, given that 48% of SMEs who didn’t use non-bank lending in 2017 are considering it for 2018.

With SME owners revealing a solid reliance on personal credit cards to give their business the working capital required for day to day operations, those with better business solutions must find a way to reach these small business people.

Businesses implementing appropriate working capital solutions to get on top of cash flow impediments are well placed to realise their growth ambitions.