Suncorp gave a quarterly update under Australian Prudential Standard 330.

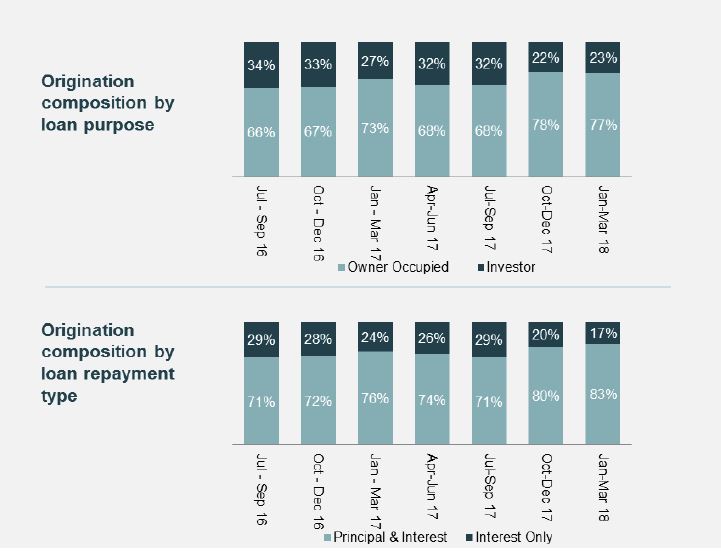

Total lending grew 0.9%, or 5.4% year to date, slower than the first half. Total lending assets grew $546 million to $58.3 billion over the quarter. Mortgage growth was 0.8% in the quarter, or $361 million. Investor and interest only loan mix declined.

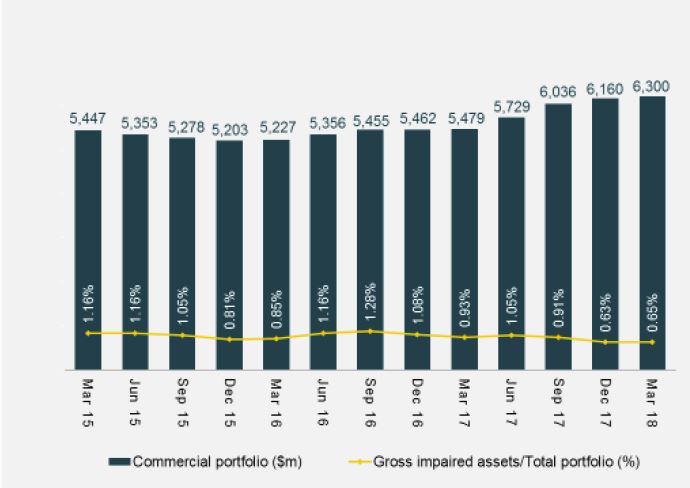

They also reported some growth in the business portfolio.

They also reported some growth in the business portfolio.

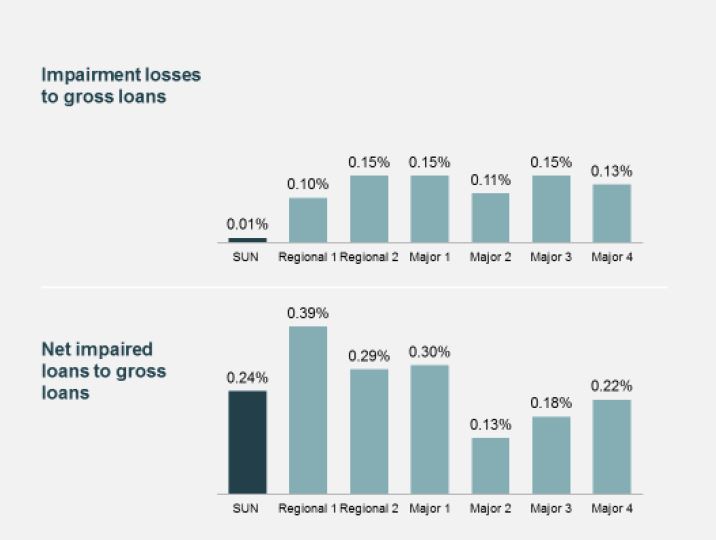

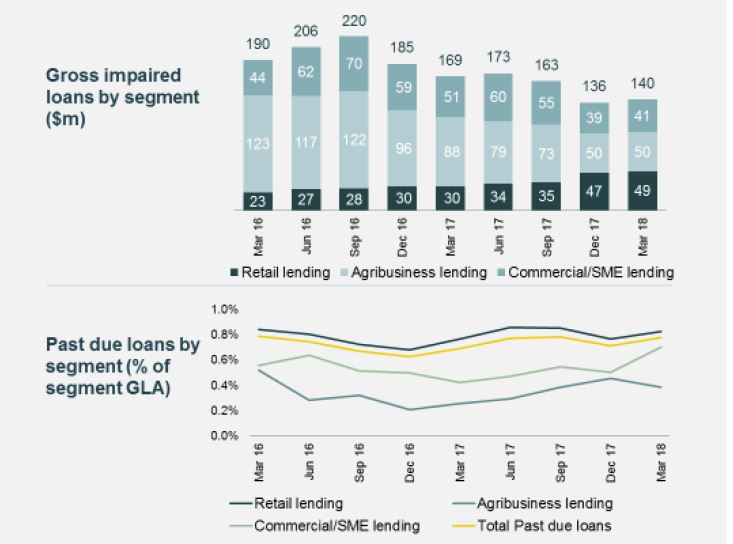

Impairment losses for the quarter were 2 million or 1 basis point on gross loans (annualised), well below their 10-20 range through the cycle.

Impairment losses for the quarter were 2 million or 1 basis point on gross loans (annualised), well below their 10-20 range through the cycle.

However, the % of loans past due rose.

However, the % of loans past due rose.

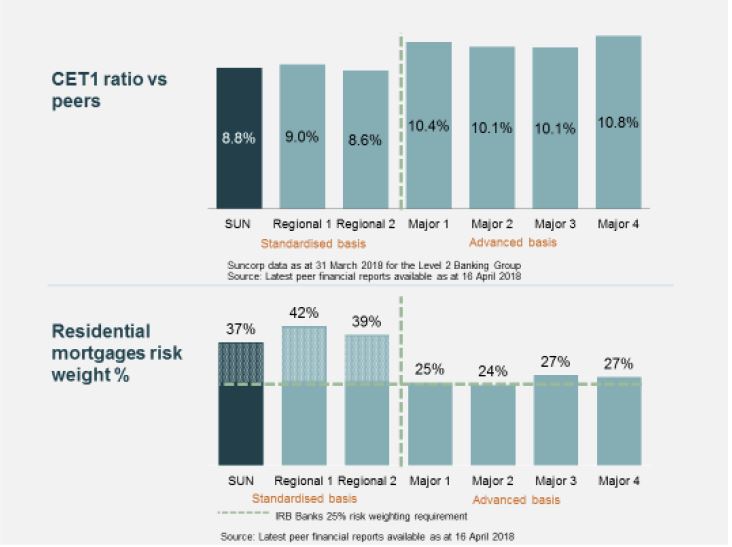

NSFR was 112% and the CET1 ratio was 8.80.

NSFR was 112% and the CET1 ratio was 8.80.

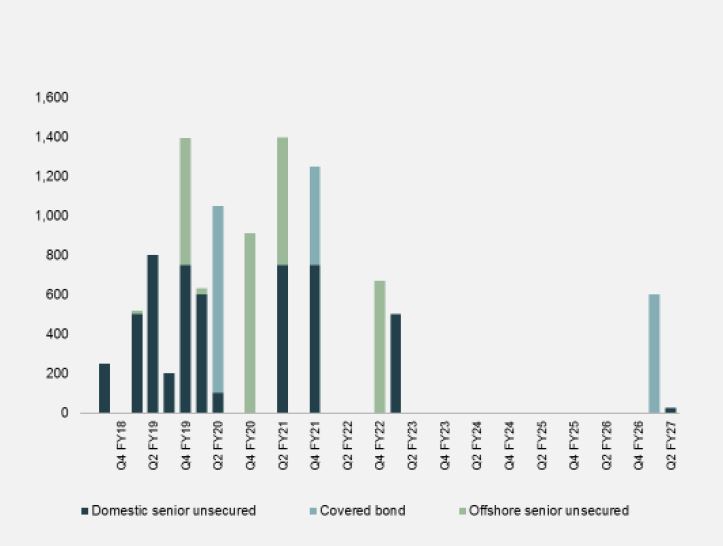

They executed $4.2 billion in term wholesale issuance over the financial year to date, including both domestic and offshore, with an average weighted term of 3.3 years.

Subsequent to the March quarter they announced a $1.25 billion Residential Mortgage-backed Security transaction, which increased CET1 by around 13 basis points.

Subsequent to the March quarter they announced a $1.25 billion Residential Mortgage-backed Security transaction, which increased CET1 by around 13 basis points.