We look at the latest from the ABS. The drought and lower dollar is not helping.

What will the RBA do?

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at the latest from the ABS. The drought and lower dollar is not helping.

What will the RBA do?

We review the latest ABS data.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6202.0Dec%202019?OpenDocument

Australia’s trend unemployment rate decreased to 5.1 per cent in December 2019, according to the latest information released by the Australian Bureau of Statistics (ABS) today.

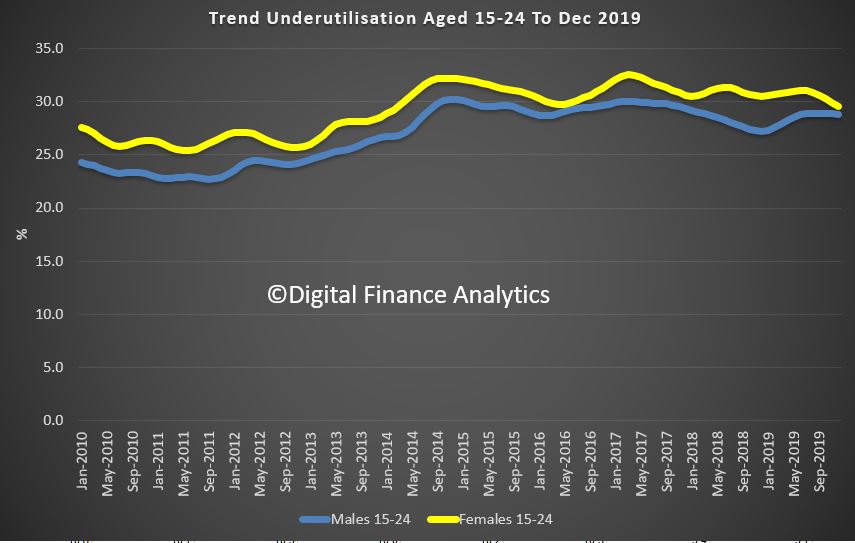

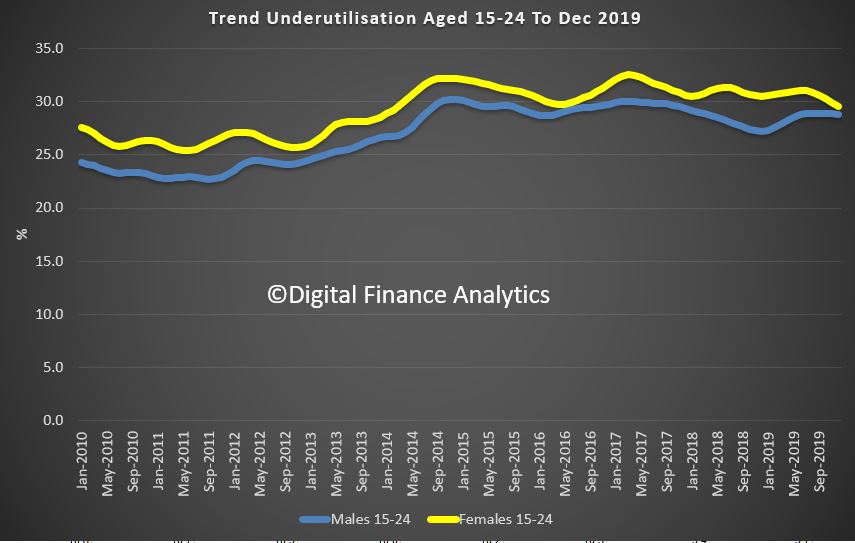

This may be enough to stay the RBA’s hand in February, as the headline rate fell, and the jobs hours worked rose, though there was a disproportionate shift towards part-time work, and the underutilisation rate is also higher. In fact, the fall can be best linked to a falling participation rate as more chose not to work over the summer. So nothing here to really support signs of a stronger economy. Underutilisation among the 15-25’s is above 25%.

Employment and hours

In December 2019, trend monthly employment increased by around 18,000 people. Both full-time and part-time employment increased by around 9,000 people.

Over the past year, trend employment increased by around 261,000 people (2.1 per cent), which continued to be above the average annual growth over the past 20 years (2.0 per cent).

Full-time employment growth (1.5 per cent) was below the average annual growth over the past 20 years (1.6 per cent) and part-time employment growth (3.2 per cent) was above the average annual growth over the past 20 years (3.0 per cent).

“While there has been stronger growth in part-time employment over the past year, the underemployment rate is still where it was last December, at 8.3 per cent,” said Mr Hockman.

The trend monthly hours worked increased by 0.2 per cent in December 2019 and by 1.7 per cent over the past year. This was in line with the 20 year average annual growth of 1.7 per cent.

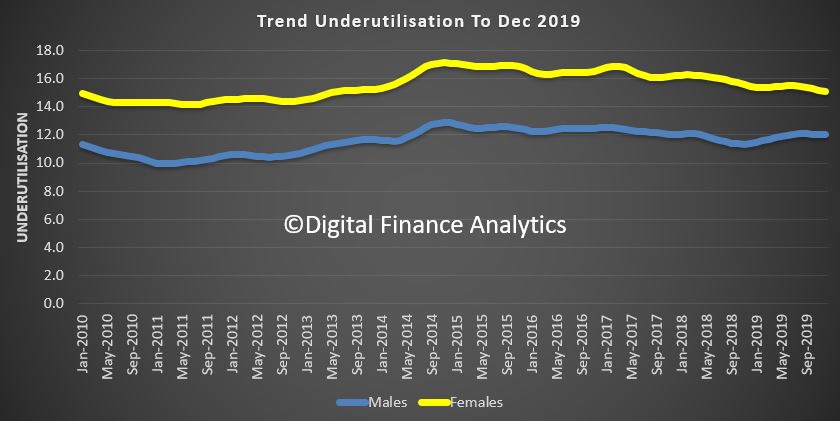

Underemployment and underutilisation

The trend monthly underemployment rate remained steady at 8.3 per cent in December 2019, unchanged over the past year. The trend monthly underutilisation rate also remained steady at 13.5 per cent in December 2019, an increase of 0.2 percentage points over the past year.

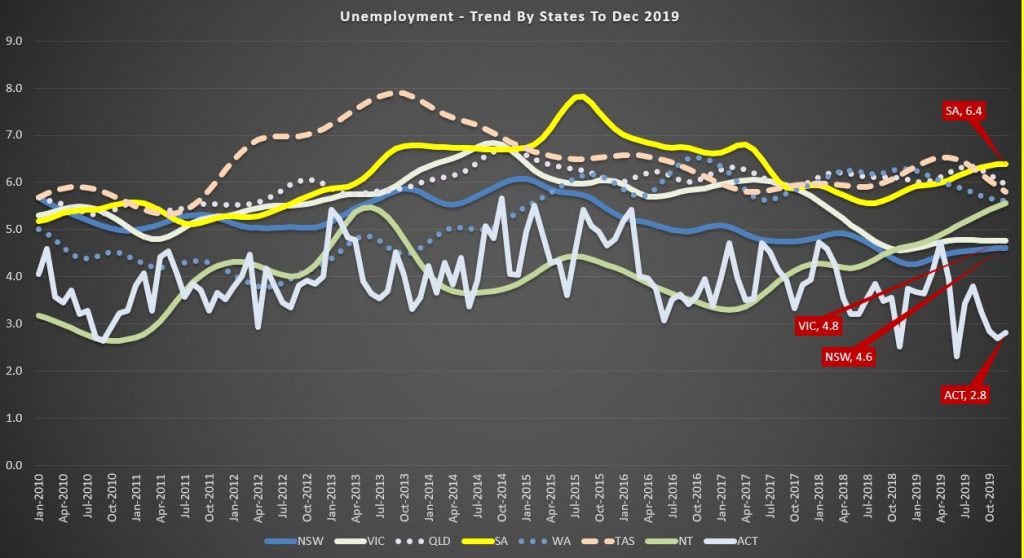

States and territories trend unemployment rate

The monthly trend unemployment rate increased in the Northern Territory, and decreased in Queensland and Tasmania in December 2019. The unemployment rate remained steady in all other states and the Australian Capital Territory.

Over the year, unemployment rates fell in Queensland, Western Australia, Tasmania and the Australian Capital Territory. Unemployment rates increased in all other states and the Northern Territory.

Seasonally adjusted data

The seasonally adjusted unemployment rate decreased by 0.1 percentage points to 5.1 per cent in December 2019, while the underemployment rate remained steady at 8.3 per cent. The seasonally adjusted participation rate remained steady at 66.0 per cent, and the number of people employed increased by around 29,000.

The net movement of employed in both trend and seasonally adjusted terms is underpinned by around 300,000 people entering and leaving employment in the month.

We look at the latest ABS Retail Turnover data. It was stronger than expected, thanks to Black Friday sales, but the overall state of retail is still weak.

We review the November 2019 data from the ABS.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8731.0Nov%202019?OpenDocument

We look at the latest stats from the ABS. Net Migration remains strong, yet despite that we have more Australians over 65 years and a relative smaller working population. What could possibility go wrong?

Australia’s population grew by 1.5 per cent during the year ending 30 June 2019, according to the latest figures released by the Australian Bureau of Statistics (ABS).

ABS Demography Director Beidar Cho said: “The population at 30 June 2019 was 25.4 million people, following an annual increase of 381,600 people.”

Natural increase accounted for 37.5 per cent of annual population growth, while net overseas migration accounted for the remaining 62.5 per cent.

There were 303,900 births and 160,600 deaths registered in Australia during the year ending 30 June 2019. Natural increase during this period was 143,300 people, an increase of 0.5 per cent from the previous year.

There were 536,000 overseas migration arrivals and 297,700 departures during the year ending 30 June 2019, resulting in net overseas migration of 238,300 people. Net overseas migration did not change compared to the previous year.

Annual population change

The preliminary estimated resident population of Australia at 30 June

2019 was 25,364,300 people. This is an increase of 381,600 people since

30 June 2018 and 75,600 people since 31 March 2019.

The annual population growth rate for the year ended 30 June 2019 was 1.5%.

Annual population growth rate (a)(b), Australia

(a) Annual growth rate calculated at the end of each quarter.

(b) All data to 30 June 2016 is final. Estimates thereafter are preliminary or revised.

Components of population change

The growth of Australia’s population is comprised of natural increase (births minus deaths) and net overseas migration (NOM).

The contribution to population growth for the year ended 30 June 2019

was higher from NOM (62.5%) than from natural increase (37.5%).

Components of annual population growth (a), Australia

(a) Annual components calculated at the end of each quarter.

Natural increase

The preliminary estimate of natural increase for the year ended 30 June 2019 was 143,300 people, an increase of 0.5%, or 700 people, compared with natural increase for the year ended 30 June 2018 (142,600 people).

Births

The preliminary estimate of births for the year ended 30 June 2019 (303,900 births) was lower by 700 births from the year ended 30 June 2018 (304,600 births).

Deaths

The preliminary estimate of deaths for the year ended 30 June 2019 (160,600 deaths) was lower by 1,400 deaths from the year ended 30 June 2018 (162,000 deaths).

Net overseas migration

For the year ended 30 June 2019, Australia’s preliminary net overseas migration estimate was 238,300 people. This was 100 people higher than the net overseas migration estimated for the year ended 30 June 2018 (238,200 people).

NOM arrivals increased by 1.6% (8,500 people) between the years ended 30 June 2018 (527,500 people) and 30 June 2019 (536,000 people).

NOM departures increased by 2.9% (8,400 people) between the years ended 30 June 2018 (289,300 people) and 30 June 2019 (297,700 people).

The preliminary NOM estimate for the June quarter 2019 (34,900 people) was 26.7% (12,700 people) lower than the June quarter 2018 (47,600 people).

States and territories

At the state and territory level, population growth has three main components: natural increase, net overseas migration and net interstate migration (NIM).

Although majority of states and territories experienced positive population growth in the year ended 30 June 2019, the proportion that each of these components contributed to population growth varied between the states and territories.

For the year ended 30 June 2019, natural increase was the major contributor to population change in Western Australia and the Australian Capital Territory. Net interstate migration loss was the largest component of population change in the Northern Territory. NOM was the major contributor to population change in New South Wales, Victoria, Queensland, South Australia and Tasmania.

NIM gains occurred in Victoria, Queensland and Tasmania. All other states and territories recorded net interstate migration losses.

Natural increase

Births

Compared with the previous year, the number of births registered for the year ended 30 June 2019 decreased in half of the states and territories.

The largest percentage decrease was in Western Australia at 2.7%. This was followed by Victoria (2.2%), The Northern Territory (1.9%) and Queensland (0.5%).

The largest increase was in Tasmania at 4.0%, followed by the Australian Capital Territory (2.1%), New South Wales (1.8%) and South Australia (1.6%).

For more information, see table 10.

Deaths

Compared with the previous year, the number of deaths registered for the year ended 30 June 2019 decreased in half of the states and territories.

Tasmania had the largest percentage decrease at 5.2%. This was followed by the Australian Capital Territory (4.7%), Queensland (2.7%) and New South Wales (1.0%).

Increases occurred in Western Australia at 2.1% followed by the Northern Territory (1.7%) and Victoria (0.1%). South Australia had no change.

For more information, see table 11.

Preliminary estimates of births and deaths are subject to fluctuations caused by lags or accumulations in the reporting of birth and death registrations (for more information see Explanatory Notes 10-11).

Net overseas migration

Compared with the previous year, NOM decreased the most in New South Wales (4,800 people), followed by Victoria (3,700 people), the Australian Capital Territory (1,500 people) and the Northern Territory (100 people).

The largest increase was in Queensland (5,200 people), followed by Western Australia (3,900 people), South Australia (1,100 people) and Tasmania (10 people). For more information, see table 13.

NOM arrivals

The number of NOM arrivals for the year ended 30 June 2019 increased in Tasmania (9.1%), Queensland (5.5%), South Australia (5.1%), Western Australia (3.9%), Victoria (1.8%) and the Northern Territory (1.2%).

The largest percentage decrease in NOM arrivals was in the Australian Capital Territory (11.4%), followed by New South Wales (0.7%). For more information, see table 13.

NOM departures

Compared with the previous year, the number of NOM departures for the year ended 30 June 2019 increased in Tasmania (19.7%), Victoria (9.0%), the Northern Territory (3.8%), the Australian Capital Territory (3.6%), New South Wales (3.4%) and South Australia (1.5%).

The largest percentage decrease was recorded in Western Australia at 6.7%, followed by Queensland (1.0%). For more information, see table 13.

Net interstate migration

In the year ended 30 June 2019, Victoria, Queensland and Tasmania had net interstate migration gains. Queensland had the highest net gain with 22,800 people. This was followed by Victoria (12,200 people) and Tasmania (2,000 people). Net losses from interstate migration were in New South Wales (22,100 people), Western Australia (6,500), the Northern Territory (4,400 people), South Australia (4,000 people) and the Australian Capital Territory (200 people). For more information.

Annual interstate migration – arrivals, departures and net

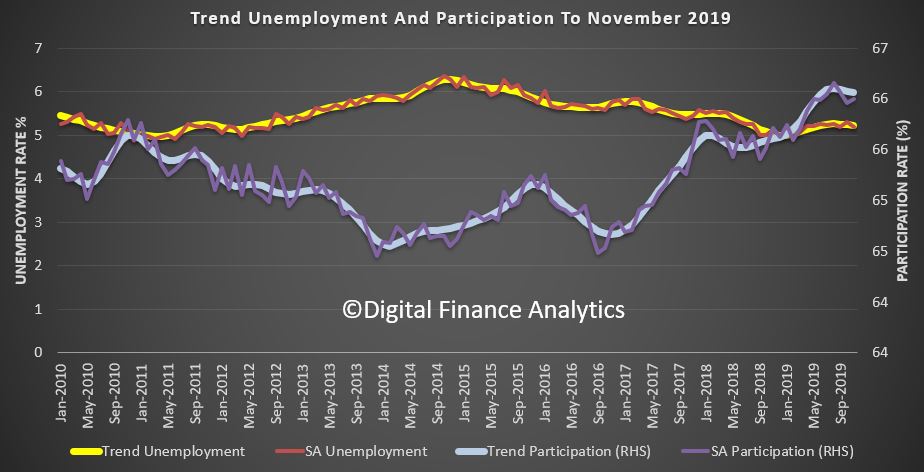

Australia’s trend unemployment rate decreased by less than 0.1 percentage points to 5.2 per cent in November 2019, according to the latest information released by the Australian Bureau of Statistics (ABS) today.

ABS Chief Economist Bruce Hockman said: “In November 2019, the trend unemployment rate decreased slightly to 5.2 per cent, the same level it was six months ago.”

“Over the past six months, the trend unemployment rate, participation rate and employment to population ratio have all remained relatively stable,” said Mr Hockman.

Employment and hours

In November 2019, trend monthly employment increased by around 17,000 people. Full-time employment increased by around 8,000 people and part-time employment increased by around 9,000 people.

Over the past year, trend employment increased by around 269,000 people (2.1 per cent), which continued to be above the average annual growth over the past 20 years (2.0 per cent). Full-time employment increased at the same rate as the past 20 years (1.6 per cent), and part-time employment (3.2 per cent) was above the average annual growth over the past 20 years (3.0 per cent).

The trend monthly hours worked increased by 0.1 per cent in November 2019 and by 1.6 per cent over the past year. This was slightly below the 20 year average annual growth of 1.7 per cent.

Underemployment and underutilisation

The trend monthly underemployment rate remained steady at 8.4 per cent in November 2019, an increase of 0.1 percentage points over the past year. The trend monthly underutilisation rate also remained steady at 13.6 per cent in November 2019, an increase of 0.3 percentage points over the past year.

States and territories trend unemployment rate

The monthly trend unemployment rate remained steady in Victoria, Queensland, South Australia and the Australian Capital Territory in November 2019. The unemployment rate increased in New South Wales, Western Australia and the Northern Territory, and decreased in Tasmania.

Over the year, unemployment rates fell in Western Australia and the Australian Capital Territory. The unemployment rate increased in all other states and the Northern Territory, except Tasmania where the rate was the same as it was 12 months ago.

Over the past year, trend employment increased by 268,900 people (or 2.1%), which was above the average annual growth rate over the past 20 years of 2.0%. Over the same 12 months, the trend employment to population ratio, which is a measure of how employed the population (aged 15 years and over) is, increased by 0.3 percentage points (pts) to 62.6%.

Dynamic Market changes

Trend employment increased by 17,400 people (0.13%) between October and November 2019. This was below the monthly average growth rate over the last 20 years of 0.16%.

Underpinning these net changes in employment is extensive dynamic change, which occurs each month in the labour market. In recent months there has been more than 300,000 people entering and leaving employment. There is also further dynamic change in the hours that people work, which results in changes in the full-time and part-time composition of employment.

Trend full-time employment increased by 8,300 people between October and November 2019, and part-time employment increased by 9,000 people. Compared to a year ago, there were 140,800 more people employed full-time and 128,100 more people employed part-time. This compositional change has led to an increase in the part-time share of employment from 31.4% to 31.8%.

The trend estimate of monthly hours worked in all jobs increased by 2.3 million hours (0.1%) to 1,782.8 million hours in November 2019. Over the past year, monthly hours worked in all jobs increased by 1.6%, below the 2.1% increase in employed people. In November, the average hours worked per employed person was around 137.5 hours per month or around 31.7 hours per week.

The trend unemployment rate decreased by less than 0.1 pts to 5.2% in November 2019. The number of unemployed people decreased by 1,200 in November 2019 to 716,300 people, and by 44,000 people since November 2018.

The trend participation rate remained steady at 66.1% in November 2019, and was 0.5 pts higher than in November 2018. The female participation rate remained steady at 61.2% and the male participation rate remained steady at 71.1%.

The labour force includes the total number of employed and unemployed people. Over the past 12 months, the labour force increased by 312,900 people (2.3%). This rate of increase was above the rate of increase for the total Civilian Population aged 15 years and over (1.6%).

The trend participation rate for 15-64 year olds, which controls (in part) for the effects of an aging population, remained steady at 78.7%. The gap between male and female participation rates in this age group was less than 10 pts, at 83.2% and 74.2% respectively, continuing the long term convergence of male and female participation.

The trend participation rate for 15-24 year olds (who are often referred to as the “youth” group in the labour market) remained steady at 68.1%. The unemployment rate for this group remained steady at 11.7% from October to November 2019, and has increased by 0.3 pts since November 2018.

Seasonally adjusted data

The seasonally adjusted unemployment rate decreased by 0.1 percentage points to 5.2 per cent in November 2019, while the underemployment rate decreased by 0.2 percentage points to 8.3 per cent. The seasonally adjusted participation rate remained steady at 66.0 per cent, and the number of people employed increased by around 40,000.

The net movement of employed in both trend and seasonally adjusted terms is underpinned by around 300,000 people entering and leaving employment in the month

Rotational Data

In original terms, the incoming rotation group in November 2019 had a lower employment to population ratio than the group it replaced (62.5% in November 2019, compared to 63.2% in October 2019), and was lower than the sample as a whole (62.8%). The incoming rotation group had a lower full-time employment to population ratio than the group it replaced (42.5% in November 2019, compared to 43.8% in October 2019), and was lower than the sample as a whole (42.9%).

The unemployment rate of the incoming rotation group was higher than the group it replaced (5.2% in November 2019, compared to 4.8% in October 2019) and was higher than the sample as a whole (4.8%). The participation rate of the incoming rotation group was lower than the group it replaced (66.0% in November 2019, compared to 66.4% in October 2019) and higher than the sample as a whole (65.9%).

In looking ahead to the December 2019 estimates, in original terms, the outgoing rotation group in November 2019, that will be replaced by a new incoming rotation group in December 2019, had a lower employment to population ratio in November 2019 (62.3%) compared to the sample as a whole (62.8%). The outgoing rotation group in November 2019 had a lower full-time employment to population ratio (42.7%) than the sample as a whole (42.9%).

The outgoing rotation group had a higher unemployment rate in November 2019 (4.9%) compared to the sample as a whole (4.8%). The participation rate of the outgoing rotation group in November 2019 (65.5%) was lower than the sample as a whole (65.9%).